A Short Course In Non-Life Insurance

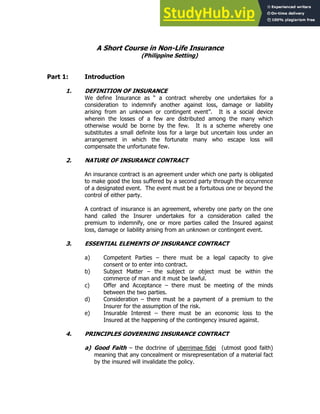

- 1. A Short Course in Non-Life Insurance (Philippine Setting) Part 1: Introduction 1. DEFINITION OF INSURANCE We define Insurance as “ a contract whereby one undertakes for a consideration to indemnify another against loss, damage or liability arising from an unknown or contingent event”. It is a social device wherein the losses of a few are distributed among the many which otherwise would be borne by the few. It is a scheme whereby one substitutes a small definite loss for a large but uncertain loss under an arrangement in which the fortunate many who escape loss will compensate the unfortunate few. 2. NATURE OF INSURANCE CONTRACT An insurance contract is an agreement under which one party is obligated to make good the loss suffered by a second party through the occurrence of a designated event. The event must be a fortuitous one or beyond the control of either party. A contract of insurance is an agreement, whereby one party on the one hand called the Insurer undertakes for a consideration called the premium to indemnify, one or more parties called the Insured against loss, damage or liability arising from an unknown or contingent event. 3. ESSENTIAL ELEMENTS OF INSURANCE CONTRACT a) Competent Parties – there must be a legal capacity to give consent or to enter into contract. b) Subject Matter – the subject or object must be within the commerce of man and it must be lawful. c) Offer and Acceptance – there must be meeting of the minds between the two parties. d) Consideration – there must be a payment of a premium to the Insurer for the assumption of the risk. e) Insurable Interest – there must be an economic loss to the Insured at the happening of the contingency insured against. 4. PRINCIPLES GOVERNING INSURANCE CONTRACT a) Good Faith – the doctrine of uberrimae fidei (utmost good faith) meaning that any concealment or misrepresentation of a material fact by the insured will invalidate the policy.

- 2. b) Insurable Interest – is meant that interest which exists when the insured will suffer a disadvantage if the contingency insured against happens and will enjoy a benefit if the contingency insured against fails to happen. c) Indemnify – to make good a loss. This means to place the insured in the same situation in which he was before the loss. d) Subrogation – the right of an insurer to be substituted to any right of action which the insured may have against a third person whose negligence or wrongful act caused the loss or injury. e) Contribution – means that if there is more than one policy in force covering the same interest in the same subject matter against the same peril, the insured shall not be entitled to recover more than full amount of the loss. f) Proximate Cause – that which in a natural and continuous sequence, unbroken by any new independent cause, produces that event and without which, that event would not have occurred. 5. MAJOR CLASSES OF GENERAL INSURANCE a) Fire b) Marine aa. Marine Cargo bb. Marine Hull c) Motor Car aa. Private Car bb. Commercial Vehicle cc. Land Transportation Operator dd. Motorcycle ee. Motor Trade d) Personal Accident e) Aviation aa. Hull bb. Liabilities f) Engineering Insurance aa. Contractors All Risks bb. Erection All Risks cc. Machinery Breakdown g) Miscellaneous Casualty Lines aa. Comprehensive General Liability

- 3. bb. Scheduled Property Floater h) Bonds aa. Surety bb. Fidelity 6. FORMS a) Proposal – an application for cover or for a premium to be quoted. It gives the Insurer full details of the risk against which insurance protection is to be provided. b) Cover Note – a document by which temporary cover is granted by the Insurer to the Assured pending issuance of regular policy. c) Policy – not the contract itself but evidence of the contract. Main Sections aa. Basic Data/Schedule i Policy Number ii Name of Insured iii Amount Insured iv Period of Insurance v Insurance Rate vi Amount of Premium bb. Recital Clause or Preamble – spells out the parties to the contract, the proposal as basis of the contract, the premium. cc. Operative Clause – sets out the circumstances under which the insurers are liable to the insured dd. Exclusions Clause – enumerates the excepted risks in the coverage ee. Conditions – sets out the rules which govern the application and interpretation of the contract as a whole ff. Attestation Clause – confirms that the insurers have authenticated the contract by signature. d) Endorsement – policy alterations refer to changes made after the issuance of policies or at the time of issuance for the purpose of altering, limiting, extending or clarifying any of the policy terms or conditions. The usual method of effecting policy alterations is by way of endorsements. An endorsement is defined as a written form of agreement between the Insured and the Insurer entered into for the purpose of modifying, limiting, extending, altering, correcting or clarifying

- 4. policy terms, conditions or wordings or to incorporate additional or new agreements. 7. RISK - it is possibility of loss or injury 8. PERILS - are the causes of loss. Their existence creates risks. Fire, theft, death and sickness are perils. 9. HAZARDS Hazards are the conditions of a risk that may create or increase the chance of loss. The kinds of hazards are physical, moral and morale hazards. 10. PARTIES TO AN INSURANCE CONTRACT a) Insurer – any person, partnership, association or corporation duly authorized to transact business. b) Insured – anyone except a public enemy may be insured.

- 5. Part 2: FIRE INSURANCE 1. DEFINITION Fire Insurance is a contract whereby one (the insurer) promises, for a consideration (the premium) to indemnify another, (the Assured) for direct loss or damage of the latter’s property by fire or lightning. 2. POLICY TERM Refers to the period of insurance, that is, the time limit within which a policy will remain in force. Fire policies are usually written for a period of twelve (12) months or one year and are therefore issued on an annual basis. 3. OPEN POLICY AND VALUED POLICY The Standard Fire Policy is an open policy which means that in the event of loss, whether total or partial, it is understood that the amount of loss shall be subject to appraisal and the liability of the company, if established, shall be limited to the actual loss, subject to applicable terms, conditions, warranties and clauses of the policy, and in no case shall exceed the amount of the policy. In contrast, valued policy is one which expresses on the face an Agreement that the thing insured shall be valued at a specific sum. In the event of total loss, the valuation on the policy is deemed to be conclusive between the parties, except when there is fraud or error on the part of either party. 4. THE SUM INSURED The sum insured is simply the insurer’s maximum liability and a basis on which the premium is calculated; it is not an admission of the insurers of the value of the property nor it is the amount which they should pay in the event of the loss, unless there is a stipulation to this effect. 5. WHO MAY BE INSURED a) Absolute or Registered Owner of Property b) Part Owner or Joint Owner of Property c) Mortgagor or Mortgagee d) Lessor or Lessee e) Bailee – to whom property has been entrusted

- 6. 6. WHAT MAY BE INSURED a) Building (completed or under construction) b) Contents aa. Stocks in trade, goods or merchandise bb. Machinery, equipment, spare parts, accessories and tools. cc. Business or household appliances, utensils, furniture, fixtures and fittings. dd. Personal effects and belongings (money and jewelry excluded). ee. Other materials, property, such as postage stamps, books, motor vehicles and others. 7. DESCRIBING INSURED PROPERTY a) Machinery and Equipment “ On machineries and equipment of every kind and description …” However, if certain specific machinery or equipment are to be insured only, then such must definitely be specified so that the identity of that particular machinery or equipment insured may be established in the event of loss. b) Stocks “ On stocks in trade …” or “ on general merchandise of every kind and description …”. It is however, advisable to name some of the stocks or merchandise covered such as flour, rice, textiles etc. c) Household Contents i Household furniture, fixtures and fittings ii Personal effects and belongings (excluding money and jewelry) iii Electrical appliances iv Books and magazines v Kitchen utensils vi Betterments and improvements d) Business or Store Contents i Stocks in trade ii Business or store furniture, fixtures and fittings iii Business machines and electrical appliances iv Business equipment, betterments and improvements v Office stationeries and supplies

