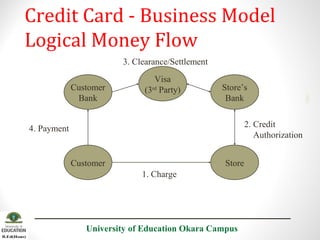

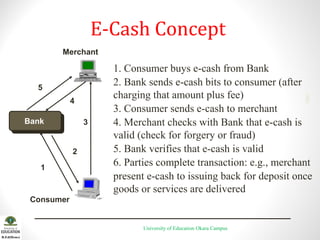

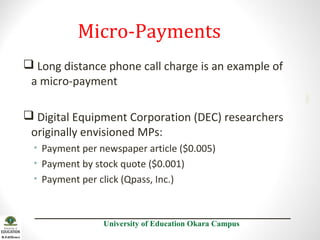

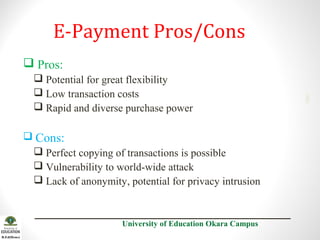

This document discusses various electronic payment methods. It begins by defining electronic payment as a financial exchange that occurs online between buyers and sellers using digital payment instruments. It then describes some traditional payment methods like cash, checks, and money orders. The document goes on to explain popular e-payment methods like credit cards, digital currency, e-wallets, peer-to-peer payments, smart cards, micro-payments, and B2B payments. It provides details on how some of these methods work, such as the credit card business model and digital currency concepts. The document concludes by listing some pros and cons of electronic payments.