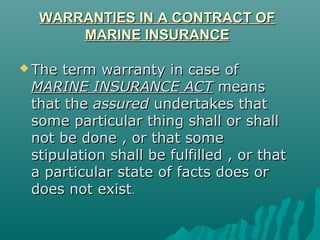

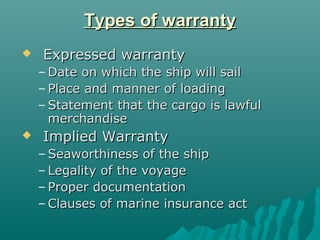

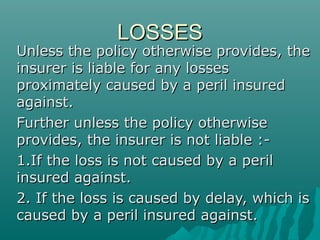

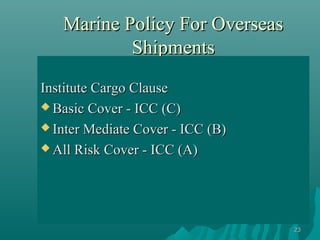

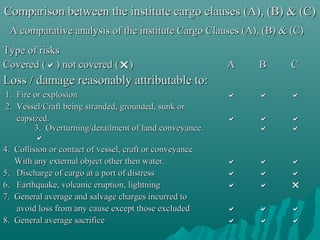

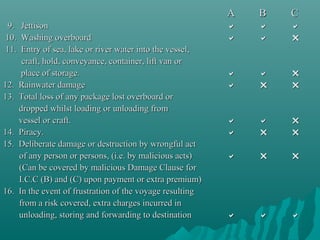

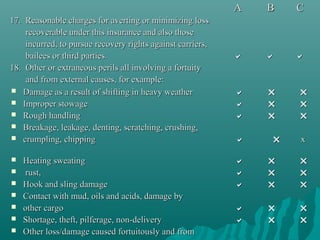

This document provides an overview of marine insurance and key concepts related to business risk management. It defines marine insurance as a contract where the insurer agrees to indemnify the insured for losses from marine adventures. Some key points covered include the meaning and purpose of marine insurance policies, principles like utmost good faith and insurable interest, types of policies and clauses, insured perils and exclusions, losses like total/partial/average losses, and warranties. The document also compares the different levels of coverage under the Institute Cargo Clauses A, B and C.

![Marine Policy

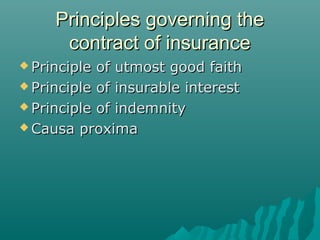

Meaning :-

The terms and conditions on which a

contract of marine insurance is entered

into between the assured and the

insurer are incorporated in a document.

It must be signed by or on behalf of

the insurer [Sec.26(1)].

It must be duly stamped under the

Stamp Act, 1899.](https://image.slidesharecdn.com/marineinsppt-130304232326-phpapp02/85/Marine-ins-ppt-6-320.jpg)

![Types of Marine Policies

Some important types of policies are:

I. Voyage Policy :-

Where the contract is to insure the subject-

matter at and from or from one place to

another or others [Sec.27(1)].

II. Time Policy :-

Where the contract is to insure the subject-

matter for a definite period of time

[Sec.27(1)].

It can’t be for a period more than a year

[Sec.27(2)].

It may, however, contain a ‘continuation

clause’.](https://image.slidesharecdn.com/marineinsppt-130304232326-phpapp02/85/Marine-ins-ppt-8-320.jpg)