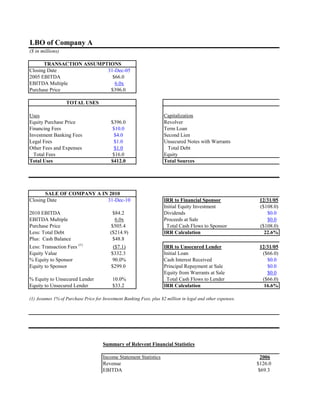

The document details the leveraged buyout (LBO) of Company A, including key financial metrics such as total uses and sources of funds, projected EBITDA growth, and acquisition details from 2005 to 2010. It outlines the transaction's implications for both financial sponsors and unsecured lenders, highlighting their respective internal rates of return (IRR). Additionally, it provides historical and projected financial statements, including income statements and balance sheets, offering insights into Company A's financial performance over the years.