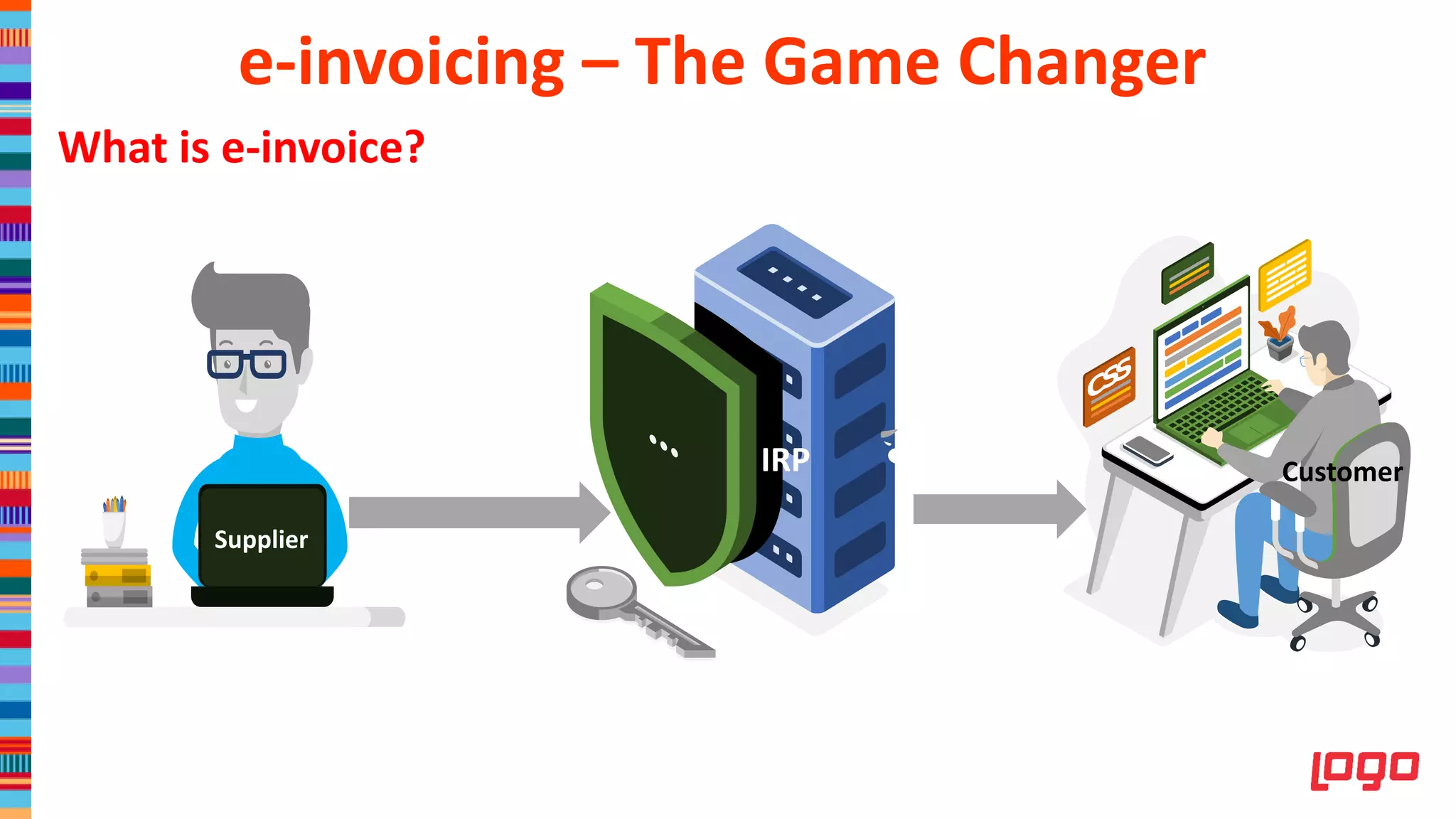

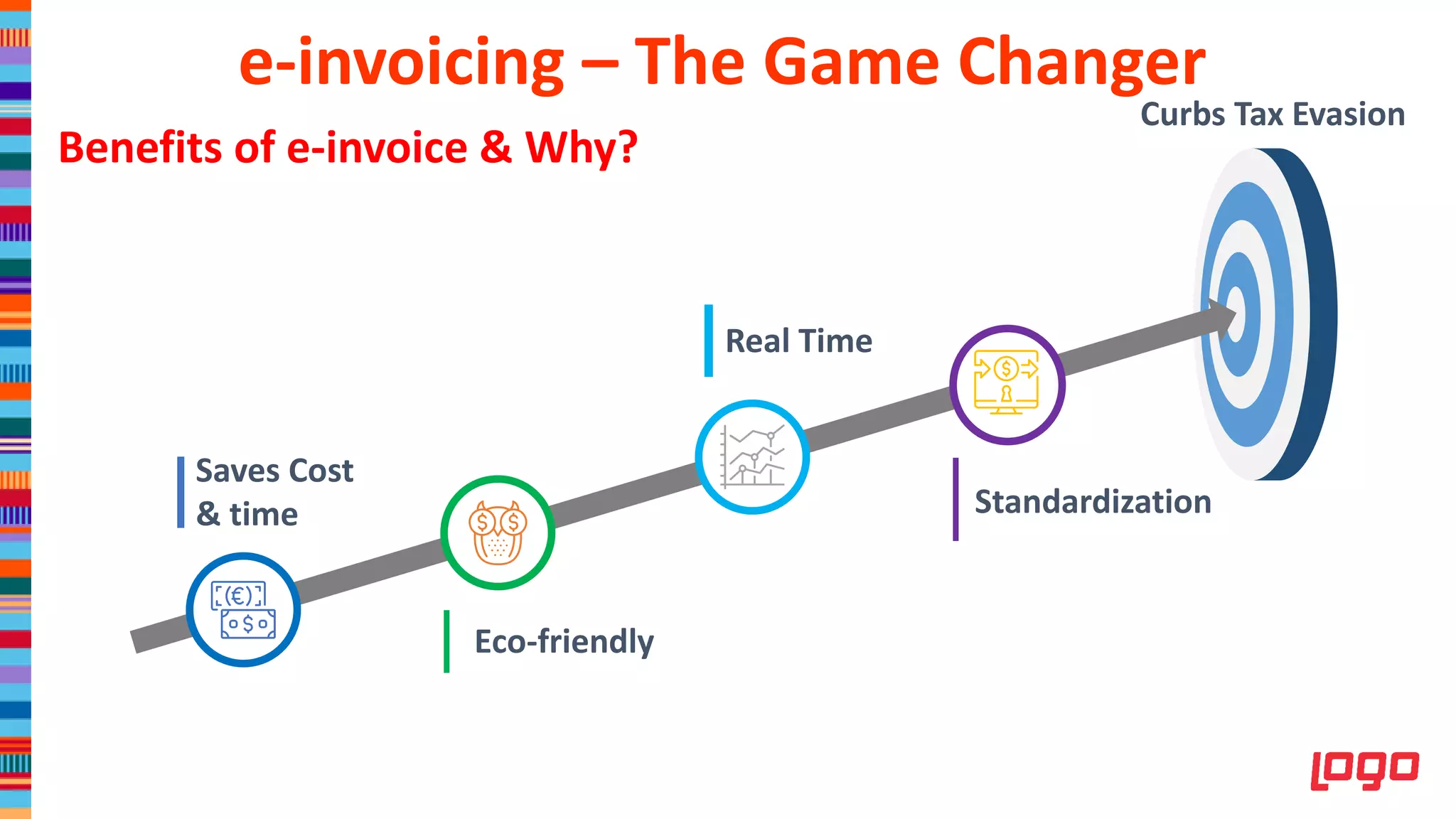

