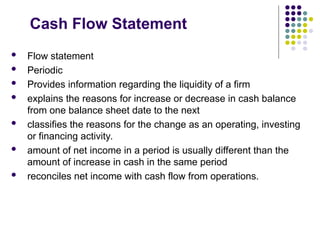

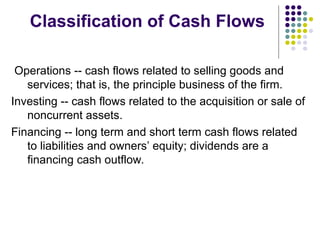

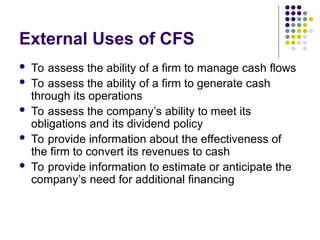

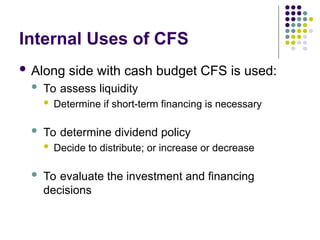

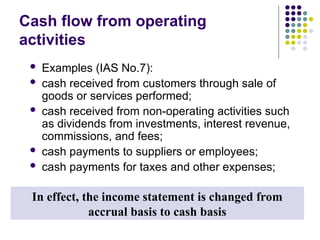

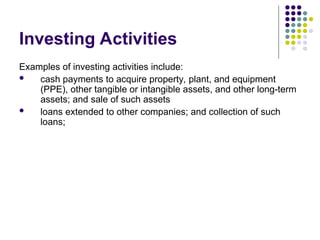

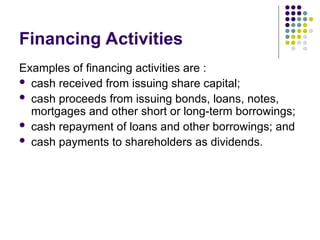

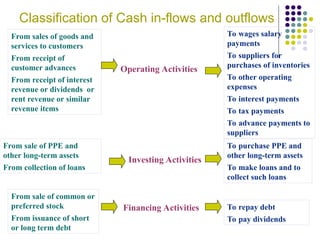

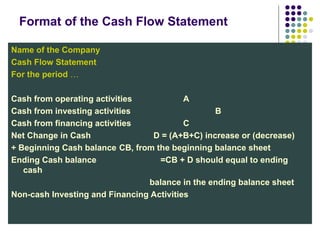

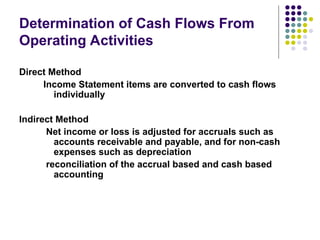

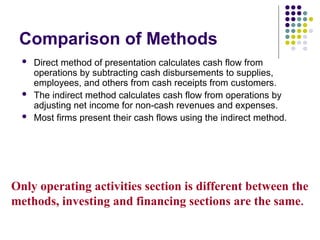

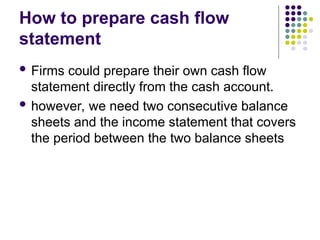

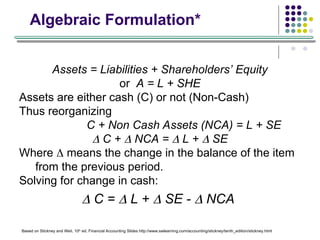

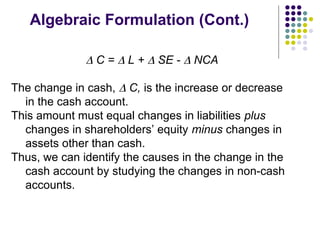

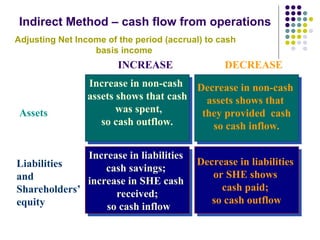

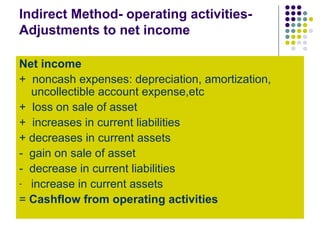

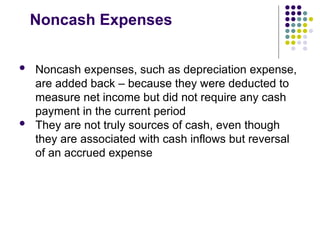

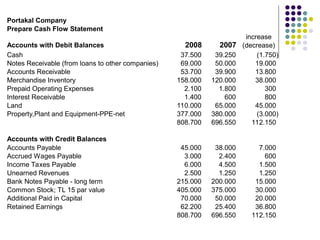

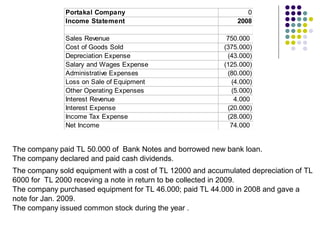

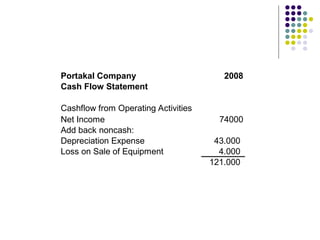

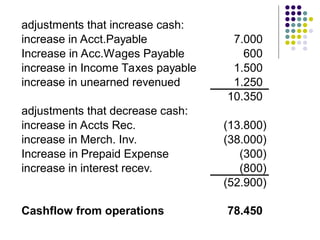

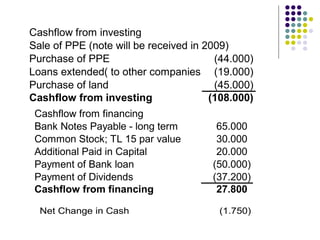

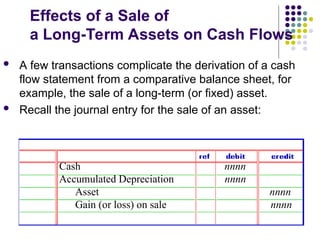

The document provides a comprehensive overview of the cash flow statement, detailing its purpose, classifications, and methods of preparation. It emphasizes the distinctions between cash flow from operating, investing, and financing activities, and discusses the transition from accrual to cash basis accounting. Additionally, it outlines the significance of cash flows for both internal and external stakeholders and compares the cash flow metrics with net income.