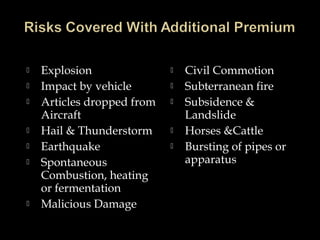

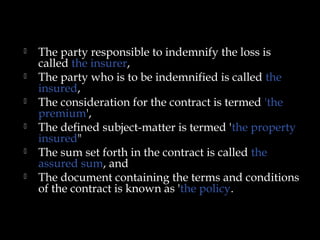

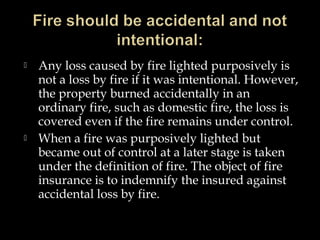

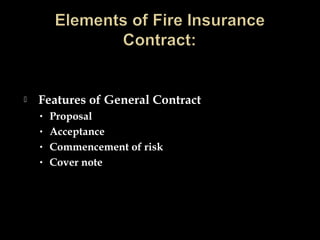

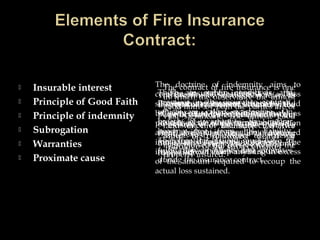

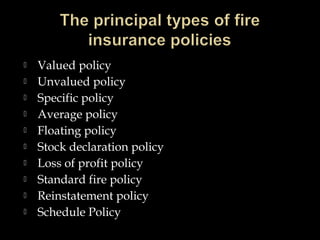

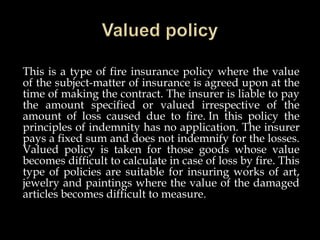

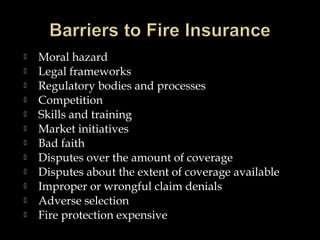

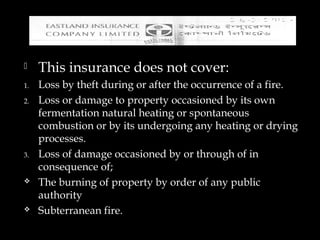

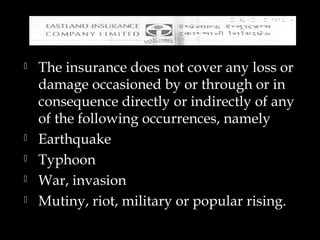

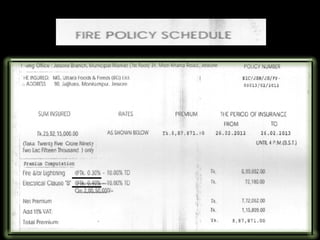

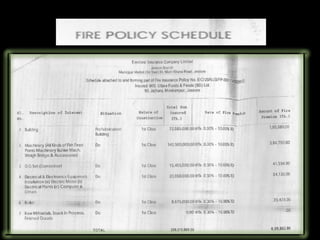

Fire insurance is a specialized type of insurance designed to cover property damage caused by fire and other perils, historically established after the Great Fire of London in 1666. The contract involves two parties—the insurer who provides indemnity against defined risks, and the insured who seeks coverage, with specific terms like 'premium,' 'assured sum,' and the 'policy.' Various types of fire insurance policies exist, each with distinct characteristics, covering different perils, and aiming to compensate for accidental losses while adhering to principles like insurable interest and utmost good faith.