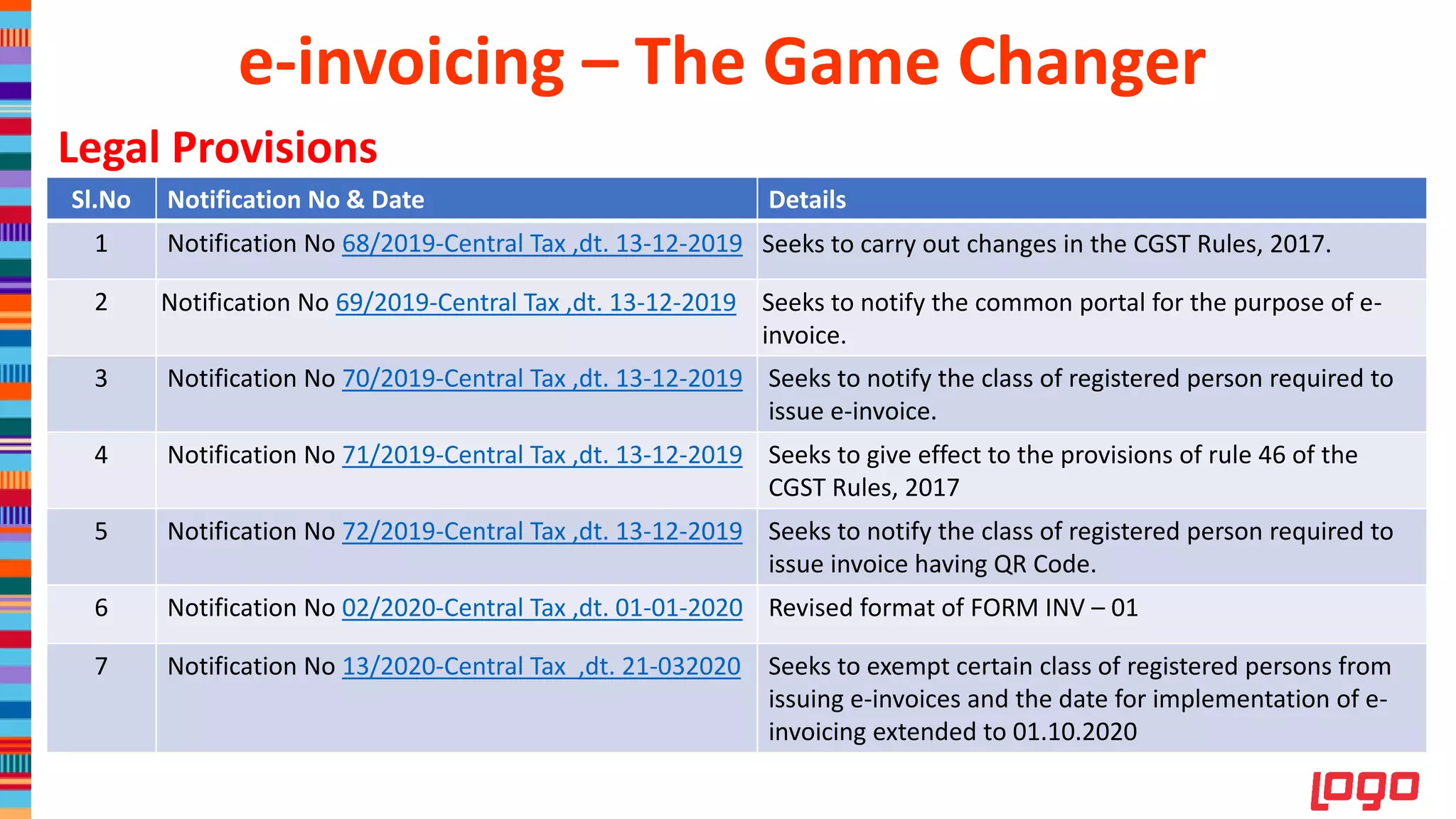

