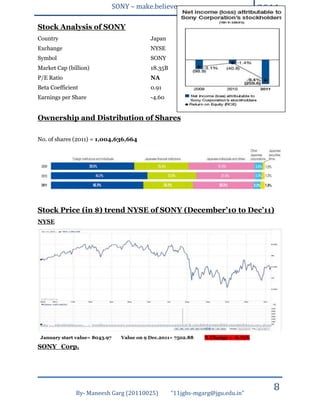

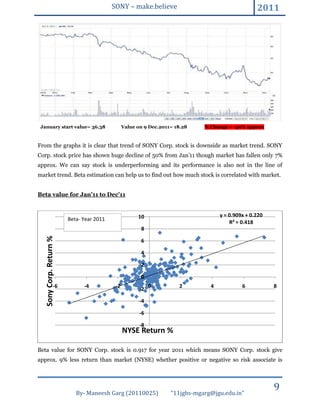

The document provides an analysis of Sony Corporation, detailing its history, major products, operations in India, financial highlights, stock performance, and competitive standing. Sony, a leading global consumer electronics company, has been a significant player since its establishment in 1946, but is currently facing challenges such as declining stock prices and net losses. The recommendations suggest a cautious 'wait & watch' approach due to long-term debt and declining sales revenue.