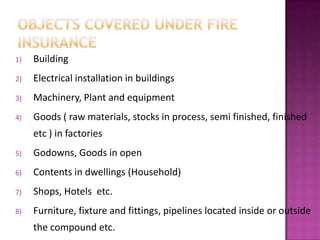

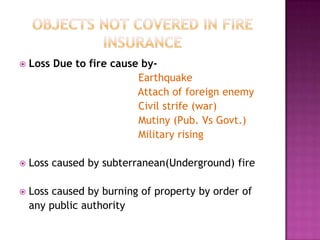

1) Fire insurance provides coverage for losses due to fire to both commercial and residential properties. It can cover buildings, machinery, equipment, inventory and other property.

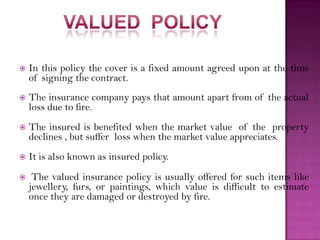

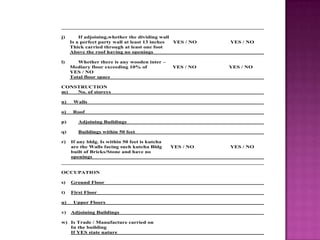

2) There are different types of fire insurance policies including specific insurance policies that provide a fixed payout amount, reinstatement policies that cover rebuilding costs, and floating policies that cover inventory stored in multiple locations.

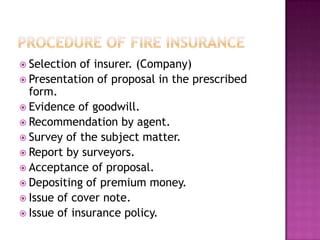

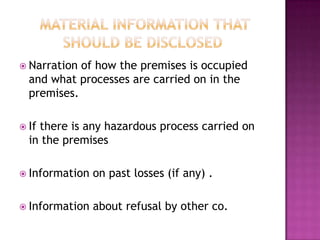

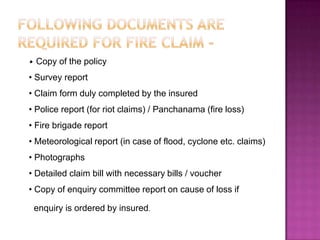

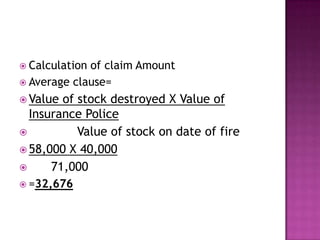

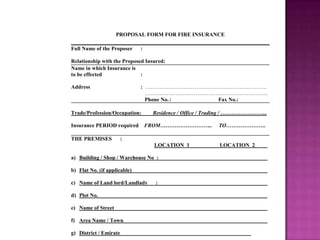

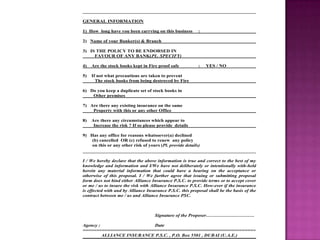

3) To make a claim, the insured needs to provide documents like the insurance policy, loss assessment reports, bills and invoices, and police reports in the case of arson. The insurance company will then pay the claim amount as per the policy terms.