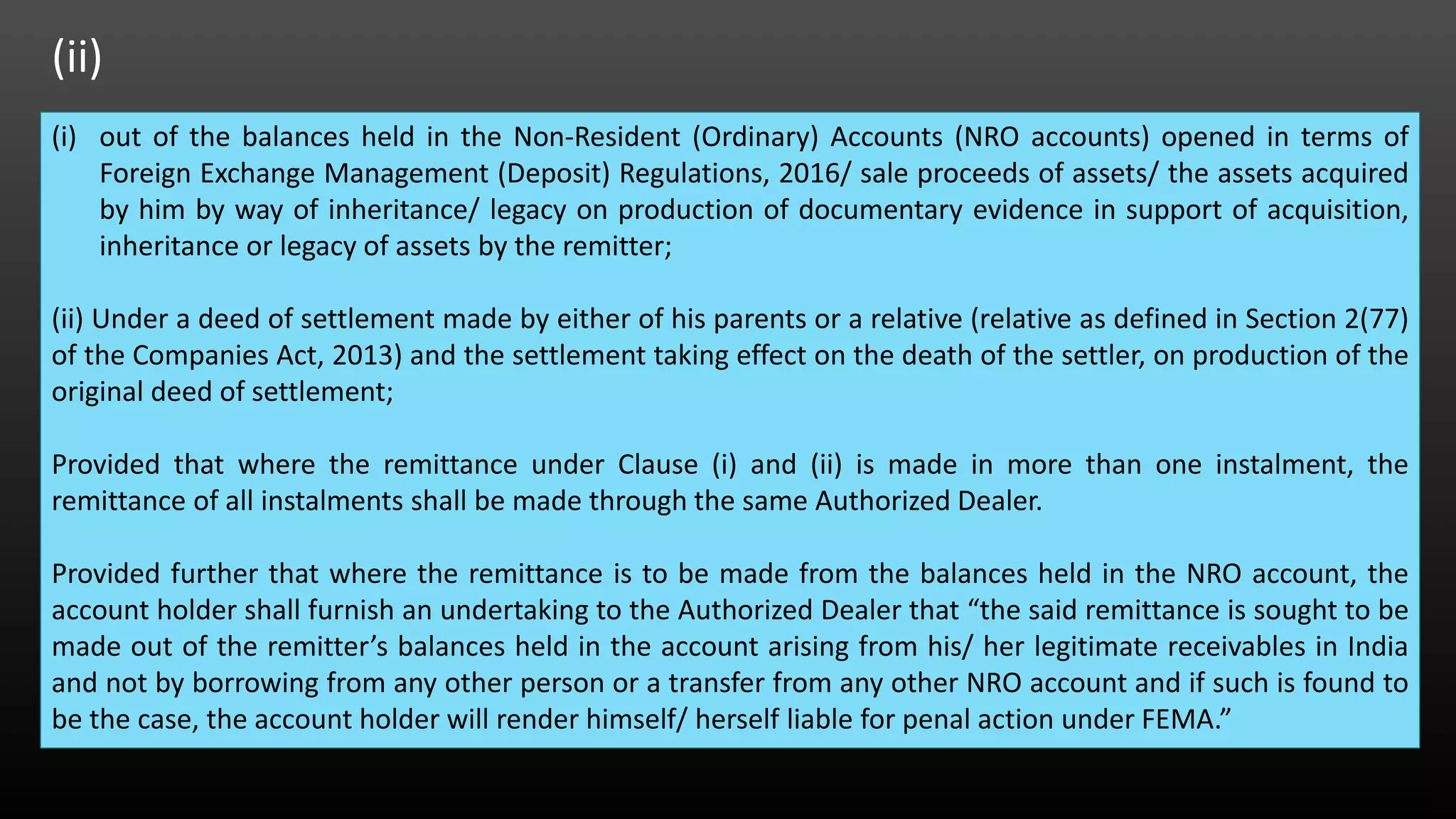

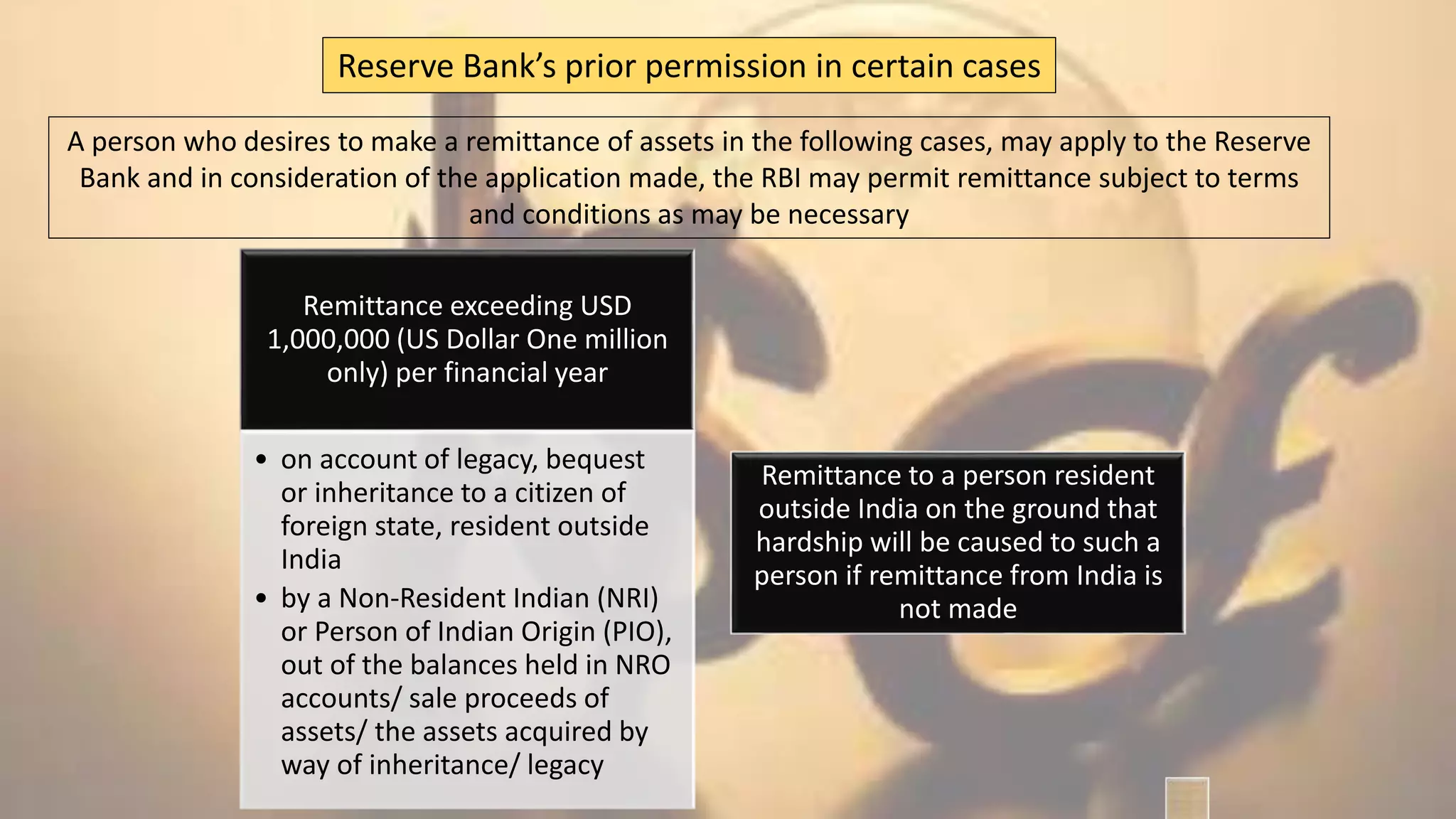

The document discusses the Foreign Exchange Management Act (FEMA) and its regulations regarding the remittance of assets. FEMA was introduced in 2000 to consolidate and amend laws relating to foreign exchange. It aims to facilitate external trade and payments. The Foreign Exchange Management (Remittance of Assets) Regulations, 2016 place various prohibitions and permissions regarding the remittance of assets held in India. These include prohibiting remittance without permission, and permitting remittance in cases such as inheritance, winding up of offices, and payment of taxes in accordance with Indian law.