CA Unit-4 (Overhead) Problems and Solutions

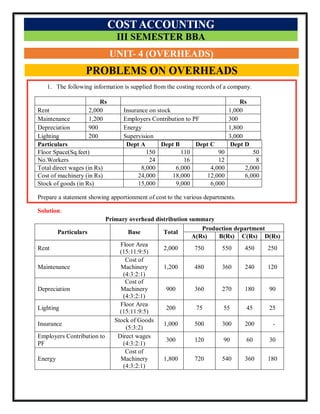

- 1. Cost Accounting III sem BBA Chaithra C M.com, NET Assistant Professor Module 4 Overhead Cost Control 1. The following information is supplied from the costing records of a company. Particulars Dept A Dept B Dept C Dept D Floor Space(Sq.feet) 150 110 90 50 No.Workers 24 16 12 8 Total direct wages (in Rs) 8,000 6,000 4,000 2,000 Cost of machinery (in Rs) 24,000 18,000 12,000 6,000 Stock of goods (in Rs) 15,000 9,000 6,000 Prepare a statement showing apportionment of cost to the various departments. Solution: Primary overhead distribution summary Particulars Base Total Production department A(Rs) B(Rs) C(Rs) D(Rs) Rent Floor Area (15:11:9:5) 2,000 750 550 450 250 Maintenance Cost of Machinery (4:3:2:1) 1,200 480 360 240 120 Depreciation Cost of Machinery (4:3:2:1) 900 360 270 180 90 Lighting Floor Area (15:11:9:5) 200 75 55 45 25 Insurance Stock of Goods (5:3:2) 1,000 500 300 200 - Employers Contribution to PF Direct wages (4:3:2:1) 300 120 90 60 30 Energy Cost of Machinery (4:3:2:1) 1,800 720 540 360 180 Rs Rs Rent 2,000 Insurance on stock 1,000 Maintenance 1,200 Employers Contribution to PF 300 Depreciation 900 Energy 1,800 Lighting 200 Supervision 3,000

- 2. Cost Accounting III sem BBA Chaithra C M.com, NET Assistant Professor Supervision No. of Workers (6:4:3) 3,000 1,200 800 600 400 Total Overheads 10,400 4,205 2,965 2,135 1,095 2. The following data is obtained from the books of a company for the half year ended 30th September 2020. Prepare overhead distribution summary. Particulars Production Dept. Service Dept. A B C X Y Direct Wages (in Rs) 7,000 6,000 5,000 1,000 1,000 Direct Materials 3,000 2,500 2,000 1,500 1,000 No. Employees 200 150 150 50 50 Electricity (k.wh) 8,000 6,000 6,000 2,000 3,000 No. of light points 10 15 15 5 5 Asset value (in Rs) 50,000 30,000 20,000 10,000 10,000 Area occupied (square yards) 800 600 600 200 200 The Expense for the 6 months were: Stores overhead Rs.400 Motive power Rs.1,500 Electric lighting 200 Labour welfare 3,000 Depreciation 6,000 Repairs and Maintenance 1,200 General overheads 10,000 Rent and Taxes 600 Apportion the expenses of Dept X in the ration 4:3:3 and dept Y in the Proportion of direct wages to the depts. A, B and C, respectively. Solution Primary overheads distribution summary Particulars Basic Total Production Dept Service Dept A B C X Y Direct materials Actuals 2,500 - - - 1,500 1,000 Direct Wages Actuals 2,000 - - - 1,000 1,000 Stores Overheads Direct materials (6:5:4:3:2) 400 120 100 80 60 40 Motive power Electricity(KWH) (8:6:6:2:3) 1,500 480 360 360 120 180

