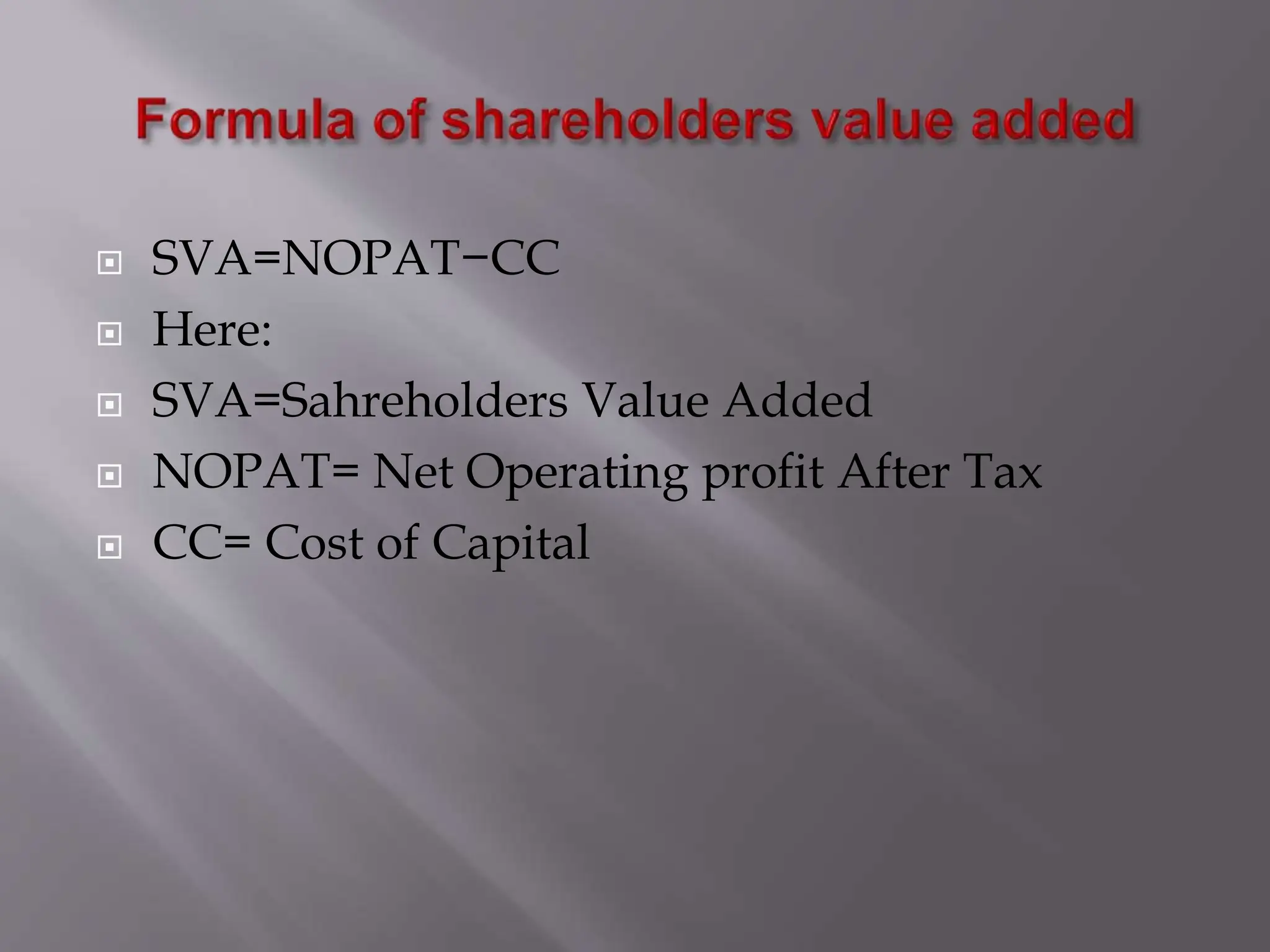

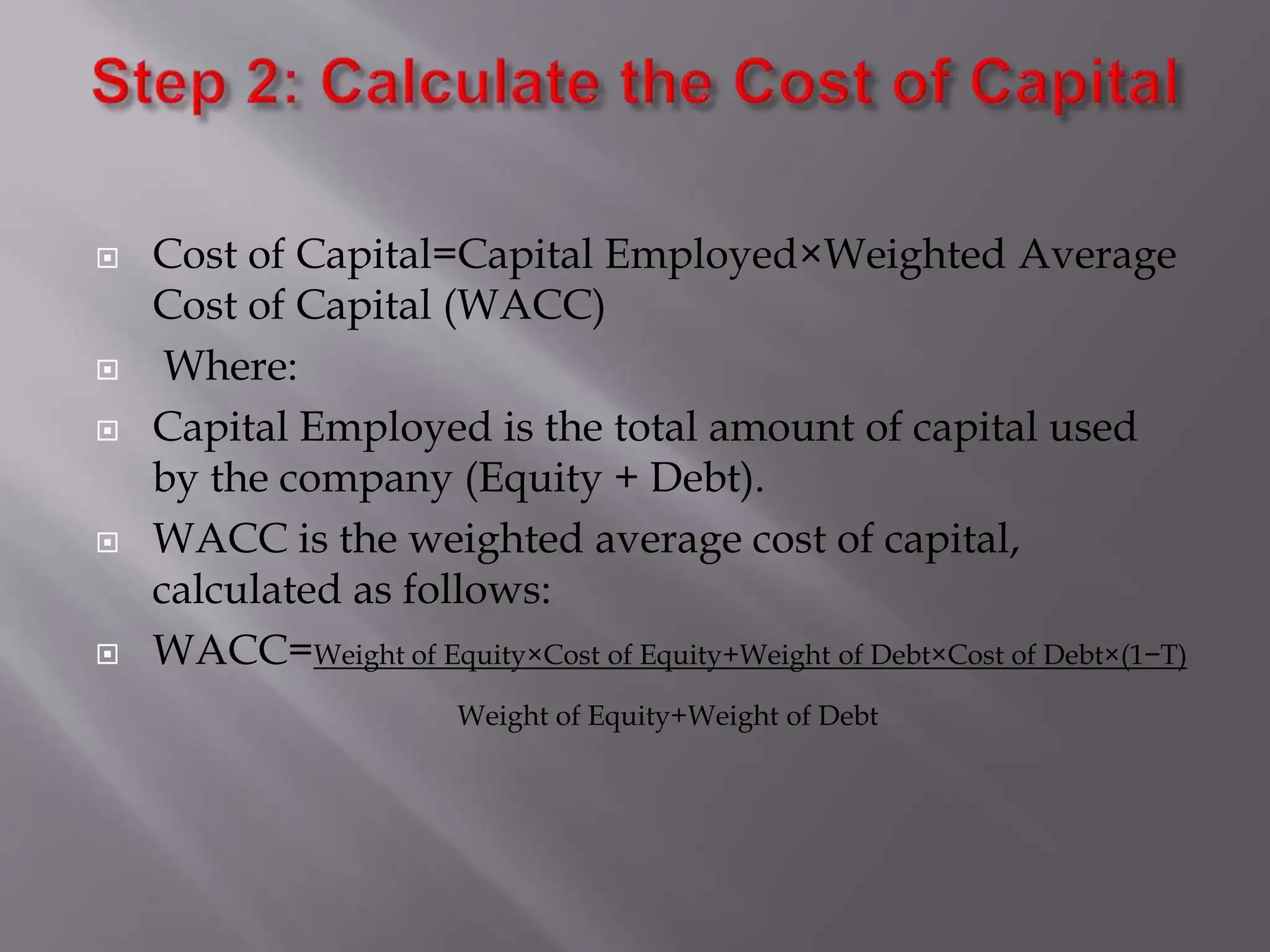

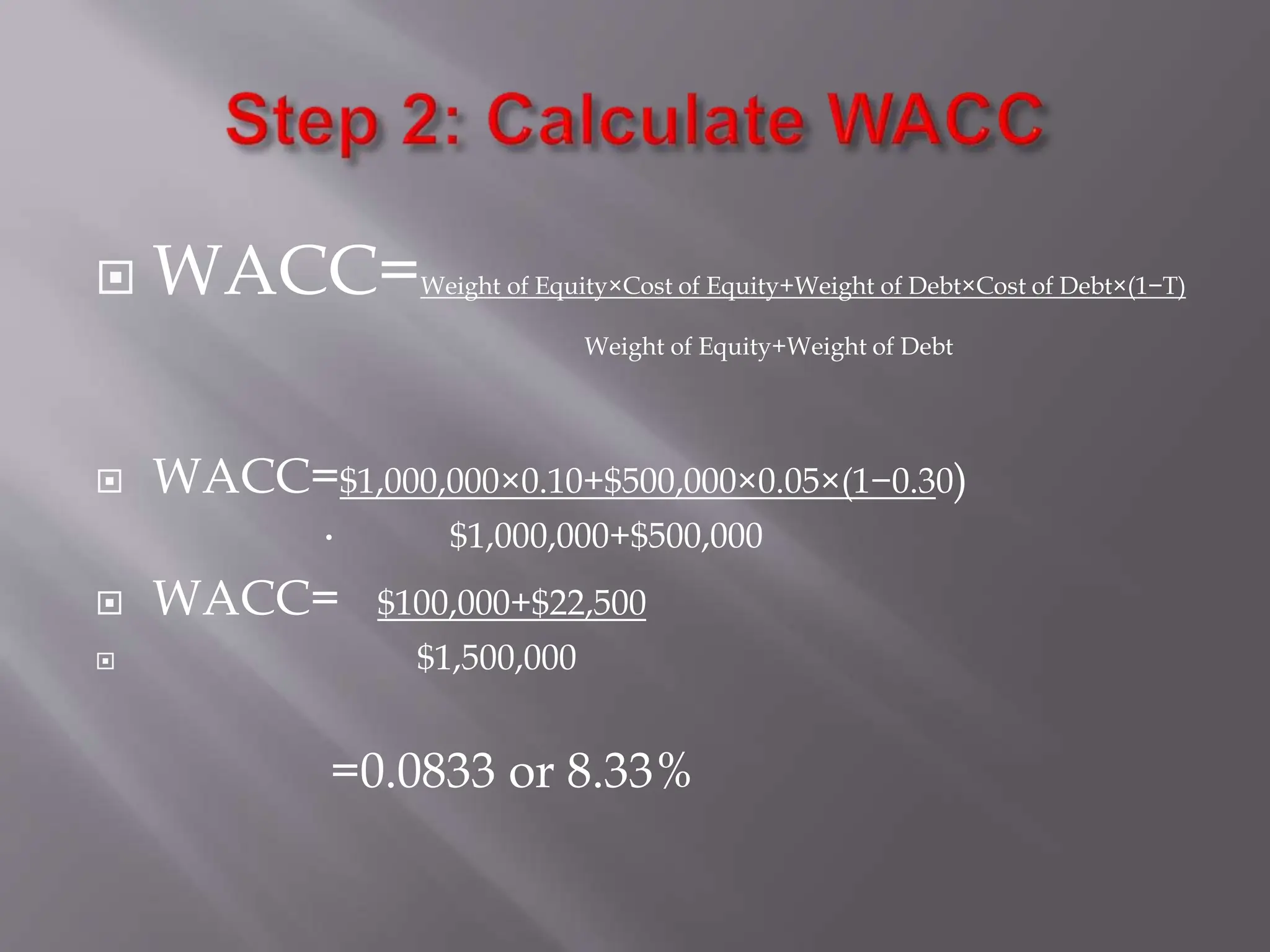

