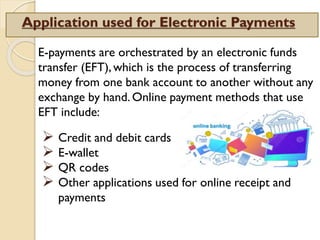

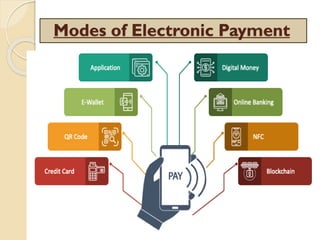

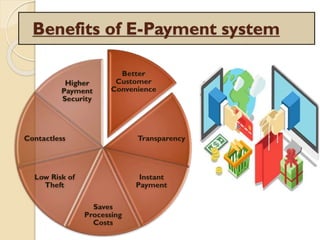

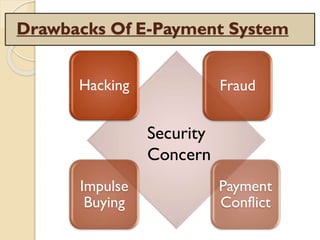

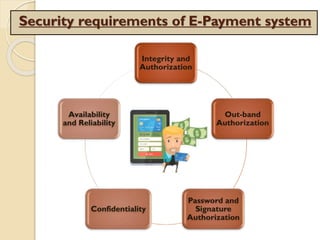

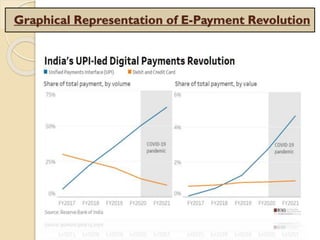

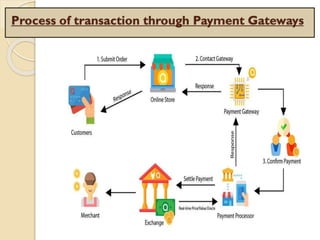

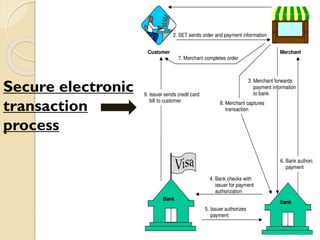

The document provides information about electronic payment systems including definitions, applications, modes, benefits, drawbacks, security requirements, payment gateways, and secure electronic transaction processes. It defines electronic payments as the electronic transfer of funds and discusses common applications like credit/debit cards, e-wallets, and QR codes. Benefits include convenience, transparency, security, and cost savings while drawbacks include risks of hacking, fraud, and impulse buying.