- 3. Cost Accounting III sem BBA Chaithra C M.com, NET Assistant Professor Electricity lighting No. of light points (2:3:3:1:1) 200 40 60 60 20 20 Labour Welfare No. employees (4:3:3:1:1) 3,000 1,000 750 750 250 250 Depreciation Value of Assets (5:3:2:1:1) 6,000 2,500 1,500 1,000 500 500 Repair & Maintenance Value of Assets (5:3:2:1:1) 1,200 500 300 200 100 100 Genaral overheads Direct wages (7:6:5:1:1) 10,000 3,500 3,000 2,500 500 500 Rent & taxes Area (Sq.yards) (4:3:3:1:1) 600 200 150 150 50 50 Total overheads 27,400 8,340 6,220 5,100 4,100 3,640 Secondary overhead distribution summary Particulars Basis Total Production Dept A B C As per primary distribution summery Actuals 19,660 8,340 6,220 5,100 Service depts X (4:3:3) 4,100 1,640 1,230 1,230 Y Direct wages (7:6:5) 3,640 1,416 1,213 1,011 Total overheads 27,400 11,396 8,663 7,341 3. Sneha company is having 4 departments A,B and C are production department and D is a service department. The actual cost for a period is as follows:- Rent Rs.20,000 Repairs Rs.12,000 Depreciation Rs.9,000 Lighting Rs.2,000 Supervision Rs.30,000 Insurance on materials Rs.10,000 Employees insurance Rs.3,000 Power Rs.18,000 The following data is available in respect of 4 departments: Particulars A B C D Area in Sq. feet 150 110 90 50

- 4. Cost Accounting III sem BBA Chaithra C M.com, NET Assistant Professor No. of Workers 24 16 12 8 Total wages (in Rs) 8,000 6,000 4,000 2,000 Value of stock (in Rs) 15,000 9,000 6,000 - Value of plant 24,000 18,000 12,000 6,000 Apportion of cost to the various department on most equitable basis and service department to the production department in the ratio 4:4:2. Solution: Primary Distribution Summary Particulars Base Total Production department Service department A(Rs) B(Rs) C(Rs) D(Rs) Rent Floor area is sq.feet (15:11:9:5) 20,000 7,500 5,500 4,500 2,500 Repairs Value of plant (4:3:2:1) 12,000 4,800 3,600 2,400 1,200 Depreciation Value of plant (4:3:2:1) 9,000 3,600 2,700 1,800 900 Lighting Area in sq.feet (15:11:9:5) 2,000 750 550 450 250 Supervision No. of workers (6:4:3:2) 30,000 12,000 8,000 6,000 4,000 Insurance on materials value of stock (5:3:2) 10,000 5,000 3,000 4,000 - Employees Insurance Total wages (4:3:2:1) 3,000 1,200 900 600 300 Power Value of plant (4:3:2:1) 18,000 7,200 5,400 3,600 1,800 Total Overheads 1,04,000 42,050 29,650 21,350 10,950

- 5. Cost Accounting III sem BBA Chaithra C M.com, NET Assistant Professor Secondary Distribution Summary Particulars Base Total Production department A(Rs) B(Rs) C(Rs) As per primary distribution summary 93,050 42,050 29,650 21,350 Service department D (4:4:2) 10,950 4,380 4,380 2,190 Total overheads 1,04,000 46,430 34,030 23,540 4. Lakshmi Ltd. has 3 production department and two service departments. From the following figures, prepare the overhead distribution summary using simultaneous equation method and repeated distribution method and also calculate overhead rate per labour hour. Particulars Production Dept. Service Dept. A B C X Y Direct Materials 45,000 30,000 15,000 12,000 9,000 Direct wages 30,000 22,500 15,000 6,000 4,500 value of machine 60,000 45,000 30,000 - - Floor area (Sq.feet) 30,000 20,000 15,000 10,000 5,000 HP rate of machine 240 200 160 - - No. of light points 120 90 60 30 20 No. of labour hrs 8,000 6,000 4,000 - - Other details: Indirect materials Rs.22,200 Indirect wages Rs.15,600 Depreciation on Machinery Rs.27,000 Depreciation on building Rs.12,000 Rent Rate & Taxes Rs.9,000 Electric power Rs.33,750 Lighting Rs.2,400 General expenses Rs.7,500 The Service rendered by each department to other department are as follows. A B C X Y X 30% 40% 20% - 10% Y 10% 20% 50% 20% -