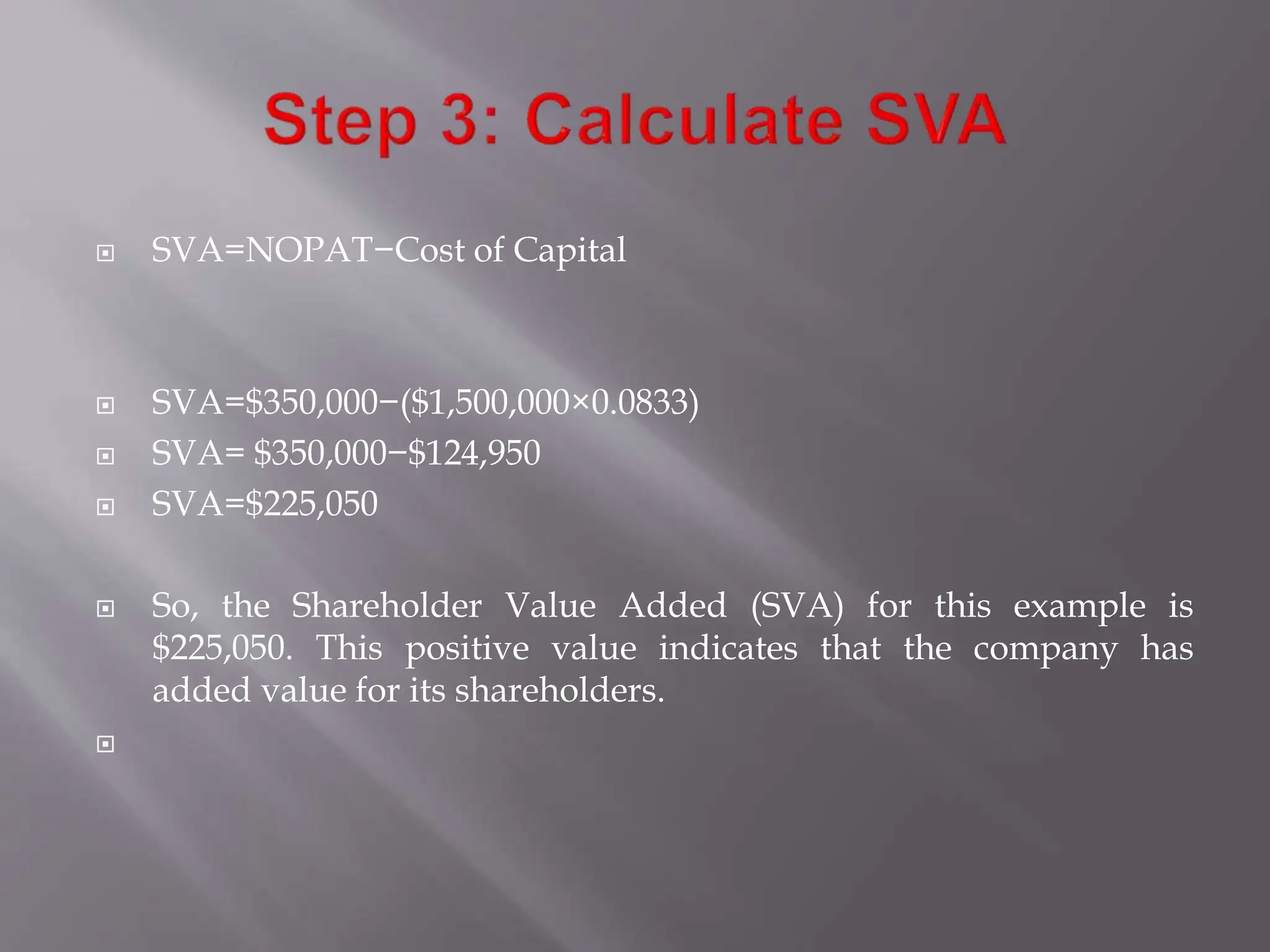

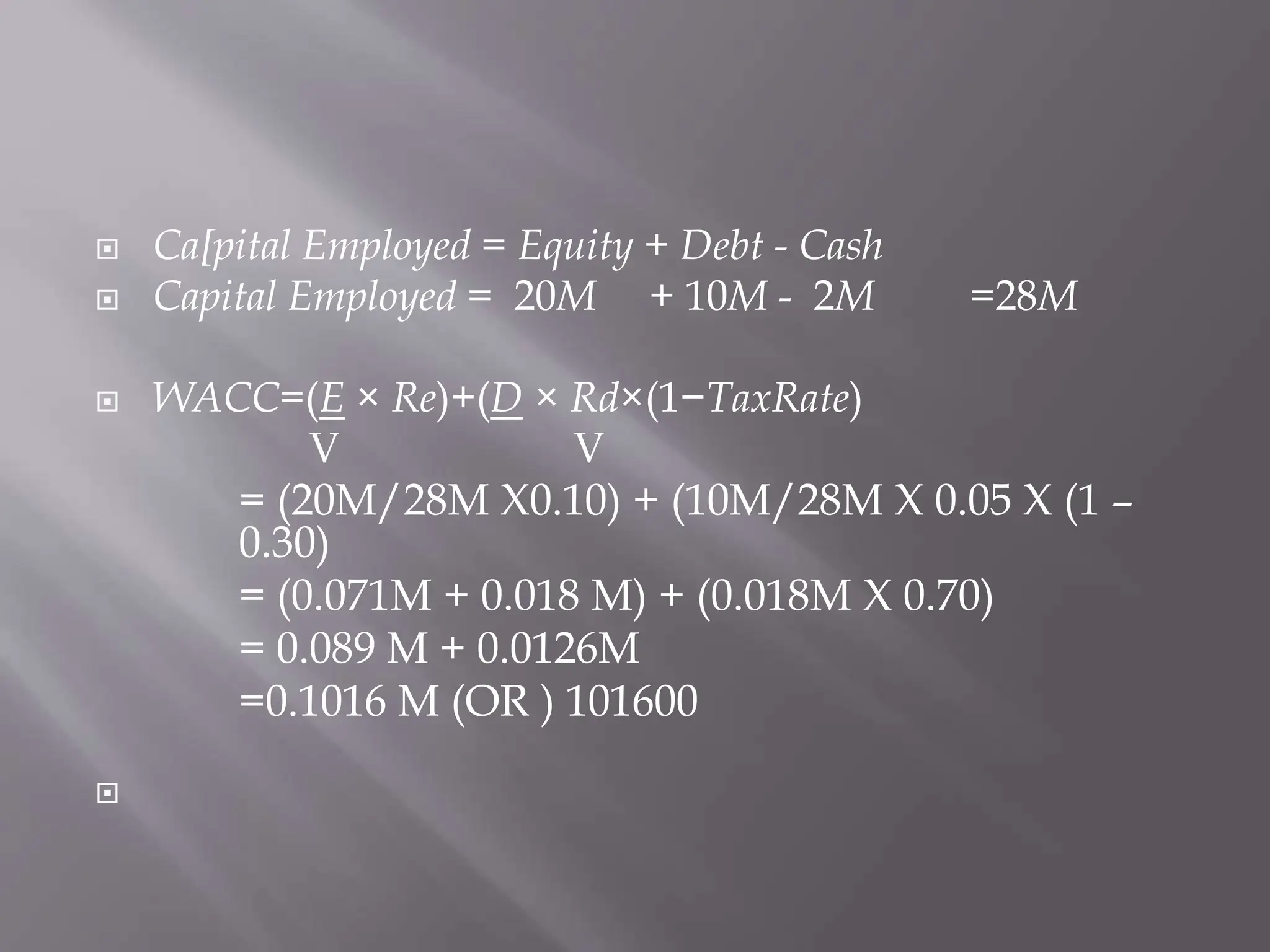

Shareholder Value Added (SVA) is a metric that measures the value a company has added for shareholders over time. It is calculated by subtracting the cost of capital from the net operating profit after taxes (NOPAT). SVA indicates whether a company has increased shareholder value through profitable operations that exceed the minimum return expected by shareholders and lenders.