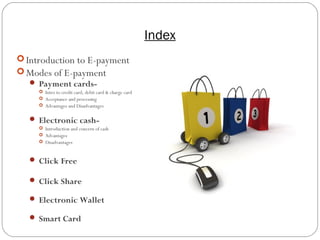

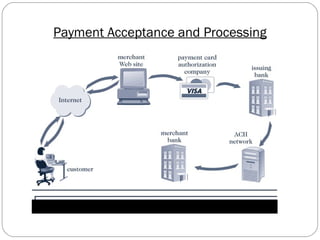

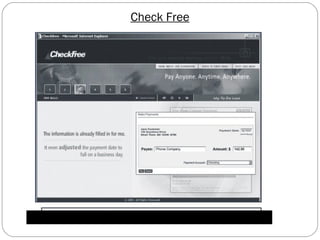

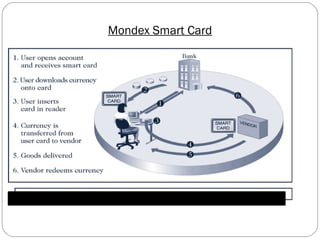

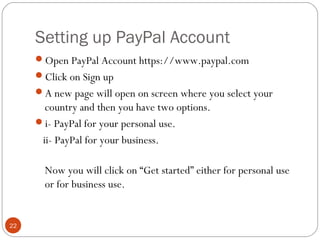

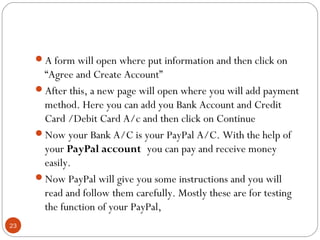

This document provides an overview of different electronic payment systems including payment cards, electronic cash, check free, check share, electronic wallets, and smart cards. It discusses the basic concepts and workings of these various e-payment methods. Key points covered include how payment cards like credit, debit, and charge cards work as well as their acceptance and processing. Advantages and disadvantages of payment cards and electronic cash are also summarized. The document also gives brief descriptions of different electronic wallet and smart card systems.