- 6. Cost Accounting III sem BBA Chaithra C M.com, NET Assistant Professor Solution: Primary Overhead Distribution Summary Particulars Basis Total Production Dept. Service Dept. A B C X Y Direct materials Actuals 21,000 - - - 12,000 9,000 Direct Wages Actuals 10,500 - - - 6,000 4,500 Indirect Materials Direct materials (15:10:5:4:3) 22,200 9,000 6,000 3,000 2,400 1,800 Indirect Wages Direct wages (20:15:10:4:3) 15,600 6,000 4,500 3,000 1,200 900 Depreciation on machinery value of machine (4:3:2) 27,000 12,000 9,000 6,000 - - Depreciation on building Floor area (6:4:3:2:1) 12,000 4,500 3,000 2,250 1,500 750 Rent, rates and taxes Floor area (6:4:3:2:1) 9,000 3,375 2,250 1,688 1,125 562 Electric power HP rate of machine (6:5:4) 33,750 13,500 11,250 9,000 - - Lighting No. of light points (12:9:6:3:2) 2,400 900 675 450 225 150 General expenses Direct wages (20:15:10:4:3) 7,800 3,000 2,250 1,500 600 450 Total overhead 1,61,250 52,275 38,925 26,888 25,050 18,112 (1) Simultaneous equation method X=25,050+ 20 100 Y Y=18,112 + 10 100 X

- 7. Cost Accounting III sem BBA Chaithra C M.com, NET Assistant Professor X=25,050 + 0.2Y Y=18,112+0.1X X-0.2Y=25,050 x (0.1) -0.1X + Y = 18,112 x (1) 0.1X – 0.02Y = 2,505 -0.1X + Y = 18,112 0.98Y= 20,617 Y = 20,617 0.98 Y = Rs 21,038 X – 0.2(21,038) = 25,050 X – 4208 = 25,050 X = 25,050 + 4,208 X = Rs. 29,258 Therefore, Service department X = Rs. 29,258 Y = Rs. 21,038 Secondary distribution summary Particulars Total Production Dept. A B C As per primary distribution summary 1,18,088 52,275 38,925 26,888 Service department X(29,258) in (30%,40%,20%) 26,332 8,777 11,703 5,852 Y(21,038) in (10%,20%,50%) 16,830 2,104 4,207 10,519 Total Overheads 1,61,250 63,156 54,835 43,259

- 8. Cost Accounting III sem BBA Chaithra C M.com, NET Assistant Professor (2) Repeated distribution method: (Secondary distribution summary) Particulars Production Dept. Service Dept. A B C X Y As per primary distribution summary 52,275 38,925 26,888 25,050 18,112 Service departments X(30%, 40%,20% & 10%) 7,515 10,020 5,010 -25,050 2,505 20,617 Y (10%,20%,50% & 20%) 2,062 41,234 10,309 4,123 -20,617 X 1,237 1,649 825 -4,123 412 Y 41 82 206 83 -412 X 25 33 17 -83 8 Y 1 2 5 -8 Total overhead 63,156 54,835 43,259 - No. of labour hours 8,000 6,000 4,000 Labour hour rate 7.89 9.14 10.81 Note: Slight Changes in answer due to decimal point is acceptable. 5. An Engineering company has 3 production department and 2 service departments. The overhead analysis of the various departments are as follows – Production department – A – Rs 10,250, B - Rs 12,260, C – Rs 6,840 Service departments – X – Rs 5,523 y – Rs 3,327 The service department overheads are apportioned to the production department are as follows – Apportion the service department expenses to the production department under: 1. Simulation Equation method. 2. Repeated distribution method. Solution: X = 5,523 + 10 100 𝑌 Particulars A B C X Y X 25% 30% 25% - 20% Y 40% 20% 30% 10% -

