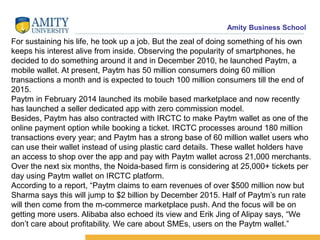

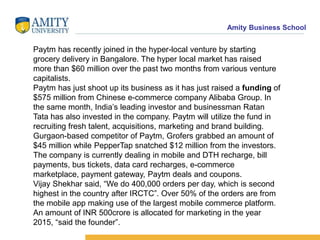

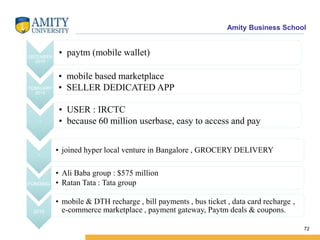

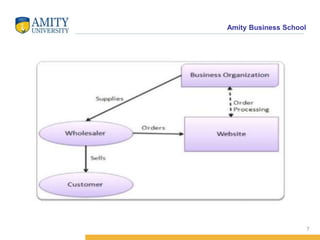

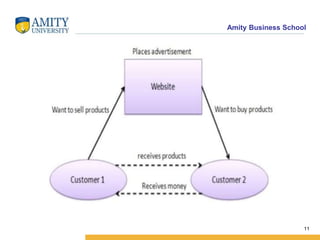

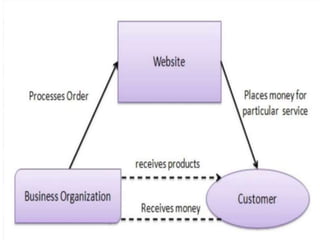

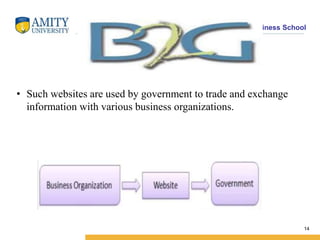

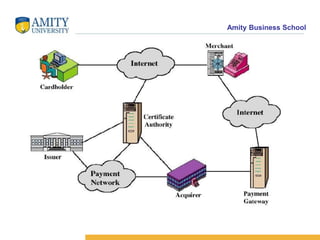

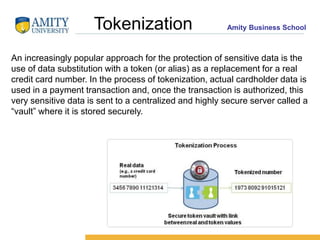

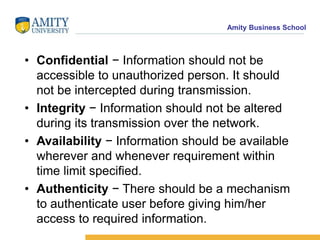

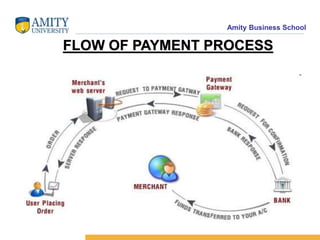

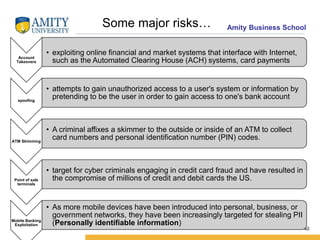

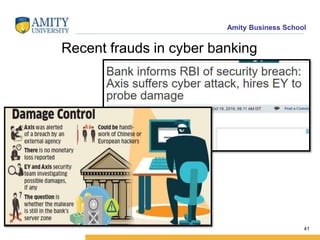

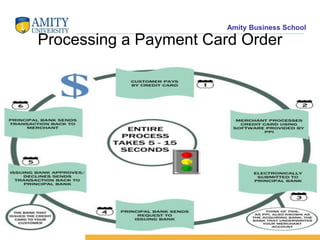

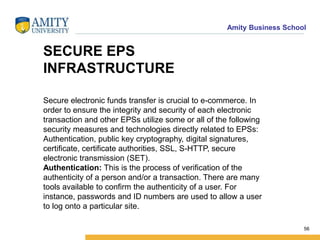

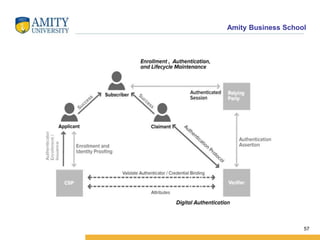

The document discusses electronic payment systems (EPS), detailing various models such as B2B, B2C, C2C, and C2B transactions, along with different payment methods including credit cards, debit cards, net banking, and mobile wallets. It also covers security measures like encryption, digital signatures, and tokenization to protect transactions, as well as potential risks involved in cyber banking and strategies to enhance security. Additionally, advancements in payment technology are highlighted, indicating a trend towards increased convenience and security in electronic transactions.

![Amity Business School

Hypertext Transfer Protocol (HTTP)

Web browsers typically use HTTP to communicate with web servers,

sending and receiving information without encrypting it. For sensitive

transactions, such as Internet e-commerce or online access to financial

accounts, the browser and server must encrypt this information. S-HTTP

is an obsolete alternative to the HTTPS protocol

for encrypting web communications carried over HTTP. HTTPS and S-

HTTP were both defined in the mid-1990s to address this need. S-HTTP

was used by Spyglass's web

server,[1] while Netscape and Microsoft supported HTTPS rather than S-

HTTP, leading to HTTPS becoming the de-facto standard mechanism for

securing web communications.

64](https://image.slidesharecdn.com/epsprojectsemester2finalpresentation-180427192017/85/Electronic-Payment-System-EPS-Presentation-64-320.jpg)