- 7. e) Office Contents i Office furniture, fixtures and fittings ii Office equipment, machines and electrical appliances iii Office stationeries and supplies iv Office betterments and improvements 8. LOCATION OF INSURED PROPERTY The location of an insured property is given in the following sequence: a) House Number and Name of the Street b) House Number of the whole building of which the premises to be insured forms a part c) District, town, municipality or city d) Province e) District and Block Number, if any 9. PERILS COVERED BY FIRE INSURANCE POLICY The following perils are covered in a Standard Fire Policy: a) Fire (subject to certain exclusions) b) Lightning, whether fire ensues or not The following forms of damage are likewise covered: a) Damage during or immediately following a fire caused by: aa. Smoke or Scorching bb. Falling walls and the like b) Damage caused by fire brigade or other competent authority in the discharge of their duty c) Damage to property removed from a burning building in an effort to save such property. 10. EXCLUSIONS Some of the exclusions provided for in a fire policy are: a) Inherent vice, process of decay

- 8. b) War, invasion, act of foreign enemy, hostilities or warlike operations (whether war be declared or not) civil war, mutiny, civil commotion, insurrection, rebellion, revolution, military or usurped power. c) Riot, strike, malicious action, impact by vehicle, forest fire d) Earthquake, volcanic eruption, flood, inundation, windstorm, tempest, water damage, removal of debris, consequential loss. e) Nuclear reaction, nuclear radiation. 11. SPECIAL PERILS INSURANCE (EXTENDED COVER) Some perils that are excluded as previously mentioned can also be covered by paying an additional premium and is usually effected by the issuance of an endorsement to the fire policy. a) Earthquake b) Typhoon and Flood c) Riot and Strike d) Loss or damage caused directly by impact of land vehicle or falling object. e) Bursting or overflow of water tanks, apparatus or pipes. 12. PREMIUM PAYMENTS Our Standard Fire Policy emphatically states that the insurance company does not assume liability unless the premium is paid. The insurance company will make good any loss after payment of premium. 13. POLICY CANCELLATIONS A fire policy may be cancelled at the request of the Insured upon which the unearned premium must be refunded. No reason need be given by the Insured. 14. RENEWALS After a policy has been in force for one year, it may be renewed for another year subject to mutual consent. In other words, both the insured and the insurance company has the option to decide whether to renew or not.

- 9. 15. COVER NOTES Sometimes applicants need insurance coverage very badly, but necessary details or date are not available for the issuance of regular policies. In such case, insurance companies may issue provisional certificates of insurance coverage known as Cover Notes in which the basic or skeletal information is listed. However, cover notes are temporary in nature and must be replaced with regular policies within sixty (60) days. 16. PROCEDURES OF FIRE INSURANCE CLAIMS Generally speaking, whenever a fire loss occurs, the very first thing for an agent to do would be to give written notice to the insurance company involved and to inquire which adjuster or adjustment company the insurer has designated to handle the claim. After an adjuster conducted an on-site inspection, normally a claim form will be given to the insured. There are many questions to be answered. Primarily, the information would concern policy no., location of risk, property insured, date and time of fire, origin and cause of fire, extent of loss, other insurances and the amount of the claim. Claim form is to be subscribed and notarized. The Insured may be required to submit supporting papers and documents to prove his claim, such as income tax returns, building plans (in case of building insurance), invoices, sales records and others. After the adjusters having evaluated all the facts and circumstances surrounding the fire, liability has to be admitted or denied in behalf of the insurance company. If it were admitted, the adjuster would then proceed to negotiate with the insured to determine the amount of compensation payable and to resolve matters concerning salvage, if any. This would eventually lead to payment of the loss. If it were denied, then an official advice will have to be given of such denial.

- 10. Part 3: MARINE INSURANCE DEFINITION Marine Insurance is an insurance against risks connected with navigation in which a ship, cargo, freightage, profit or other insurable interest in movable property may be exposed during a certain voyage or a fixed period of time. 1. CLASSES OF MARINE INSURANCE Marine Insurance is classified according to the subject matter insured, as follows: a) Cargo Insurance – this refers to insurance on goods or movables. According to the Rules of Construction of Policy, the term goods means goods in the nature of merchandise, and does not include personal effects or provision and stores for use on board. b) Hull Insurance – this refers to insurance on ship, i.e., hull and machinery and specially covers loss of or damage to hull or machinery directly caused by accidents in loading, discharging or shifting cargo or fuel; explosions on shipboard or elsewhere; breakdown of or accident to nuclear installations or reaction on shipboard or elsewhere bursting of boilers, breakage of shafts or any latent defect in the machinery or hull; contact with an aircraft; negligence of master, officers, crew or pilots provided such loss or damage has not resulted from want of due diligence by the assured, owners or managers. c) Freight Insurance – as the name suggests, this refers to insurance on freight. The rules for construction of policy defines freight as including the profit derivable by shipowner from the employment of his ship to carry his own goods or movables, as well as freight payable by a third party, but does not include passage money. A freight insurance policy covers a sum not exceeding 15% of the value of hull and machinery. Loss of freight is recoverable if directly caused by the perils mentioned above. In the event of a total loss of the insured vessel, the sum insured shall be paid in full. 2. SOME OF THE PERILS INSURED AGAINST The plain form of marine policy enumerates the perils insured against, as follows:

- 11. a) Fire – hardly needs definition. Damage due to fire, lightning, smoke, scorching, damage done by water or by chemicals used in extinguishing fire, are compensable. b) Collision – loss or damage caused by the impact of vessel with another or any stationary object (including ice). c) Stranding – when in consequence of some accidental or unusual occurrence, she comes in contact with the ground or other obstruction, and remains hard fast upon it. It may be on the rocks, on piles which have been driven into the harbour bed, and so forth. d) Grounding – this is almost similar to stranding. This is a situation where ship or vessel cannot move as it has struck bottom. Vessel, however, has not sunk. e) Sinking – this is a situation where ship or vessel goes underneath the surface of the water. In respect of sinking, it must generally be of such a nature that the vessel is completely covered with water. If the vessel could still be further immersed, there is no sinking. 3. MARINE CARGO INSURANCE a) Types of Policy aa. Open Policy – a continuous contract covering automatically all shipments within certain geographical limits for an indefinite period of time subject to cancellation by either party. bb. S. G. Form (Ship-goods) – covers only one shipment or voyage. b) Particulars of a Marine Cargo Policy aa. Name and address of assured bb. Amount of Insurance and Value of Goods cc. Full description of cargo dd. Type of packing – no. of crates/packing/boxes ee. Marks and Numbers ff. Name of Vessel gg. Loading/Sailing/Arrival Dates hh. Ports of Origin and Destination ii. Consignee, if other than proposer or shipper jj. Terms and conditions of insurance kk. Bill of Lading ll. Negotiating Bank and Letter of Credit mm. Place of Settlement and/or Payment of Claim

- 12. 4. TYPES OF COVERAGES (Old Clauses) An Insured may choose the type of coverage he wants depending on his particular needs. The following are the coverages available: a) Total loss by total loss of vessel only this is the most restricted cover. In order for a claim to arise, the vessel carrying the cargo has to be a total loss and the cargo impossible to save except at a cost exceeding the value of the salvaged cargo. b) Total Loss Only – interest must have been totally lost by one of the perils enumerated in the policy. c) Free from Particular Average (FPA) – loss of a part of a whole shipment which is not a total loss is not covered (old clauses) Losses Allowed: aa. Total and/or constructive total loss bb. Total loss of any apportionable part or a distinct species, if the whole shipment is composed of several species. cc. Total loss of any package in loading, transhipment or discharge. dd. Direct liability for general average sacrifice ee. General average contributions ff. Salvage charges gg. Particular charges whenever recoverable under a policy covering particular average. hh. Sue and labor charges ii. Particular average irrespective of percentage if the vessel or craft be stranded, sunk or burnt, and so forth. d) With Average (WA) – under this, particular average and other loss or damage are recoverable in all circumstances in which they are admitted under FPA. All other particular average arising from perils insured against is payable if it attains the percentage specified in the policy. (old clauses) e) Against All Risks – all losses that are payable under the WA are covered as well as losses from the additional coverages such as: (old clause) aa. Theft, pilferage, and non-delivery bb. Leakage and breakage cc. Fresh water damage dd. Sweat and mold ee. Hook damage All risks does not cover faulty manufacture, inherent vice or delay.

