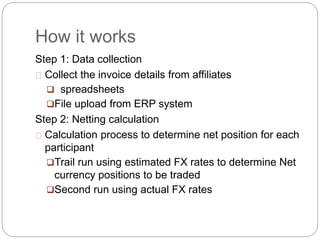

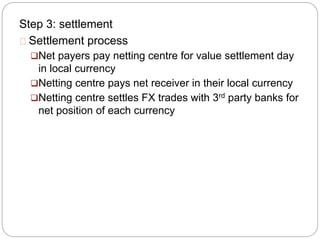

Internal sourcing of funding refers to raising funds from within an organization through retained profits, sale of assets, goods and services. It has advantages like immediate availability of capital without interest payments but disadvantages like limited funds and lack of tax deductions. Multilateral netting simplifies settling inter-company transactions by collecting payment details, calculating net positions, and settling payments through a netting center. This reduces funds transfers and foreign exchange costs compared to individual settlements.