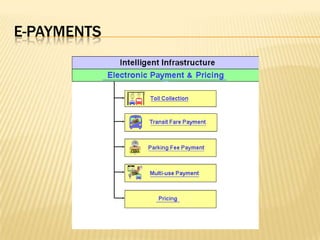

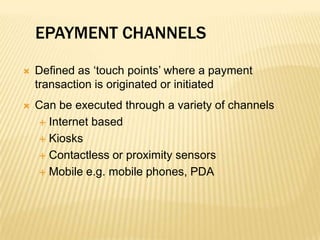

The document discusses electronic payment systems, highlighting their significance as alternatives to traditional financial transactions. It covers various types of e-payment options, including credit cards, digital wallets, and mobile payments, along with their advantages and associated risks. The need for security and trust among transaction parties is emphasized, as well as the evolving landscape of payment technologies and consumer perceptions of security.