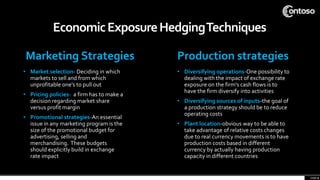

The document discusses foreign exchange risk management, detailing types of forex exposures such as translation, economic, and transaction exposure that companies face in international trade. It explains the impact of currency fluctuations on financial transactions and presents various hedging techniques to mitigate these risks, including contractual hedges and production strategies. Additionally, the document emphasizes the importance of market selection, pricing policies, and promotional strategies in managing these exchanges.