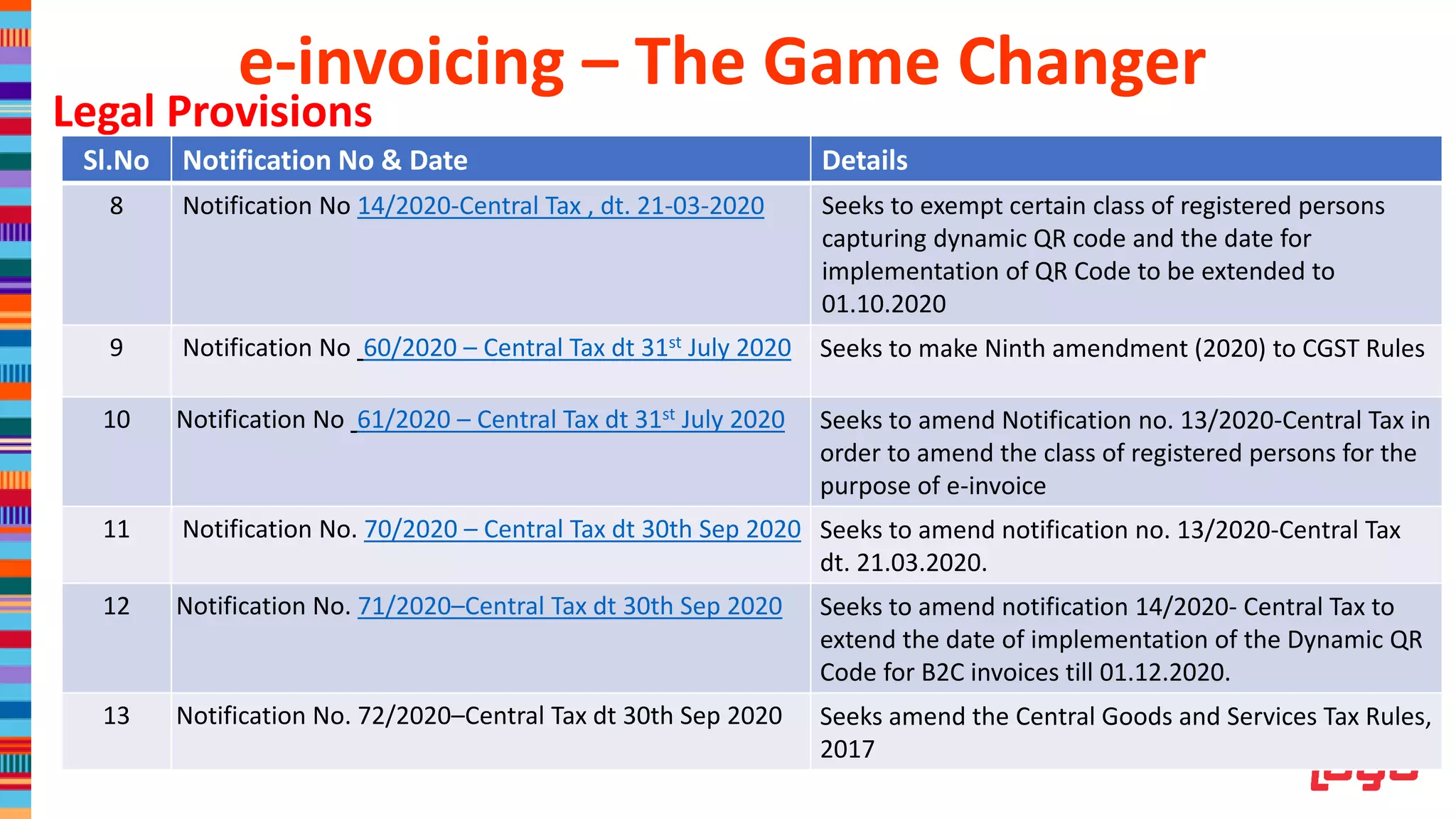

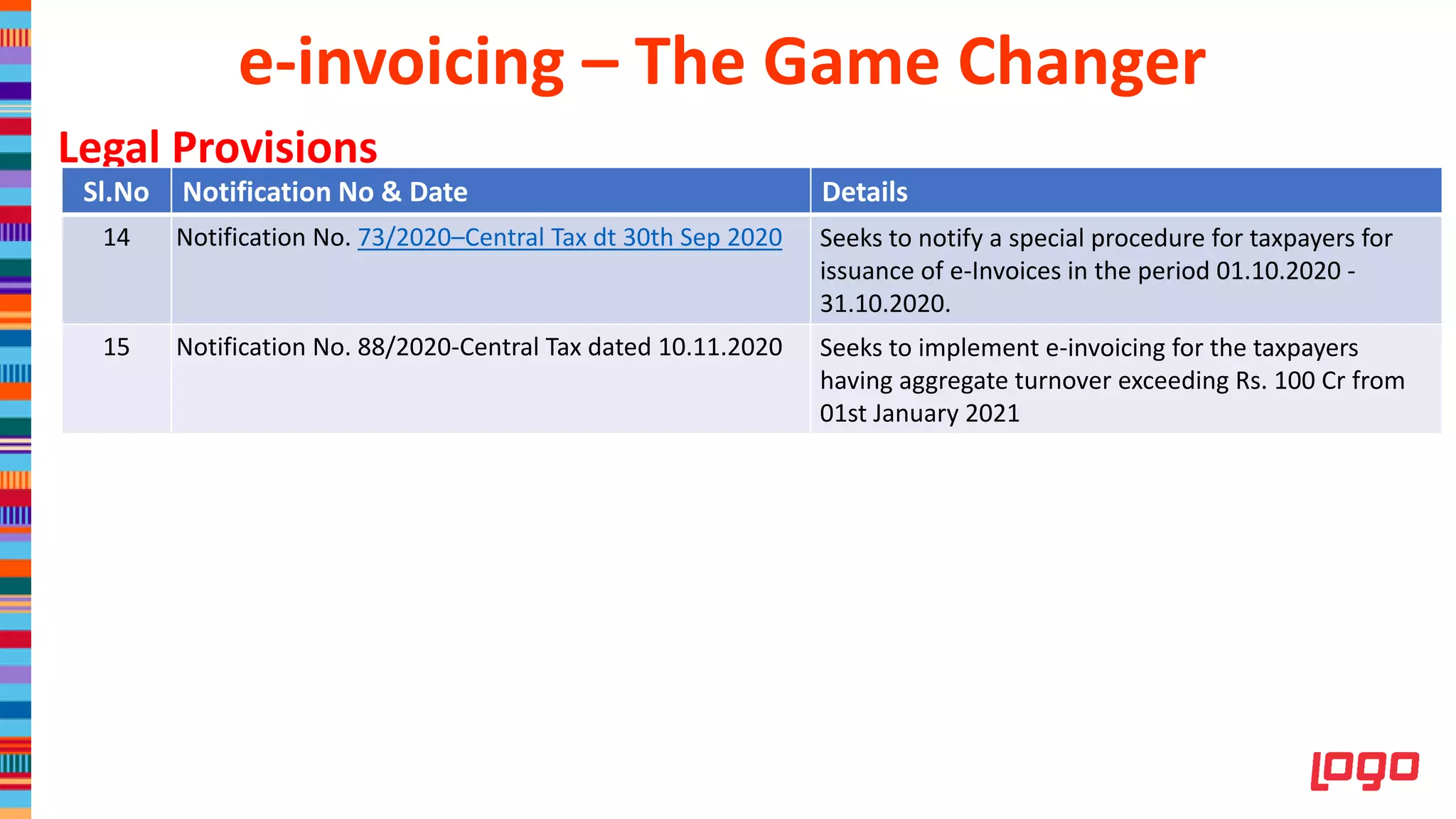