- 9. Cost Accounting III sem BBA Chaithra C M.com, NET Assistant Professor Y = 3,327 + 20 100 𝑋 X = 5,523 + 0.1Y Y = 3,327 + 0.2X ( X – 0.1Y = 5,523) x0.2 (-0.2X + Y = 3,327 ) x1 0.2X – 0.02Y = 1,105 -0.2X + Y = 3,327 0.98Y = 4,432 Y = 4,432 0.987 Y = 4,522 X – 0.1Y = 5,523 X – 0.1(4522) = 5,523 X – 456 = 5,523 X = 5,523 + 452 X = 5,975 Secondary Distribution Summary Repeated distribution method Particulars Production Department Service Department A B C X Y As per Primary Distribution summary 10,250 12,260 6,840 5,523 3,327 Service department X (25%, 30%, 25% &20%) 1,381 1,657 1,381 -5,523 +1,105 4,432 Y (40%,20%,30% & 10%) 1,773 886 1,330 443 -4,432 Particulars Total Production Department A B C As per Primary Distribution summary Service department 29,350 10,250 12,260 6,840 X (5,975) 4,781 1,494 1,793 1,494 Y (4,522) 4,069 1,809 904 1,356 Total Overheads 38,200 13,553 14,957 9,690

- 10. Cost Accounting III sem BBA Chaithra C M.com, NET Assistant Professor X 111 133 111 -443 89 Y 36 18 27 8 -89 X 2 4 2 -8 - Total OH 13,553 14,958 9,691 - - Decimal points could cause some changes in answer which is acceptable. 6. A factory has 3 production departments and 2 service departments. The following figures are extracted from the books of accounts – Overheads Production Department Service Departments A B C X Y 15,620 25,086 9,094 8,000 2,500 Particulars Production Department Service Departments A B C X Y X 30% 40% 10% ----- 20% Y 20% 20% 50% 10% ----- Estimated working hours of production departments are – A – 500 hrs, B – 1,250 hrs and C – 700 hrs. Prepare a statement shoeing the distribution of two service departments by using simultaneous equation method and repeated distribution method and also calculate hourly rate for each department. Solution: Simultaneous equation method I Step: X = 8,000 + 10Y / 100 Y = 5,200 + 20X / 100 II Step:X = 8,000 + 0.1 Y Y = 5,200 + 0.2 X III Step: X – 0.1Y = 8,000 (multiply with 0.2) -0.2X + Y = 5,200 (multiply with 1) IV Step: 0.2X – 0.02Y = 1,600 -0.2X + Y = 5,200

- 11. Cost Accounting III sem BBA Chaithra C M.com, NET Assistant Professor V Step: 0.98Y = 6,800 Y = 6,800/0.98 = 6,939. VI Step: X = 8,000 + 0.1 Y X = 8,000 + (0.1 * 6,939) X = 8,000 + 694 = 8,694 Therefore, Service department X = Rs 8,694 & Service department Y = RS 6,939 Secondary Distribution Summary (Simultaneous equation method) Particulars Total Production Department A B C As per Primary Distribution summary 49,800 15,620 25,086 9,094 Summary Service department: X (30%, 40%, 10%) 6,955 2,608 3,478 869 Y (20%, 20%, 50%) 6,246 1,388 1,388 3,470 Total Overheads 63,000 19,616 29,952 13,432 Estimated Working hours 500 1,250 700 Rate per hour 39.23 23.96 19.19 Note: Apportionment of service department X: A = 8,694 * 30/100 = 2,608, B = 8,694 *40/100 = 3,478, C = 8,694 * 10/100 = 869 Apportionment of Service department Y: A = 6,939 *20/100 = 1,388, B = 6,939 * 20/100 = 1,388, C = 6,939 *50/100 = 3,469 Secondary distribution summary (Repeated distribution summary) Particulars Production Department Service Department A B C X Y As per Primary Distribution summary 15,620 25,086 9,094 8,000 5,200 -8,000 +1,600 Service department X in (30%,40%10% & 20%) 2,400 3,200 800 6,800 -6,800 Y in (20%,20%,50% &10%) 1,360 1,360 3,400 680 X 204 272 68 -680 136 -136 Y 27 27 68 14 X 4 6 1 -14 3

