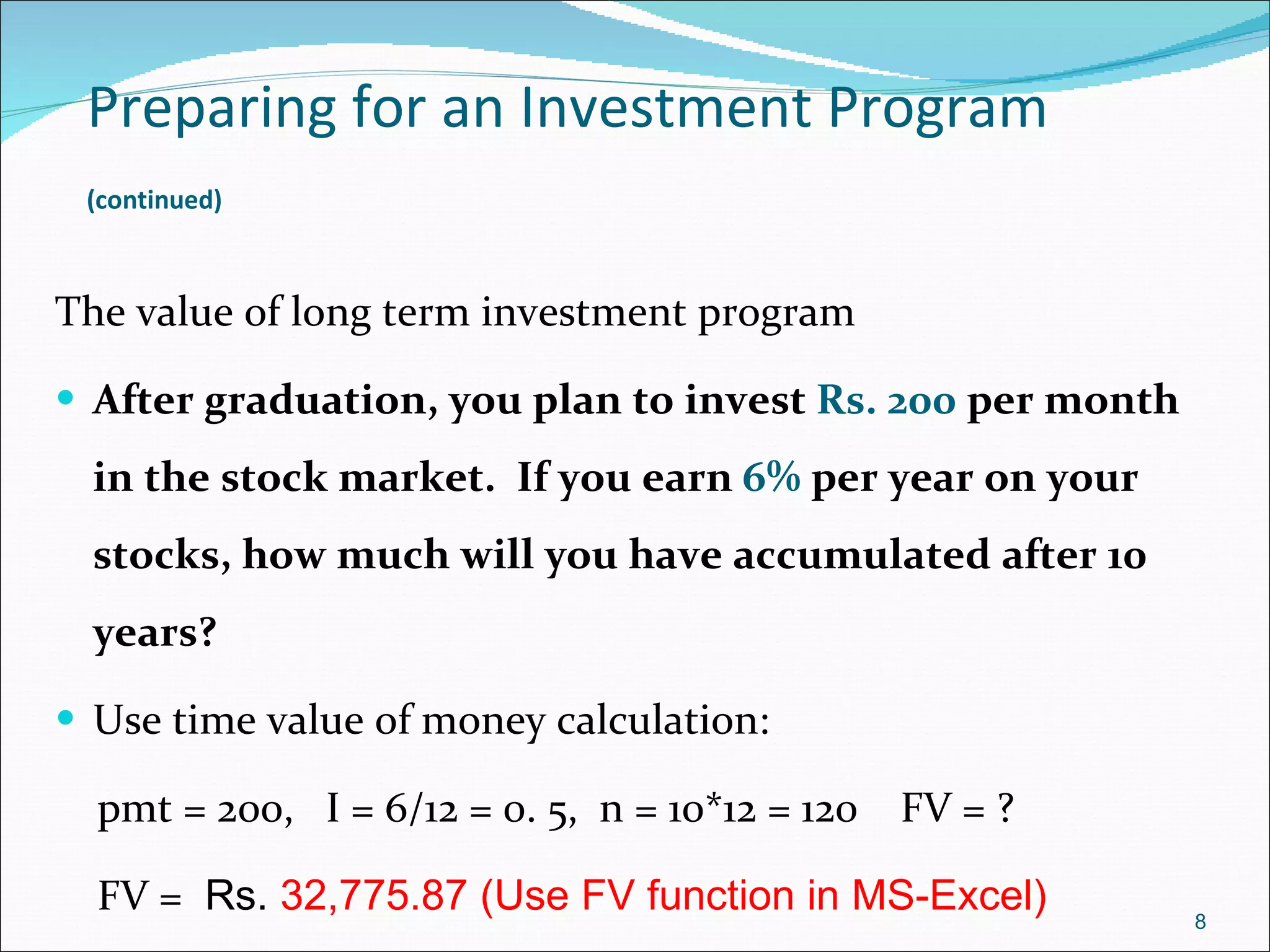

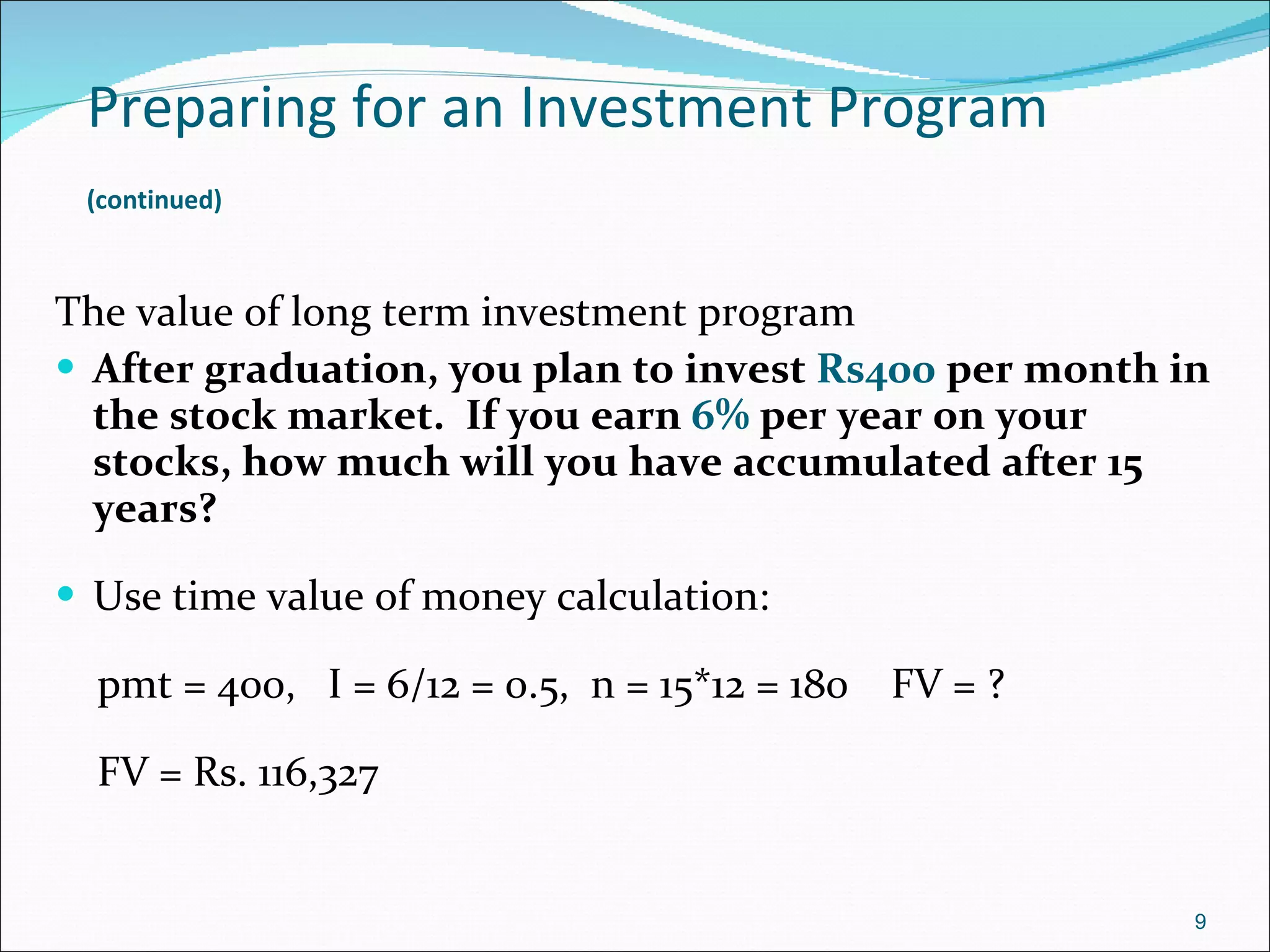

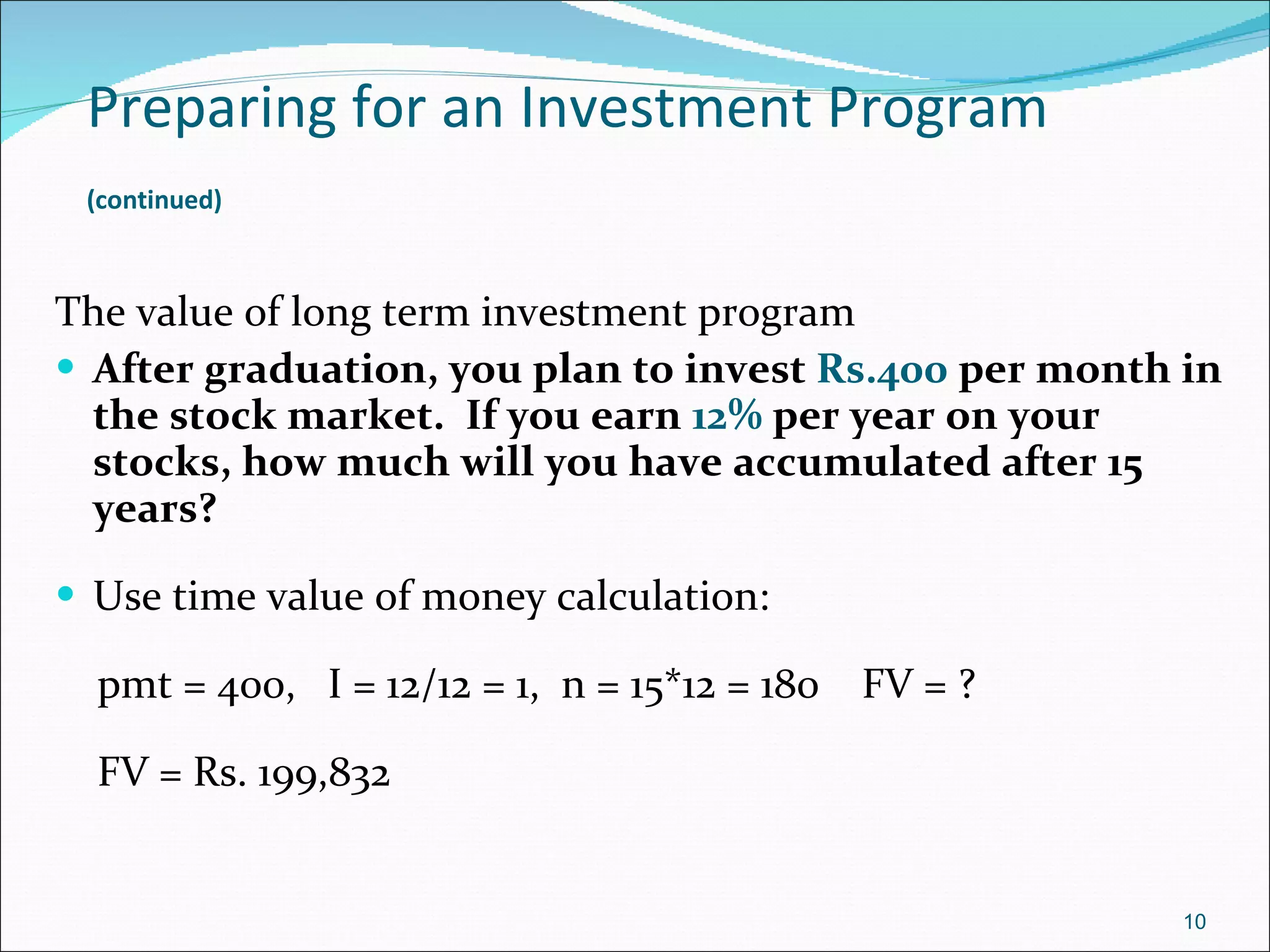

