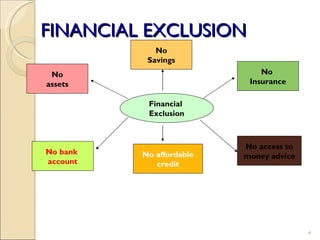

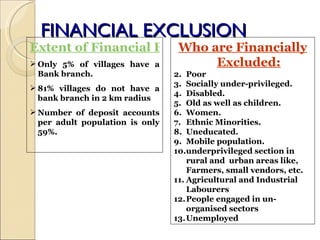

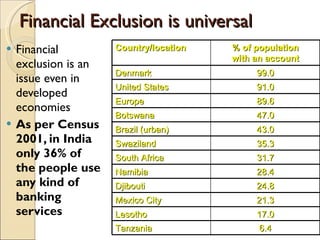

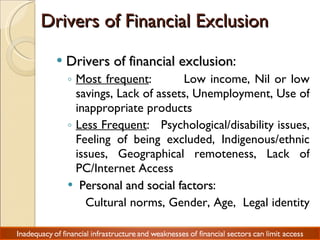

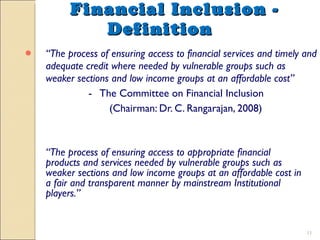

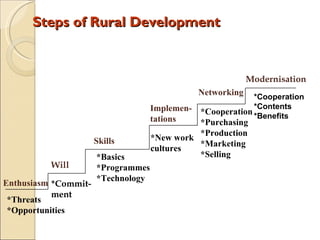

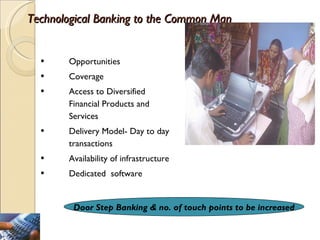

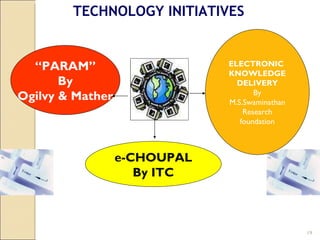

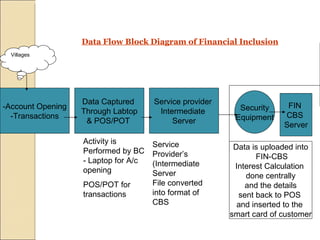

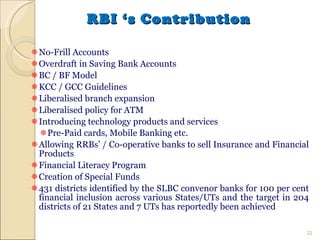

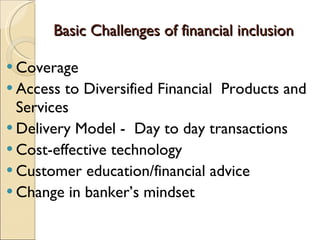

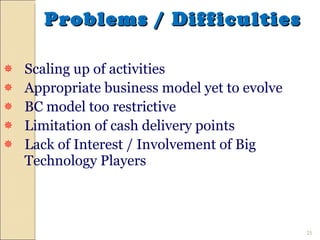

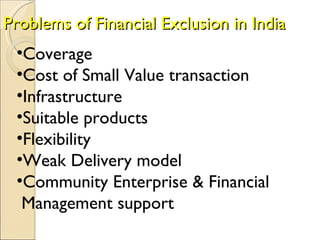

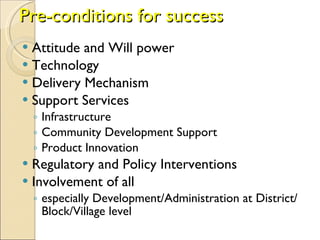

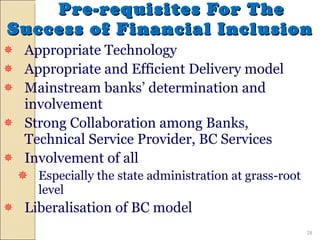

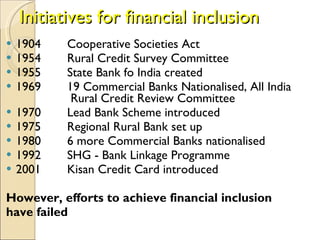

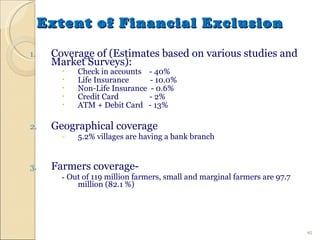

The document discusses financial inclusion and exclusion in India. It notes that only 5% of villages have a bank branch and 81% do not have one within 2 km. Many groups are financially excluded including the poor, women, elderly, and those in rural areas. It outlines various initiatives taken by the government and RBI to promote financial inclusion through programs like self-help groups, nationalization of banks, and the business correspondent model. Technology is seen as an important enabler but challenges remain around appropriate business models, infrastructure, and products.