- 12. Cost Accounting III sem BBA Chaithra C M.com, NET Assistant Professor Y 1 1 1 -3 Total Overhead 19,616 29,952 13,432 ----- ----- Estimated Working hours 500 1,250 700 Rate per hour 39.23 23.96 19.19 While apportioning X dept expenses its divided to all dept excluding Y and viceversa. 7. Practice Question The following particulars relate to a manufacturing company which has 3 production departments A, B & C and two departments X & Y. Total department overhead as per primary distribution --- Production departments – A: Rs 6,300, B: Rs 7,400 & C: Rs 2,800 Service departments - X: Rs 4,500, Y: Rs 2,000 The company decided to change the service department cost on the basis of the following percentages: Particulars A B C X Y X 40% 30% 20% ---- 10% Y 30% 30% 20% 20% ---- Find out the total overhead of production departments, charging service department cost to the production department by simultaneous Equation method. Solution After solving under Simultaneous Equation method , X value = 5,000 and Y value = 2500 Total Overhead Charges under both the method = A = 9,050 B = 9,650 and C = 4,300

- 13. Cost Accounting III sem BBA Chaithra C M.com, NET Assistant Professor Machine Hour Rate : 1. Compute Machine hour rate Cost of Machine Rs 11,000 Scrap value Rs 680 Repairs for the effective working life Rs 1,500. Standing charges for 4 weekly period Rs 1,600.Effective working life 10,000 hrs. Power used 6 units per hr at 0.05 paisa per unit .Hours worked in 4 weekly period 120hrs. Solution Computation of Machine Hr rate Weekly Working hrs = 120hrs Particulars Amt Rate /hr Standing Charges 1600 Total Standing charges per hour. 13.3333 Variable charges or Running charges Depreciation 1.032 Repairs 1500/10,000 0.15 Power used 6*0.05 0.3 Total Running Charges per hour 1.482 Total Machine Hr rate 14.815 Working Note: Standing charges refers to those expenses that remains fixed Running Charges refers to those expenses that fluctuates with the changing production. 1.Standing charges per hour = Total standing charges Total hrs worked in week = 1,600/120 = Rs 13.333/ hr 2) Calculation of Depreciation Depreciation = Cost of Machine +Installation charges-Scrap Estimated life of Machine in hours Dep= 11,000+0-680 = Rs 1.032/ hr 10,000

- 14. Cost Accounting III sem BBA Chaithra C M.com, NET Assistant Professor 2. The details given below relate to 3 machines in a workshop. Determine the machine hour rate of these machines. Particulars Machine I Machine II Machine III Value of the Machine 50,000 1,50,000 75,000 Floor Area (Sq Mtrs) 50 100 50 Wages of Operators 2,000 3000 1,500 Oil Waste etc 500 700 600 No of light points 5 10 5 Sundry Expenses 300 350 250 Hp of Machine 12 25 13 Machine hrs 1,200 2,500 1,300 The other particulars are as follows Depreciation Rs 27,500 Rent Rs 4,500 Lighting Rs 400 Power Rs 5,000 Supervisory Expenses Rs 3,000 (the supervisor devotes equal time on all the machine) A job requires materials of Rs 3,000, Labour Cost Rs 500 and it utilizes the services of machines as follows. Machine 1 10hrs, Machine II 12 hrs and Machine III 5 hrs . Also estimate factory cost of the job. Solution Calculation of Machine Hr rate Particulars Base Total Machine I Machine II Machine III Depreciation Cost of Machine 2:6:3 27,500 5000 15,000 7500 Rent Floor area 1:2:1 4,500 1125 2250 1125 Lighting No of Light points 1:2:1 400 100 200 100 Power HP of Machines 12:25:13 5000 1200 2500 1300 Supervisory Expenses Equal Time 1:1:1 3,000 1000 1000 1000 Sundry Expenses Actual 900 300 350 250 Wages of Operators Actual 6,500 2000 3000 1500

