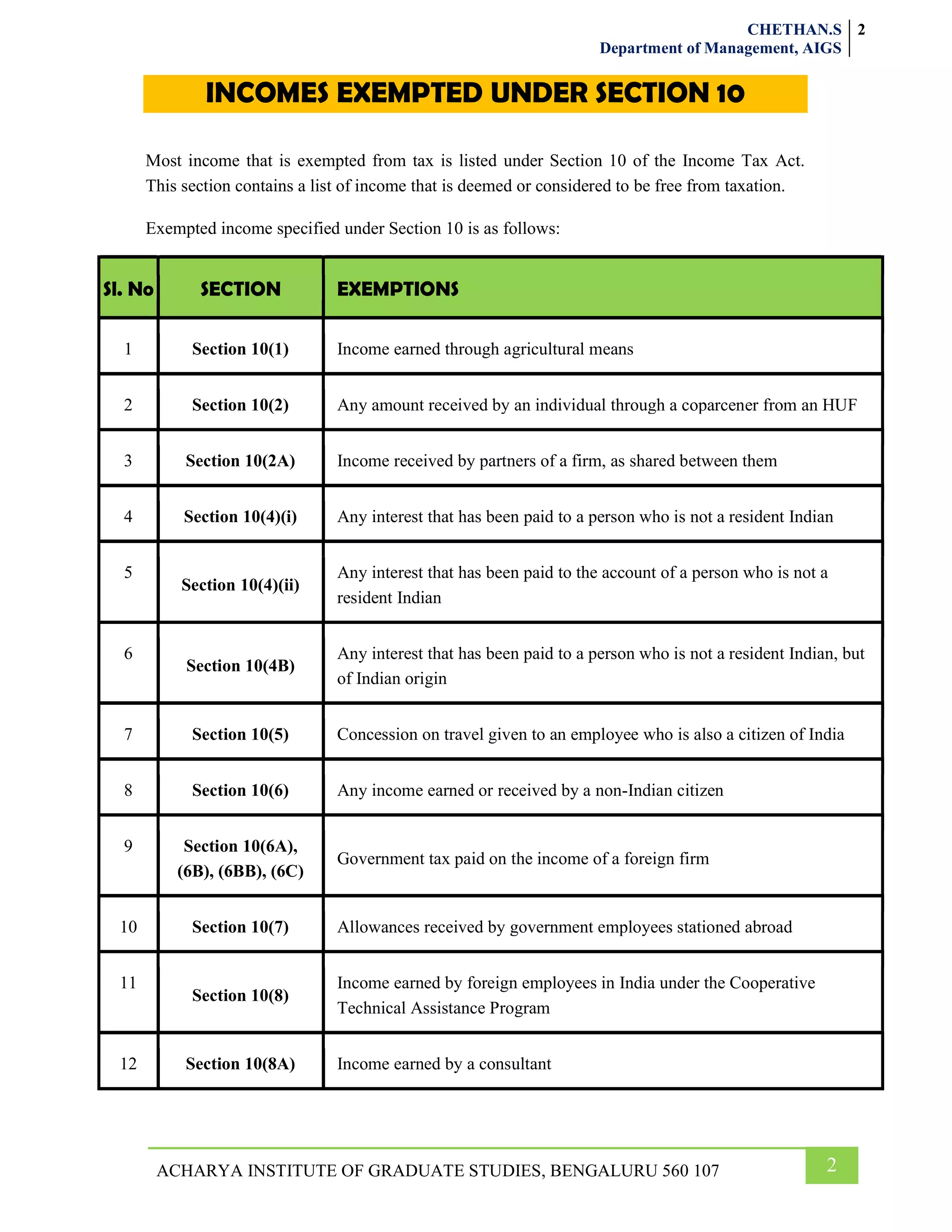

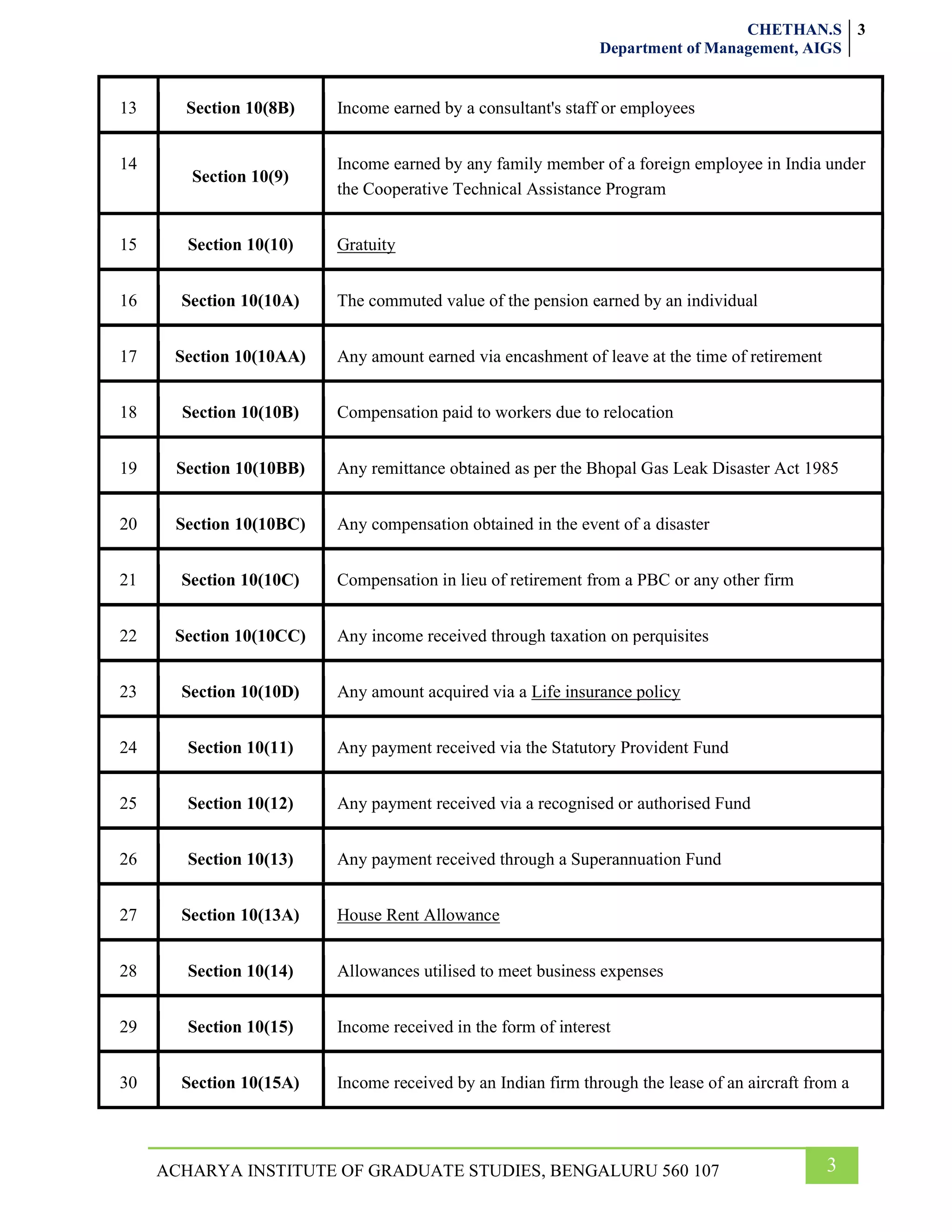

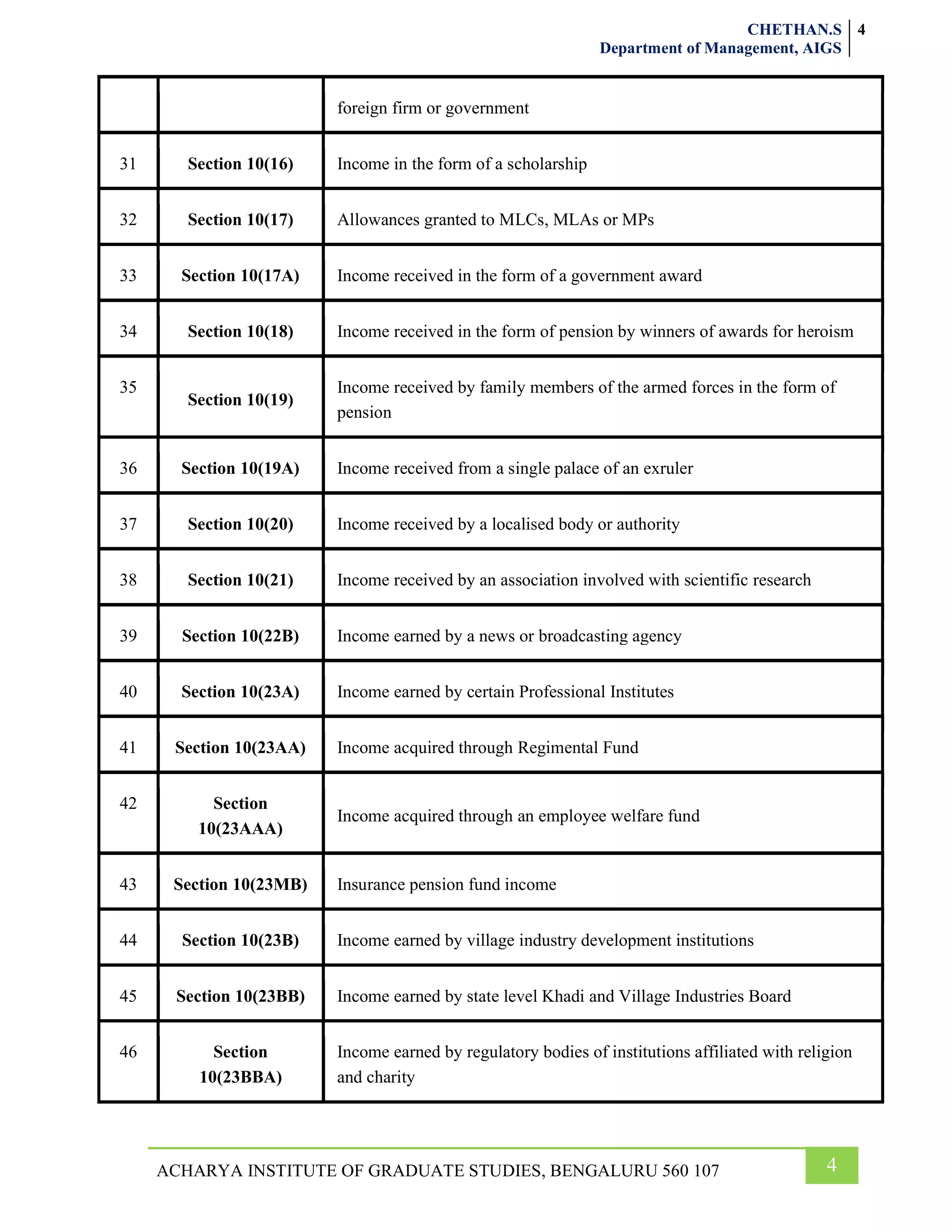

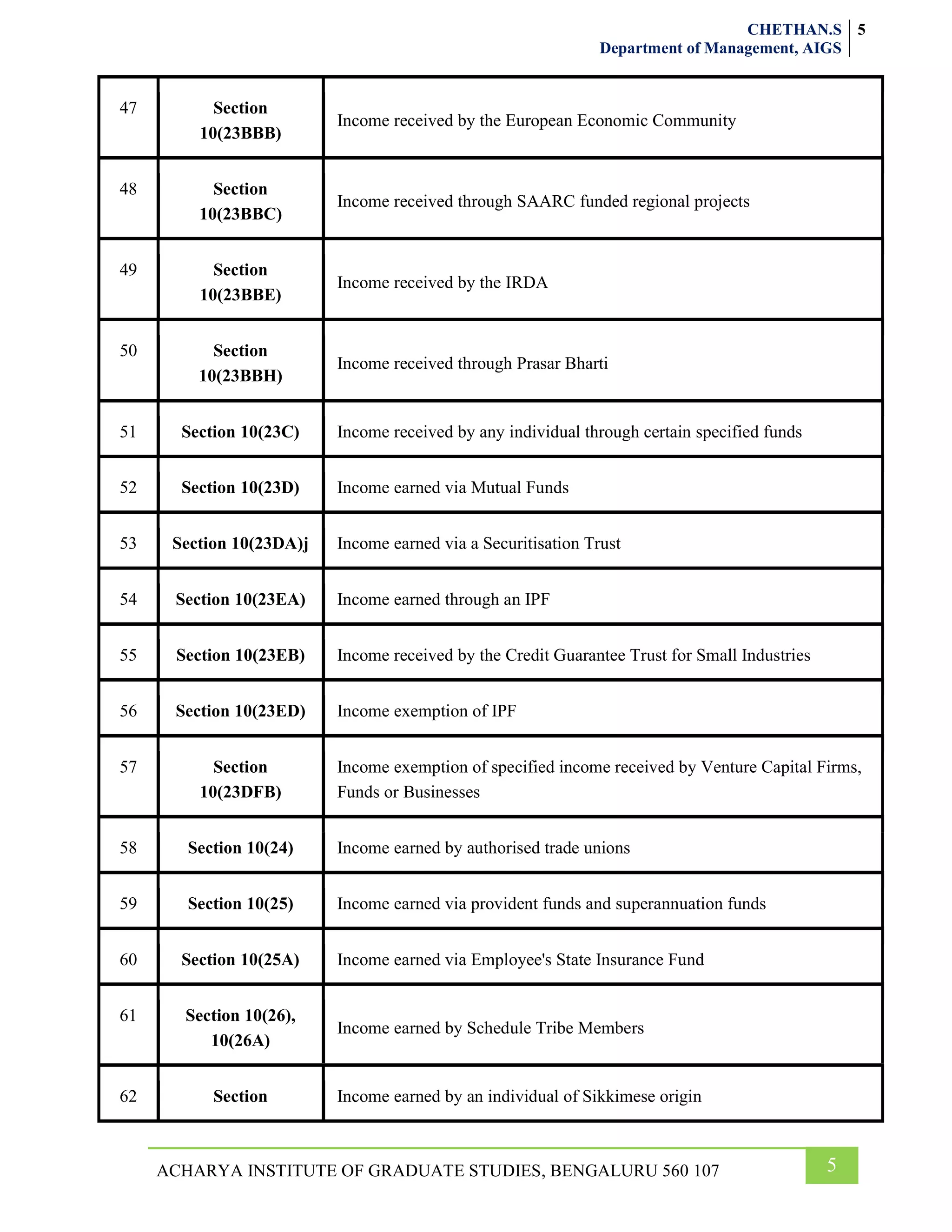

