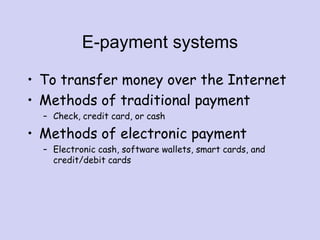

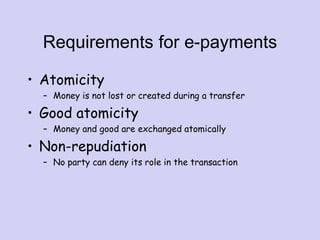

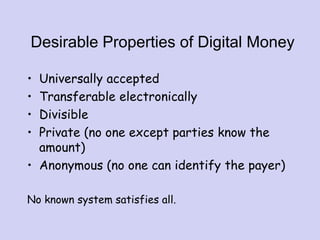

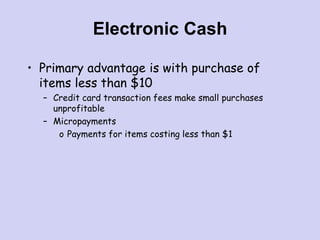

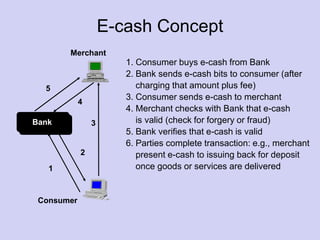

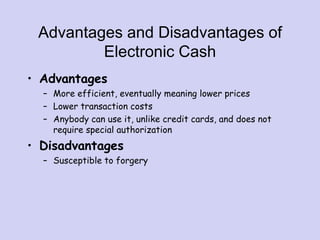

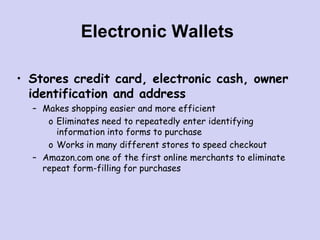

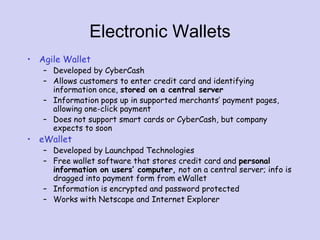

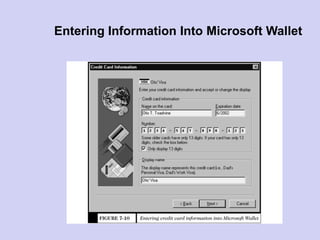

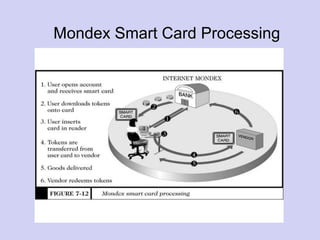

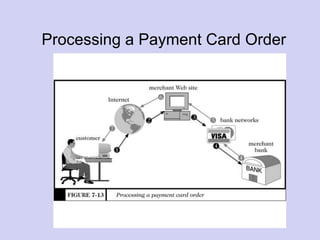

The document discusses various electronic payment systems used for e-commerce transactions. It describes advantages and disadvantages of different systems including electronic cash, electronic wallets, smart cards, and credit cards. It provides details on how each system works, examples of implementations, and considerations regarding their adoption and success.