- 15. Cost Accounting III sem BBA Chaithra C M.com, NET Assistant Professor Oil waste Actual 1,800 500 700 600 Total Machine Expenses 11225 25000 13375 No of Machine Hrs 1200 2500 1300 Machine hr rate 9.35 10.00 10.29 Machine hr rate = Total Machine Expenses /No of Machine hrs. Calculation of Factory Cost of the job Particulars Amount Materials 3000 Labour Wages 500 Prime Cost 3,500 (+) Works Overhead Machine I (10*9.35) 93.5 Machine II (12*10) 120 Machine III (5*10.29) 51.45 264.95 Factory or Works Cost 3764.95 3. From the following relating to the machine, Calculate Machine hr rate : Purchase price of the machine with the scrap value zero Rs 90,000 Installation and Incidental charges incurred on the machine Rs 10,000 Life of the machine 10 yrs Working hrs per annum 2,000 Repair Charges :50% of depreciation Machine consumes 10 units of electric power per hour at Rs 40 paisa per unit. Oil expenses at Rs 8 per day of 8 hrs Consumable Stores at Rs 16 per day of 8 hrs Wages of 2 machine operators at Rs 32 per day of 8 hrs. Solution Calculation of Machine hr rate Working hrs 2,000pa Particulars Amount Rate / hr Standing Charges Oil Expenses 8 Consumables Stores 16 Total Standing charges (A) 24 3 Running charges

- 16. Cost Accounting III sem BBA Chaithra C M.com, NET Assistant Professor Depreciation 5 Repairs Charged (50% of depreciation) 2.5 Power (10units*0.40 paise/unit ) 4 Wages of operators (32/8) 4 Total Running Charges (B) 15.5 Machine Hr rate (A+B) 18.5 Working Notes: 1. Standing charges per hour = Total standing charges Total hrs worked in day = 24 /8 = Rs 3/ hr 2) Calculation of Depreciation Depreciation = Cost of Machine +Installation charges-Scrap Estimated life of Machine in hours Dep= 90,000+10,000-0 = Rs 5 10*2,000 4. Practice Question Compute Machine hr rate, From the following information Particulars Amount Depreciation of Machinery 24,000 Depreciation of Building 4,000 Repais to Machinery 8,000 Insurance on Machinery 1,600 Indirect Wages 12,000 Power 12,000 Lighting 1,600 Employee State Insurance 8,400

- 17. Cost Accounting III sem BBA Chaithra C M.com, NET Assistant Professor Particulars Machine I Machine II Machine III Direct Wages 2,400 4,800 4,800 Power (Units) 60,000 20,000 40,000 No of Workers 8 16 16 Light Points 16 48 96 Space Occupied (Sq Mtrs) 800 1,600 1,600 Cost of Machine 60,000 2,40,000 3,00,000 Hours Worked 500 600 800 Solution : Depreciation on Building is calculated on space occupied. Total Machine I Machine II Machine III 71,600 14,400 25,680 31,520 Machine Hr rate 28.8 42.8 39.4 5. A Machine Costing Rs 10,000 is expected to run for 10 years. At the end of it’s life the scrap value is expected at Rs 900.repairs during the whole life of machine was Rs 10,000.The machine is expected to run 3,600 hrs per year on an average. The electricity consumption is 20units per hour at 5 paisa per unit. The machine occupies ¼ of the area of the department and has two light points out of 10 light points for lighting. The foreman has to devote 1/6 of his time towards this machine. The monthly rent of the department is Rs 600 and lighting charges amount to Rs 240 per month. The foreman is paid a monthly salary of Rs 1,800. Find out the machine hour rate, assuming insurance is @ 1%p.a and the expenses oil and other consumable stores amounts Rs 20 per month. Solution Calculation of Machine hr rate Working hrs 3600 hrs p.a Particulars Amount Rate / hr Standing Charges Rent (600*1/4) 150 Lighting (240*2/10) 48 Sundry expenses & other consumables 20 Insurance (10,000*1 * 1 100 12 8.33 Foreman salary (1,800*1/6) 300

