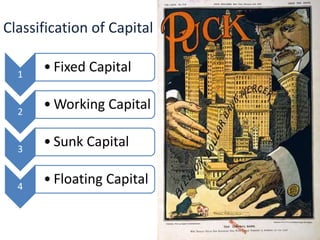

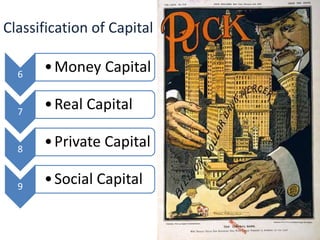

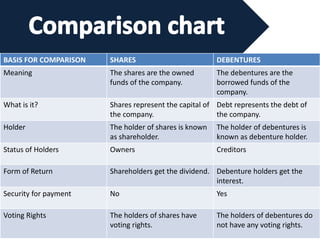

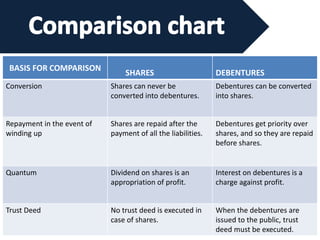

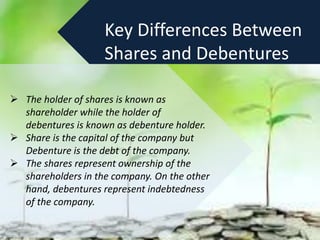

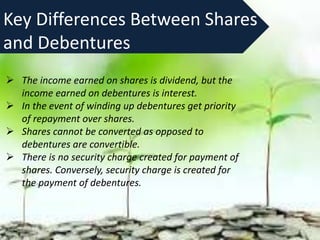

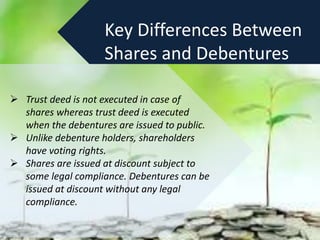

This document discusses various topics related to finance including the definition and importance of finance, types of finance (private and public), classification of capital (fixed, working, sunk, floating), sources of finance (short term sources like overdrafts, trade credit, bank loans, credit cards, leases and long term sources like equity shares, retained profits, debentures, venture capital), objectives of financial management, difference between accounting and finance, and types of financial institutions (commercial banks, investment banks, insurance companies, investment companies, closed-end investment companies).