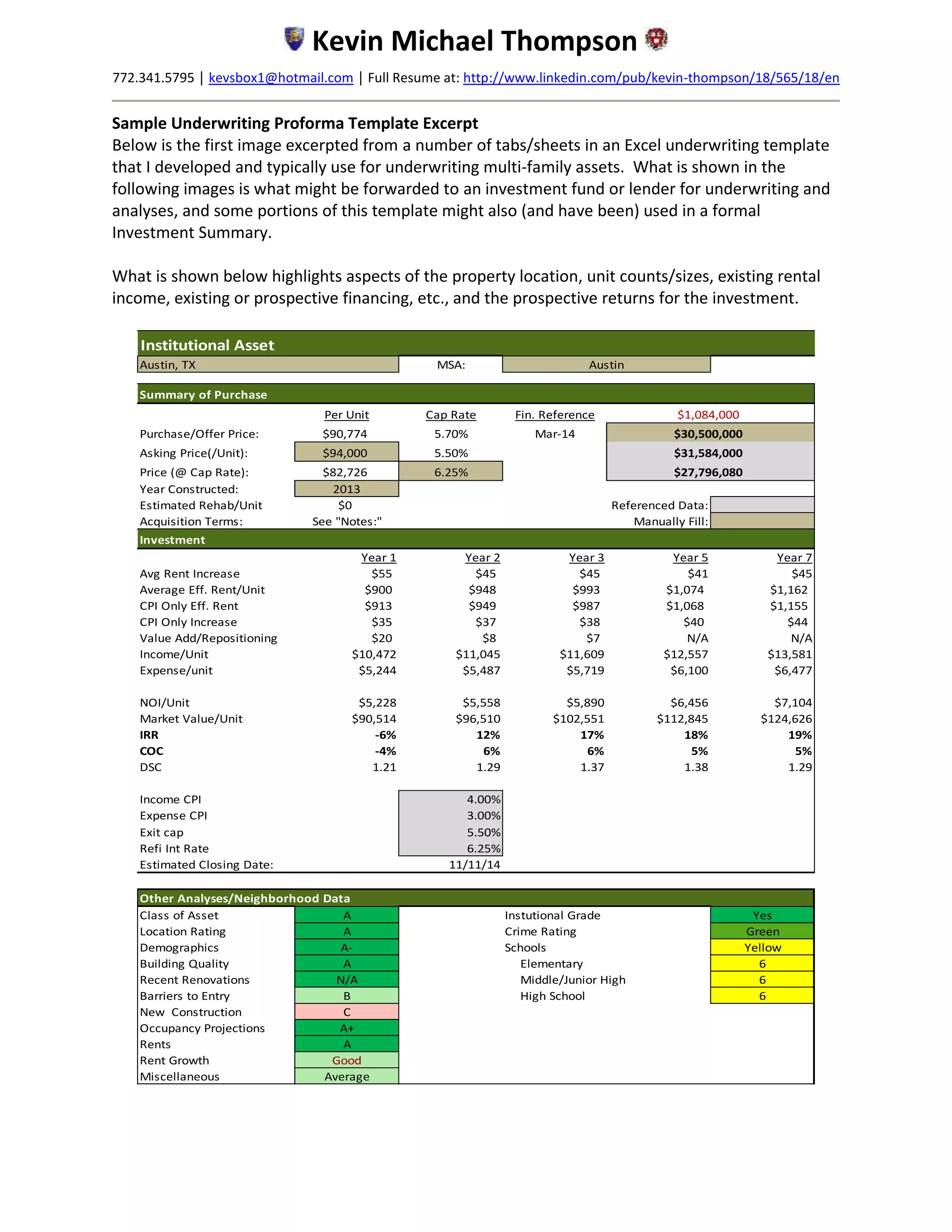

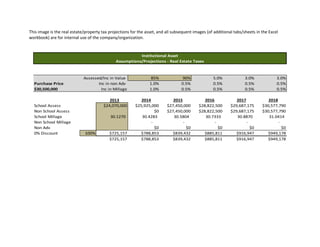

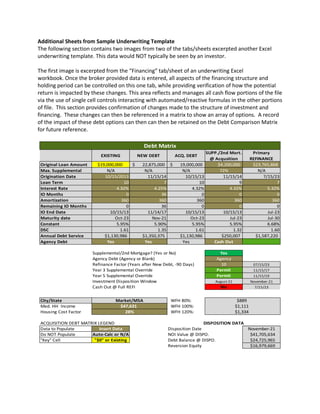

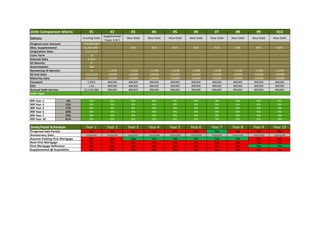

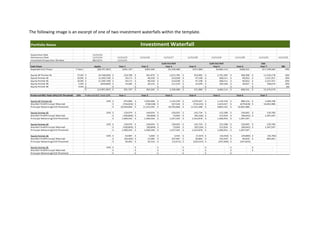

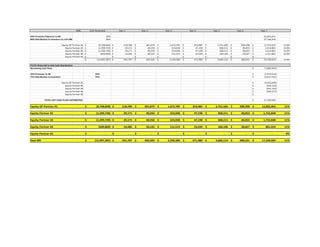

This document contains an excerpt from an Excel underwriting template used to analyze the purchase of a multi-family property in Austin, TX. The template provides key details about the property such as unit mix and sizes, existing rental income, purchase price, projected returns, and financing. It projects stabilized net operating income, cash flows, returns, and potential refinancing amounts over a 7 year period. The property is described as an institutional grade asset with 336 units appealing to young tech tenants. Projected returns include a 12% IRR in year 1, 17% in year 3, and cash-on-cash returns of 6-7% in years 2-7.