- 13. 5. BASIC MARINE CARGO COVERS NEW CLAUSES – (For Air and Water Transport) A) INSTITUTE CARGO CLAUSES “C” 1. Perils Covered Loss of or damage to the subject-matter insured reasonably attributable to: a. Fire or explosion b. Vessel or craft being stranded grounded sunk or capsized c. Overturning or derailment of land conveyance d. Collision or contact of vessel craft or conveyance with any external object other than water e. Discharge of cargo at a port of distress f. General average sacrifice g. Jettison 2. Duration of Cover Warehouse at the port of loading up to delivery to warehouse at port of destination, or upon the lapse of fifteen (15) days counting from the date the cargo landed at port of discharge, WHICHEVER SHALL FIRST OCCUR. 3. Clauses and Warranties under Clauses “C” a. Institute Cargo Clauses “C” 1/1/82 b. Red Clause “B” 1/11/76 c. Institute Classification Clause 1/7/78 (not applicable for air transport) d. Fifteen (15) days clause. (For overseas shipment) e. Seven (7) days clause. (For inter-island shipment) 4. Goods and merchandise allowed for clauses “C” cover: a. shipment of powder like cement, wheat, flour, etc. b. Rice and grains c. Salt, sugar, tobacco, seeds d. Copper and copper products e. Non-flammable chemicals f. Non-flammable liquids g. Frozen fish and meat products h. Vegetable and other food items

- 14. B) INSTITUTE CARGO CLAUSES “B” 1. Perils Covered Loss of or damage to the subject-matter insured reasonably attributable to: a. All clauses “C” perils, plus b. Earthquake, volcanic eruption or lightning c. Washing overboard d. Entry of sea lake or river water into vessel craft hold conveyance container liftvan or place of storage e. Total loss of any package lost overboard or dropped whilst loading on to, or unloading from, vessel or craft. 2. Duration of Cover (Same as CLAUSES “C”) 3. Clauses and Warranties under clauses “B” a. Institute Cargo Clauses “B” 1/1/82 b. Red Clause “B” 1/11/76 c. Institute Classification Clause 1/7/78 (not applicable for air transport) d. Fifteen (15) days clause. (for overseas shipment) e. Seven (7) days clause. (for inter-island shipment) 4. Goods and merchandise allowed for clauses “B” a. Automobiles and trucks and other motor vehicle b. Native handicrafts c. Textiles and clothings d. Paper/plastic products C) INSTITUTE CARGO CLAUSES “A” OR ALL RISKS 1. Perils Covered All types of loss or damage except: a. Inherent Vice – the natural tendency of some items to effect a chemical reaction within themselves to as to make them physically unusable for the intended purposes. e. g. decay in case of fruits and vegetables, rotting in case of fresh meat, spontaneous combustion in the case of copra.

- 15. b. Delay – frequently occurring in shipments of chemicals due to prolonged storage at the piers, the chemicals could lose their potency. 2. Duration of Cover (Same as in clauses “B” and “C”) 3. Clauses and Warranties under Clauses “A” or All Risks a. Institute Cargo Clauses “A” 1/1/82 b. Institute Classification Clause 1/7/78 (not applicable for air transport) c. Red Clause “B” 1/11/76 d. Fifteen (15) days clause. (for overseas shipment) e. Seven (7) days clause (for inter-island shipment) f. Institute Theft, Pilferage and Non-Delivery (Insured Value) Clause 16/7/28 g. Nuclear Exclusion Clause 4. Goods and Merchandise allowed for ALL RISKS cover as follows: a. Steel machineries and spare parts b. Steel products D) TOTAL LOSS ONLY 1. Perils Covered Total loss of the entire cargo due to perils insured against. 2. Duration of Cover From the time cargo is admitted onboard the vessel until unloaded therefrom at the port of destination or upon the lapse of seven (7) days counting from the date cargo landed at port of discharge, whichever shall first occur.

- 16. 3. Clauses and Warranties under TLO a. Red Clause “B” 1/11/76 b. Typhoon Clause c. Overloading Warranty d. Nuclear Exclusions Clause e. Seven (7) days clause E) TOTAL LOSS BY TOTAL LOSS OF THE VESSEL ONLY (TL/TLVO) 1. Perils Covered Total loss of the entire cargo arising from total loss of the vessel. The proximate cause should be perils of the sea. 2. Scope of Cover Whilst on board the vessel 3. Clauses and Warranties under TL/TLVO a. Red Clause “B” 1/11/76 b. Typhoon Clause c. Overloading Warranty d. Nuclear Exclusions Clause F) LAND TRANSPORT 1. Perils Covered – Loss or damage arising from the following: a. Fire, including self-ignition and internal explosion of the conveyance. b. Accidental collision of the vehicle with any other automobile, vehicle or object excluding, however, contact with any portion of the road bed, curbing, any stationary object while backing for loading or unloading or rails or ties of street and excluding collision of the load with any object when such collision of the load with any object does not involve collision of the carrying truck.

- 17. c. Overturning or upset of the motor truck d. Explosion e. Collapse or subsidence of bridges f. Flood (meaning rising of navigable waters), lightning, cyclone, tornado, landslide, earthquake and volcanic erruption. 2. Scope of Cover Whilst in transit on board the truck. 3. Clauses and Warranties under Truck Risks Clause a. Red Clause “B” 1/11/76 6. LOSSES a) Total Loss aa. Actual Total – a material and physical loss of the subject matter insured. bb. Constructive Total – commercial loss of the subject matter insured is reasonably assumed if more than ¾ of the value is actually lost. b) Partial Loss Any other loss not considered total. c) General Average Loss Loss due to a general average act – when any extra-ordinary sacrifice or expenditure is voluntarily and reasonably made or incurred in the time of peril for the purpose of preserving the property imperilled in the common adventure

- 18. 1. CLAIMS PROCEDURE In the event of loss or damage, it is the duty of the assured to safeguard his insured cargo and he is required under his marine cargo policy, as follows: a) To claim immediately on the carriers, Port Authorities or other Bailee for any missing package. b) To apply immediately for survey by carrier’s or other Bailees’ Representative if any loss or damage be apparent and claim on the Carriers or other Bailees for any actual loss or damage found at such survey. c) In no circumstances, except under written protest, to give clean receipts where goods are in doubtful condition. d) To give notice in writing to the Carriers or other Bailees within three (3) days of delivery if the loss or damage was not apparent at the time of taking delivery. 2. In general, the documents required by a marine insurer to be produced by the assured for purposes of substantiating a loss under the policy are the following: a) Marine Cargo Policy b) Supplier’s Invoice c) Supplier’s Packing List d) Bill of Lading e) Certificate of Bad Order f) Certificate of Short-Delivery g) Certificate of Non-Delivery h) Certificate of Short-Landing i) Certificate of Survey j) Correspondence exchange between the assured and Bailees

- 19. Part 4: MOTOR CAR INSURANCE Motor Vehicle (Auto) Insurance, defined - any kind of insurance pertaining to the ownership, maintenance or use of motor vehicle. Two (2) Major Divisions of Auto Insurance Coverage 1. Physical or Material Damage Coverage This is the insurance that protects the insured from loss or damage to the car itself. Example of covered losses are as follows: a. Collision or overturning b. Fire, lightning, self-ignition c. External explosion d. Burglary, theft e. Malicious act, other than by the insured f. Whilst being transported by road, rail, inland transit, lift or elevator. 2. Casualty Coverage – refers to the liability and personal accident coverage afforded under the motor car policy; consists of the following sub-groupings: a. Bodily Injury Liability b. Property Damage Liability the insured shall become legally obligated to pay for injury and/or damage to property belonging to others caused by accident, arising from the use, ownership and maintenance of the insured vehicle, subject to policy limits. c. Personal Accident – this covers death or injuries to occupants of the vehicle resulting from accident whilst boarding, riding or alighting from the insured vehicle, regardless of liability. Five (5) Motor Vehicle Policy Forms in Use: 1. Private Car Policy Form - for private use cars 2. Commercial Vehicle Form - for vehicles used for carriage of own goods and for domestic and social purposes 3. Motor Trade Policy - this is the policy for motor car dealers for vehicles whilst on display and on demonstration

