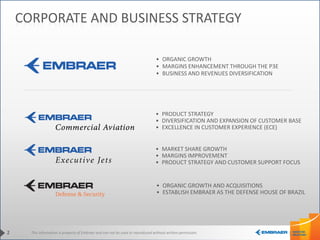

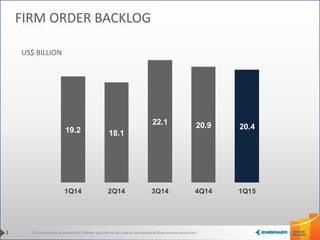

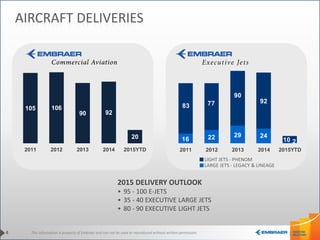

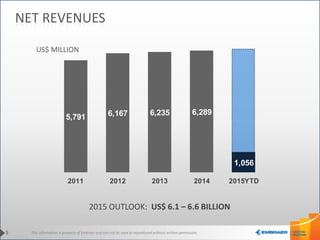

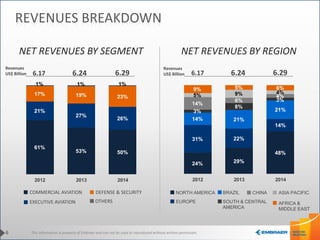

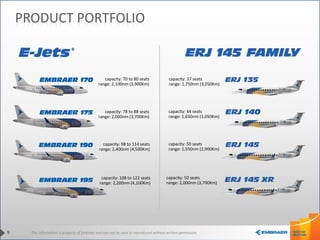

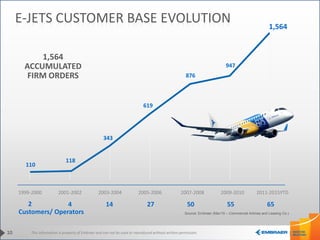

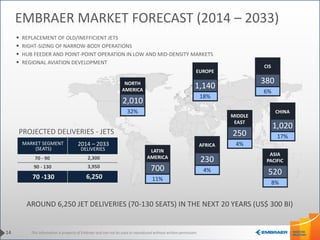

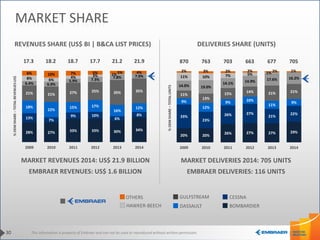

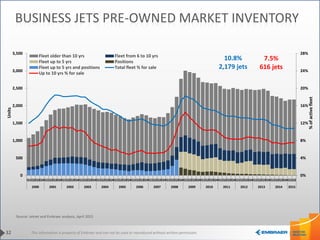

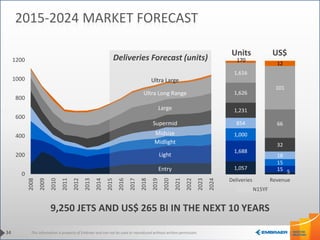

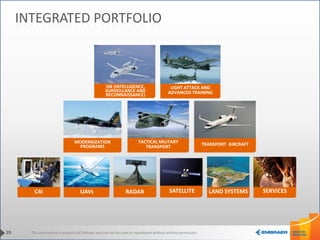

This document discusses Embraer's corporate and business strategy, including organic growth, margin enhancement, business diversification, and establishing itself as Brazil's defense leader. It outlines strategies for product diversification and expansion, customer experience excellence, and market share growth. Charts show increasing order backlog, jet deliveries, revenues, and breakdown of revenues by segment and region from 2011-2014.