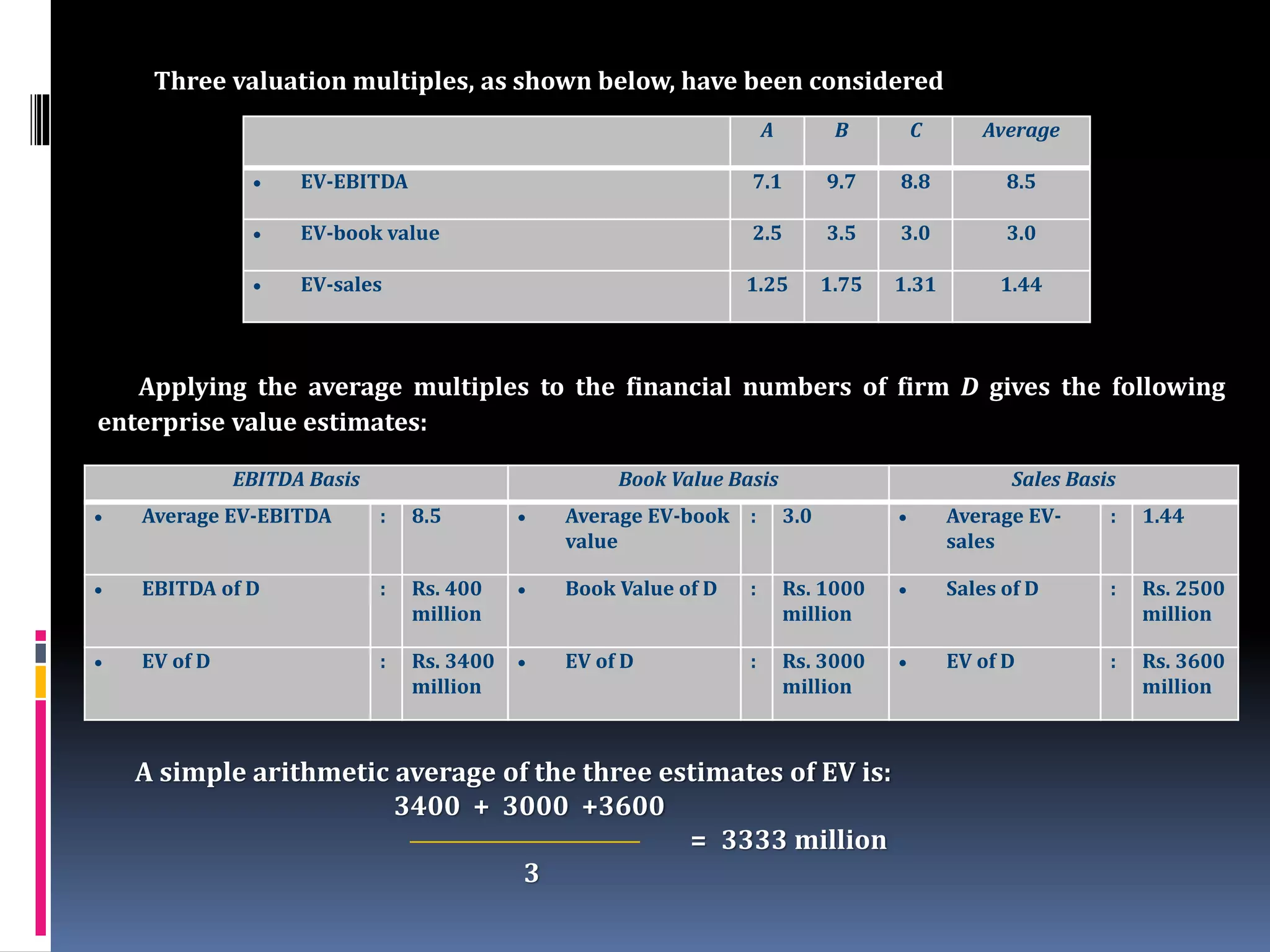

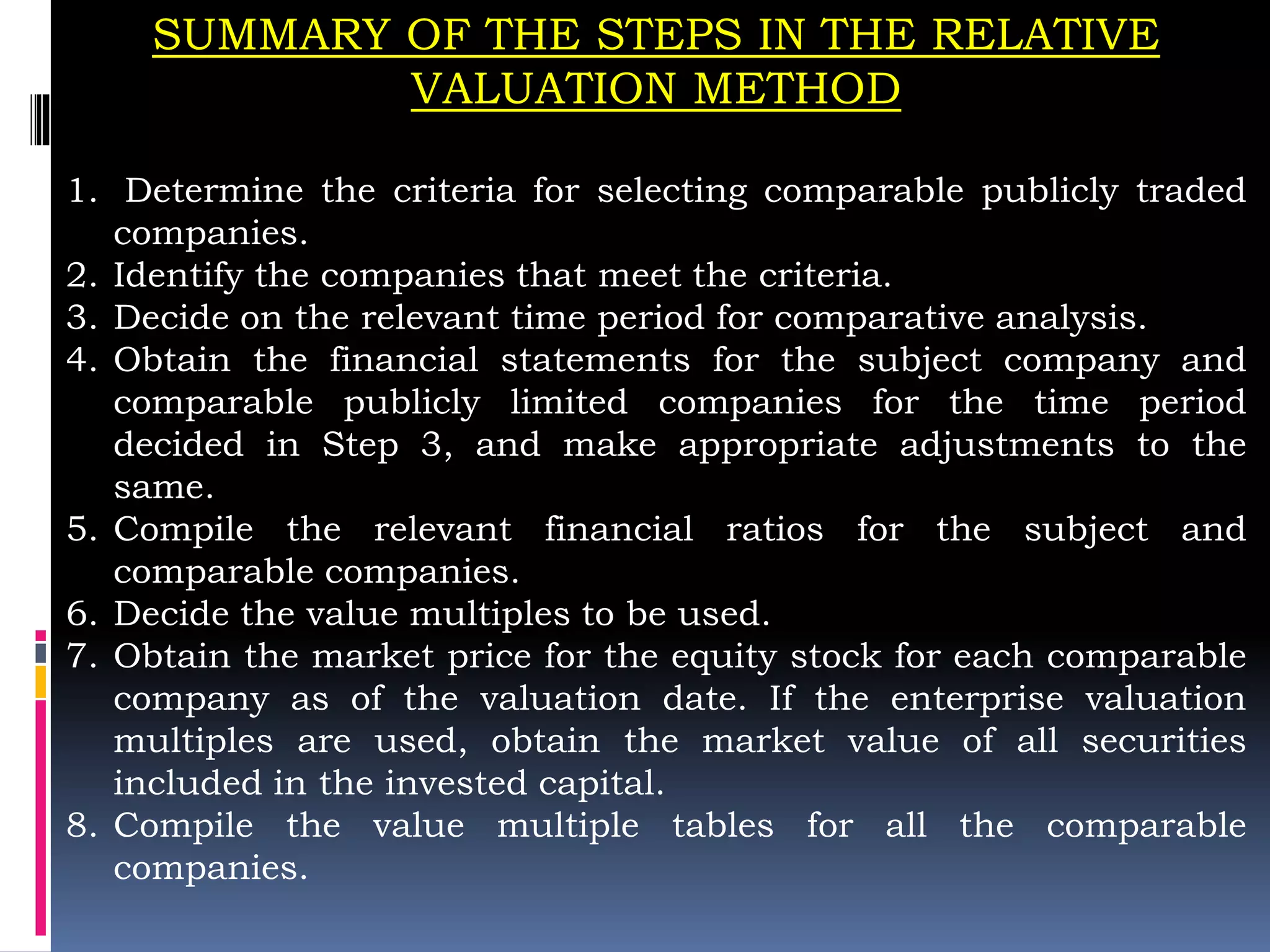

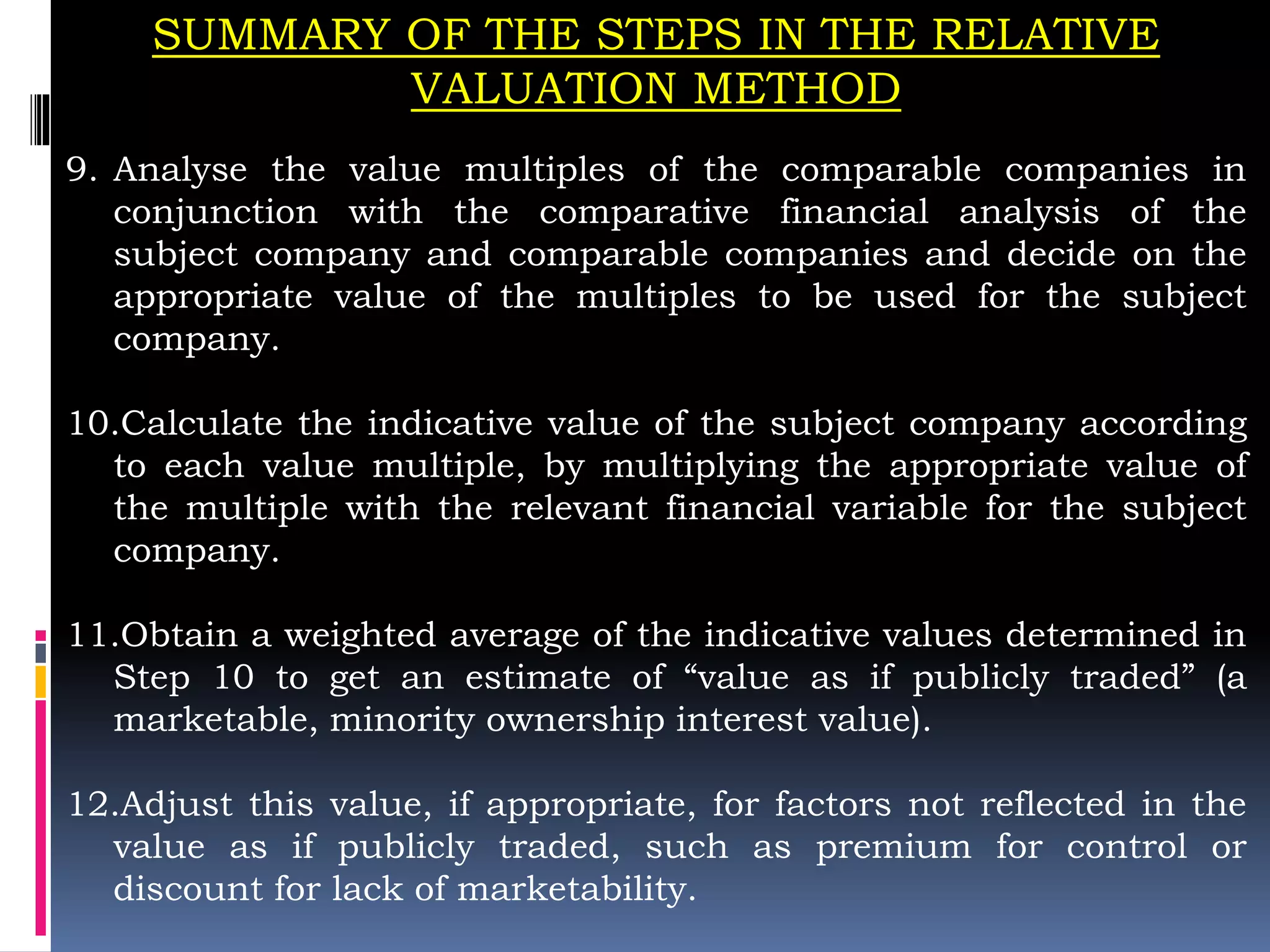

This document discusses relative valuation, which values an asset based on comparable assets currently priced in the market. It outlines the steps in relative valuation, including analyzing the subject company, selecting comparable companies, choosing valuation multiples, calculating multiples for comparables, and valuing the subject company. It also discusses various valuation multiples used in relative valuation like P/E, P/B, P/S, EV/EBITDA, and their fundamental determinants. Best practices for using multiples are also presented.