- 20. 4. Motor Cycle Policy - for motorcycles and tricycles 5. Land Transportation Operators Policy - for vehicles used for carriage of passenger and cargo for hire or reward. Automotive equipment not belonging under these classifications (e.g. mobile crane, bulldozer, road grader, road roller, farm tractor, etc.) are insured under Inland Floater Policy. BRIEF DISCUSSION OF PRINCIPAL POLICY CONDITIONS 1) Recital Clause “Whereas the Insured by his corresponding proposal and declaration and which shall be the basis of this contract and is deemed to be incorporated herein has applied to the Company for the insurance hereinafter contained, subject to the payment of the premium as consideration for such insurance.” Two (2) terms in this Recital Clause must be noted: a. Proposal Form It is common practice in the insurance of motor vehicle to insist upon the completion of a written proposal form setting out the details of the risk and it will be observed that this proposal is incorporated in the policy and thus made part of the policy. Any material misrepresentation may adversely affect the validity of the policy. b. Premium – The Insurance Code provides: 1. “Sec. 77. An insurer is entitled to payment of the premium as soon as the thing insured is exposed to the peril insured against. Notwithstanding any agreement to the contrary, no policy or contract of insurance issued by an insurance company is valid and binding unless and until the premium thereof has been paid, except in the case of a life or an industrial life policy whenever the grace period provisions applies. 2. Under Sec. 64 of the Insurance Code, non-payment of the premium is one of the grounds that allows an insurance company to cancel a policy. 2) Section I – LIABILITY TO THE PUBLIC a. Principal provision – to pay all sums necessary to discharge liability of the insured in respect of bodily injury and/or death to any THIRD PARTY, in an accident caused by or arising out of the use of the scheduled vehicle provided that the insured’s liability shall have first been determined.

- 21. Essential Elements 1. the purpose is to indemnify the insured 2. there must be an accident 3. the accident must have been caused by or arose out of the use of the motor vehicle 4. the insured must be legally liable. b. Limits of Liability – as specified in the schedule in accordance with the law. c. Who are protected – (1) Insured and (2) Authorized driver d. Extended Protection – This insurance protection covers the insured even when personally driving another private car not belonging to him and not hired by him under a hire purchase agreement. e. Note that this policy provisions is in compliance with the Compulsory Motor Vehicle insurance law. 3) Section II – NO FAULT INDEMNITY a. Policy Provision – the insurance company will pay any claim for bodily injury and/or death to any THIRD PARTY or passenger without the necessity of proving fault or negligence of any kind. b. Conditions 1. total indemnity of any one third-party-not to exceed P10,000 subject to schedule of indemnities. 2. Proof of loss, under oath: a. Police report of accident or any evidence sufficient to establish the accident. b. Medical report and evidence of medical or hospital expenses; and/or c. Death Certificate and evidence sufficient to establish the proper payee. c. Who will pay No-Fault 1. Claim must be made against only one vehicle owner or insurer. 2. If third party is occupant of a vehicle – insurer of vehicle in which he is riding, mounting or dismounting will pay “No-Fault”. 3. In any other case – insurer of the directly offending vehicle will pay.

- 22. 4) Section III – LOSS OR DAMAGE This part of the policy protects the vehicle described in the schedule, its accessories and spare parts. a. The CAUSES of loss or damage covered by the Policy 1. accidental collision or overturning 2. accidental collision or overturning consequent upon mechanical breakdown or consequent upon wear and tear. 3. Fire, external explosion, self-ignition or lightning or 4. burglary, house breaking or theft. 5. Malicious act. 6. Whilst in transit (including the process of loading and unloading) accidental to transit by road, rail, inland waterway, lift or elevator). b. Methods of Indemnity – At the OPTION of the INSURANCE COMPANY: 1. Pay in cash the amount of loss or damage 2. Repair, Reinstate 3. Replace the vehicle Conditions: 1. Insurer’s liability shall not exceed the cost of the parts or damaged and the reasonable cost of fitting such parts or value of the vehicle at the time of the loss. 2. Insured’s estimate of value of the vehicle as stated in the schedule of the policy will be the maximum amount payable. 3. For the cost of replacement parts, the amount of settlement shall be the cost of brand new part(s) to replace. The damage parts less the following depreciation schedule (not applicable in case of total loss). For Private Cars Age of Vehicle Rate of Depreciation (share of the insured) Age of Vehicle Rate of Depreciation (share of the Insured) Up to 3 years Nil Over 6 years up to 7 years 35% Over 3 years up to 4 years 20% Over 7 years 40% Over 4 years up to 5 years 25% Batteries, Tires, Ball Over 5 years up to 6 years 30% Joint, Tie Rods, & Shock Absorbers 45%

- 23. For Commercial Vehicles Age of Vehicle Rate of Depreciation (share of the insured) Age of Vehicle Rate of Depreciation (share of the Insured) Up to 3 years Nil Over 6 years up to 7 years 40% Over 3 years up to 4 years 25% Over 7 years 45% Over 4 years up to 5 years 30% Rebuilt & Reconditioned Vehicle 45% Over 5 years up to 6 years 35% Batteries, Tires, Ball Joint, Tie Rods, & Shock Absorbers 50% 5) Section IV – EXCESS LIABILITY INSURANCE This additional insurance, if requested, must be specified in the policy and the premium for such coverage must be paid. This is the part of the policy that covers LIABILITY of the Insured which are not covered under Section I because of the limits in the schedule. a. Policy Provision 1. The Insurance Company will reimburse the insured for all sums actually paid by the Insured to discharge liability in accordance with all the provisions of Section I except the limits of liability for Section I but only in excess of: a. the limits of liability of Sections I and II when such limits have been exhausted, or b. the liability limits required for scheduled vehicle under Section 377 of the Insurance Code in the event no coverage exists as described in par.(a) 2. The Company will pay all sums necessary to discharge liability of the insured in respect of Damage to property in an accident caused by or arising out of the use of the scheduled vehicle or in connection with the loading or unloading of the scheduled vehicle. Provided that: a. Insured’s liability shall have first been determined either - by final court judgment after actual trial, or - by written agreement of insured, the claimant, and the insurance company

- 24. b. The Company shall not be liable in respect of damage to property belonging to the Insured, or held in trust by, or in the custody or control of the insured or any member of the Insured’s household or being conveyed by the scheduled vehicle. GENERAL EXCEPTIONS UNDER ANY SECTION The following are not covered by the Policy: 1. Liability incurred outside the Philippines 2. Accident or liability whilst the vehicle is - being used otherwise than in accordance with the limitations as to use. - being driven by any person other than an Authorized Driver. 3. Liability by virtue of an agreement but which would not have attached in the absence of agreement (except amicable settlement on minor accident to avoid impairing flow of traffic). 4. Except claims under Sec. I and II, any loss, damage or liability, DIRECTLY OR INDIRECTLY, PROXIMATELY OR REMOTELY occasioned by, contributed to by or traceable to or ARISING OUT OF, or IN CONNECTION with - flood, typhoon, hurricane - volcanic eruption, earthquake or other convulsion of nature - invasion, the act of foreign enemies, hostilities or warlike operations (whether war be declared or not) - civil commotion, mutiny, rebellion, insurrection, military or usurped power - or by any direct or indirect consequences of any of said occurrences The burden of proof for claim during the above circumstances is on the insured. 5. Any sum the insured could recover were it not for an agreement between the insured and other party. 6. Bodily injury or death of: - any person in the employ of the insured - any member of insured’s household who is riding in the vehicle

- 25. IMPORTANT CONDITIONS APPLICABLE TO ALL SECTIONS The following are conditions the Insured must know: 1. Notice – Every notice or communication regarding this policy must be delivered in writing to the Company. 2. Safeguard of Vehicle – The Insured shall - take reasonable steps to safeguard from loss or damage. - maintain the vehicle in efficient condition. - not leave the vehicle unattended without proper precautions to prevent further loss or damage in the event of any accident or breakdown. - in case of theft or other criminal act which may give rise to a claim, give immediate notice to police and cooperate with the Company in securing conviction. 3. Notice of Claim The insured shall, as soon as possible, give notice to the Company with full particulars. Every letter, claim, writ, summons and process shall be notified and forwarded to the Company immediately on receipt. 4. Admission, Offer, Promise or Payment No admission, offer, promise or payment shall be made by or on behalf of the insured without the written consent of the Company. 5. Relinquish Conduct of Defense The Company may pay to the Insured and the Third Party Claimant jointly the full amount of the Company’s liability and relinquish the conduct of any defense, settlement or proceedings. 6. Cancellations Both the insurance company and the insured has the right to have the policy cancelled. 7. In case of difference or dispute as to amount of Company’s liability, arbitration is condition precedent to any action or suit upon the policy.

