Embed presentation

Downloaded 13 times

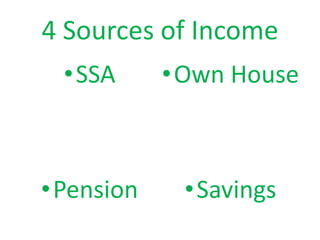

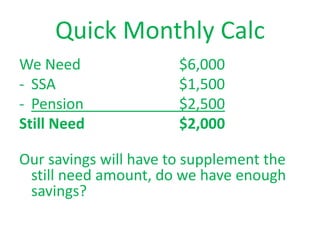

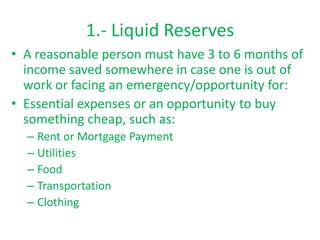

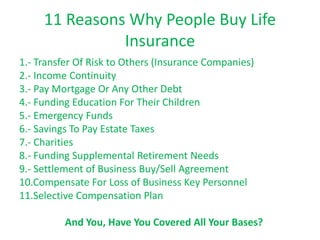

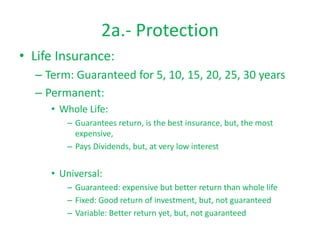

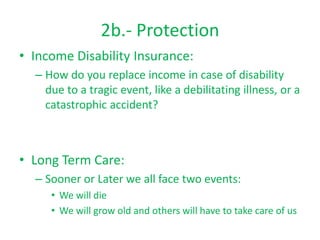

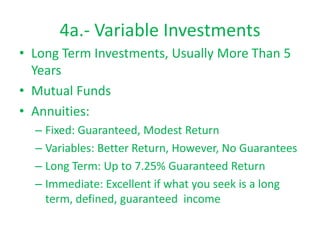

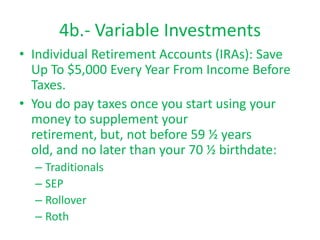

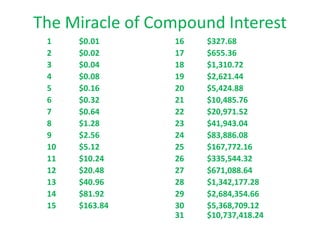

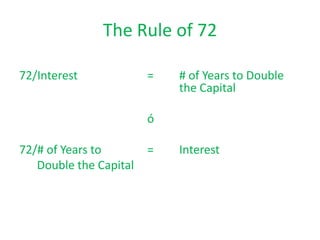

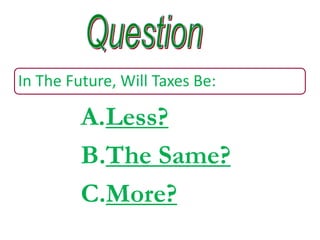

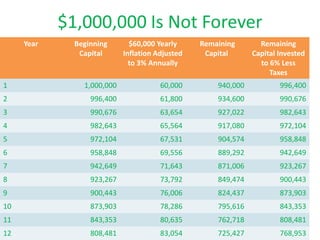

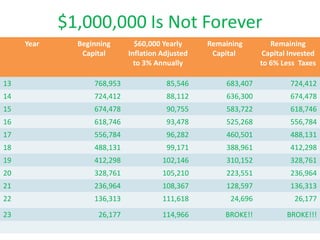

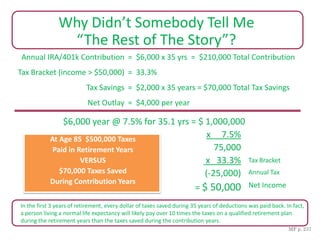

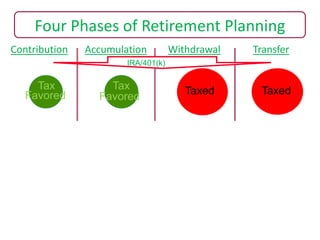

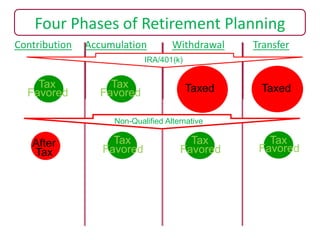

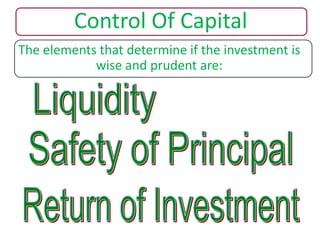

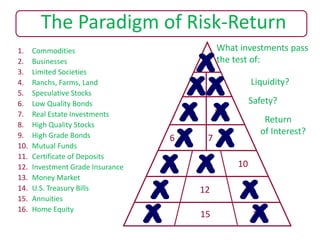

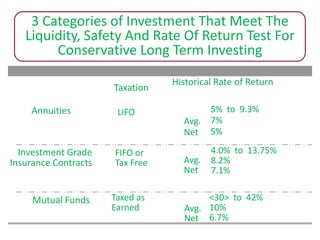

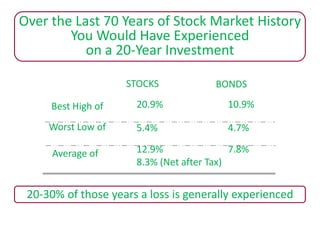