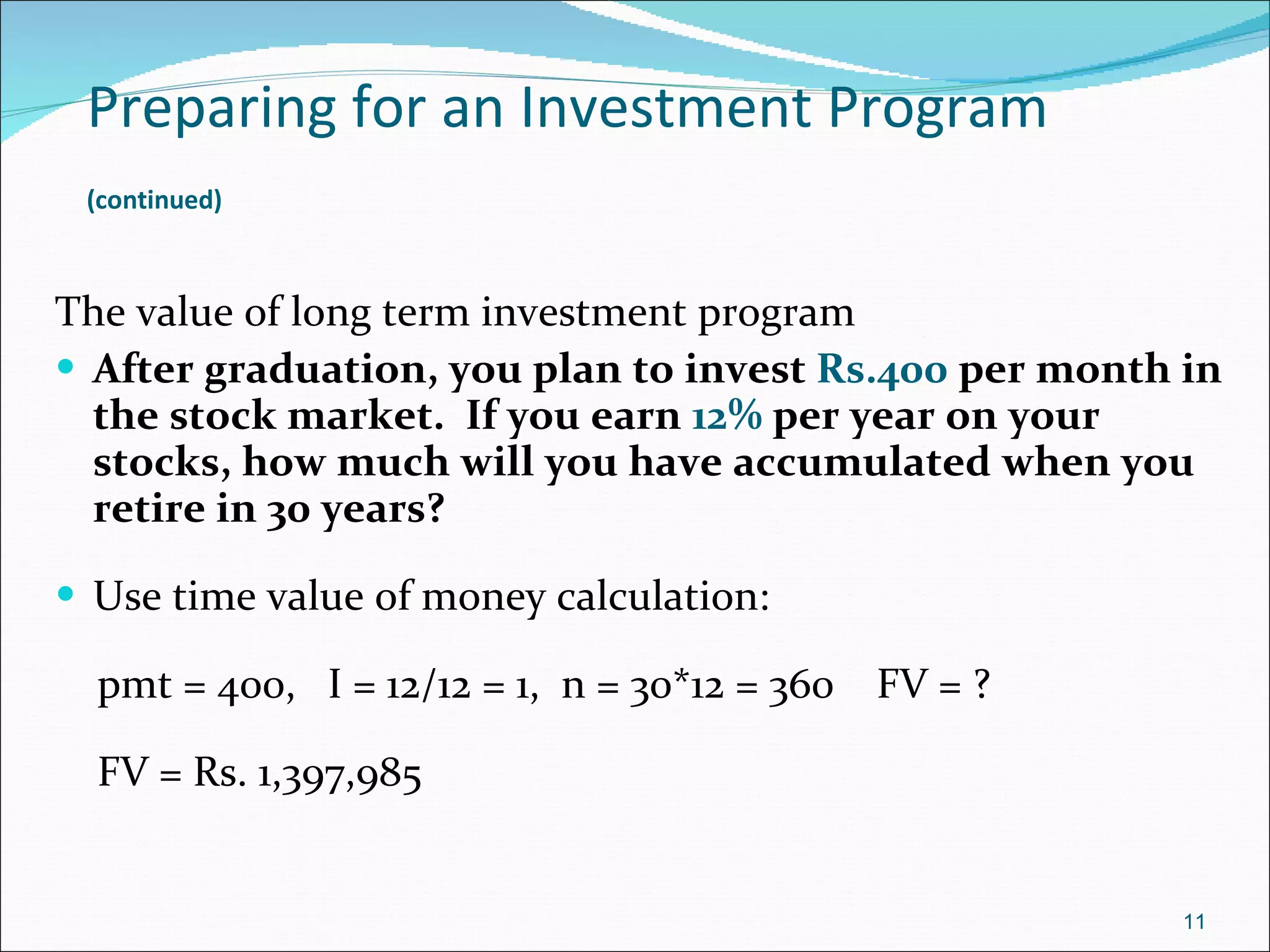

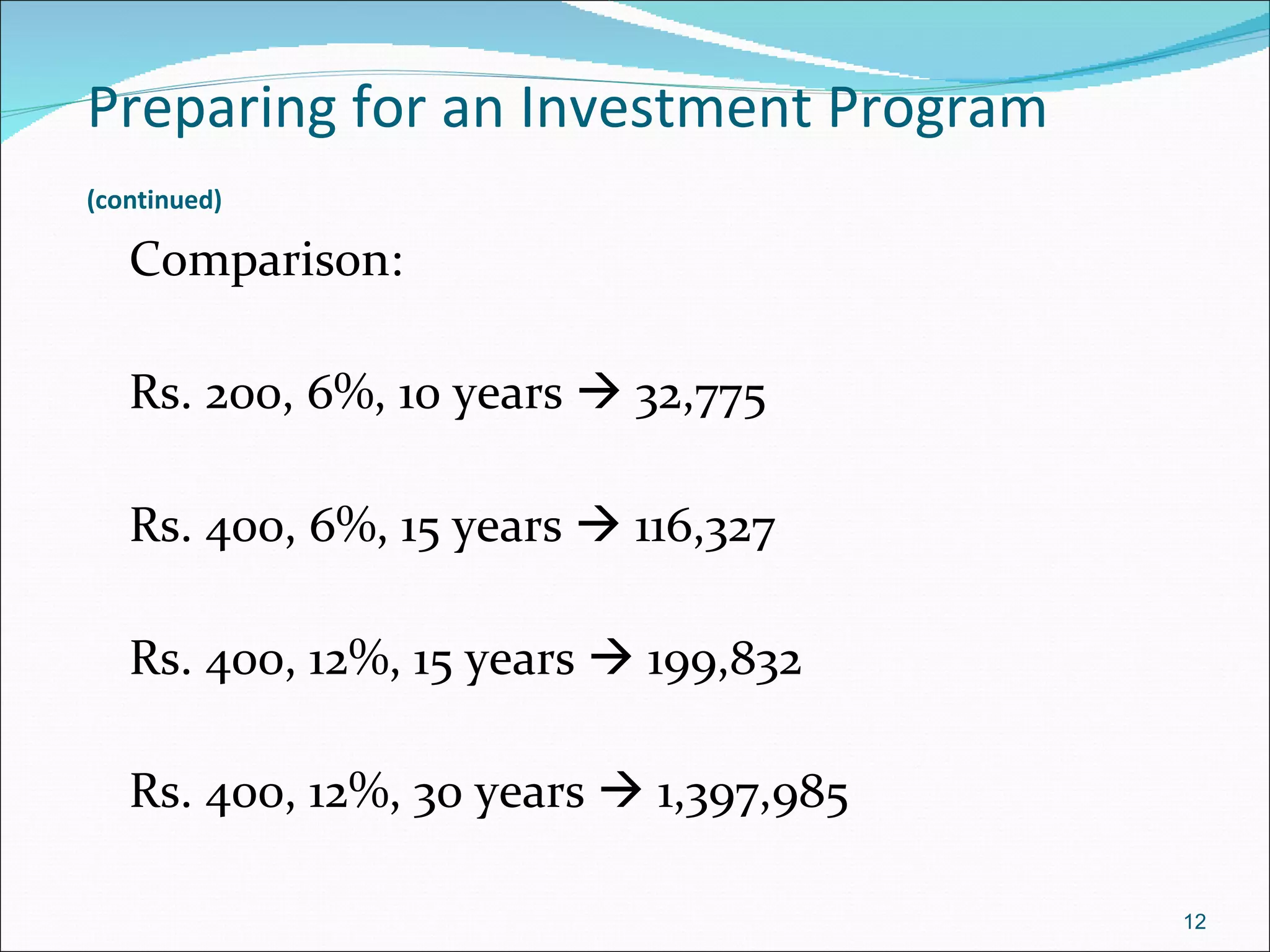

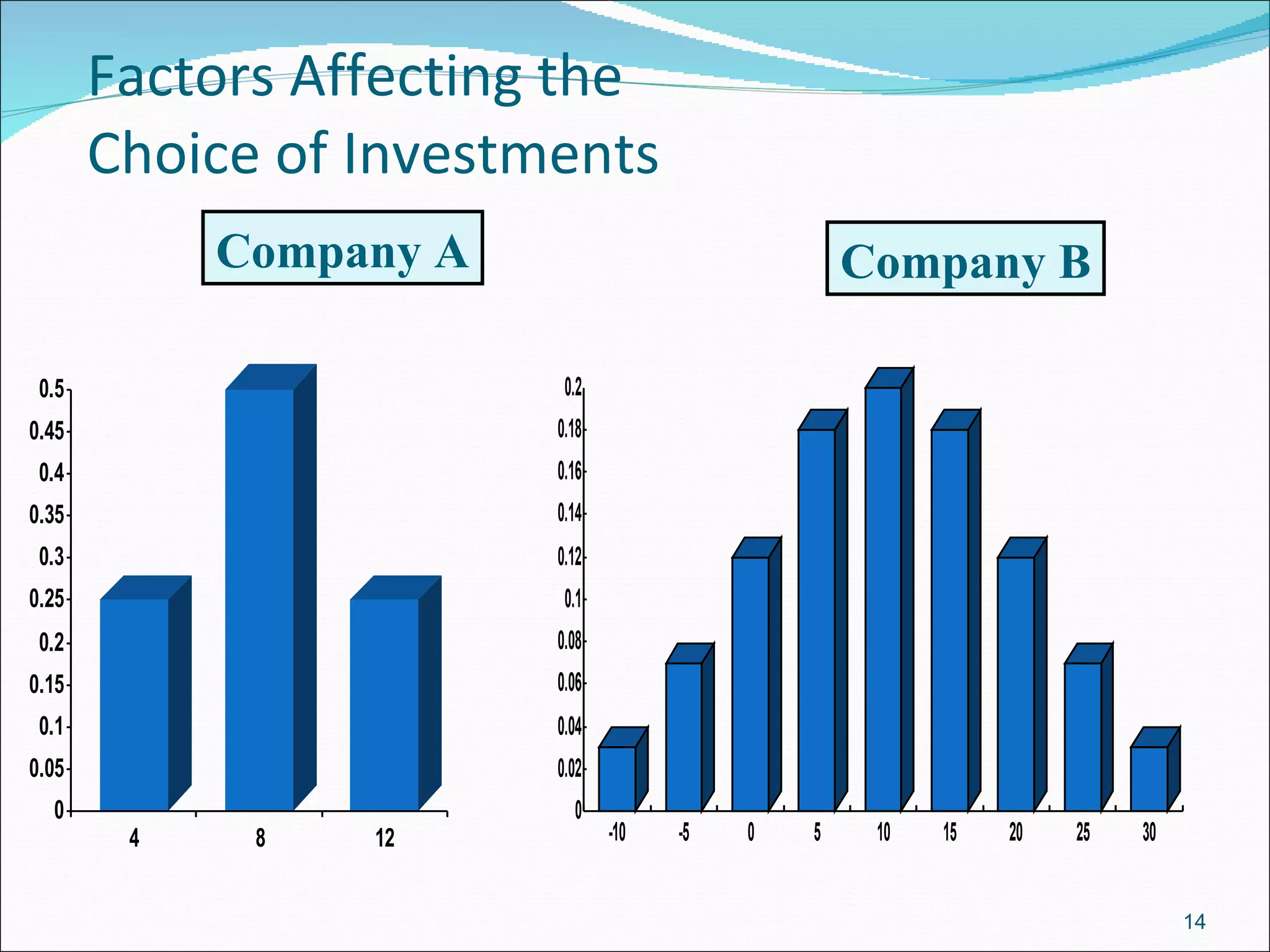