- 26. Part 5: ACCIDENT & HEALTH INSURANCE A. Hazards to which Income – Earning Individuals (Income Producers) are subject: 1. Premature Natural Death – or dying too soon 2. Economic Death – or living too long 3. Disability Due to accident 4. Disability Due to Illness B. Insurances for the physical and economic well-being of individuals Life Insurance is the instrument which affords protection against the first two hazards. By means of its policies, the family is guaranteed against the economic consequences of the husband’s or father’s death, and the insured himself is protected against the time when his earning days are over that the he becomes a burden to the family. Disability Insurance finds its uses in continuing the income of the insured during the time when by reason of injury or illness he is unable to work. It has also a collateral function in indemnifying the insured against the heavy additional expenses which disability always entails. Personal Accident (PA) Insurance – is that particular type of insurance which provides benefits/indemnity in case of losses to the person or physical well-being of an insured individual arising out of accident. Types of Losses that can be sustained by the individual from accident and types of Benefits available. 1. Accidental Loss of Life – Lump sum called Principal Sum 2. Accidental Loss of Limb or sight – Lump sum called Capital Sum 3. Loss of Income – Fixed cash benefits usually payable on weekly basis 4. Medical Expense – Medical Reimbursement Health Insurance – includes a variety of individual and group coverage whose basic purpose is to reimburse the cost of medical treatment and replace the lost income in case of illness or injuries. Forms of Health Insurance: 1) Basic Hospital Expense Insurance 2) Basic Surgical Expense Insurance 3) Physician’s Attendance Benefit 4) Major Medical Expense Insurance

- 27. C. Underwriting – unlike in property insurance where an ocular inspection of the risks being insured can be made prior to binding of coverage, the personal accident underwriter usually has just to content himself with an accomplished application form to form a picture of the person he is insuring. The application form for PA insurance usually provides for at least the following information: 1. Name 6. Beneficiary 2. Age 7. Health Status 3. Sex 8. Insurance History 4. Address 9. Existing Insurance 5. Occupation 10. Signature Occupational Classification – The exposure of a person to accident is a function of the type of work he does or his occupation. 4 Major Occupational Classes: Class I - Non-hazardous occupation with office or travel duties Class II - Limited occupational exposure Class III - Skilled and semi-skilled with moderate occupational exposure Class IV - Skilled and semi-skilled with extensive occupational exposure D. Application of Fundamental Insurance Principles on Accident and Health Insurance 1. Utmost Good Faith. Although both parties to the proposed insurance contract are bound by this doctrine, the duty of disclosure is more exacting on the person applying for insurance. The prospective insured alone knows, or should know, all the material facts that will have bearing on his acceptability for this type of insurance, and it is his duty to disclose them. 2. Indemnity. A personal accident policy, as a rule, is not a contract of indemnity but a benefit policy. Under a contract of indemnity, the amount recoverable is measured by the extent of the insured’s financial loss. On the other hand, a benefit policy is a contract to pay a sum of money in the event of certain contingency, it is however wrong to state that a personal accident policy is never a contract of indemnity. An employer may undertake to pay an employee full wages in the event of his disablement and insure his liability to do so. This is a contract of indemnity and the usual consideration applies.

- 28. In practice, the principle of indemnity is preserved as fas as possible by not granting higher benefits than those justified by the applicant’s financial standing. Whenever possible, if the sums insured seem large for a person of a particular occupation and age, tactful inquiries should be made to see whether he might be better off disabled than when working. 3. Subrogation. The right of subrogation, by which insurers run after Third Parties causing the loss, arises only from a contract of indemnity. Since the great majority of personal accident policies are not contracts of indemnity, subrogation does not apply. This means that an insured may collect the benefits payable under his policy and, in addition, claim against a negligent third party, receiving compensation from him as though no benefit had been received from any insurance. 4. Contribution. This, like subrogation, does not apply where the contract is not one of indemnity. An insured may hold several personal accident policies and is entitled to the full benefits of each. The total insurance benefits from the several sources could therefore be far in excess of the insured’s usual income. A safeguard is sometime provided by requiring the proposer to disclose particulars of any other insurances held, so that it may be confirmed that the combined benefits correspond to the proposer’s income. 5. Insurable Interest. This is always necessary for a valid insurance contract. An individual is deemed to have an unlimited interest in his own person. In many personal accident contracts, therefore, insurable interest presents no problem, but the principle calls for special consideration if the insurance is taken on another person. Examples are an employer who insures his employees, or a wife who insures her husband. In most insurance contracts, the insured must have an insurable interest at the time of loss, but with personal accident insurance and life insurance, it is thought to be sufficient if there was a valid interest when the policy was issued or when it was last renewed. 6. Proximate Cause. The doctrine of proximate cause is important in dealing with personal accident claims, because more than one cause may operate to produce the condition resulting in the claim. It must then be ascertained whether the dominant and effective cause was an insured peril on one which was excluded from the contract. As an example, an insured suffers from gall stones, is knocked down by a motor car and dies, although but for the gall stones he would not have died. His death is not an accident within the policy (Cawley V. National Employers, 1885). E. The Policy Form. The policy form to be considered in this lesson is that in general use for annual contracts. The wording and arrangement of the principal clauses vary with insurers. There are two forms existing: the Continental or British form and the

- 29. American form. One clear difference between the two is in the scale of Indemnities for non-death losses. The continental form defines “loss” as meaning amputation or loss of use, whereas the American form defines it as only actual severance or dismemberment. The constituent parts of a Personal Accident policy is the same as other policies, earlier discussed and need not be repeated here.

- 30. Part 6: AVIATION INSURANCE 1. DEFINITION Aviation insurance is an insurance against risk of loss or liability which may be incurred in connection with the ownership or operation of an aircraft. 2. TYPES OF COVERAGES a) Hull Insurance - provides coverage for actual physical loss of or damage to the insured aircraft from fire, explosion, windstorm, theft, crash or other causes while in flight, taxiing, moored or on the ground. b) Liability Insurance aa. Third Party Liability - indemnifies the insured in respect of all sums which the latter may be legally held liable for death and/or bodily injury or property damage arising out of the ownership or operation of the aircraft. bb. Passenger Legal Liability - protects the insured against legal liability arising out of the death or injury of any passenger whilst boarding, in or disembarking from the aircraft. cc. Passenger Admitted Liability - (sometimes called Passenger Voluntary Settlement Endorsement) - pays benefits in respect of accidental bodily injury sustained by any passenger even if the owner or operator of the aircraft it not legally liable. dd. Combined Single Limit Liability - as the title implies, the coverage states the insurer’s maximum liability for any one or any combination of the above coverage) other than Hull). ee. Pilot Seat Accident Insurance - provides for accident insurance covering any authorized pilot operating the aircraft at the time of the occurrence which gives rise to a claim for bodily injury or death of the pilot. ff. Medical Expense Reimbursement - provides for reimbursement of medical, hospital or surgical expenses incurred due to any accident resulting in death or bodily injury to passengers or pilot.

- 31. 3. UNDERWRITING INFORMATION a) Description of Aircraft aa. Airframe i Make, Type and Series Number ii Year of Manufacture iii Declared Maximum Number of Passengers to be carried at any one time iv Identification Marks bb. Engine i Number and Type cc. Extra Equipment and Accessories dd. Values i Aircraft with standard instruments and equipment ii Details of extra equipment and accessories b) Geographical Limit - Republic of the Philippines c) Pilot - The aircraft will be operated in flight only by a named pilot or as approved by the assured subject to a certain number of flying hours. d) Uses aa. Business and Pleasure - personal, pleasure, family and business uses excluding any operation for hire or reward or for instruction. bb. Industrial Aid - all the uses stated in business and pleasure also the transportation of executives, employees, guests of the insured, goods and merchandise but excluding any operation for hire or reward or for instruction. cc. Limited Commercial - all uses in business and pleasure and industrial aid also the carriage of passengers and freight for hire or reward but excluding any form of instructions or rental to others. dd. Commercial - all the uses stated in the foregoing also use for any other purpose to be specifically declared.

