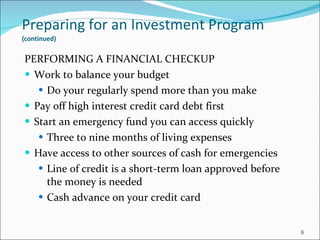

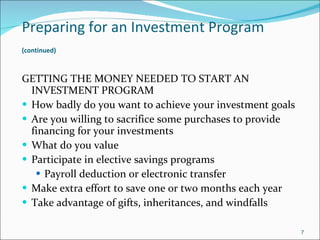

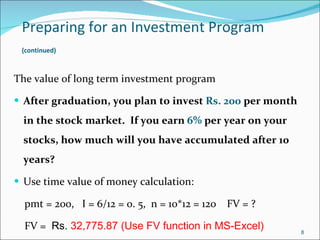

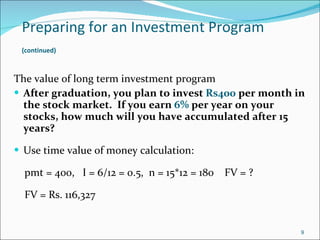

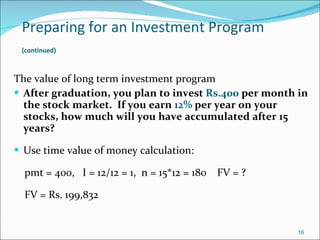

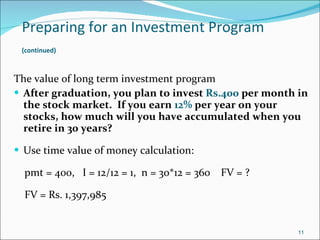

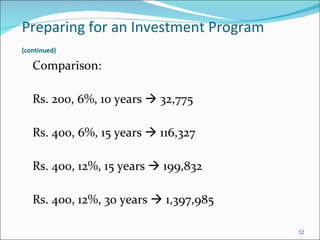

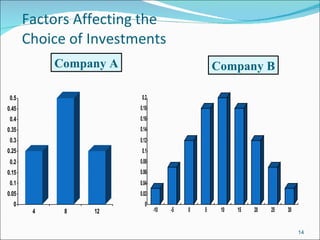

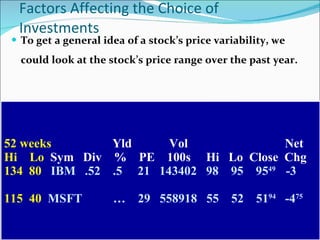

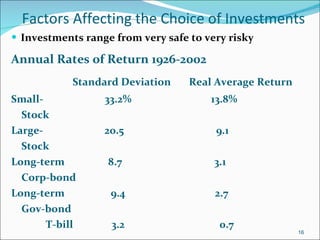

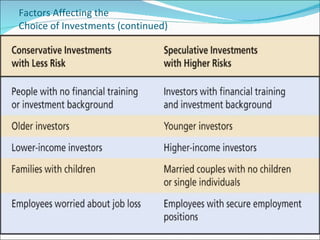

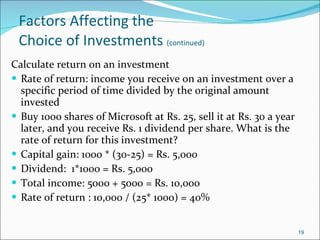

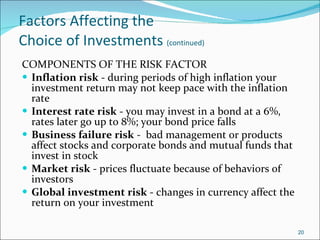

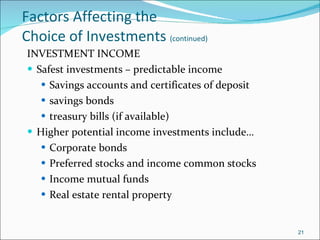

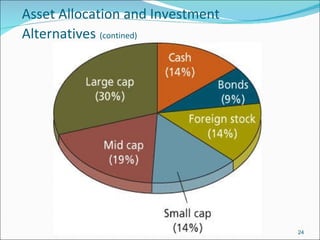

The document discusses why establishing an investment program is important, including accumulating retirement funds, enhancing income, and saving for major expenditures. It describes assessing factors like safety, risk, income growth and liquidity when choosing investments and explains how asset allocation and investment alternatives like stocks, bonds, mutual funds and real estate can affect an investment plan. The importance of an investor's role in managing their portfolio is also emphasized.