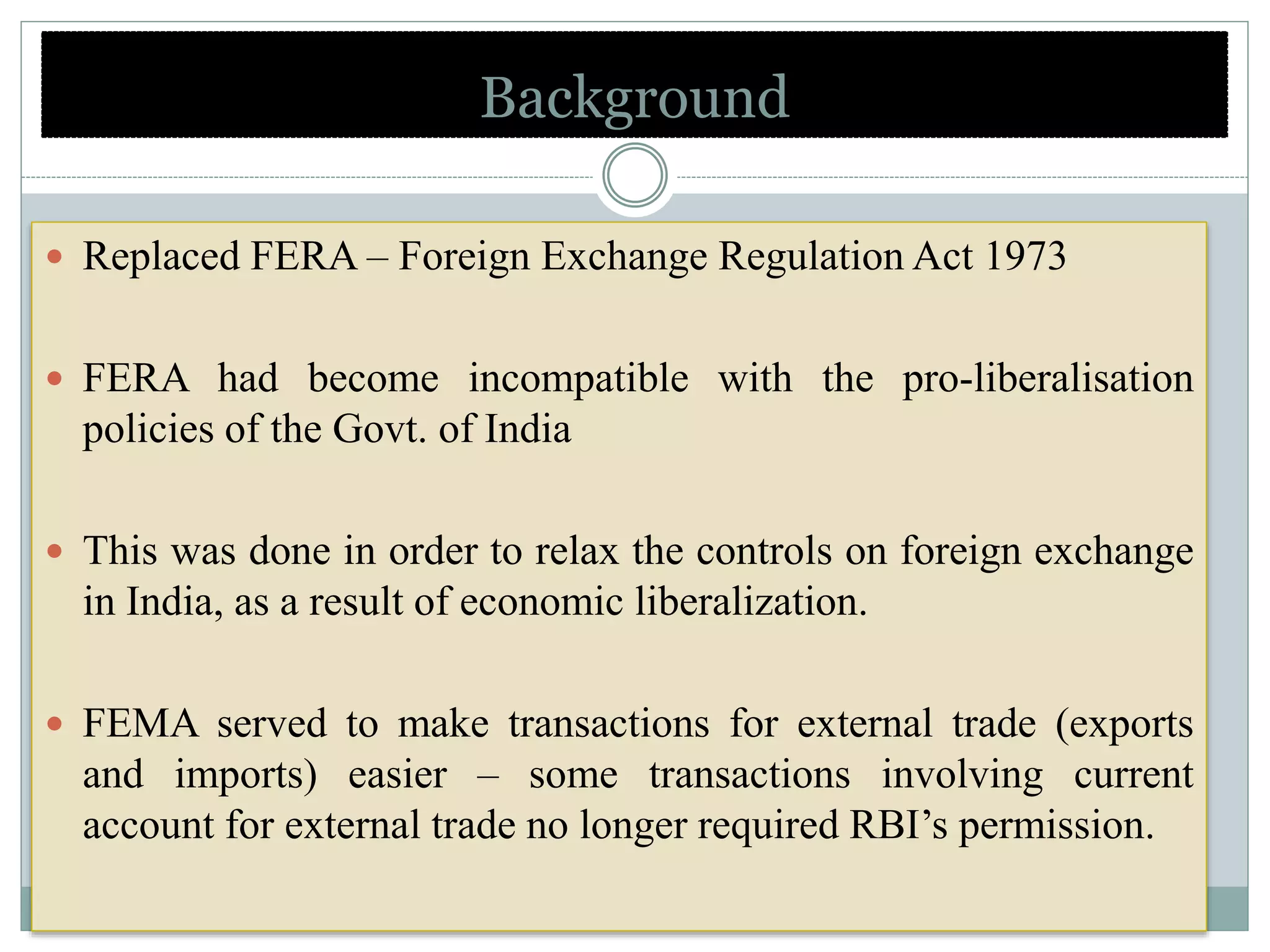

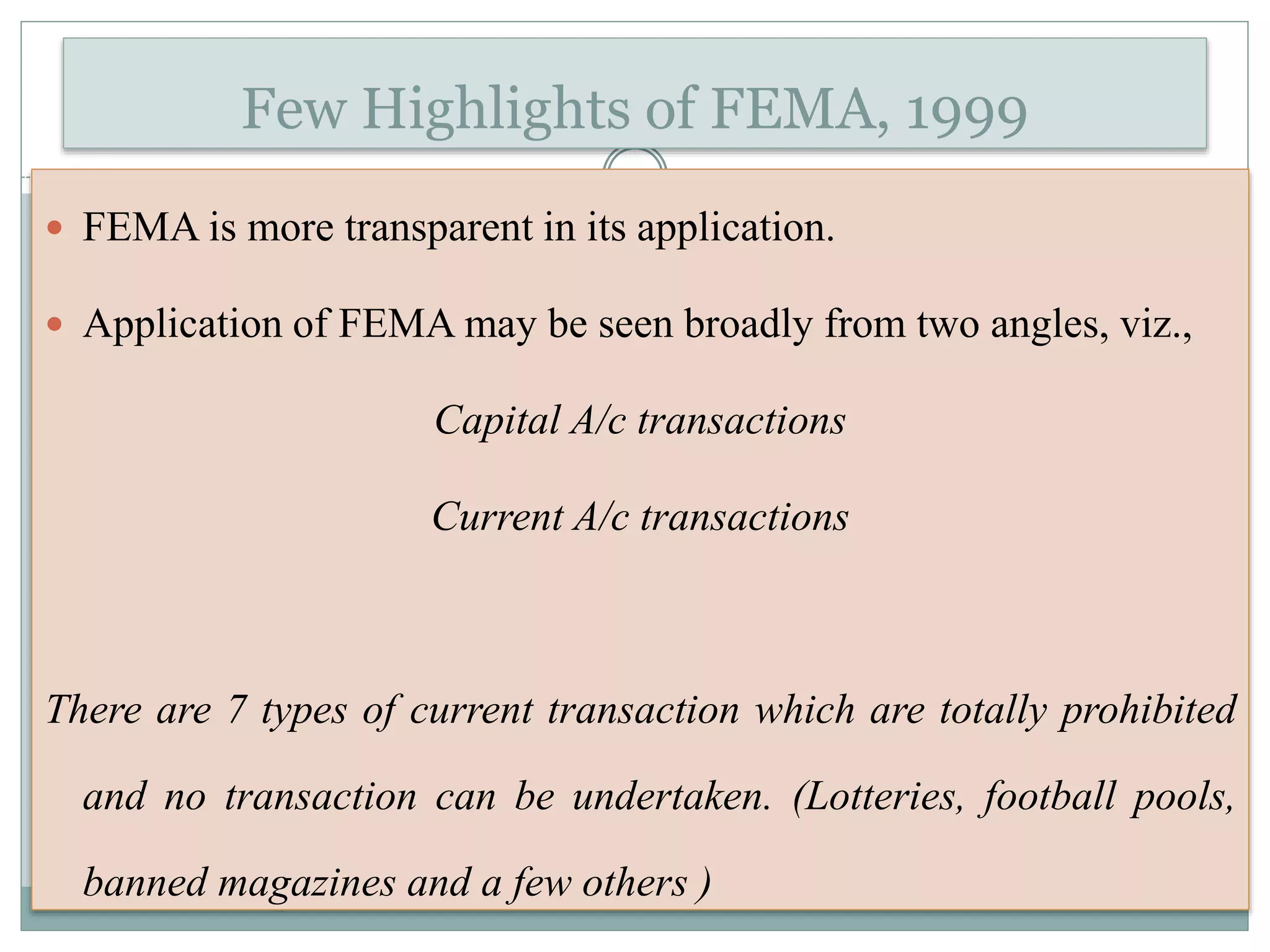

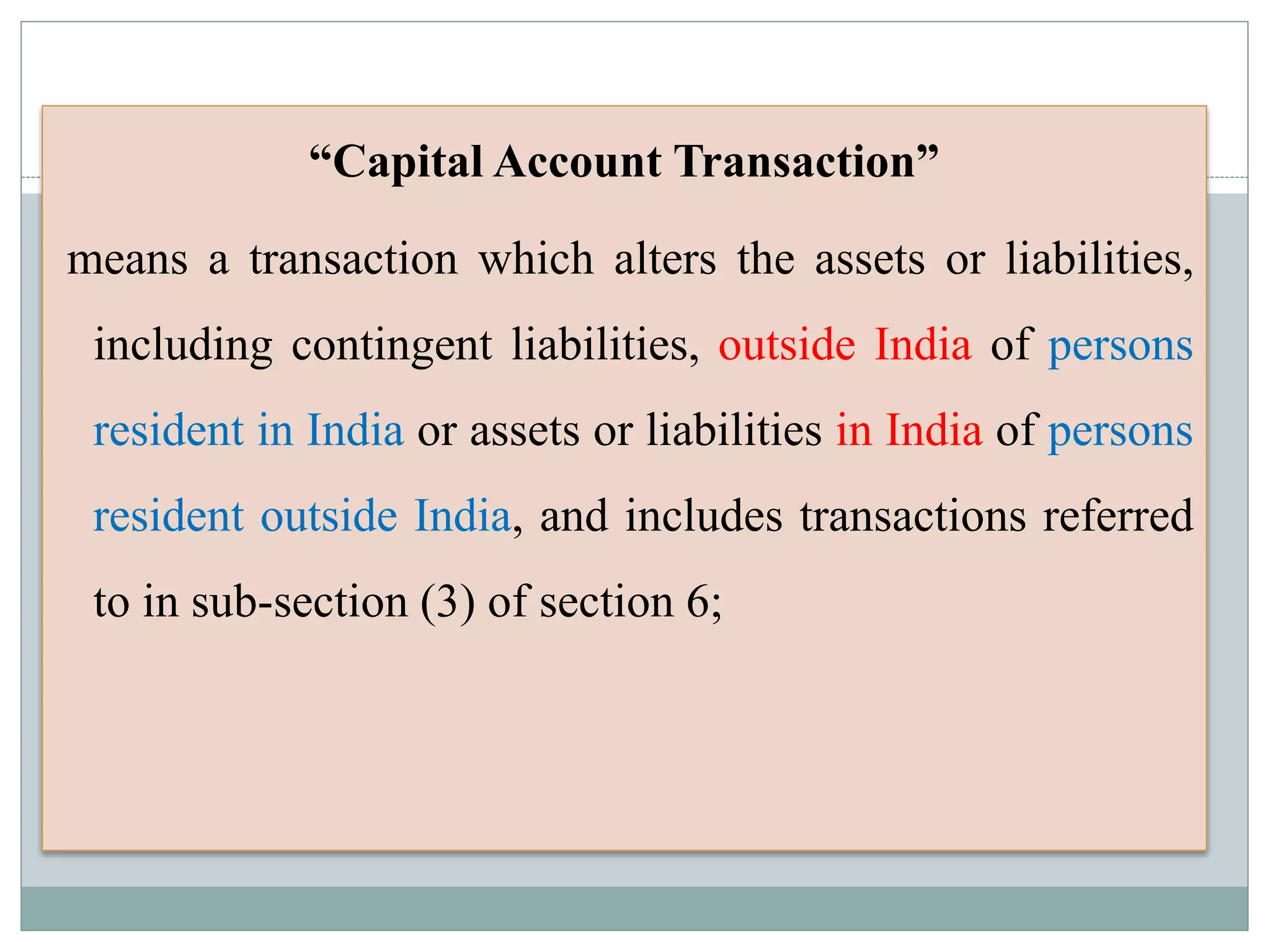

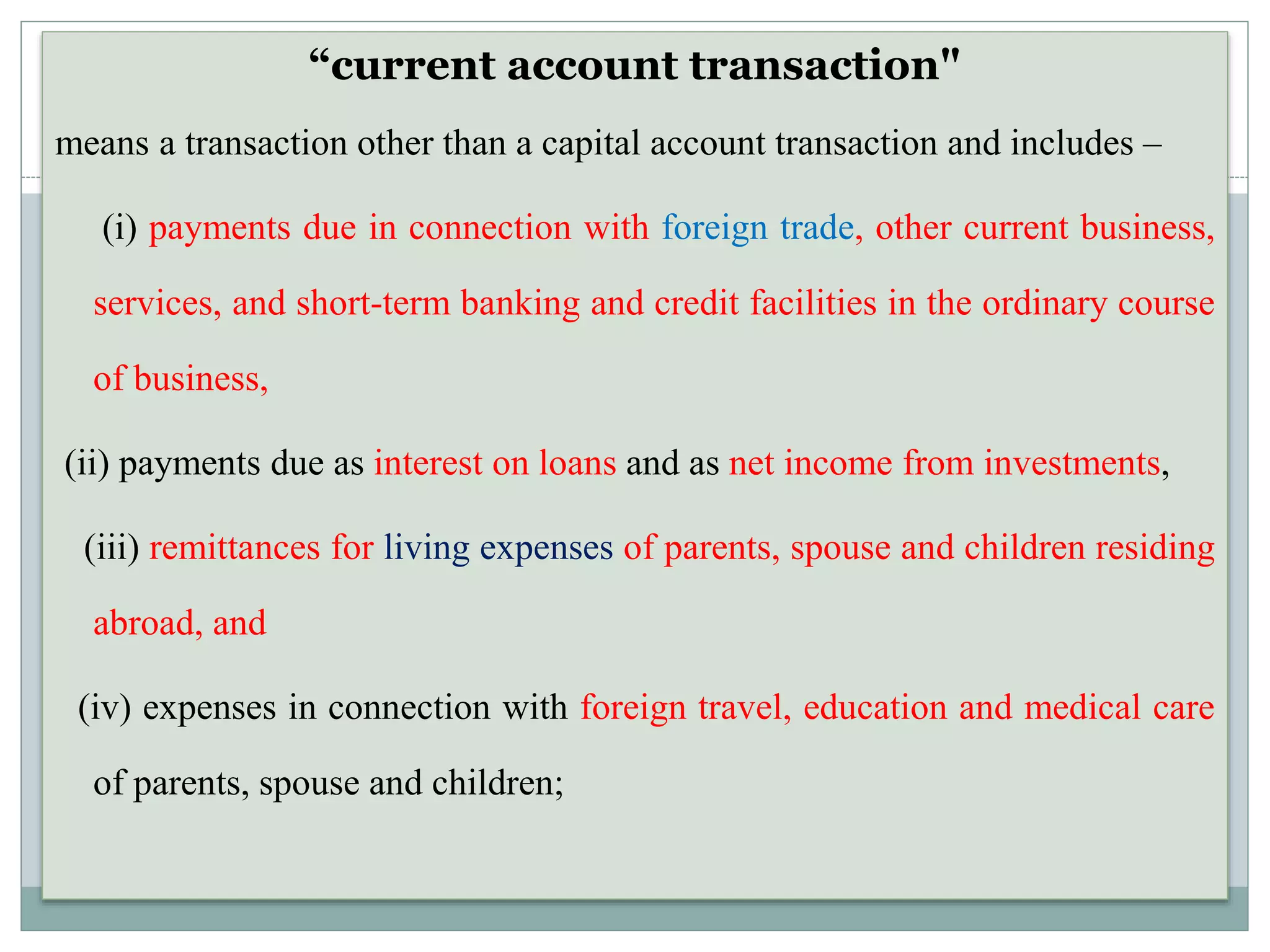

