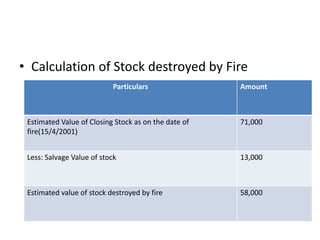

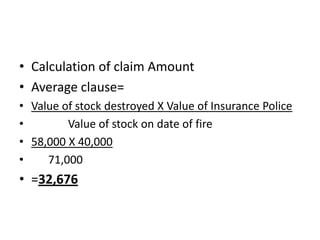

The document outlines the steps to calculate a fire insurance claim in India. It provides details of stock levels and purchases/sales for a company before and after a fire on April 15, 2001. It then shows the calculations to determine: [1] the gross profit ratio for 2000 and 2001, [2] the estimated value of stock destroyed in the fire, and [3] the claim amount based on an average clause in the Rs. 40,000 insurance policy. The claim amount is calculated to be Rs. 32,676. Popular fire insurance companies in India are also listed.