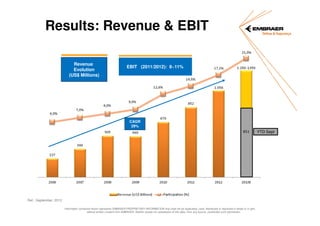

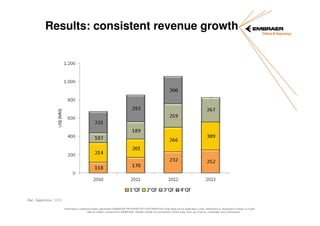

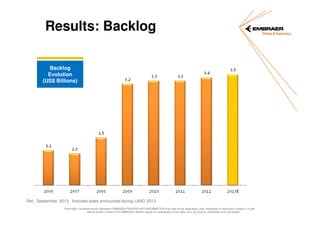

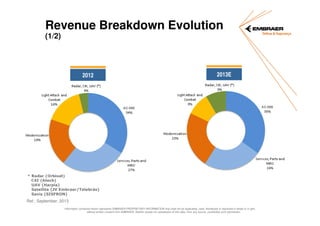

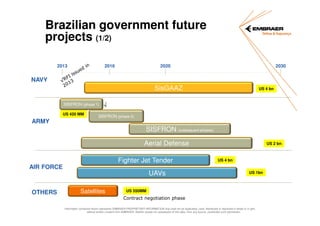

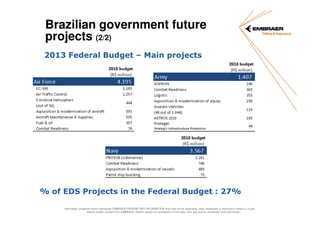

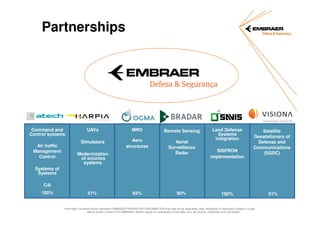

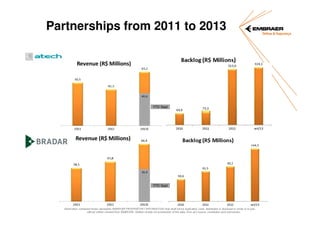

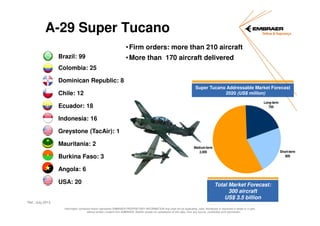

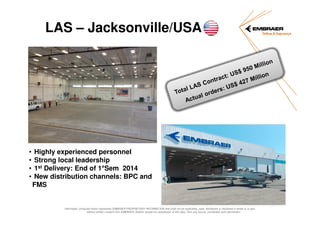

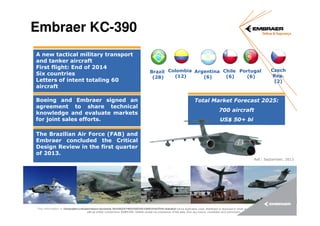

The document provides an overview of Embraer's defense division, including highlights from 2013, financial results, future projects, and key programs. Some of the 2013 highlights mentioned include the US Air Force selecting the A-29 Super Tucano for its Light Air Support program and completing the Critical Design Review for the KC-390 military transport aircraft. The financial results show consistent revenue growth and increasing backlog. Future projects outlined include various systems and aircraft for the Brazilian military projected out to 2030 with a total value of over $10 billion.