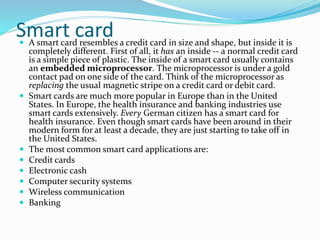

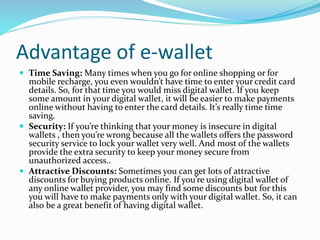

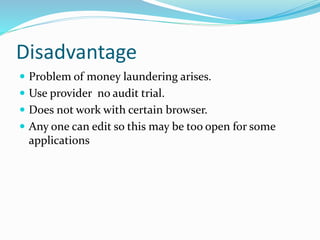

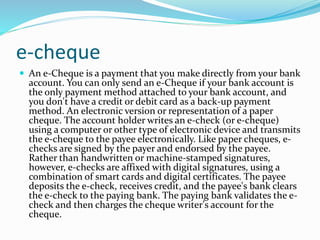

The document discusses electronic payment systems. It explains that electronic payment systems allow transactions to be made electronically without cash or checks by using online or mobile banking. The use of electronic payment methods has grown significantly with the rise of e-commerce and internet banking. Various electronic payment options are described, including digital wallets, credit/debit cards, e-checks, stored-value cards, and smart cards. The benefits of electronic payments for both consumers and merchants are convenience, security, and efficiency.