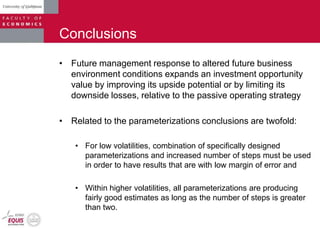

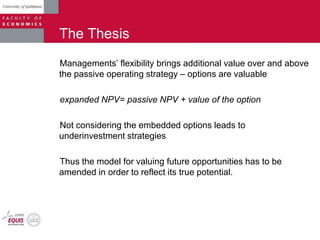

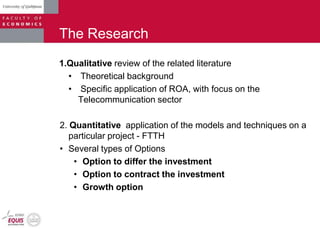

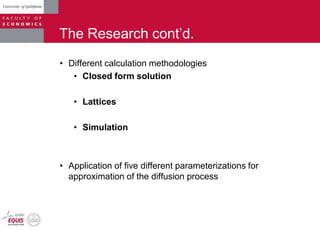

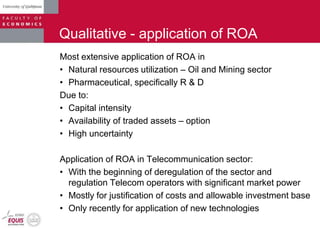

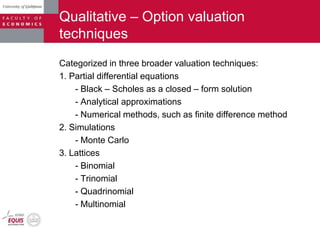

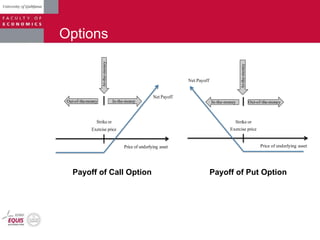

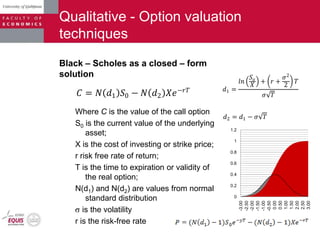

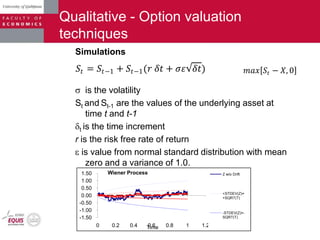

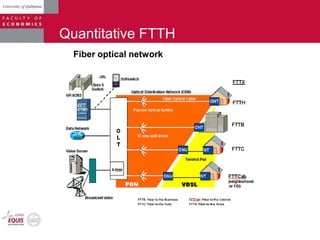

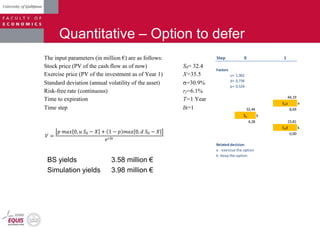

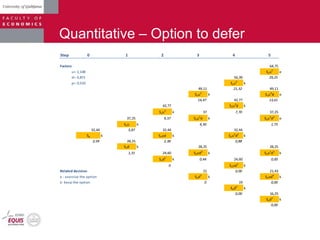

The thesis explores capital budgeting decision-making in the telecom sector through real option analysis (ROA), arguing that traditional discounted cash flow (DCF) analysis underestimates the value of management flexibility in investments. It identifies limitations of DCF, such as reliance on historical beta for future performance and constant discount rates for non-constant cash flows, and emphasizes the need for an adapted model that incorporates these real options. The research includes both qualitative literature review and quantitative application of ROA to a case study involving fiber-to-the-home (FTTH) technology, utilizing various option valuation techniques.

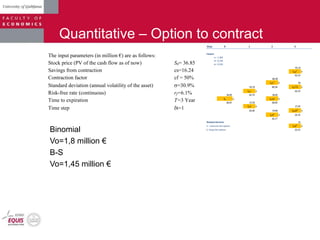

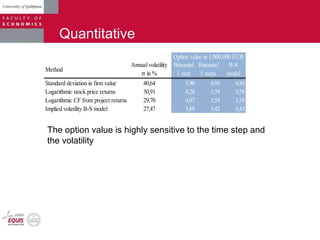

![Quantitative Different parameterizations

0,00

0,50

1,00

1,50

2,00

2,50

3,00

3,50

4,00

4,50

5,00

1 2 5 10

Project value

[millionEUR]

number of steps n

BS

CRR

RB

Trigerogis

Hull

Haahtela

=30,9%

Option to defer the investment for one year](https://image.slidesharecdn.com/dimitarserafimov-presentation-130526113523-phpapp02/85/Capital-Budgeting-decision-making-in-telecom-sector-using-real-option-analysis-28-320.jpg)

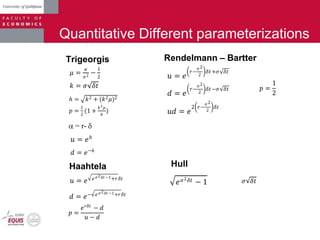

![Quantitative Different parameterizations

-1

0

1

2

3

4

5

6

0% 5% 10% 15% 20% 25% 30% 35% 40% 45%

Project value

[million €]

Volatility

BS

CRR

Trigeorgis

RB

Hull

Haahtela

0

0.5

1

1.5

2

5% 10% 15% 20%

Option to Differ the Investment (Double Step) With Different

Parameterizations in Relation to Volatility](https://image.slidesharecdn.com/dimitarserafimov-presentation-130526113523-phpapp02/85/Capital-Budgeting-decision-making-in-telecom-sector-using-real-option-analysis-29-320.jpg)