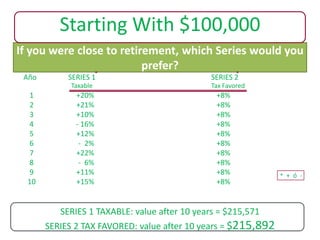

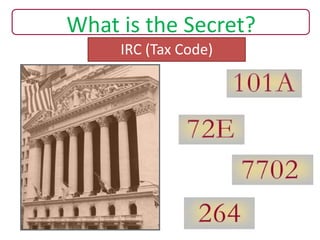

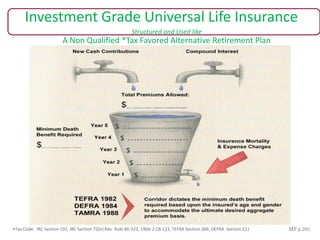

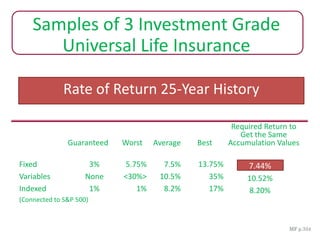

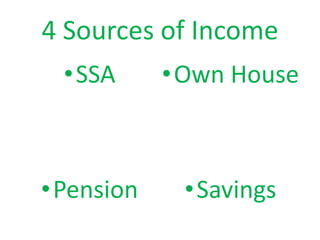

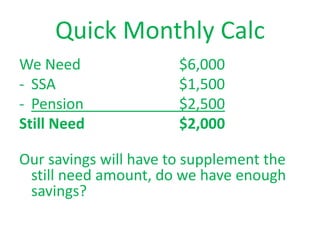

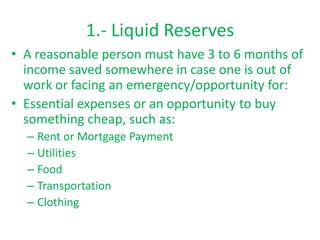

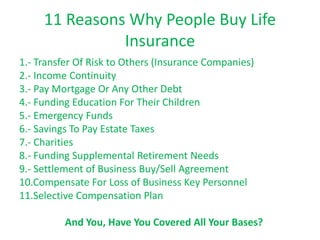

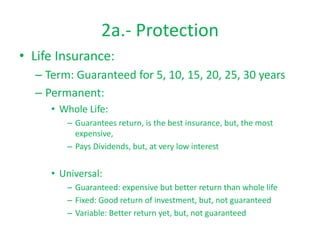

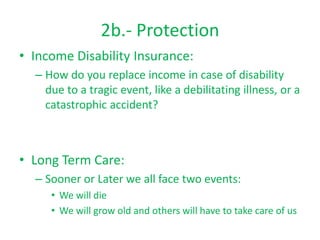

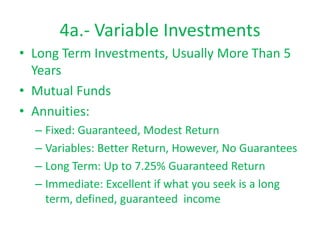

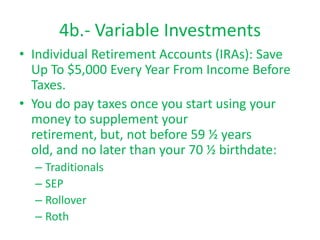

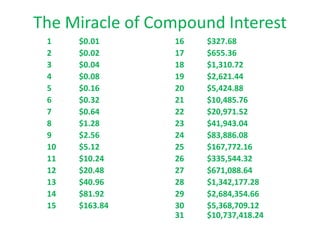

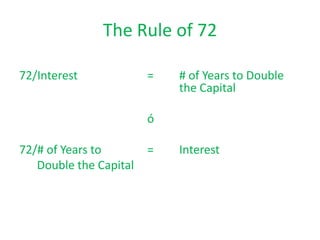

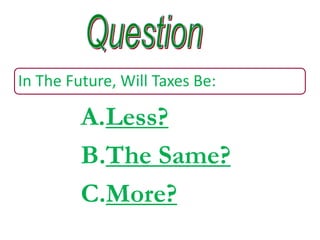

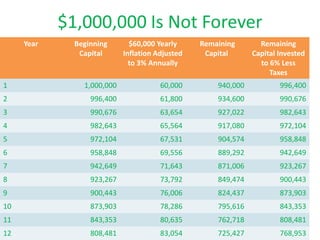

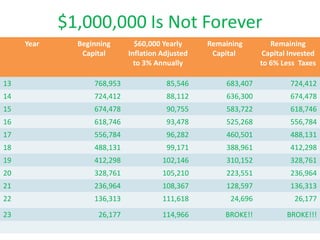

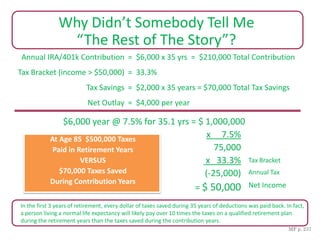

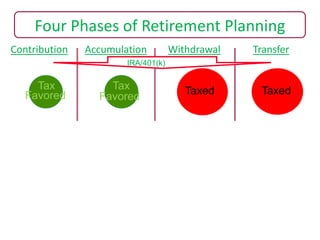

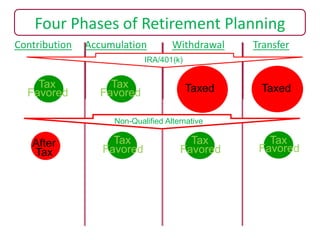

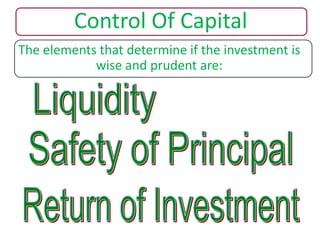