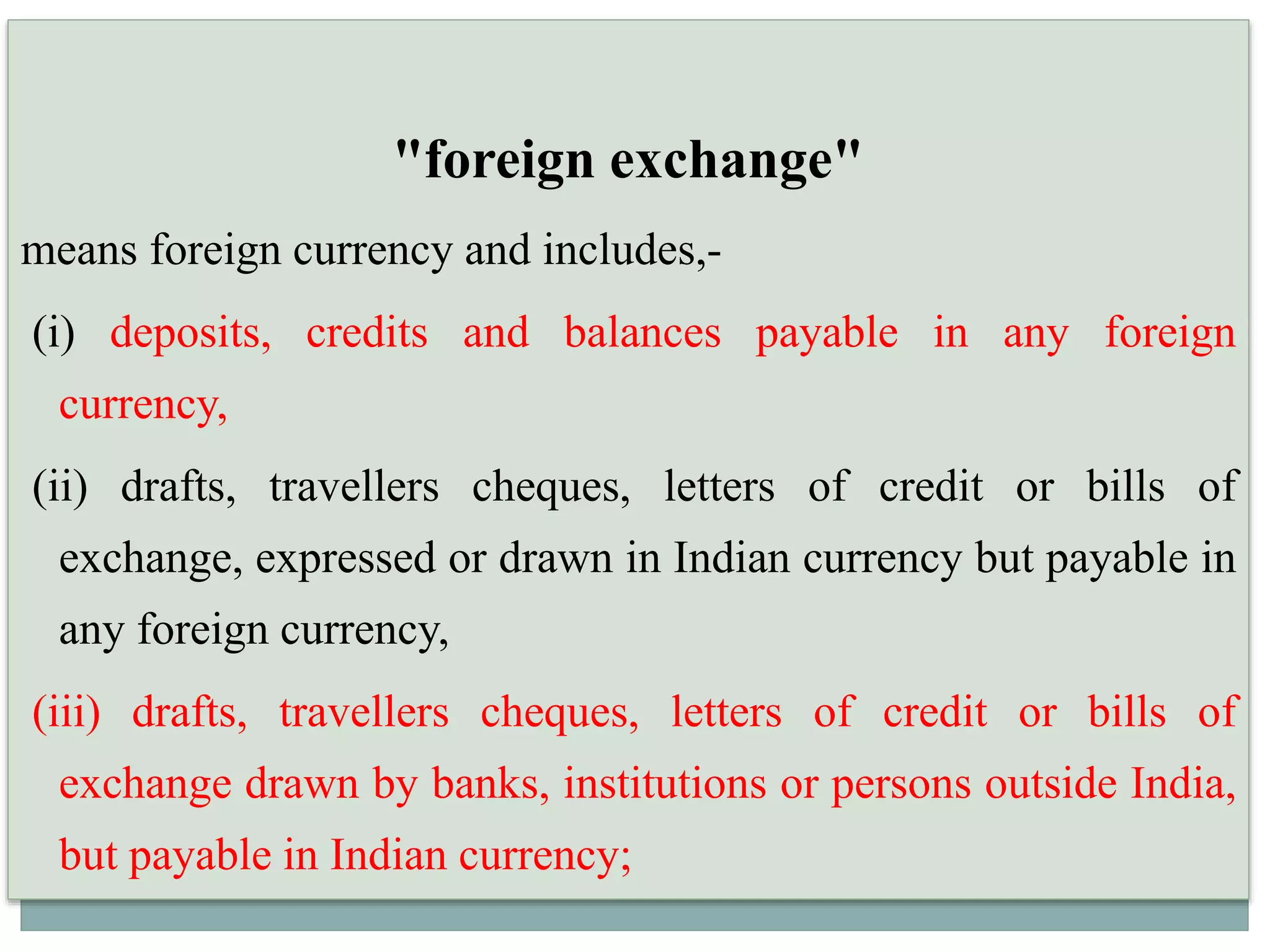

The document provides an overview of the Foreign Exchange Management Act (FEMA) 1999 which replaced the Foreign Exchange Regulation Act (FERA) 1973. FERA had become incompatible with India's liberalization policies while FEMA aimed to facilitate external trade and payments. Key differences between the two Acts include FERA focusing on conserving foreign exchange while FEMA facilitates its use for trade. Violations under FERA were criminal versus civil under FEMA. The document outlines the objectives, highlights, definitions and regulations under FEMA regarding current account transactions, capital account transactions, and realization and repatriation of foreign exchange to India.

