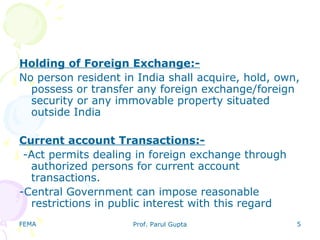

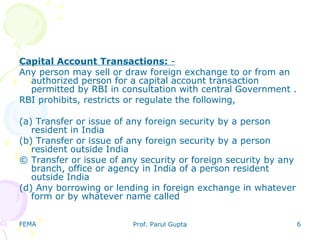

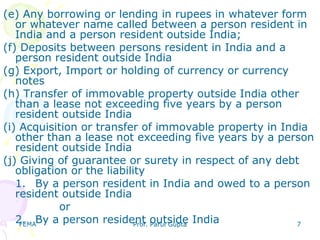

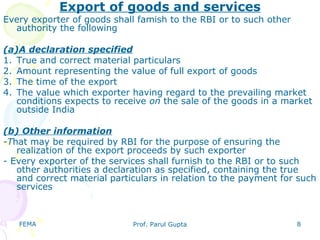

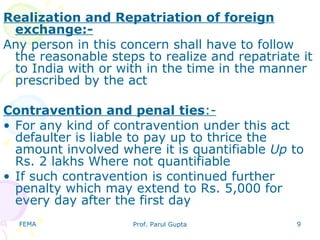

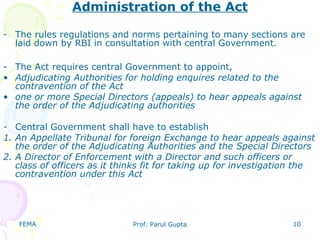

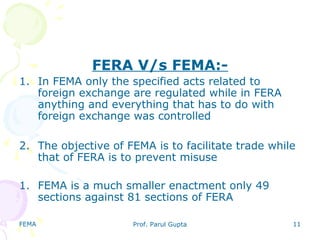

The Foreign Exchange Management Act (FEMA) was introduced in 1999 to replace the Foreign Exchange Regulation Act (FERA) of 1973 and facilitate India's external trade and payments. FEMA aims to promote orderly development and maintenance of foreign exchange markets in India through proper regulation. It regulates transactions involving foreign exchange in India and oversees important matters like dealings in foreign exchange, payments to and receipts from overseas entities, and holding of foreign currency. FEMA also governs capital account transactions, export and import of goods/services, realization of foreign exchange proceeds, and contraventions and penalties. The Reserve Bank of India is primarily responsible for administering FEMA rules and regulations in consultation with the central government.