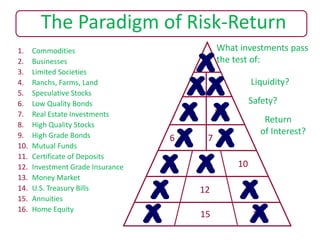

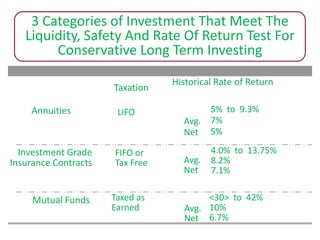

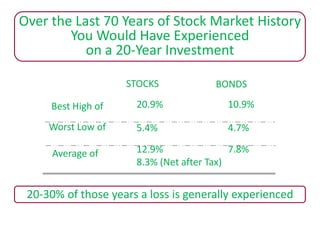

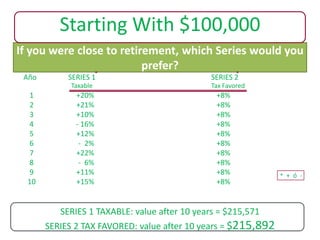

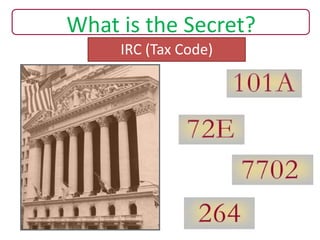

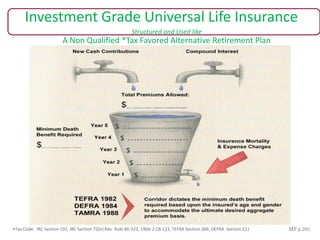

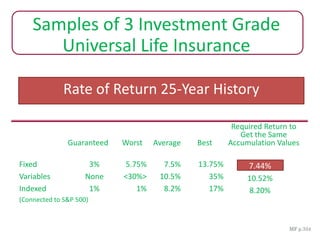

This document provides information about financial planning and investments. It discusses the importance of having liquid reserves, different types of investments including fixed and variable options, and factors to consider like risk, return, and taxes. It also covers retirement planning, comparing qualified versus non-qualified options, and how to structure investments for a tax-favored alternative retirement plan using universal life insurance. The key ideas are financial security, diversification, and maximizing returns while minimizing taxes and risks.