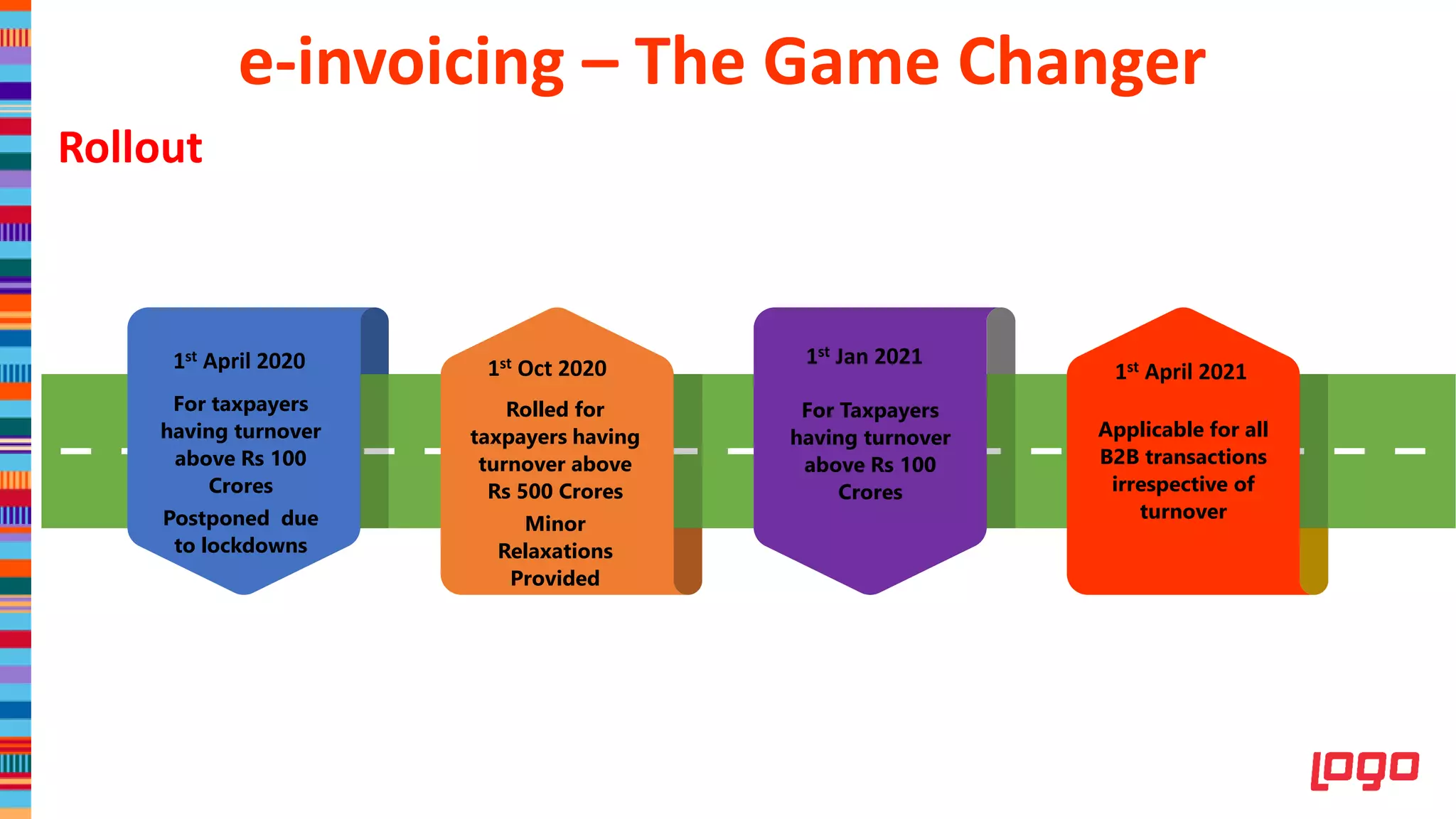

