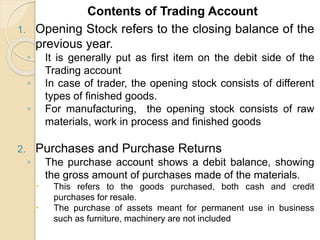

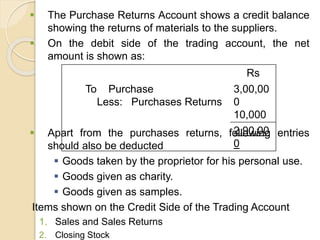

The document discusses financial statements and trading accounts. It explains that financial statements are prepared annually to understand a business's profit/loss and financial position. A set of financial statements includes a balance sheet, profit and loss account, and notes. It also discusses the purpose and components of a trading account, which is used to determine gross profit or loss by matching the cost of goods sold against sales revenue. Direct expenses are also included. The document provides an example trading account and explains how gross profit or loss is calculated.