![Contravention and Penalties

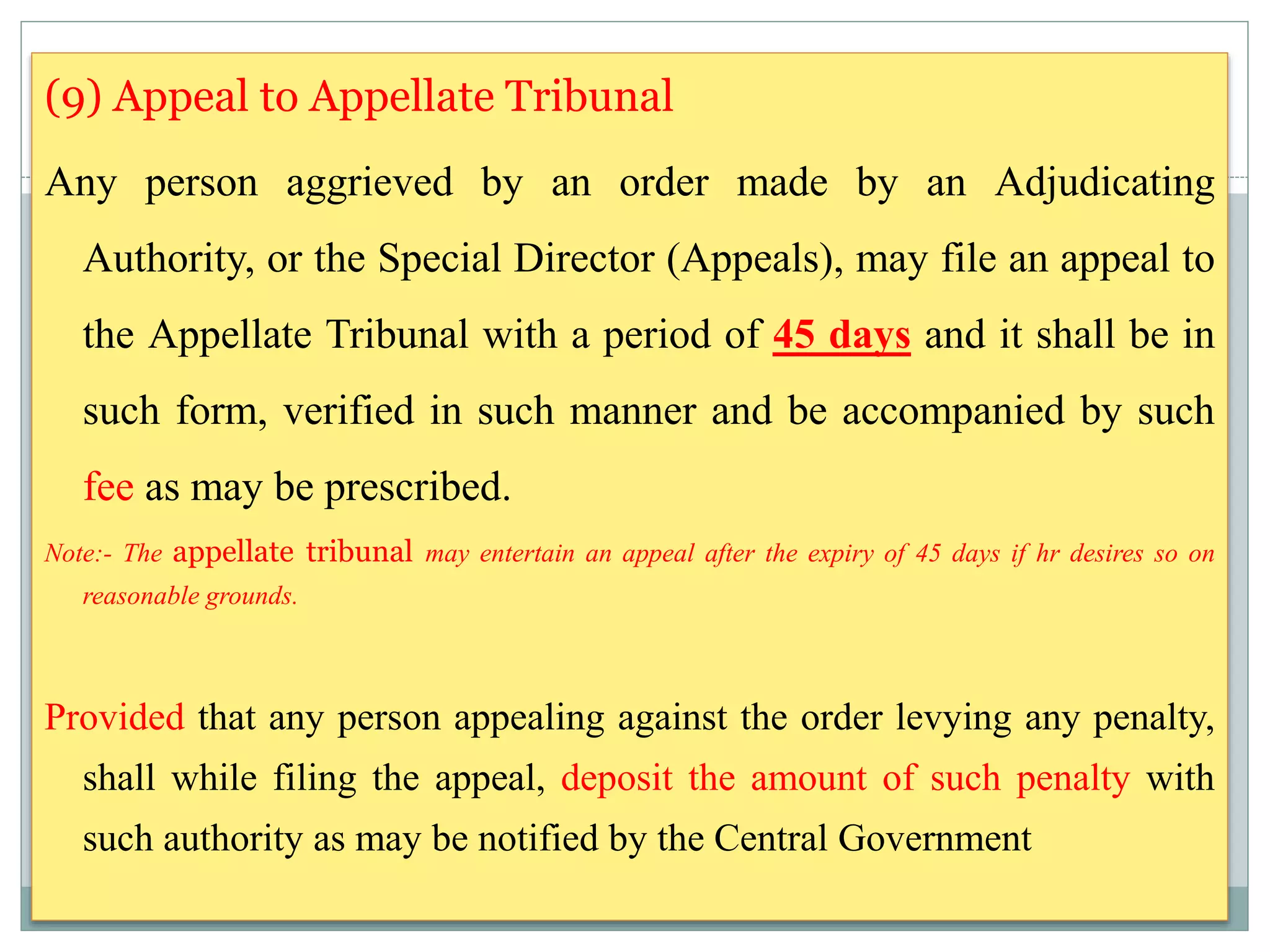

Penalties [Section 13(1)]

If any person contravenes any provision of this Act,

or contravenes any rule, regulation, notification,

direction or order issued in exercise of the powers

under this Act, be liable to a penalty up to thrice the

sum involved in such contravention where such

amount is quantifiable, or up to 2 lakh rupees

where the amount is not quantifiable.](https://image.slidesharecdn.com/femaramandeep-180324072127/75/FEMA-1999-51-2048.jpg)