- 32. Part 7 MISCELLANEOUS INSURANCE LINES: CRIME INSURANCE A. Burglary, Robbery and Theft Insurance Burglary, robbery and theft insurance pays for losses which are due to criminal activities. For this reason, this line is often referred to as “Crime Insurance”. There are a very large number of Crime policies however only a few of them are completely standardized. The majority of them, though, use approximately the same definitions. B. Characteristic of Crime Policies Certain characteristics differentiate Burglary, Robbery and Theft from other types of policies: 1. The act insured against is a violation of the law; 2. There is a considerable amount of adverse selection and crime coverage tends to be purchased only by persons who feel they are exposed to a high degree of risk; 3. The crimes insured against are defined in the policy, and the policy definition governs regardless of any statutory definition; 4. Policies are generally named-risk contracts. However, a few coverages are written on an all-risk basis; 5. The property insured is often of high value, since it is natural for criminals to attracted to especially valuable property; 6. Co-insurance is often required as a means of combating the tendency toward underinsurance. First loss cover, however, may also be granted but at a high premium rate. C. Differences between Crime Coverages 1. As to the hazards covered, that is, burglary, robbery, theft, mysterious disappearance, etc. 2. Whether coverage applies on the premises, off the premises, or both. 3. The type of property to the covered. Some contract limit the coverage to stock only while others apply only to money and securities.

- 33. 4. Persons who are covered. Some contracts cover only specified persons such as paymasters or messengers. 5. The manner in which the limits of liability apply. This concerns whether the insurance is on blanket or scheduled basis. 6. Whether the property covered is personal, business, or professional property. 7. Whether the contract is written on a specified perils or all-risk basis. D. Make-up of Burglary, Robbery and Theft Contracts The usual crime policies are composed of four sections: 1. Declarations – contain information regarding the insured, his address, his past losses, and such additional information as is necessary to properly identify the insured and assist in rating the policy. 2. Insuring Agreement – sets out the circumstances under which the insurers are liable to the insured and must be read in conjunction with the declarations. 3. Exclusions – specify those types of property and those perils which are not within the scope of the policy. 4. Conditions – cover such diverse matters as claims procedure, proofs of loss, cancellation, other insurance, changes and the like. E. Damage Caused by Criminal or attempted Criminal Acts When premises are broken into by thieves, there is usually a certain amount of damage to them. In some cases this may be negligible, while in others, it may be very extensive. There are numerous cases where criminals frustrated in their attempts at a theft, have deliberately wrecked the premises. It is the general practice of all burglary, robbery and theft contracts to cover damage caused by commission or attempted commission of an act which is covered by the policy. Damage which results from an act not covered by the policy would of course, not come within its scope. Thus a policy covering only robbery would not pay for damage which resulted from an attempted burglary and vice- versa. Definition of Terms Crime coverages will usually contain a specific definition of the acts which are covered. Burglary, robbery and theft are sometimes defined in different ways. Therefore, it is necessary that the policy give as specific definition, so that there may be no question as to what is included in the coverage. The following definitions are taken from typical policies:

- 34. 1. Burglary - The felonious abstraction of property from within the premises, by any person or persons making felonious entry therein by actual force and violence when such premises are not open for business, of which there shall be visible marks made upon the exterior of the premises at the place of such entry by tools, explosives, electricity or chemicals. 2. Robbery - the felonious taking of insured property (1) by violence inflicted upon a custodian, (2) by putting him in fear of violence, (3) by any other overt felonious act committed in his presence and of which he is actually cognizant, provided such act is not committed by an officer, partner of employee of the insured, (4) from the person or direct care and custody of a custodian who has been killed or rendered unconscious by injuries inflicted maliciously or sustained accidentally. 3. Theft - Any act of stealing 4. Money - Means currency, coins, bank notes and bullion 5. Securities - All negotiable and non-negotiable instruments or contracts representing either money or other property and includes revenue and other stamps in current use, tokens, and tickets, but does not include money. 6. Business - Includes trade, profession, or occupation 7. Premises - There are different definitions of “premises” in various contracts due to the fact that some are intended to cover only the immediate premises, while other contain various extensions. Policies issued to cover business firms often contain following definition of premises: “That portion of the interior of any building or buildings which is occupied in whole or in part by the insured in conducting its business”. (Where the contract is issued to cover the personal activities of the insured, the policy will often define premises to include grounds, garages, stables, and other outbuildings). 8. Insured - The policy definition varies from contract to contract. The major distinction is whether the contract covers only the named insured or whether it also applies to other persons. Crime coverages issued to individual often include members of the insured family, while they are a resident of the insured’s household, as well as the named insured. However, in such cases it is customary to exclude resident employees, and persons unrelated to the named insured. However, in such cases it is customary to exclude resident employees, and persons unrelated to the named insured or his spouse who pay board or rent to the insured or his spouse. 9. Guard - Any male person not less than seventeen nor more than sixty-five years of age who accompanies a custodian by direction of the insured, but who is not a driver of a public conveyance.

- 35. 10.Larceny - The terms “larceny” and “theft” are generally identical, and therefore are used interchangeably. A theft involves the taking of the personal possesions of another with a dishonest intent. Since “theft” and “larceny” include both burglary and robbery, it is not necessary to define the latter terms in policies covering theft or larceny. There are other terms found in this general line of insurance, which essentially mean the same as above. For example, one might find a policy covering “wrongful abstraction” or “willful mis-application” of funds. It is sufficient to state that these terms are essentially the same as those already mentioned. It is important to note, however, that burglary, robbery and theft policies never cover losses caused through the dishonesty of the insured or his employee. Coverage for employee dishonesty is provided by Fidelity Insurance or Fidelity Bond. Types of Policies Crime policies may be classified on the basis of the peril which they insured - burglary, robbery or theft. They may also be classified as to the buyer - individuals or commercial establishments. A third possible classification is whether the contract provides a limited or broad type of coverage. Examples of type of crime coverages are as follows: 1. Individual Coverages a. Broad Form Personal Theft - covers mysterious disappearance b. Limited form Personal Theft - does not cover mysterious disappearance. 2. Business Coverages a. Mercantile Open Stock Burglary > covers not only the stocks of business enterprise but b. Mercantile Open Stock Theft > also its fixtures, machinery & equipment & premises c. Mercantile Safe Burglary - Covers money and securities in safe lost by burglary. d. Mercantile Robbery - Covers money and securities and other property lost by robbery. e. Paymaster robbery - Covers loss of payroll funds caused by Robbery inside or outside the premises of the insured. f. Money and Securities Broad Form - This is practically an all-risk cover for money and securities inside or outside premises.

- 36. Part 8: MISCELLANEOUS INSURANCE LINES: LIABILITY INSURANCE A. Liability Insurance. It goes under diverse names as “General Liability Insurance”, Third Party Liability Insurance” and “Liability other than Automobile”. It is basically designed to cover the responsibility for payment which an insured may incur to other members of the public because of bodily injury or property damage which they have suffered. In order for the insured to be held responsible for bodily injury or property damage to others, he must have incurred such liability as a matter of law or have voluntarily agreed to it as a matter of contract (Contractual Liability). Liability insurance is often referred to as “Third Party Insurance” since there are always three parties involved – the Insurance company, the policyholder and the injured third party. This situation is in contrast to that in most insurance coverages in which there are only two parties – the insurer and the insured. B. Major Types of Liability Insurance available in the market 1. Business Liability Coverages a. Owners’ landlords’ and tenants’ b. Manufacturers’ and contractors’ c. Elevator Liability d. Products Liability e. Owners’ or Contractors’ Protective Liability f. Contractual Liability 2. Professional Liability Coverages a. Physicians’, Surgeons’ and Dentists’ Malpractice b. Druggist Liability c. Hospital Liability 3. Personal Liability Coverages a. Residence Liability b. Sports Liability c. Dog Liability 4. Comprehensive Liability Policies a. Comprehensive General Liability b. Comprehensive Personal Liability