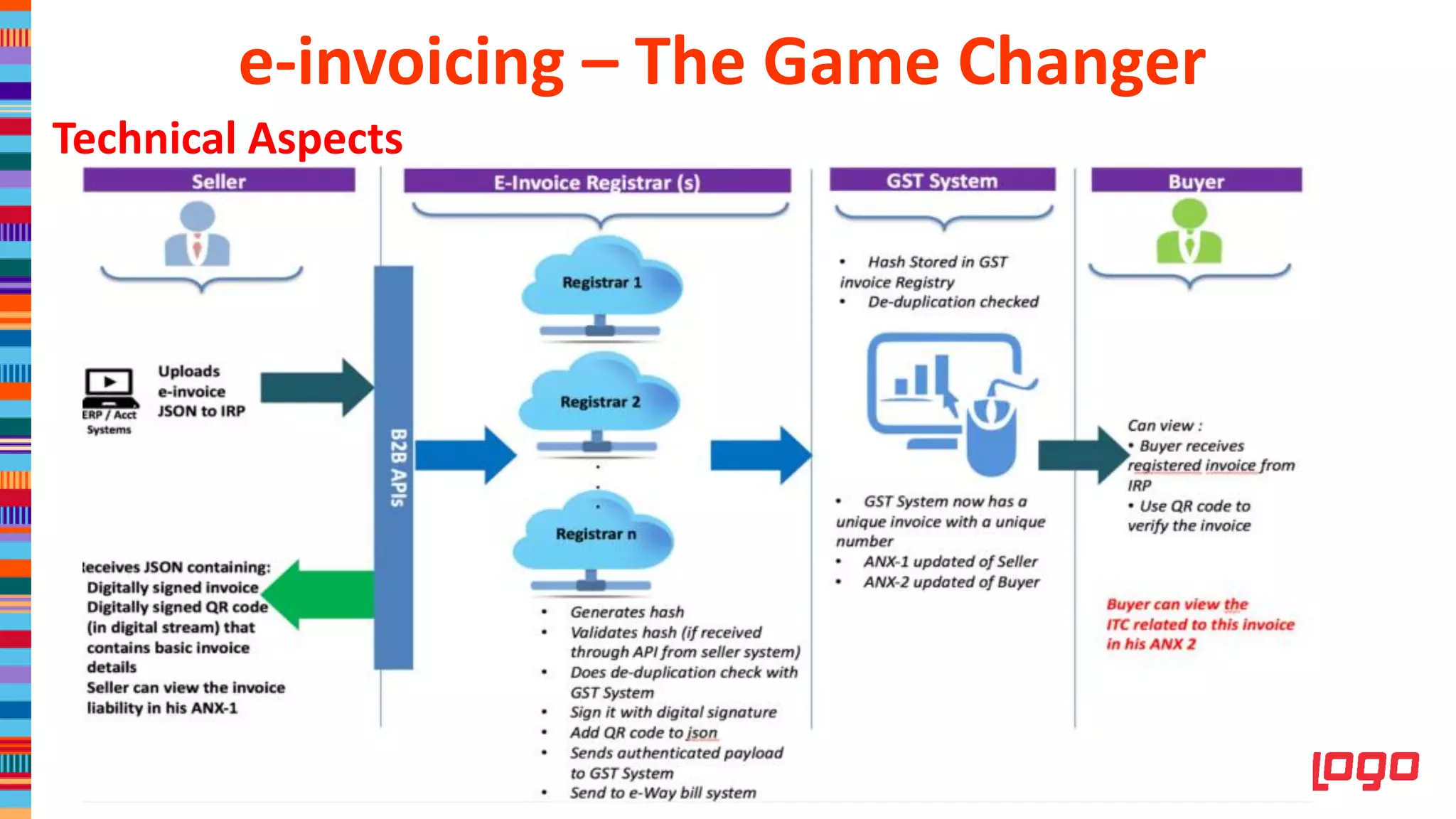

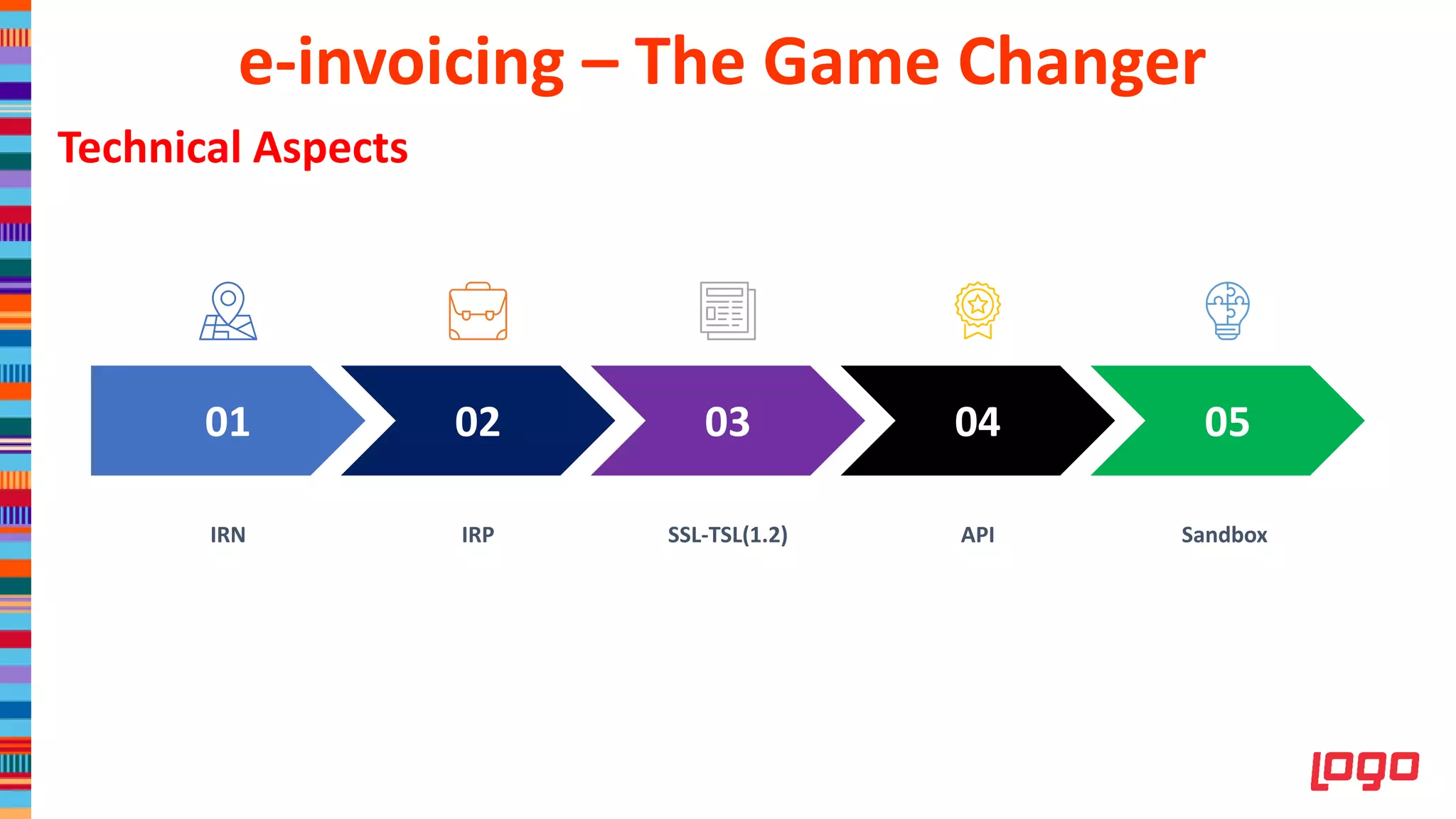