- 18. Cost Accounting III sem BBA Chaithra C M.com, NET Assistant Professor Working Notes: 1. Standing charges per hour = Total standing charges Total hrs worked in month = 526.33 /300= Rs 1.75/ hr Hours worked in a month = Hrs worked in year /12 months = 3600/12 = 300 hrs 2) Calculation of Depreciation Depreciation = Cost of Machine +Installation charges-Scrap Estimated life of Machine in hours Dep= 10,000+0-900 = Rs 0.25 10*3600 6. Practice Question Compute Machine hr rate Particulars Rate / hr Electric Power 85 paisa Steam 35 paisa Water 25 paisa Repairs Rs 550 P.a. Rent Rs 3,200 P.a. Cost of Machine Rs 15,000 Rate of depreciation 10% P.a. Running hrs of Machine 2000 hr P.a. Total Standing charges (A) 526.33 1.75 Running charges Repairs 10,000 10*3600 0.28 Depreciation 0.25 Power (20*0.05) 1 Total Running Charges 1.53 Machine Hr rate (A+B) 3.28

- 19. Cost Accounting III sem BBA Chaithra C M.com, NET Assistant Professor Solution: Treat Steam and Water as standing Charges Machine Hr rate = Rs 3.97 7. Calculate Machine Hr Rate Particulars Amount Rent of Department (1/5 space occupied by the machine) 60,000 Lighting(2 light points is used out of 12) 36,000 Insurance Premium on the Machine 6,000 Repair and Maintainence of its entire life 18,000 Cotton waste and oil 6,000 Salary of foreman (1/4 of his time devoted towards this machinery) 32,000 Cost of Machine 1,00,000 Estimated Scrap Value of machine 10,000 Installation charges of machine 20,000 Working life of the machine is expected at 18,000 hrs Machine Consumes 10 units of Power per hour at Rs 1.5 per unit Working hours of machine is 2,200 hrs per annum which includes setting up time of 200 hrs Solution Computation of Machine hour rate Working hrs (2,000 pa) Particulars Amount Rate / hr Standing Charges Rent (60,000*1/5) 12,000 Insurance premuim 6,000 Standing Charges Salary of Foreman (32,000*1/4) 8,000 Lighting (36,000*2/12) 6,000 Cotton waste and oil 6,000 Total standing Charges 38,000 19 Running Charges Depreciation 6.11 Repairs (18,000/18,000) 1 Power (10*1.5) 15.00 Total Running Charges 22.11 Machine hr rate 41.11

- 20. Cost Accounting III sem BBA Chaithra C M.com, NET Assistant Professor 1.Standing charges per hour = Total standing charges Total hrs worked in year = 38,000 /2000 = Rs 19/ hr 2) Calculation of Depreciation Depreciation = Cost of Machine +Installation charges-Scrap Estimated life of Machine in hours Dep= 1,00,000+20,000-10,000 = Rs 6.111/ hr 18,000 3) Working hrs = 2,200 (-) setting up time = 200 Effective Working hrs = 2,000 Assuming setting up time is unproductive we deduct it from working hrs, if its specified in question that setting up time is productive then you needn’t deduct. 8. Practice Question Compute Machine hr rate; Particulars Amount Cost of Machine 1,30,000 Life of Machine 10 years Installation Charges 20,000 Residual value (Scrap) 10,000 Rent and Rates per annum 16,000 Insurance per month 500 Repairs and Maintainence per annum 9,000 Consumable Stores per annum 3,000 Total Manufacturing services 2,000 Power cost is 5 units per hour 40 paise per unit Setting up time (Non Productive) 700 hrs Number of Working days in a yr 300 and 9 hrs of working each day Solution Effective Working hrs = 300*9 = 2700 (-) setting up time (700) = 2,000 hr per year Total standing charges = Rs 13.5 Total Running charges = Rs 13.5 Machine hr rate = Rs 27