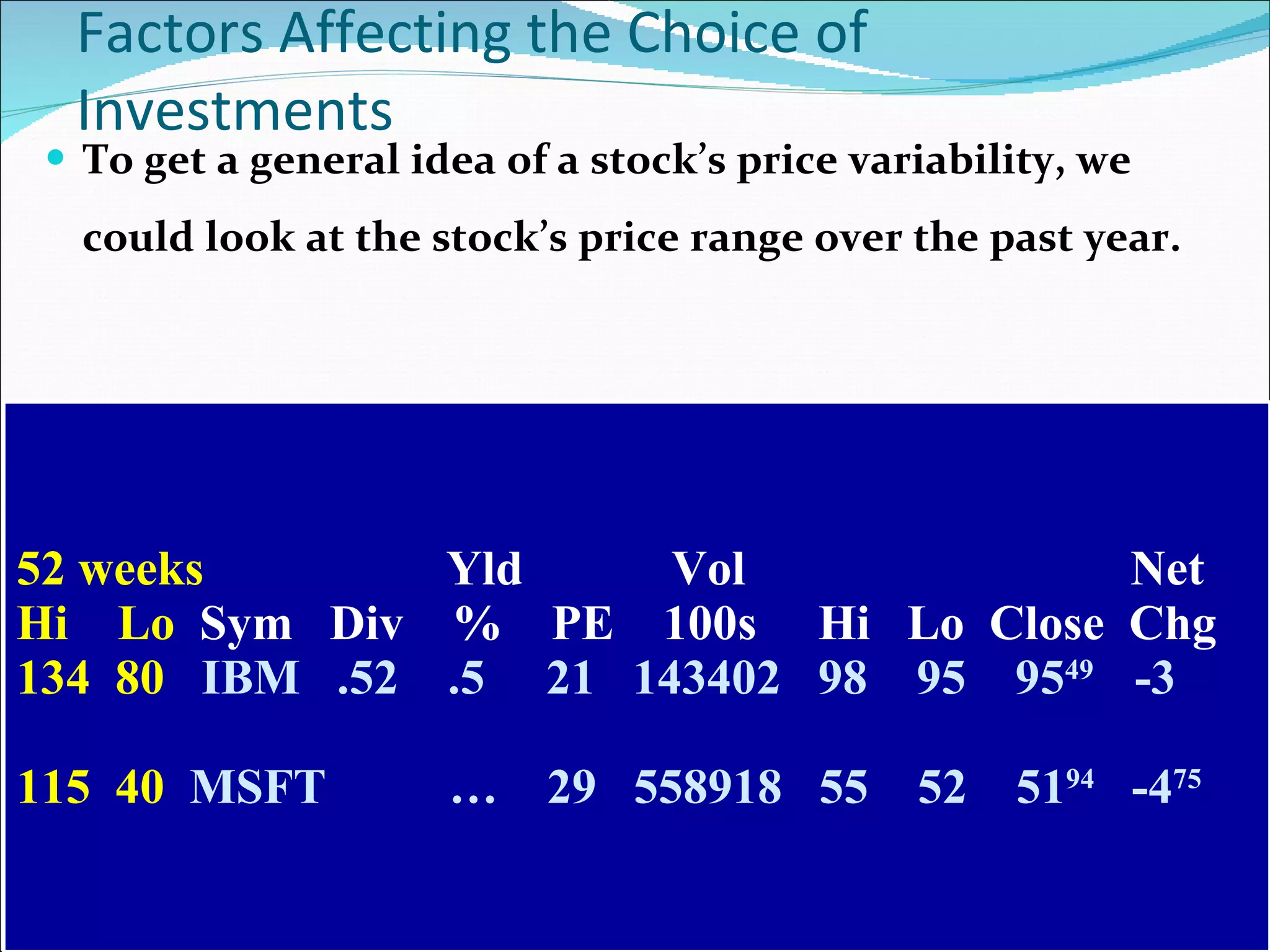

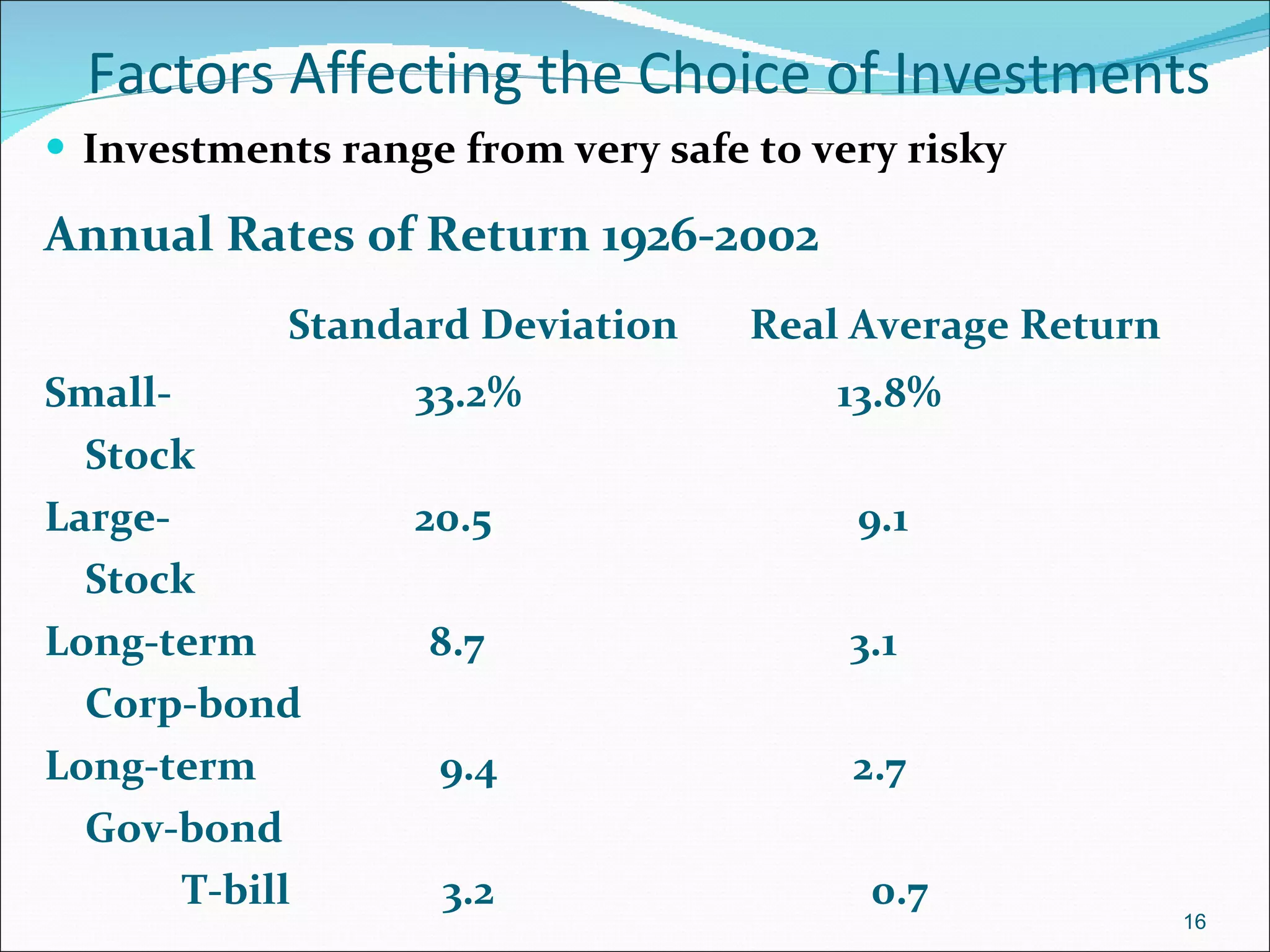

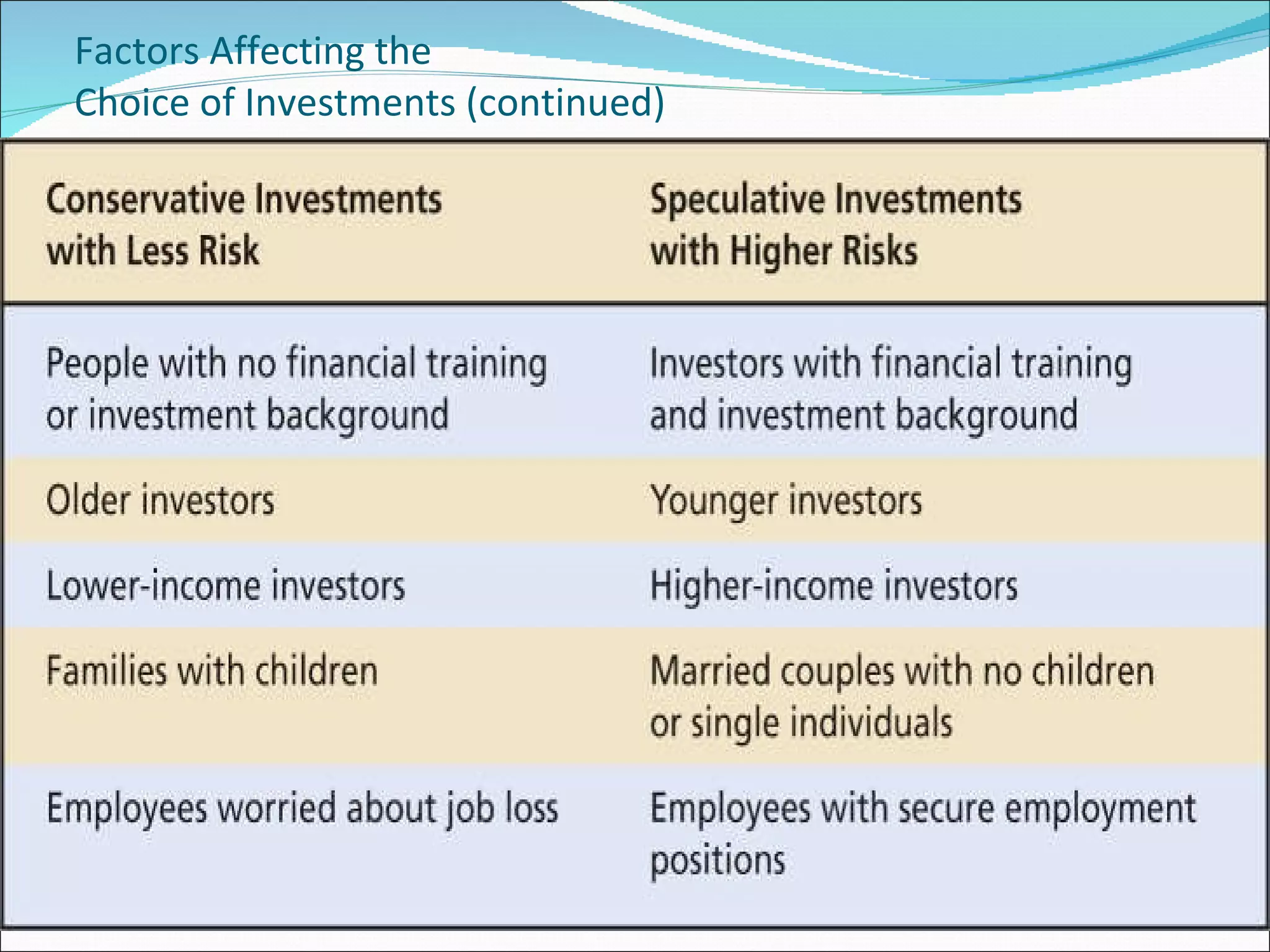

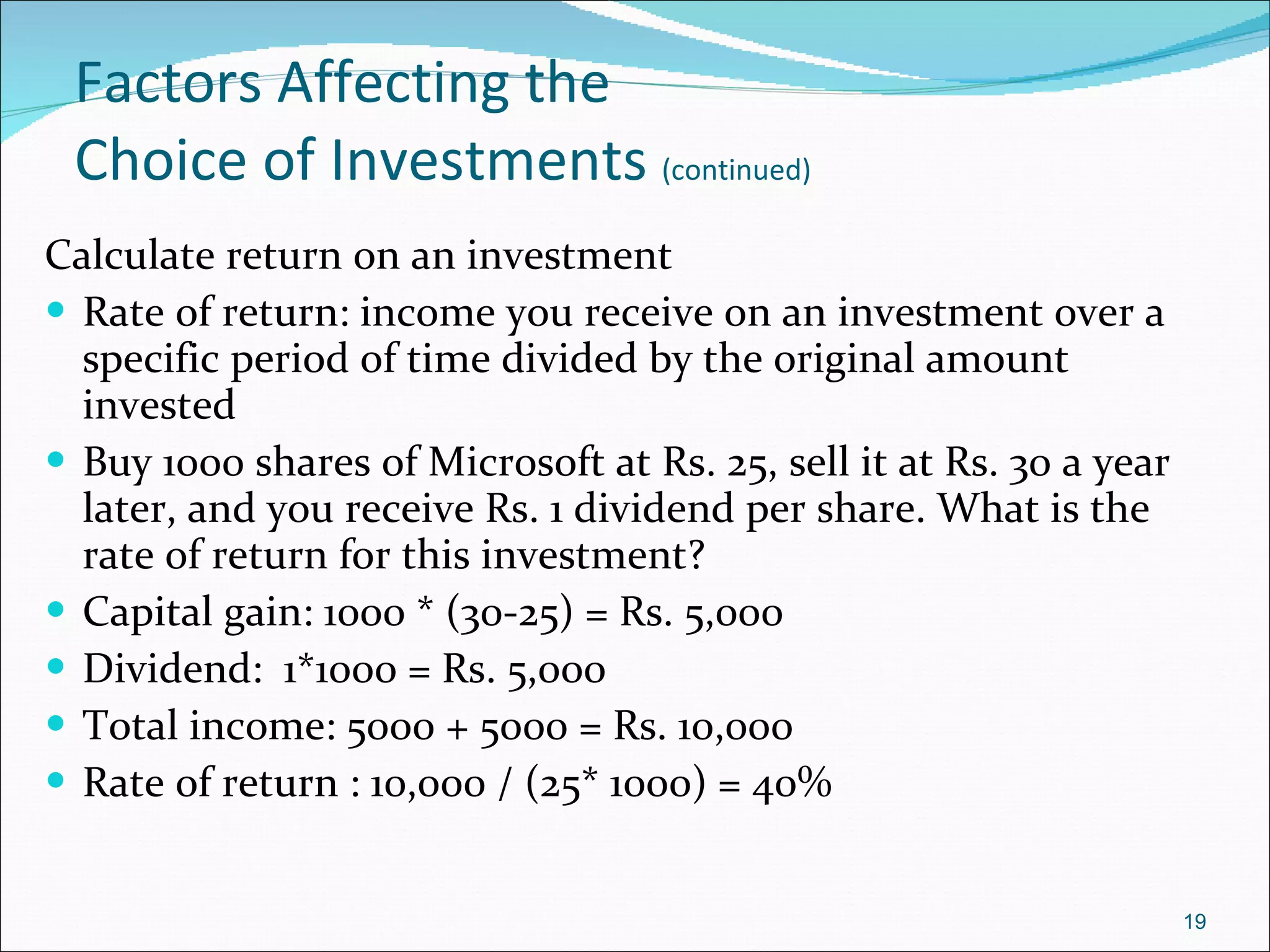