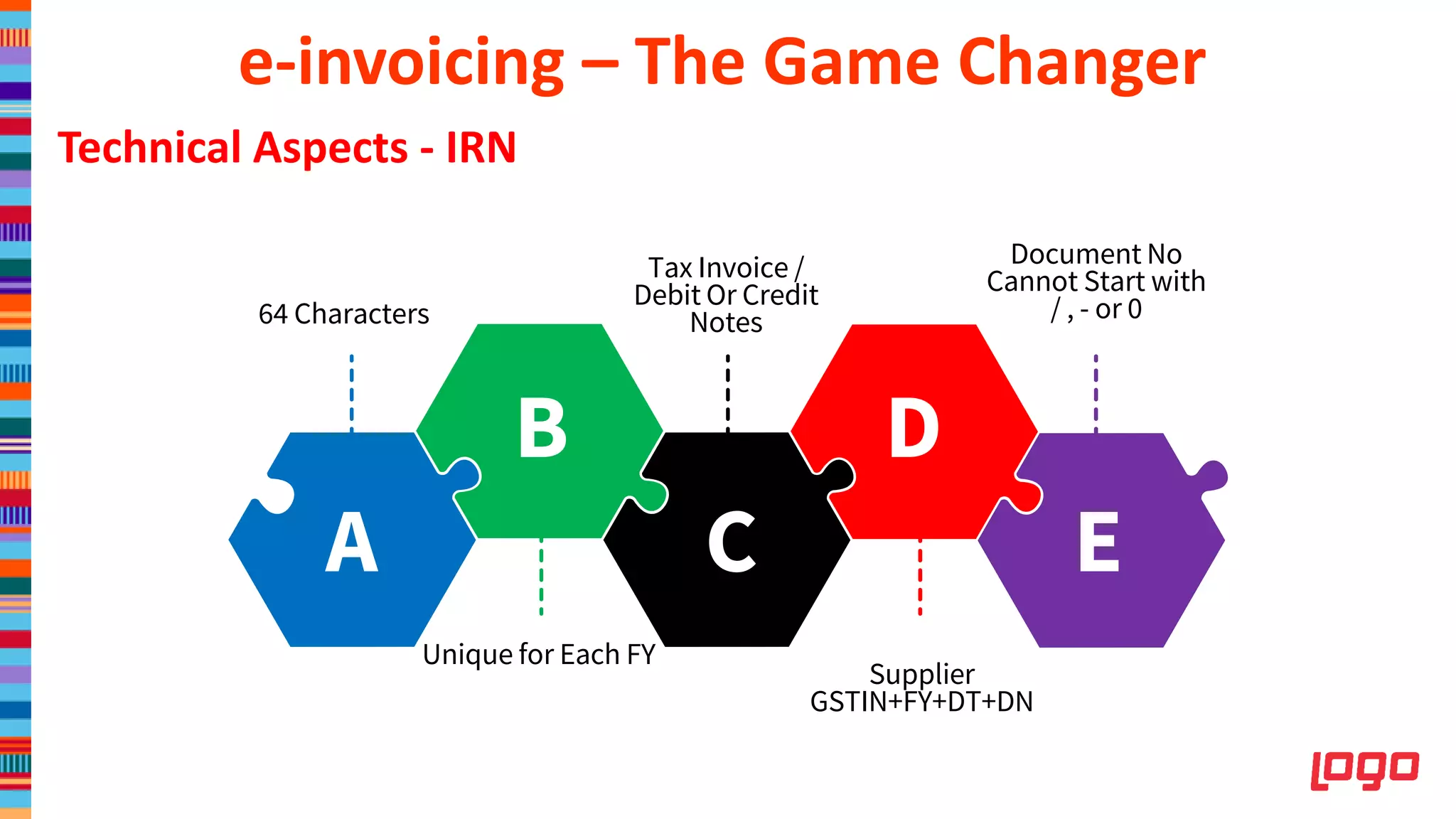