- 21. Cost Accounting III sem BBA Chaithra C M.com, NET Assistant Professor 9. Practice Question Compute Machine hr rate Particulars Amount Cost of Machine 1,60,000 Installation Charges 25,000 Estimated Scrap Value after the expiry of life (15 yrs) 10,000 Rent rates for the shop per month 1,500 General Lighting for the shop for the month 1,000 Insurance premium per annum 2,200 Power Consumption- 20 units per hour 0 Rate of power per 100 units 25 Estimated working hrs per annum 2400 hrs Setting up time 400 hrs Machine Maintenance (Productive purpose) 5% of total working time Shop supervisor salary per month 1,000 Repairs and Maintenance expenses per annum 2,000 Solution: Machine Hr Rate Rs 16.98 10. Following annual charges are available for machine number 101, compute machine hour rate, Rs Lighting (10 light points in the department of which 4 are engaged on this machine) 55,000 Rent (1/4th area occupied by the machine) 66,000 Supervisor's salary (1/3 of his time devoted on this machine) 48,000 Insurance 16,000 Lubricants 4,000 Cost of machine 1,80,000 Scrap Value 20,000 Past Experience shows that: 1. The working life of machine will be 20,000 hours. 2. Estimated working hours per annum 3,000 hours which includes setting up time 10% (unproductive) and machine maintenance 200 hours. 3. It consumes 5 units of power per hour and rate per unit of power is Rs.2. Solution:

- 22. Cost Accounting III sem BBA Chaithra C M.com, NET Assistant Professor Computation of machine hour rate Effective working hours 2,500 p.a. Particulars Amount in Rs Rate per hour A. Standing Charges Lighting (55,000 x4/10) 22,000 Rent (66,000 x 1/4 ) 16,500 Supervisor Salary (48,000 x 1/3) 16,000 Insurance 16,000 Lubricants 4,000 Total standing charges / Rate per hour 74,500 29.80 B. Running Charges: Depreciation 1,80,000−20,000 20,000 x 𝟏,𝟔𝟎,𝟎𝟎𝟎 𝟐𝟎,𝟎𝟎𝟎 8 Power (5x2) 10 Total Running Charges per hour 18.00 Machine Hour Rate (A+B) 47.80 Working Notes Calculation of total hours worked in a year Yearly working time = 3,000 hrs P.a. (-) Setting up time (unproductive 10%) = 300 (-) Machine Maintenance = 800 Effective yearly working hrs = 2,500 hrs p.a. Standing Charges = 74,500/2,500 = 29.80 11. From the following particulars compute a Machine Hour Rate including shop expenses Rs. Cost of mobile crane 25,000 Estimated life of machine 10 Years Depreciation 10% per annum on original cost Insurance 1000 p.a. Actual repairs and maintenance as estimated for its life 40,000 Consumable stores 1,200 p.a. Rent for floor space allotted Rs. 1,800 per year, rates and taxes and shop expenses for 5 similar machines Rs. 3,000 per quarter. Assume that crane will work (normal) 300 hours per month and works only at 80% of its capacity. Cost of diesel, oil etc per hour is Rs.6. Solution:

- 23. Cost Accounting III sem BBA Chaithra C M.com, NET Assistant Professor Computation of Machine Hour Rate Effective Working Hours 2,880 Hours. Particulars Amount in Rs Rate per hour A. Standing Charges Insurance 1,000 Consumable Stores 1,200 Rent 1,800 Rates, Taxes, and shop expenses(3,000x4x1/6) 2,000 Total Standing Charges / Rate per hour 6,000 2.083 B. Running Charges Depreciation 0.868 Repairs and Maintenance (40,000/2,880 x 10) 1.389 Cost of diesel, oil etc. 6.000 Total Running Charges Per hour 8.257 Machine Hour Rate (A + B) 10.34 Note: 1. Calculation of working hours Normal working hours per month 300 Number of working hours per annum (300 x 12) = 3,600 Working capacity : 3,600 x 80/100 = 2,880 hours per year 2. Calculation of Depreciation Depreciation = Cost of Machine +Installation charges-Scrap Estimated life of Machine in hours = 25000+0+0 2880*10 = 0.868 Or 10% annum on original Cost thus, 25,000*10%= 2,500 p.a 2,500/2880= Rs 0.868 12. The following particulars relate to processing machine in a factory. Compute machine hour rate. Cost of Machine 20,000 Estimated life of machine 10 Years Scrap Value 2,000 Yearly working time(50weeks of 44 hours each) 2200 hours Setting up time is estimated at 5% of total productive time and is power consumed at 10 paise per unit for the shop - Electricity consumption is 16 units per hour at 20 paise per unit