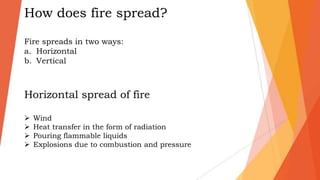

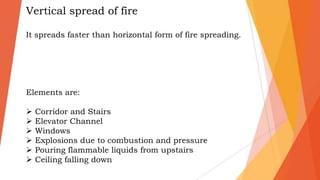

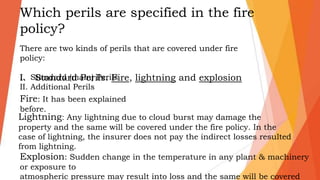

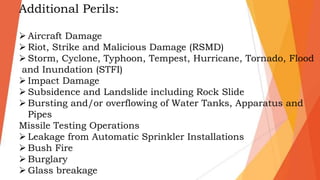

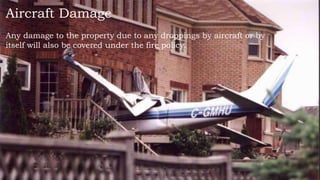

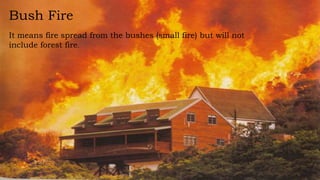

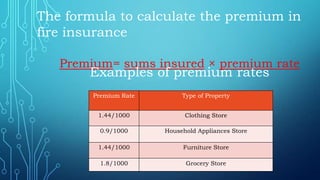

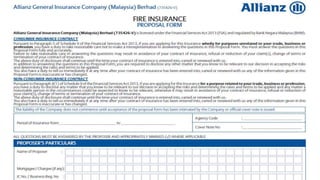

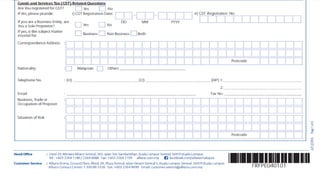

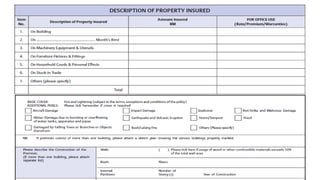

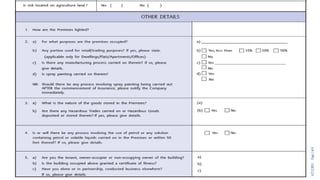

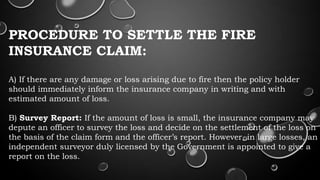

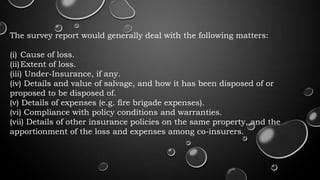

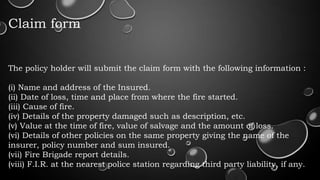

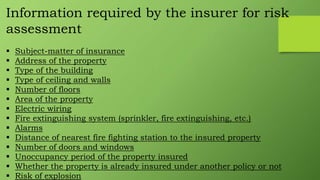

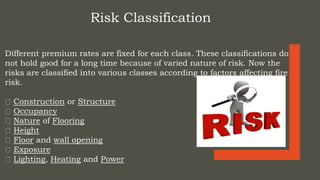

The document provides an extensive overview of fire insurance, detailing its definition, coverage, history, and the types of perils included in policies. It discusses fire dynamics, the insurance application process, premium calculations, procedures for settling claims, and exclusions. Additionally, it touches on residential and commercial property insurance, emphasizing the significance of adequate coverage and compliance with policy terms.