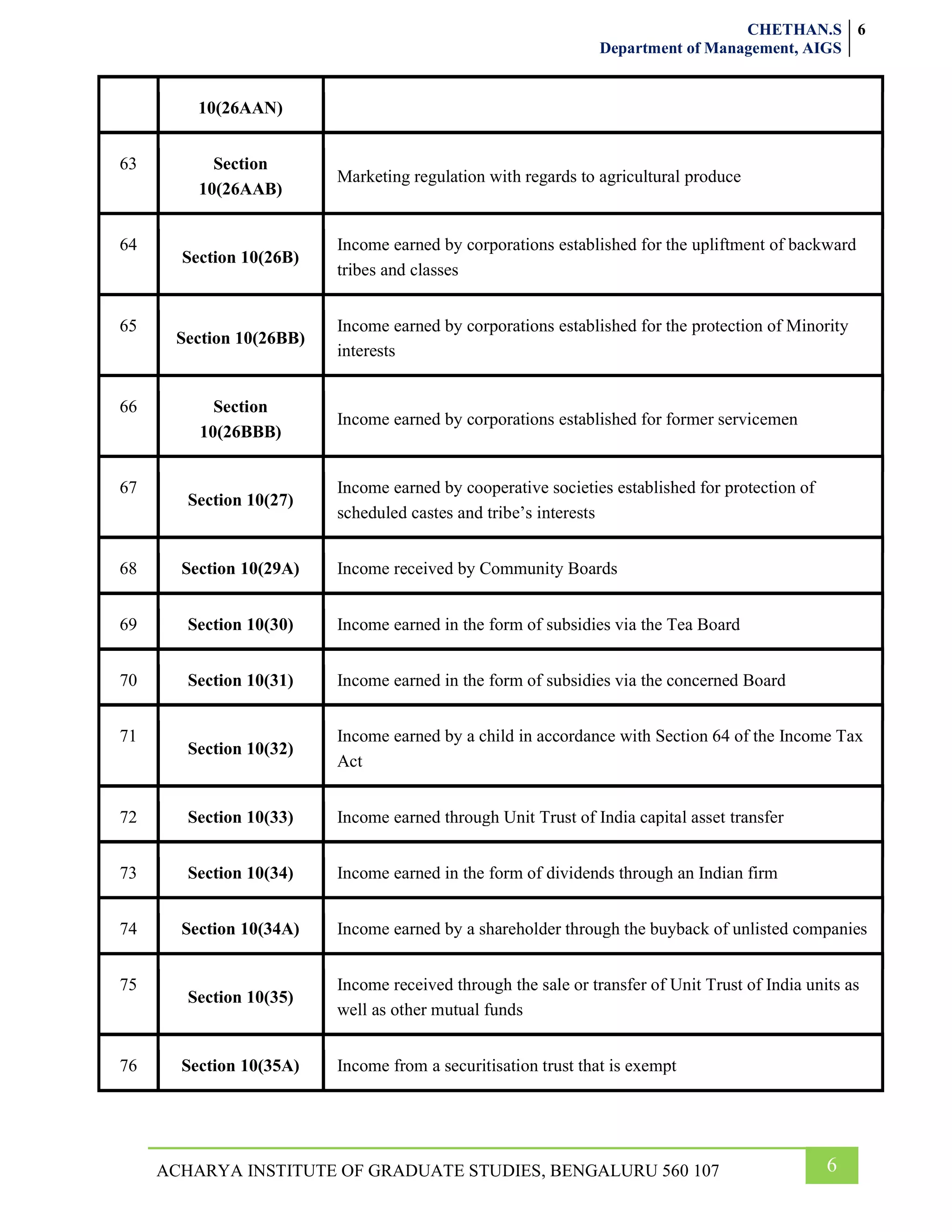

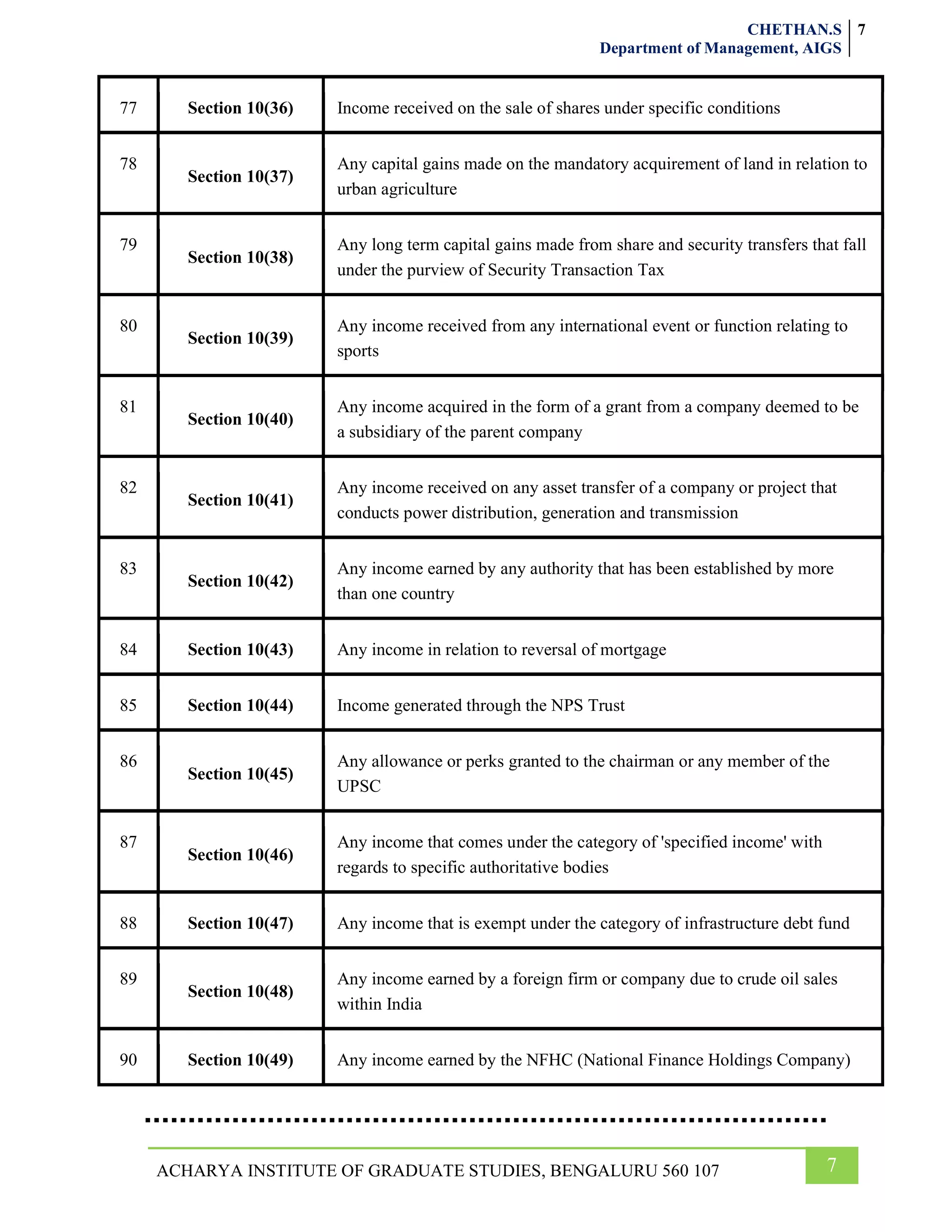

The document discusses exempted incomes under the Indian Income Tax Act. It begins by explaining the concept of exempted income and that Section 10 of the Income Tax Act lists various types of income that are exempt from taxation. It then provides a table with 90 entries that lists the specific sub-sections under Section 10 and the corresponding types of income that are exempted under each sub-section. The exempted incomes include agricultural income, interest from certain accounts, pensions, allowances for government employees, income of foreign employees in India, capital gains, dividends, and more.