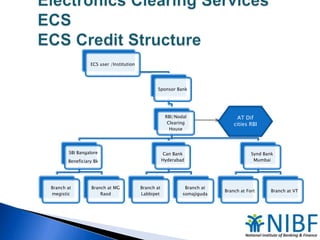

ECS (Electronic Clearing Service) allows for electronic funds transfer between bank accounts using a clearing house. It facilitates bulk payments from one account to many accounts (ECS Credits) or collection of funds from many accounts to one account (ECS Debits). The process involves an ECS user initiating transactions by submitting data to a clearing house, which then debits the user's sponsor bank and credits recipient banks for onward crediting to beneficiary accounts. This electronic system provides advantages over paper-based payments like avoiding loss of instruments and ensuring timely credit of funds.