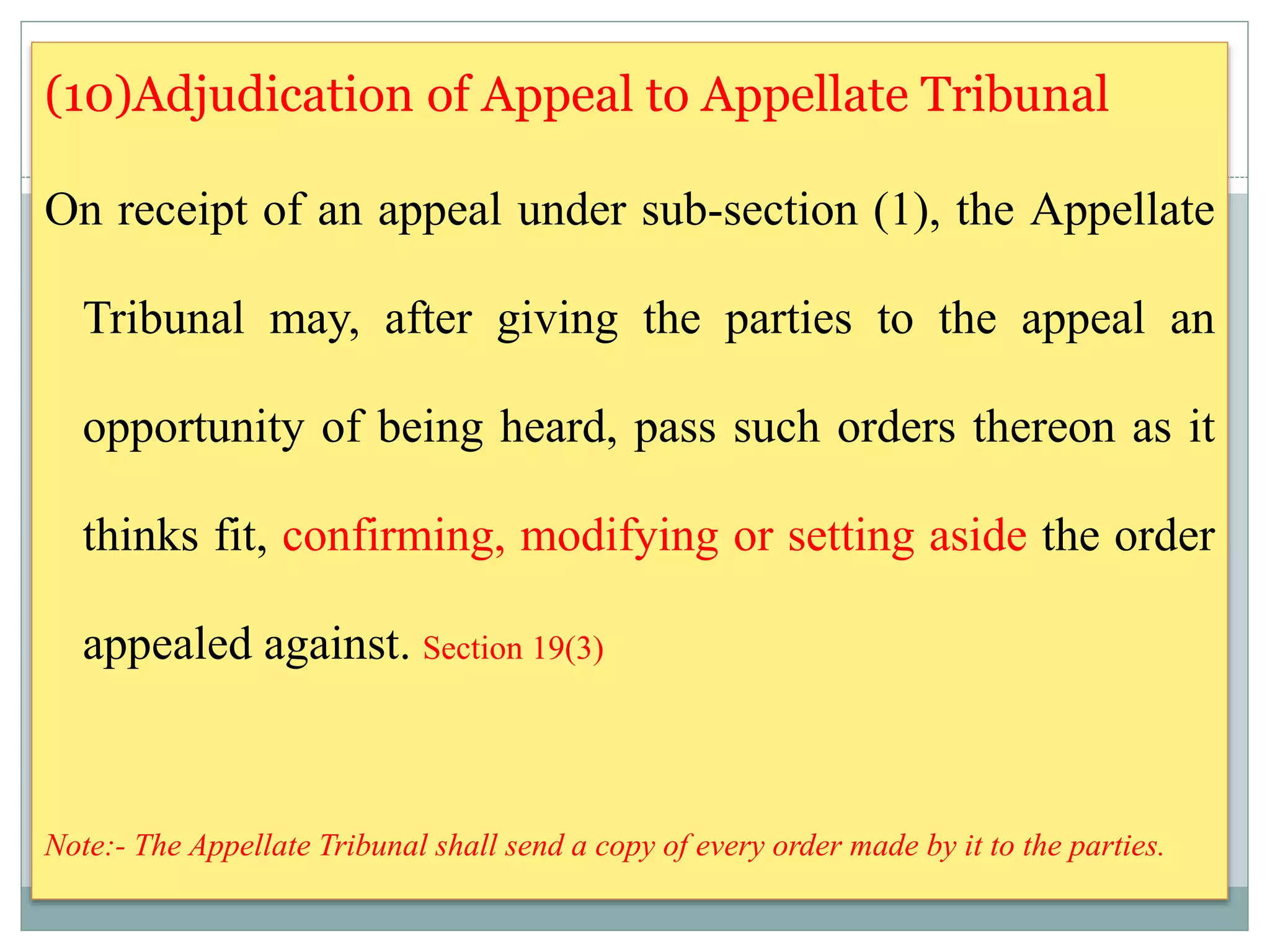

![ Any Adjudicating Authority adjudging any contravention, if he

thinks fit in addition to any penalty may direct that any currency,

security or property in respect of which the contravention has

taken place shall be confiscated to the Central Government

and further direct to defaulting person that such property shall be

brought back into India or shall be retained outside India in

accordance with the directions made in this behalf.

Confiscation of Money and Property [Section 13(2)]](https://image.slidesharecdn.com/femaramandeep-180324072127/75/FEMA-1999-53-2048.jpg)

![If any person fails to make full payment of the penalty

imposed on him under section 13 within a period of 90

days from the date on which the notice for payment of

such penalty is served on him, he shall be liable to civil

imprisonment under this section.

(However , the defaulting person shall not be arrested or detained in civil prison unless

Adjudicating Authority issue or serve a notice upon him to appear.)

Enforcement of the Orders of Adjudicating

Authorities [Section 14]](https://image.slidesharecdn.com/femaramandeep-180324072127/75/FEMA-1999-54-2048.jpg)