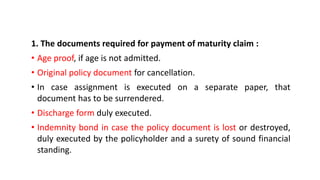

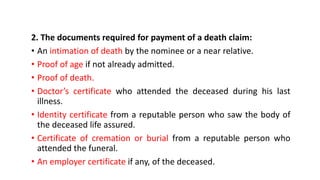

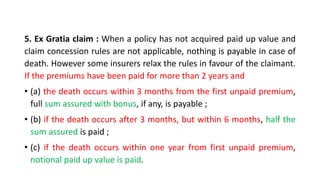

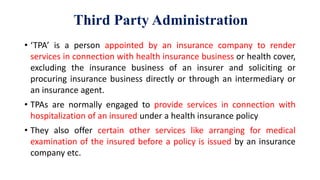

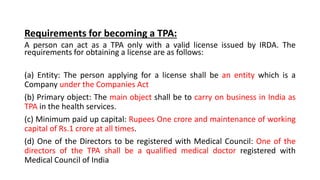

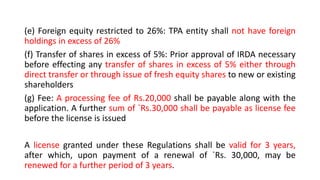

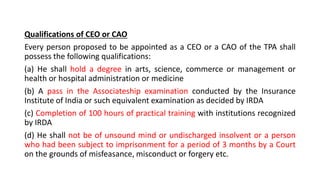

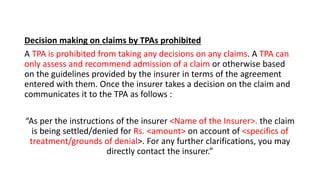

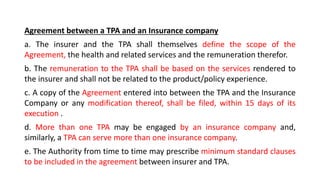

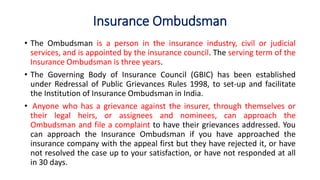

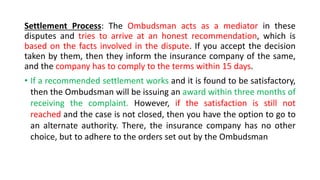

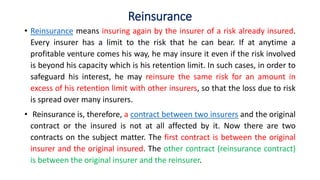

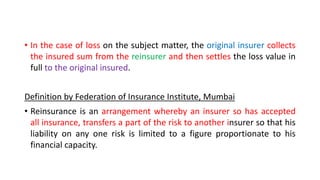

The document discusses claim management and reinsurance in the insurance industry. It covers topics such as the claim settlement process, types of claims including maturity, death and survival benefits, documents required for different claim types, procedures for settling claims, the role of third party administrators, and qualifications for CEOs and CAOs of third party administrators. It emphasizes the importance of prompt claim settlement and outlines the various stages in assessing, processing and paying out on insurance claims.