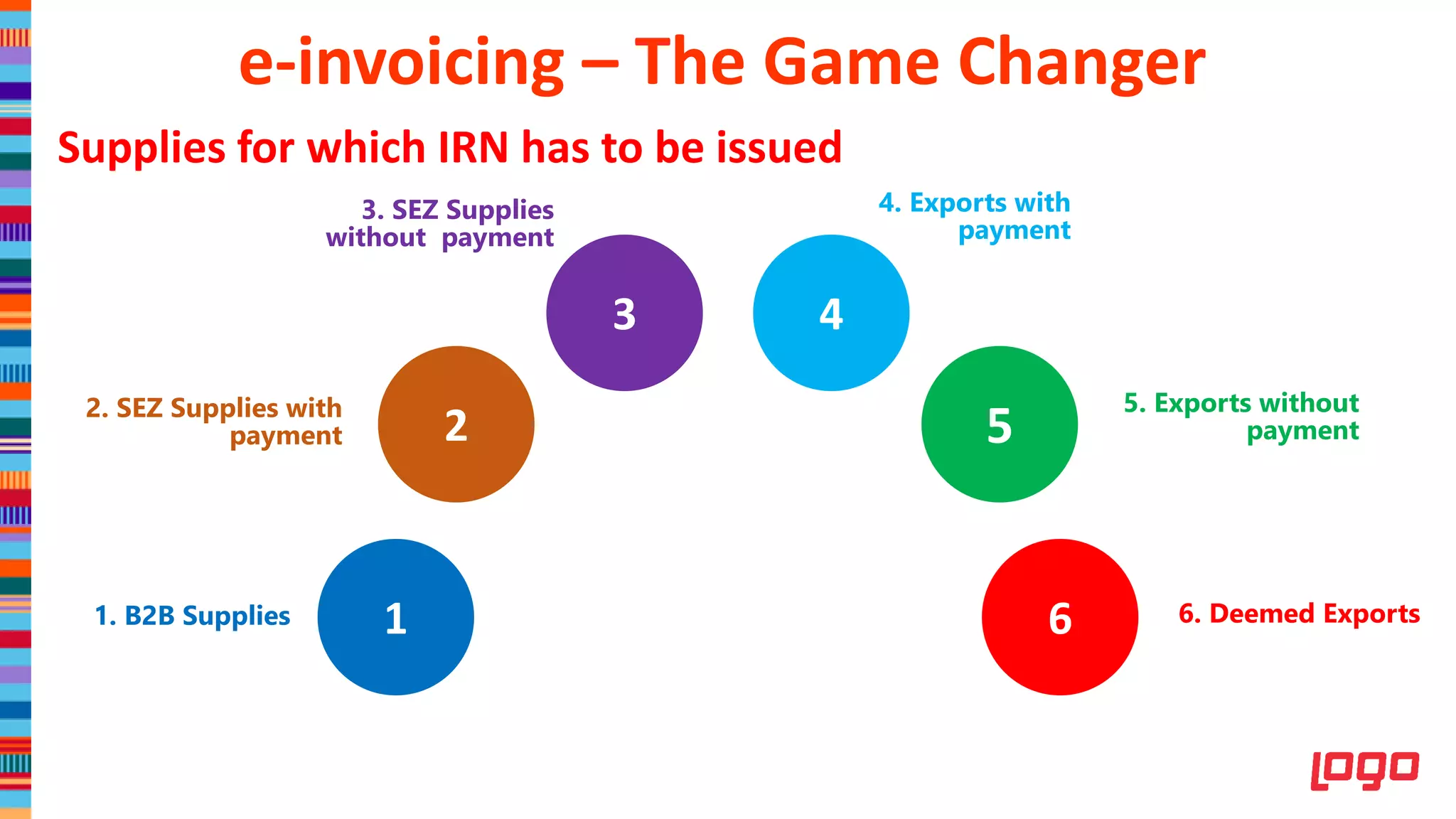

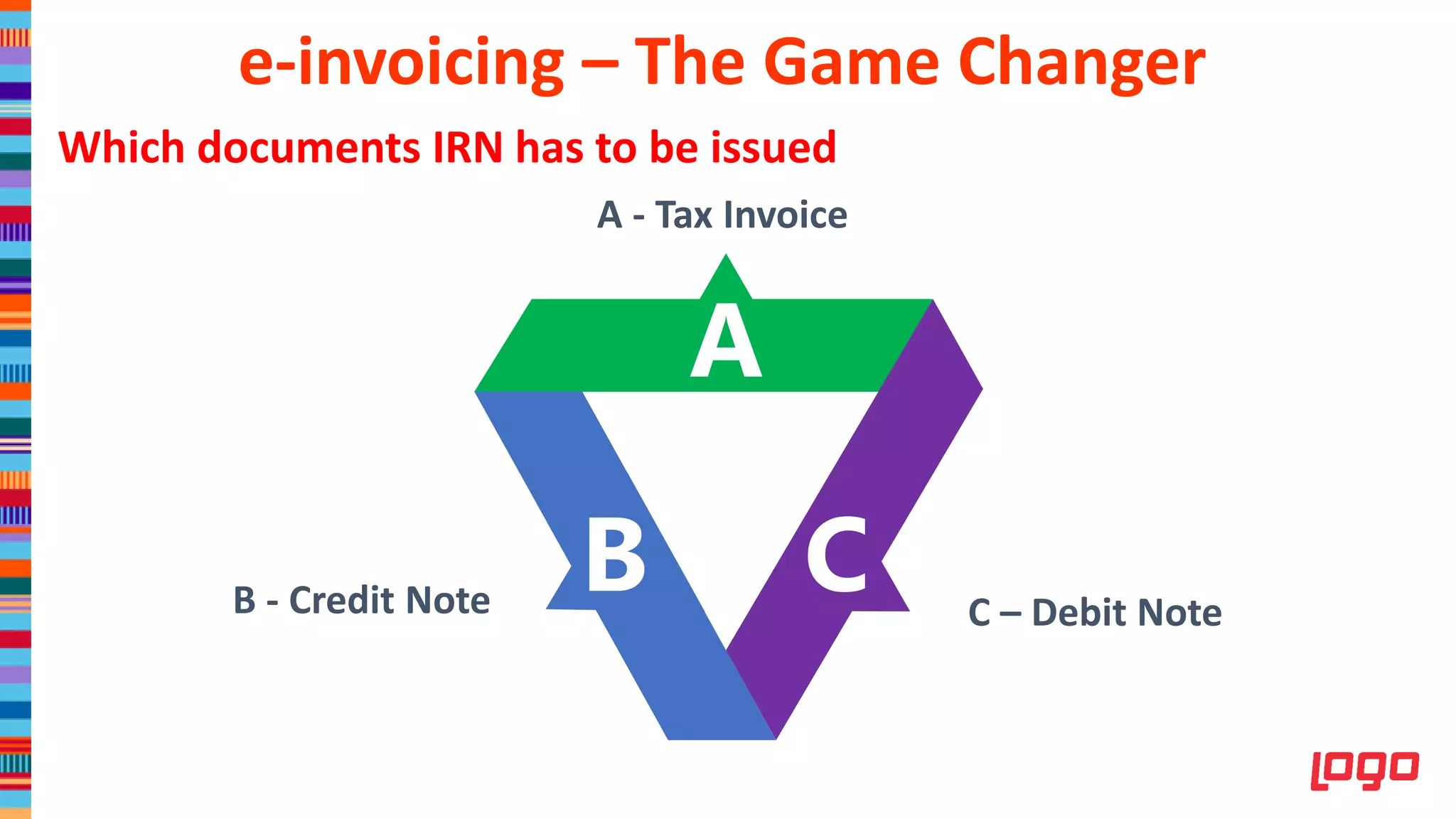

