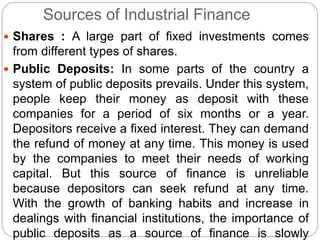

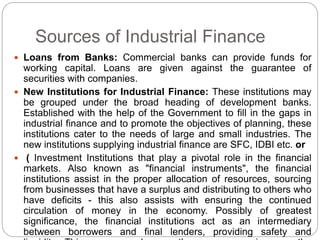

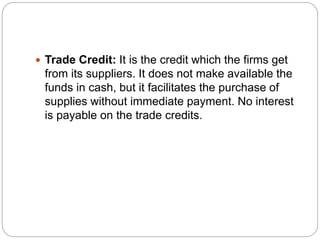

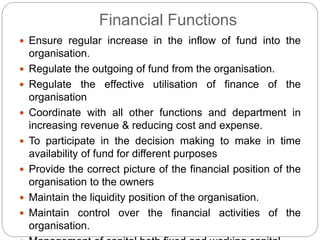

Financial management involves planning, utilizing, and controlling an organization's financial resources to achieve its goals. It includes estimating funding needs, choosing sources of finance like shareholders, debentures, banks, and investments, and managing cash flow. The finance department is also responsible for allocating surplus funds through dividends, bonuses, or reinvestment, and ensuring financial performance through controls. Sources of industrial finance include shares, public deposits, bank loans, development banks, and trade credit. Financial functions center around increasing and regulating fund inflows and outflows, utilizing funds effectively, coordinating finances, providing financial updates, and maintaining liquidity and control.