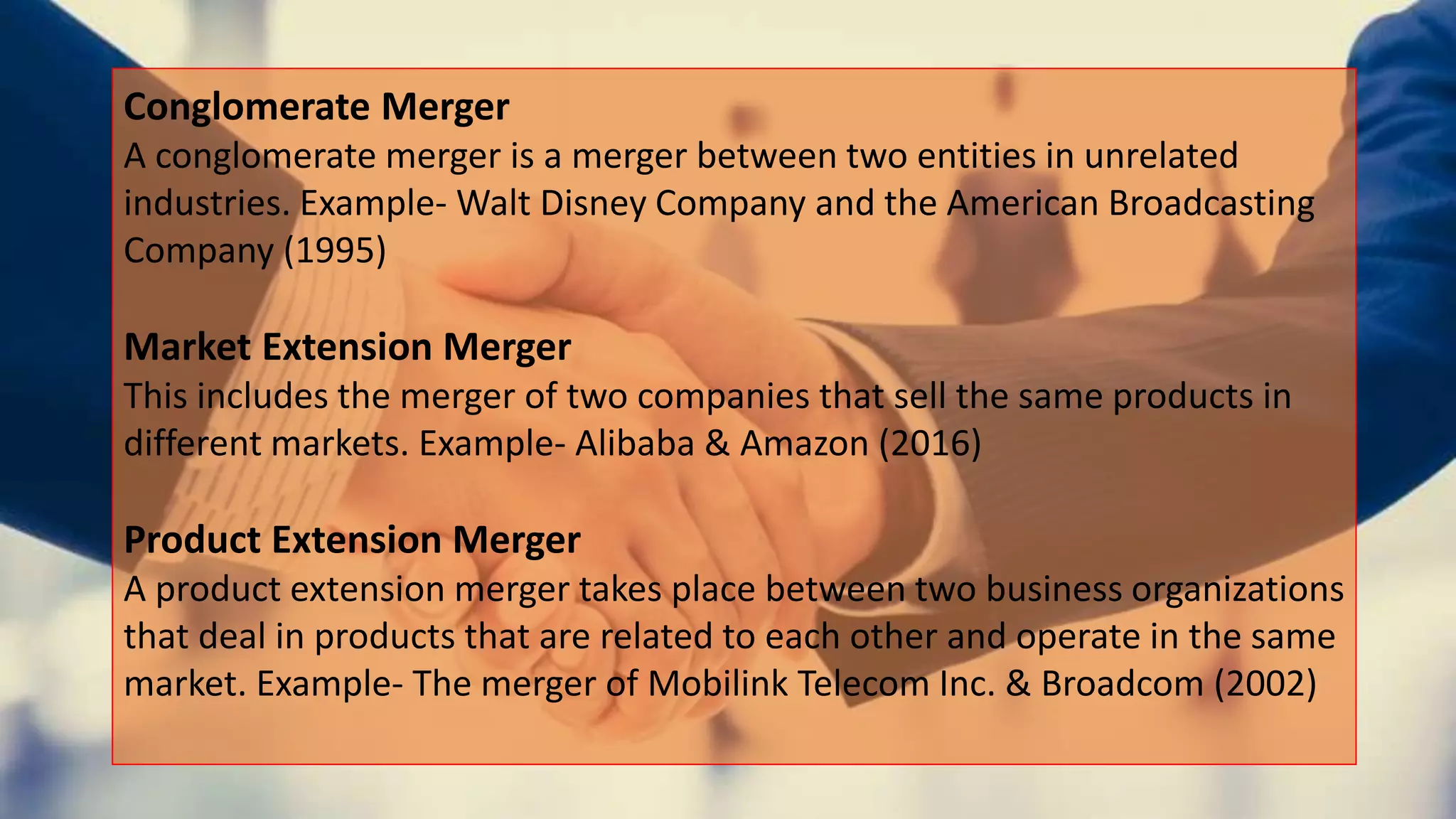

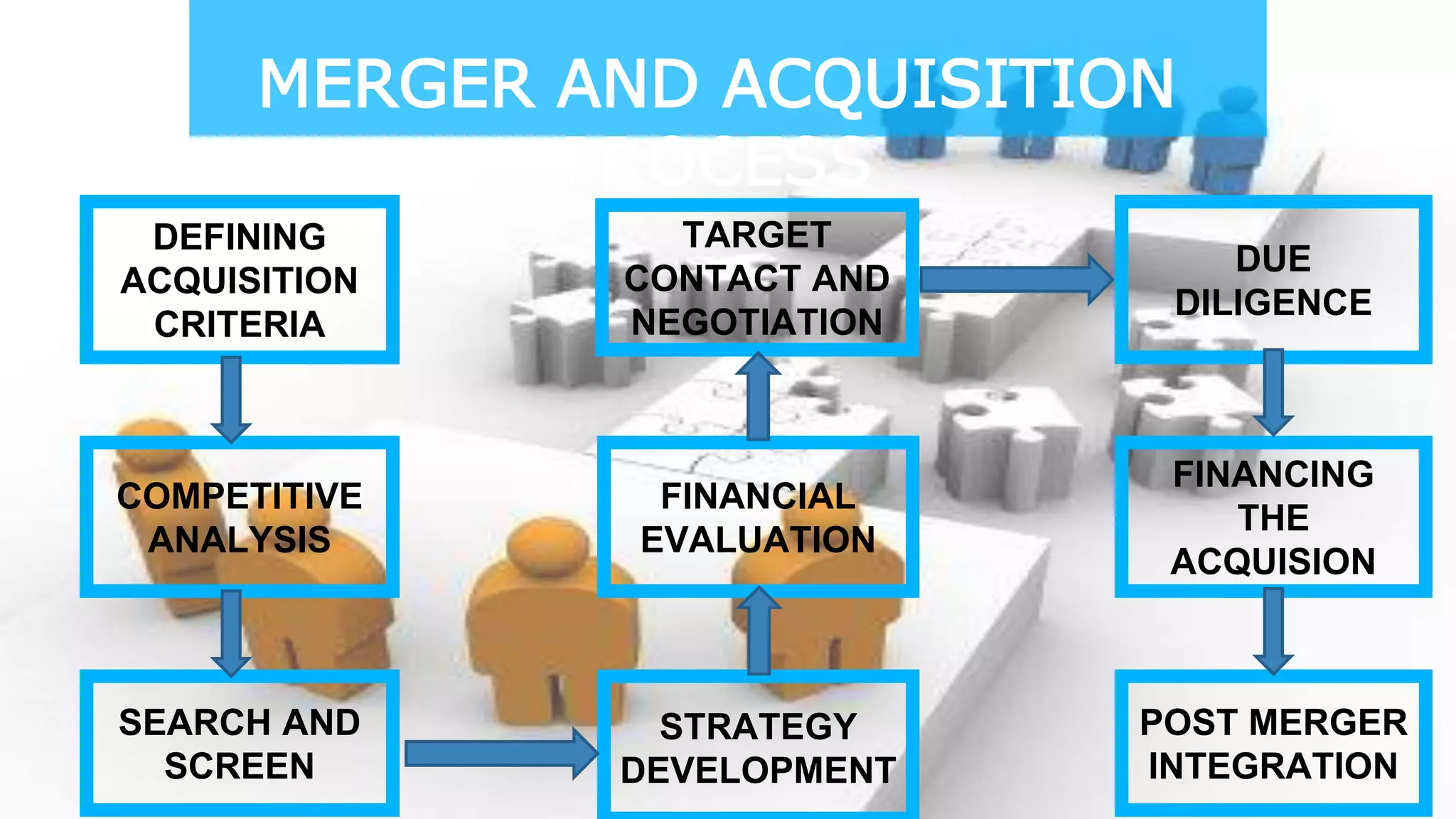

The document discusses mergers and acquisitions. It defines mergers as a transaction where two firms integrate operations to create a stronger competitive advantage. It describes different types of mergers such as horizontal, vertical, conglomerate, market extension, and product extension mergers. Acquisitions are defined as one company purchasing another. The key difference between mergers and acquisitions is that mergers form a new company while acquisitions do not. Synergy effects are cited as a driving force behind M&A deals. The regulatory framework around M&As in India is also summarized.