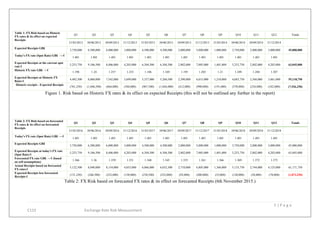

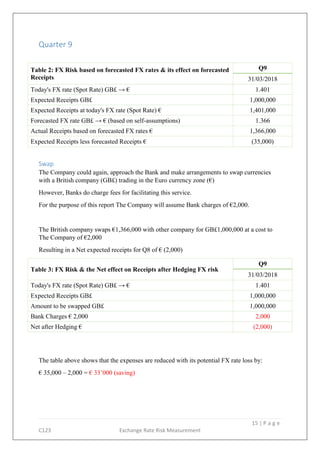

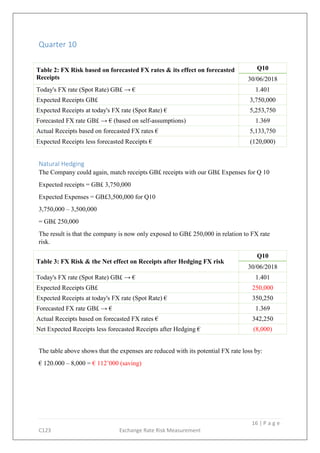

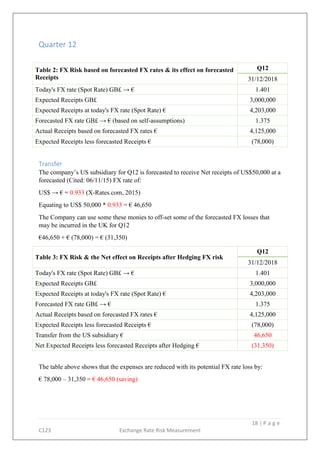

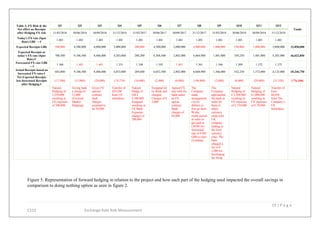

The document is a report on exchange rate risk management for a construction project titled 'Educational Hub' for the University of London, costing £45 million over three years. It outlines various hedging techniques to mitigate the financial risks associated with currency fluctuations between GBP and Euro, detailing types of exchange rate risk, including transaction, translation, and economic risk. The report includes analysis of historical and forecasted FX rates, risk assessments, and calculations related to expected receipts and potential losses due to currency exchange.