- 37. C. The Liability Hazard: Negligence. Any action which results in harm to another person may be either a criminal act or civil act. A criminal act such as murder or robbery, is a crime against society and is punished by the state. A civil wrong is a wrong against a specific person and constitutes an invasion of the rights of this third party. Civil wrongs are divided into two types: torts and breach of contract. Liability Insurance Policies. Are primarily concerned with paying for damages caused by the negligence of the insured. Negligence is a tort. The usual legal remedy in case involving civil wrongs is a suit for monetary damages. Liability insurance covers those sums which may be awarded to an injured party due to negligence on the part of the insured. Negligence. May be defined as "a failure to exercise due care". There are numerous unavoidable accidents for which it is unfair to hold anyone legally responsible. The right of recovery for damages due to negligence arises from the fact that society expects every person to conduct himself in such a way as not to injure other members of society. As a matter of self-protection, society requires that every person take into account the result of his actions on other persons. If a person fails to exercise such due care and bodily injury or property damage results, the injured party may have a right to reimbursement. D. Liability vs Accident Insurance. A careful distinction must be made between liability insurance and accident insurance. Both kinds of contracts may pay a person who has been injured. However. many people have the mistaken belief that if someone is injured, and insurance is carried, the injured party is entitled to compensation. This is not the case, since the liability contract pays only if the insured is legally obligated to pay the injured party. The fact that the insured, under a liability contract, may feel partly responsible for payment of the injured party's medical expenses, for example, is entirely irrelevant. The burden of proof generally rests on the injured party to prove that the person who injured him was negligent. Theoretically, no insurance company issuing a liability policy need pay until such time as a decision is rendered by a competent court. Practically speaking, of course, most companies find it preferable to settle cases out of court if they feel that the facts of the case are such that the court would eventually hold the insured liable. E. On-Premises vs Off-Premises Coverage. Certain contracts are written to cover liability arising from activities on the premises, others to cover liability incurred off-premises, and some cover both situations. The Owner's, Landlord's and Tenant's policy, for example, is primarily designed to cover liability arising out of accidents in and around the place of business. The Completed Operations section of the Products Liability policy is designed to cover off the premises of the insured. The Comprehensive Personal Liability policy covers occurrences both on the and off the premises of the insured.

- 38. F. Direct vs Contingent Liability Contracts. The majority of liability contracts cover the direct liability imposed by law which the insured may incur to others. So called contingent or protective liability policies cover the liability of the insured which is due to liability incurred by other person. For example, a general contractor may be responsible for an accident of his sub-contractor, and this may be covered under a contingent liability policy. G. General Make-up of Public Liability Policies. 1. Face of the Policy - contains such routine information as name and address of insured, policy period, occupation of the insured and certain declaration made by the insured concerning details of his operations. 2. Insuring Agreement - the heart of the liability contract composed of the insuring agreements which, generally speaking, are as follows: a. Coverage A - Bodily Injury Liability - To indemnify the Insured for loss by reason of the liability imposed by law upon the Insured, or assumed by him under contract as defined herein, for damages, including damages for care and loss of services, because of bodily injury, including death at any time resulting therefrom, sustained by any person or persons caused by accident. Coverage B - Property Damage Liability - To indemnify the Insured for loss by reason of the liability imposed by law upon the Insured or assumed by him under contract as defined herein, for damages because of injury to or destruction of property, including the loss of use thereof caused by accident. b. Defense, Settlement, Supplementary Payments - To indemnify the Insured for all legal expense (including taxed court costs and interest on that part of any verdict, judgment or award covered under this policy) incurred with the consent of the company in connection with any suit, even if groundless, brought against the Insured on account of this policy, including the premiums on appeal bonds and release of attachment bonds filed by the Insured in such suits. 3. General Exclusion in Liability Contracts - the following are the major exclusions generally found in liability contracts: a. Liability arising from the ownership or operation of aircraft. b. Liability arising from the ownership or operation of automobile, boats or other watercraft. c. Any sickness or injury incurred by employees. d. The war risk. e. Damage to property in the care, custody or control of the Insured.

- 39. f. Injury by products manufactured or sold by the insured or work which has been completed by the Insured of which the accident arises, unless specifically assumed. g. Liability due to work of independent contractors or as a result of structural alterations, unless specifically assumed. h. Contractual liability, unless specifically assumed. i. Elevator liability, unless specifically assumed. j. Intentional injury or damage. 4. Conditions - Cover such diverse matters as claims procedure, proofs of loss, cancellation, other insurance, changes and the like. H. Limits of Liability. Liability Policies often contain separate limits for Bodily Injury and for Property Damage. In addition, there is usually a separate per- person limit and per-accident limit for the Bodily Injury portion. The per-person limit is the maximum the company will pay to any one person. The per-accident limit is the maximum the company will pay for any given accident regardless of the number of persons who may be involved. With respect to property damage liability, there is a single limit applying to any accident. Some policies contain an aggregate policy limit for both Bodily Injury and Property Damage, which is the maximum amount the company will pay during any given policy year. I. Comprehensive General Liability. This is the broadest form of public liability coverage normally made available. This policy has five sub-divisions: 1. Premises/Operations Liability - This is the basic and most important section of the CGL contract. It provides coverages for claims arising out of the ownership, maintenance or use of the insured's premises and any and all operations performed by the Insured. 2. Elevator Liability - This coverage pays for liability arising form the ownership, maintenance, or use of elevators. Coverage applies while members of the public are in the elevator, or leaving or entering it. Strangely enough, it is possible to endorse this section of the policy to include "collision" insurance under which the company agrees to pay "direct and accidental loss of or damage to elevators and other property caused by collision of elevator or anything carried thereon with another object". 3. Independent Contracts - also known as Owner's or Contractor's Protective Liability, this type of cover represents a change from the general pattern of liability contracts. It is not a direct coverage for the acts of the insured, but a contingent coverage for the acts of others. It is sometimes referred to as a "defense coverage" since it is often purchased because of the promise of the insurance company to defend the insured in court against all lawsuits. The purpose of this section is to cover the insured against liability which has been incurred by others, but for which the insured may be secondarily liable.

- 40. 4. Products Liability Completed Operations Coverage - In essence this coverage is designed to pay for accidents which result from mistakes in the manufacture or preparation of products or the rendering of service work. The coverage provides that the accident must occur - • away from the insured's premises • after the insured has relinquished the products to others. The Products Liability coverage applies to those who manufacture or market products to be sold to others. The completed operations section is applicable primarily to firms engaged in the servicing, installation and repair work. It should be particularly noted that under the property damage section, there is an exclusion for damage to the product or premises out of which the accident arises. Thus, if a can of hair spray explodes, injuring the user and breaking the mirror in front of which he is sitting, the company would pay for the injury of the user and the replacement of the broken mirror, but not to the replacement of the can of hair spray. 5. Contractual liability - It has been previously noted that most liability policies cover only the "liability imposed by law''. Contractual liability insurance is written to cover a different hazard, namely, liability which the insured has voluntarily assumed under a contract with a Third party. The CGL policy automatically covers the following contractual assumptions of liability: a. a lease of premises b. a sidetrack agreement c. elevator or escalator maintenance agreement d. an easement required by municipal ordinance in connection with the work for the municipality. In addition, other types of agreements may be covered by this section if the company is willing to insure them. Other types of agreements must be specially submitted to the company for individual examination and rating. This must be specifically included by endorsement under this policy. Part 9 ENGINEERING INSURANCE I. Engineering Insurance: Its Scope Engineering Insurance refers collectively to such specialty insurance lines which seemingly are too technical for an insurance layman to handle and which comprise the following insurance product lines: Contractors’ All-Risks Insurance, Erection All-Risks Insurance, Machinery Breakdown Insurance, Loss of Profits following Machinery Breakdown Insurance, Deterioration of Stocks Insurance, Boiler & Pressure Vessel Insurance & Electronic Equipment Insurance.

