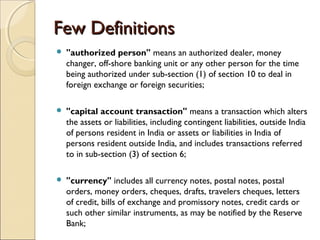

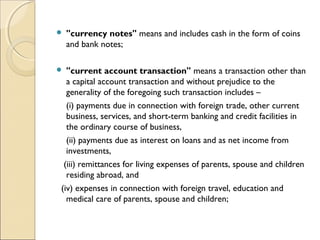

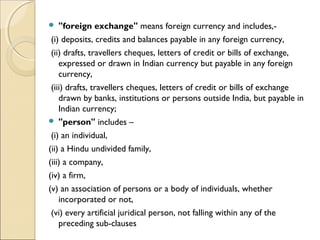

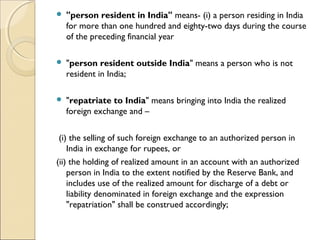

The document provides an overview of the Foreign Exchange Management Act (FEMA) of 1999 in India. Some key points:

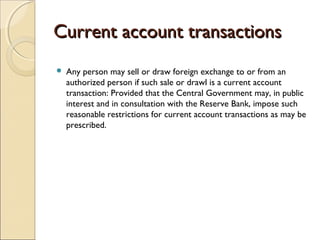

- FEMA replaced the older FERA and aimed to relax controls on foreign exchange to facilitate India's economic liberalization. It made current account transactions like trade easier.

- While FERA focused on conserving foreign exchange, FEMA aims to facilitate external trade and payments. Violations are considered civil offenses under FEMA versus criminal under FERA.

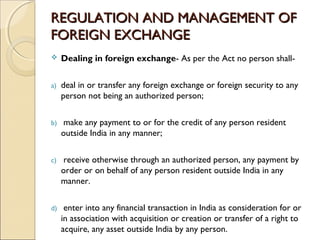

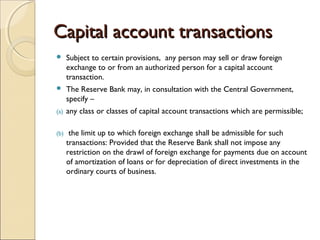

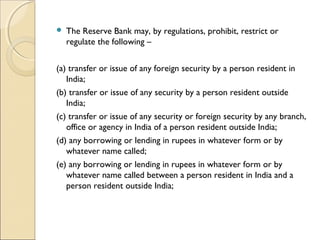

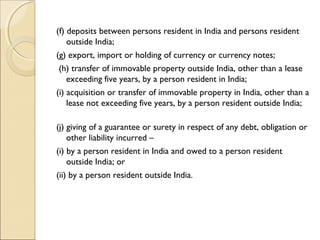

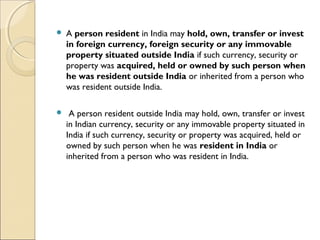

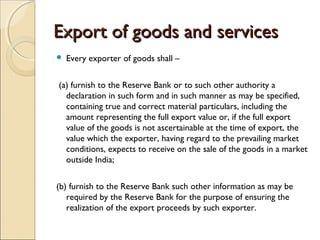

- FEMA's objectives include facilitating external trade and promoting an orderly foreign exchange market in India. It regulates transactions in foreign exchange, securities, property and borrowing/lending involving residents and non-residents.