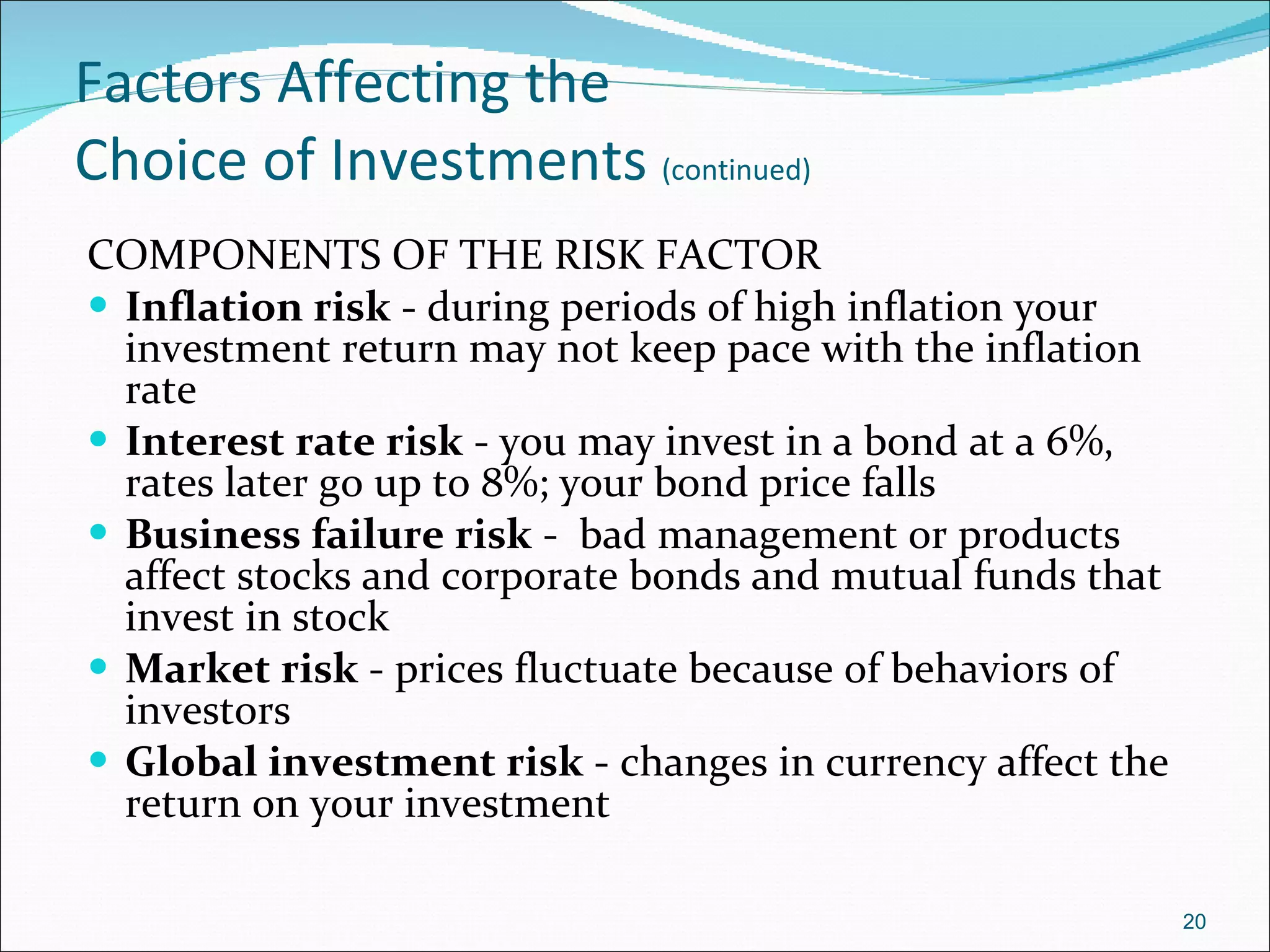

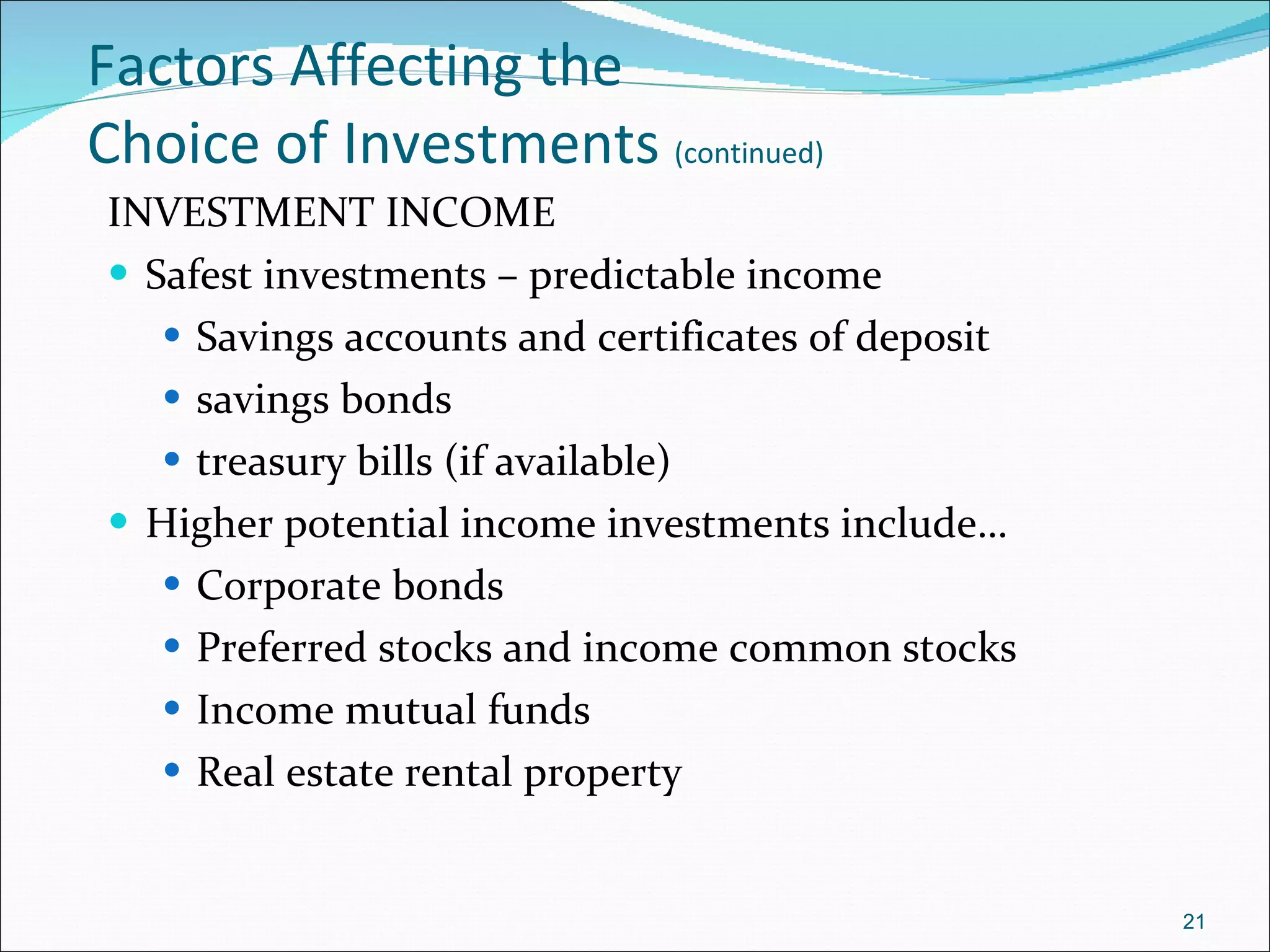

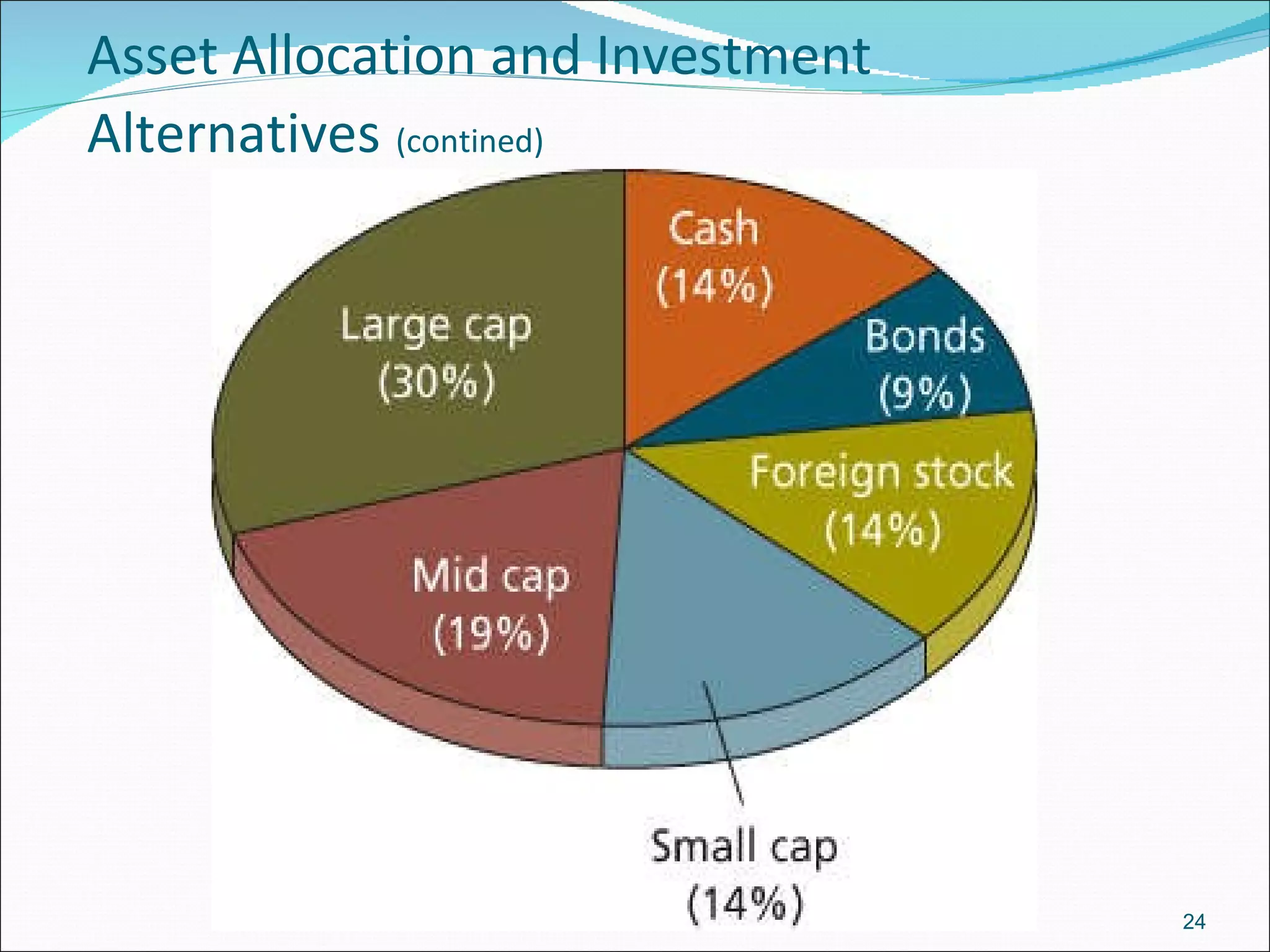

The document discusses establishing an investment program and factors to consider when choosing investments. It recommends setting financial goals, performing a financial checkup, and getting money needed to start investing. It describes how safety, risk, income, growth, liquidity, and time horizon affect investment decisions. It also covers asset allocation, investment alternatives like stocks, bonds, mutual funds and real estate, and the importance of the investor's role and using financial information resources.