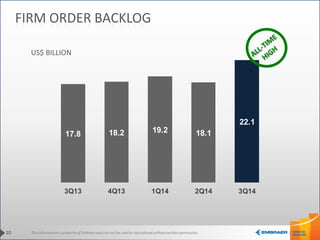

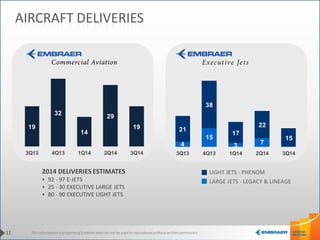

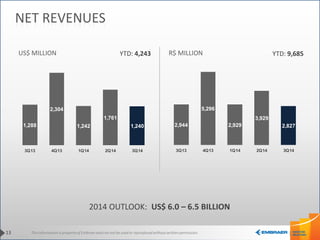

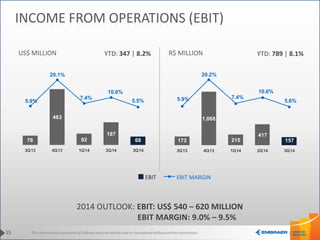

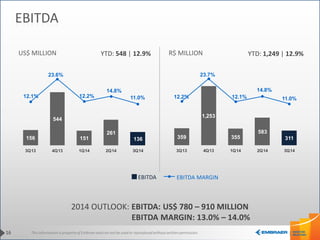

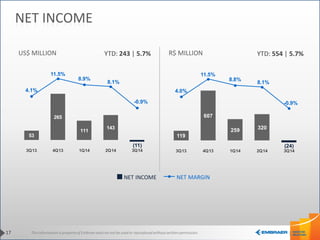

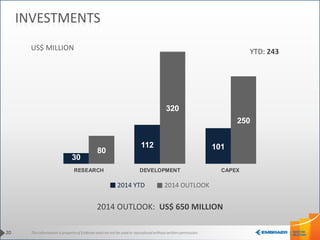

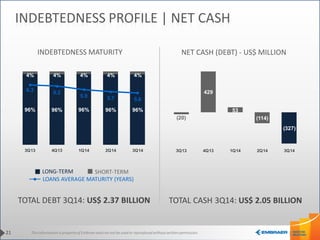

This document provides a summary of Embraer's 3rd quarter 2014 earnings results. It discusses key financial highlights such as increased order backlog, higher aircraft deliveries, and growth in net revenues. While net income declined from the previous quarter, EBITDA margins remained steady and research & development investments are on track to meet annual targets. The presentation also outlines Embraer's business segment revenue outlook and progress on various commercial and defense programs.