- 41. II. Coverage Features A. Contractors’ All Risks (CAR) Insurance – Covers “All Risks” arising out of the construction of buildings or structures. It is a property insurance by which any building or civil engineering project is protected against accidents resulting in physical damage to or the destruction of works in progress, construction plant and equipment and/or construction machinery on the site. Furthermore, the third party liability arising out of the construction can be additionally covered. a. Necessity for CAR Insurance The work of the contractor is not – as in the case of industrial production – performed in the factory or workshop where, to a large extent, precautions for preventing damage can be taken. As a rule, the contractor works on a building site exposed to unknown and unforseeable dangers, such as subsidence, ground water, flood and inundation, as well as to unfavorable weather conditions which may cause damage. Moreover, he has to contend with the potential liability claims, that may be caused to Third parties. Owing to keen competition, contracting firms are often not in a position to include in their prices a sufficient margin for the risks involved, if they wish their tender to be successful. This is especially true in view of the fact that they may also be answerable for losses and damage sustained by the contract works until these are taken over by the project owners. Directly connected with this risk is the additional liability carried out for the purpose of complying with his obligations under the maintenance clause of the building contract. For good reasons, project owners, consulting engineers, architects and financiers have made the acceptance of tender dependent on a CAR insurance being effected. b. Subject-matter Insured aa. Primarily covers the “work” to be carried out under the contract and includes all materials stored on the site but not yet incorporated in the structure. “Work” means the execution of all permanent contract works by the contractors, including preparatory work on the site, grading, levelling, excavation and other earth work, as well as the execution of temporary works provided for in the plans and separately paid for by the project owners or principal. The value of material supplied by the principal must be added to the sum insured, since it constitutes property held in trust or custody. CAR can generally be taken out for all building and civil engineering projects, such as: Dwelling houses, office buildings, warehouse, hospitals, schools, factories, silos, water towers, bridges, dams, canals, tunnels, irrigation & water supply systems, drainage & sewer systems,

- 42. roads, railway, runways, construction work in connection with power stations, ports, airports, etc. bb. Construction plant and equipment which is used on the site at the discretion of the contractor, such as: Sheds, stores, tracks, temporary accommodation and other temporary buildings, scaffoldings, form work, power supply & distributing plant, water supply installation, auxiliary bridges, piers, etc. The construction machinery used for the execution of the contract works, such as excavators, bulldozers, rollers, pile drivers, vibrators, concrete mixers, cranes, hoists, drilling machines, air compressors, pumps, dumpers, trucks not licensed for use on public roads etc may also be included for insurance, whether or not this machinery is the property of the contractor or is on hire. cc. If the installation and/or erection of machinery and/or steel structure is included under the building contract, such can be insured also under CAR provided the value of installation and erection works (which normally should be covered under Erection All Risks) is less than 50% of the total sum insured. dd. CAR may also include Third Party Liability for fatal or non-fatal injury and property damage arising from the construction up to the agreed limit. Persons who are employed by the Insured on the site are not however, considered as third party, but can be covered under separate personal accident insurance or Workmen’s Compensation insurance. c. Insured Perils: CAR covers the following: 1. Loss or damage caused by: a. “Acts of God” aa. storm, tempest, hurricane, cyclone, typhoon, tidal wave bb. flood, inundation cc. landslide, rockslide, subsidence, earthquake dd. lightning 2. Loss or damage consequent upon: a. The use of faulty or unsuitable material b. Bad Workmanship c. Faulty design for which either the principal or the contractor or an independent architect or consulting engineers is responsible.

- 43. However the costs of rectifying defects in material, design or workmanships, that is, the costs of replacing parts found to be defective are not covered by the insurance. 3. Loss of or damage to material, construction plant, equipment and/or machinery occurring during unloading and/or loading, including intermediate storage on the site. The same applies to construction plant, equipment and machinery whilst being erected and/or dismantled. 4. Loss or damage caused by burglary, theft or sabotage. d. Excluded Perils 1. War or warlike operations, invasion, civil war, strike, riot, rebellion, civil commotion, confiscation or destruction by order of authorities. 2. Nuclear reaction, nuclear radiation or radioactive contamination. 3. Mechanical and/or electrical breakdown of construction machinery, plant and equipment, normal atmospheric influence, corrosion, oxidation or wear and tear (loss or damage consequent thereon is however covered by CAR insurance). 4. Acts or orders made by the Insured or by his authorized representatives, if such acts or orders are contrary to recognized rules of engineering or to any legal regulation or provision. 5. Loss of or damage to files, bills, notes, cash, securities. 6. Loss of property discovered during the making of an inventory. 7. Penalties under contracts, fines, losses incurred as a result of delays in the completion of contract works or cancellation of the contract. 8. Loss or damage due to partial or total cessation or work. 9. Loss or damage to motor vehicles licensed for general use on public highways, watercraft and aircraft. 10. Third party liability claims under motor vehicle TPL. e. Policy Period – Maintenance Period CAR Insurance unlike other insurance, is not an annual insurance. The cover provided attaches from the commencement of the work at the site and remains in force until the contract works are completed and taken over by the principal or put into service by the latter. It is advisable for the Insured to take out fire insurance for any sections of the contract completed and turned over to the principal. Since the building site is the insured locations, the construction plant, equipment and machinery is covered from the time of arriving at the site until leaving it.

- 44. Upon request, the CAR policy may be extended to cover the subsequent maintenance period which usually lasts from 3 to 12 months. The cover during this period is however restricted and is exclusively in respect of loss or damage arising out of the performance of guarantee work. This usually consists of works not in accordance with the contract or are in any way defective. f. Sum Insured The sum insured must be equal to the sum of the following: aa. Contract value – amount laid down in the contract bb. Additional work performed by day labor and other supplementary work cc. Value of building materials and structural parts supplied by principal dd. The value of the construction plant, equipment and machinery increases the sum insured where such items are declared for insurance. They must be insured at their replacement value. B. Erection All Risks (EAR) Insurance – Is an “All Risks” cover for the entire duration of the erection, commencing when the machinery and plant intended for installation is unloaded at the site and continuing during storage on the site, during erection and the subsequent test period. EAR provides a very comprehensive cover for machinery mechanical equipment, apparatus, steel construction of any kind while in the process of installation in factories and industrial plants such as oil refineries, sugar mills, cement plants, paper mills, etc. a. Necessity for EAR Insurance The progress of industrialization, entailing the erection of machinery and plant of increased size and value has rendered it impossible for firms engaged in erection to carry the high liabilities involved for their own account. b. Subject-matter Insured aa. Machinery, mechanical equipment, apparatus, steel construction of any kind on the site where they are subsequently to be used, including the necessary construction work provided the nature of the project is predominantly that of an erection; bb. Pipelines and overhead transmission lines, including all the work necessary for laying or erecting them; cc. Second-hand machinery which is in good working order, provided that the insurance terminates upon the commencement of the

- 45. testing period which is not insurable, in the case of second-hand machinery. Subject further to the exclusion of loss or damage which can be proved to have arisen from the previous operation of the machinery. dd. Machinery & equipment required to carry out the erection (e.g. compressors, cranes, mast). Experience has shown that such machinery & equipment is prone to loss since usually it is used (second-hand) which is not regularly serviced. In addition it is exposed to the elements and this must be taken into account in rating. A condition precedent to insuring erection machinery and equipment is that the object to be installed or erected is also insured. ee. Removal of debris, which is especially important where steel constructions are concerned. ff. Additional costs incurred for overtime work, work on Sundays and holidays, as well as express freight. Air freight, however, being excluded in principle. c. Insured Perils: EAR covers the following: aa. Faults in erection bb. Lack of skill, carelessness, negligence cc. Malicious damage and sabotage dd. Theft ee. Accidents such as falling of objects, breakdown of erection equipment, or damage to machinery caused by the collapse of building or parts thereof. ff. Fire, lightning, explosion gg. Acts of God: storm, hurricane, tornado, typhoon, cyclone, flood, inundation, subsidence, landslide, rockslide. hh. Third party liability for the following damage and/or injuries may be included: i damage to property of third parties, including property held in trust by or under the custody of the insured and for which he is responsible ii bodily injuries sustained by third parties excluding employees and workers of the purchaser or of any contractors. d. Exclusions aa. War or warlike actions, strike, riot, civil commotion, nuclear energy. bb. Deliberate acts or gross negligence on the part of the Insured cc. Penalties under contract. dd. Operational deficiencies ee. Loss or damage arising from faulty design, defects in casting, defective material, bad workmanship and workshop faults are not