Embed presentation

Download to read offline

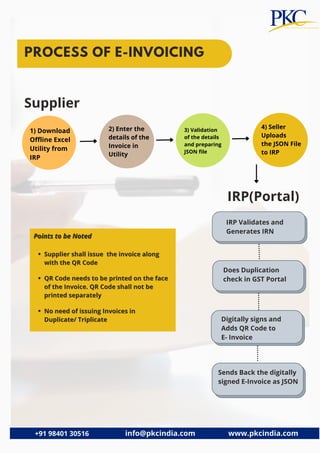

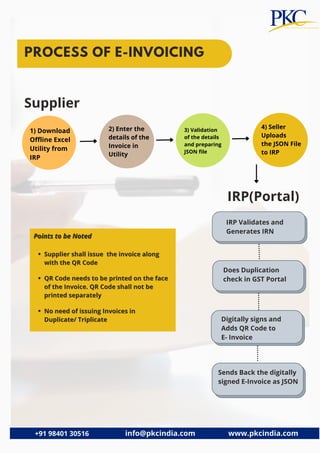

The document discusses e-invoicing requirements in India. Key points: - E-invoicing means reporting invoice details to the Invoice Registration Portal for authentication and generating a unique invoice reference number. - Certain businesses must issue e-invoices based on their aggregate turnover over the past three fiscal years, starting with businesses over Rs. 500 crore from October 2020 and over Rs. 100 crore from January 2021. - The e-invoicing process involves uploading invoice details to the portal which validates the details, generates a QR code and digitally signs the e-invoice. The QR code must be printed on the invoice.