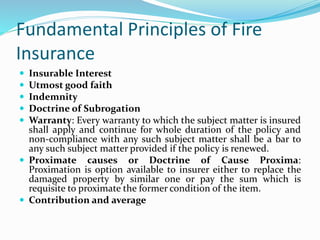

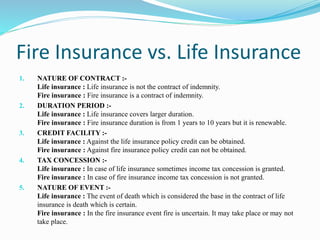

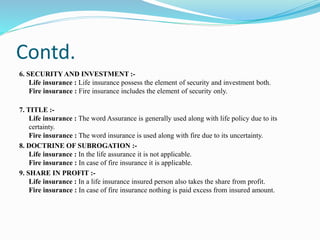

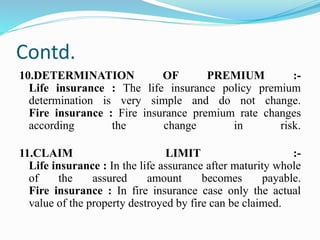

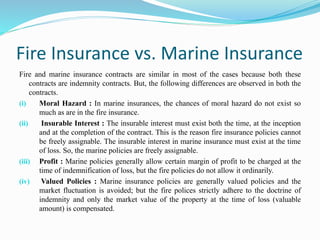

This document provides an overview of fire insurance in India. It discusses how fire is considered both pure and helpful for humans but also dangerous when uncontrolled. It then summarizes the key aspects of fire insurance such as its history in India dating back to London in 1666, the causes of fire risks, definition of fire insurance, features of fire policies, procedures for obtaining a policy, and differences between fire and life or marine insurance.