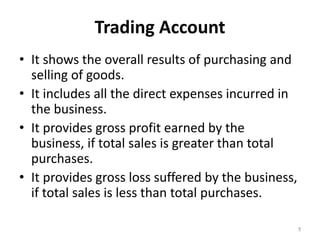

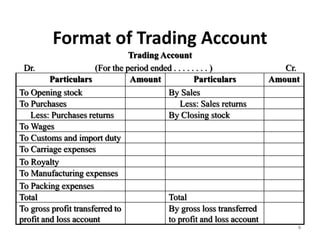

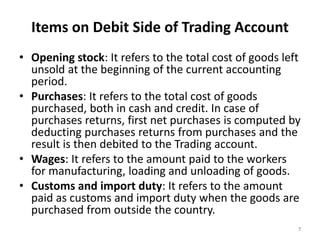

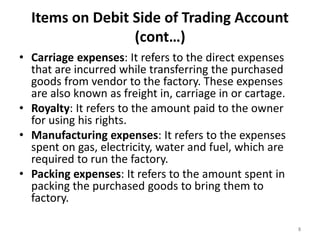

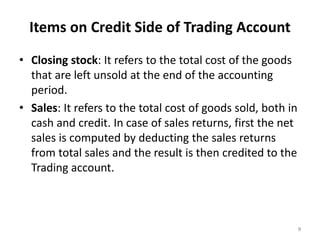

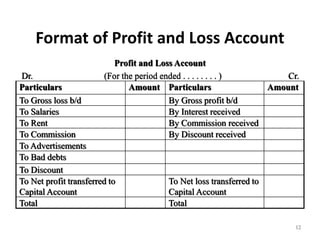

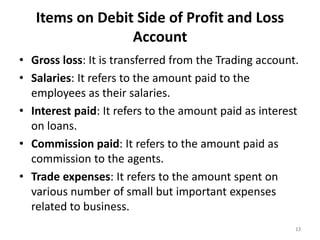

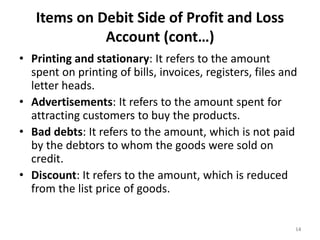

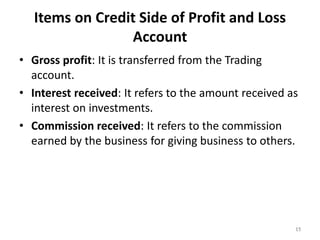

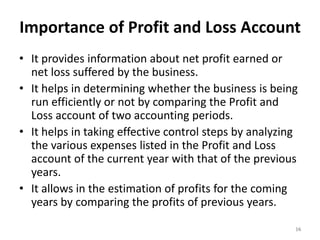

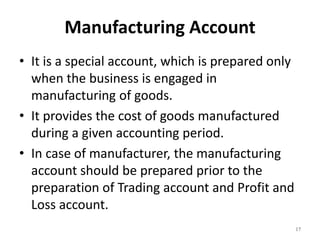

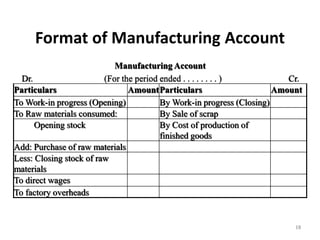

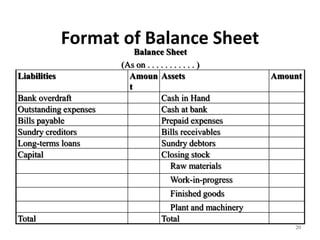

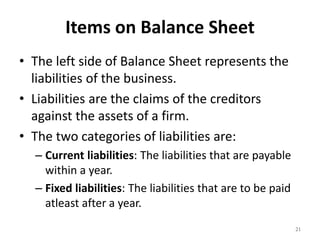

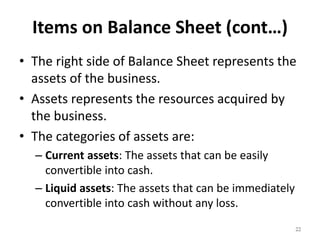

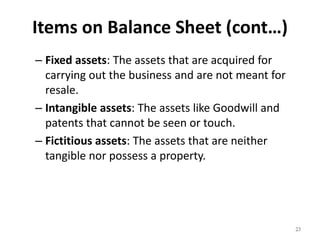

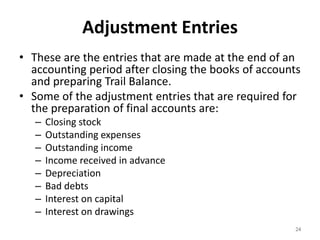

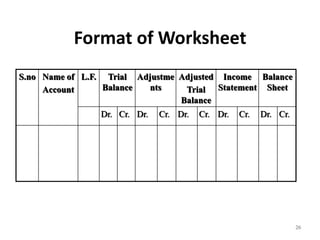

The document discusses the preparation of final accounts, which provide information on the profit/loss and financial position of a business. It describes the objectives and components of final accounts, including trading account, profit and loss account, and balance sheet. It explains the purpose of each account, the key items included on their debit and credit sides, and their importance. It also covers topics like adjustment entries, manufacturing account, and the use of a worksheet to prepare adjusted trial balance for the final accounts.