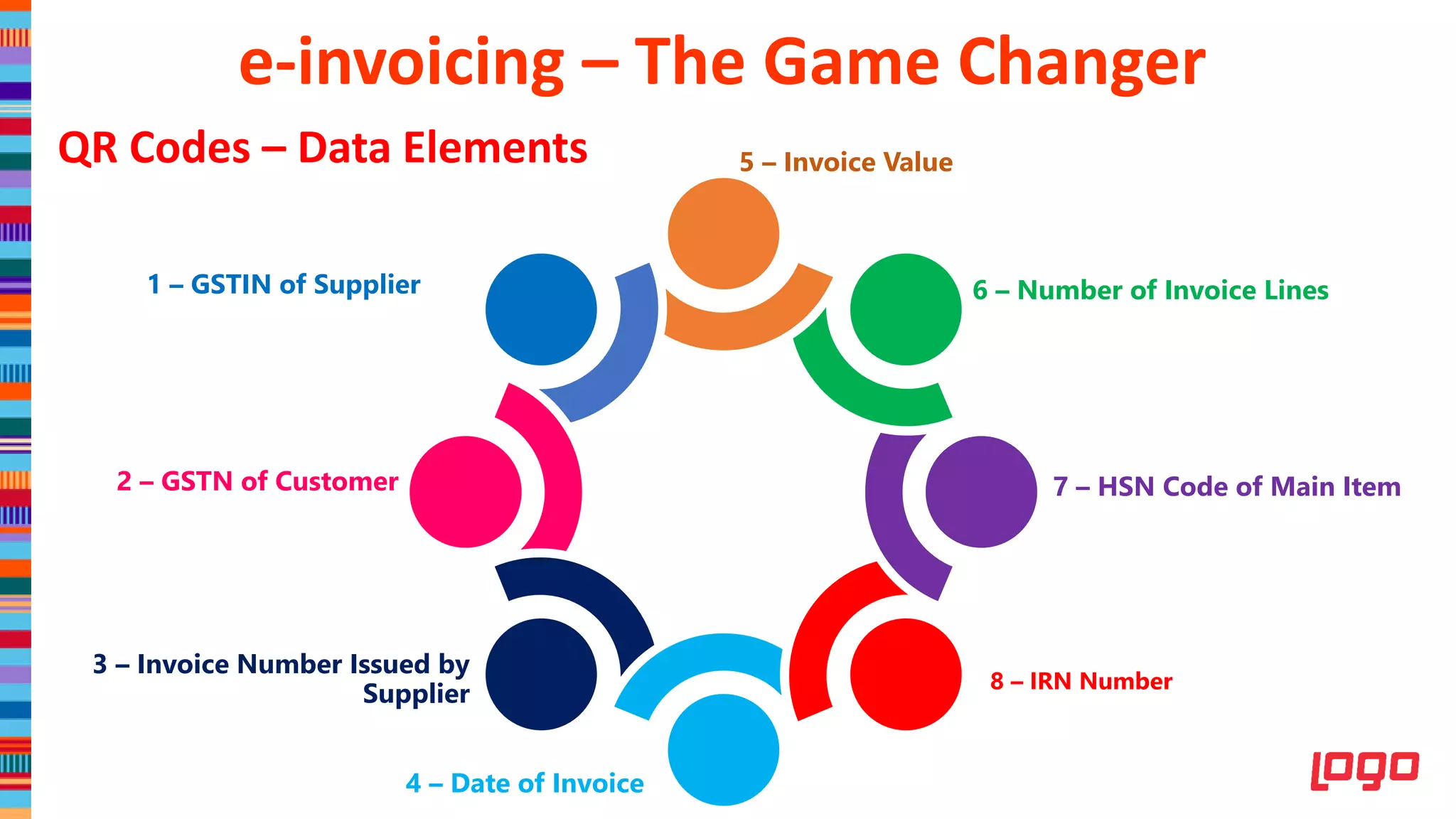

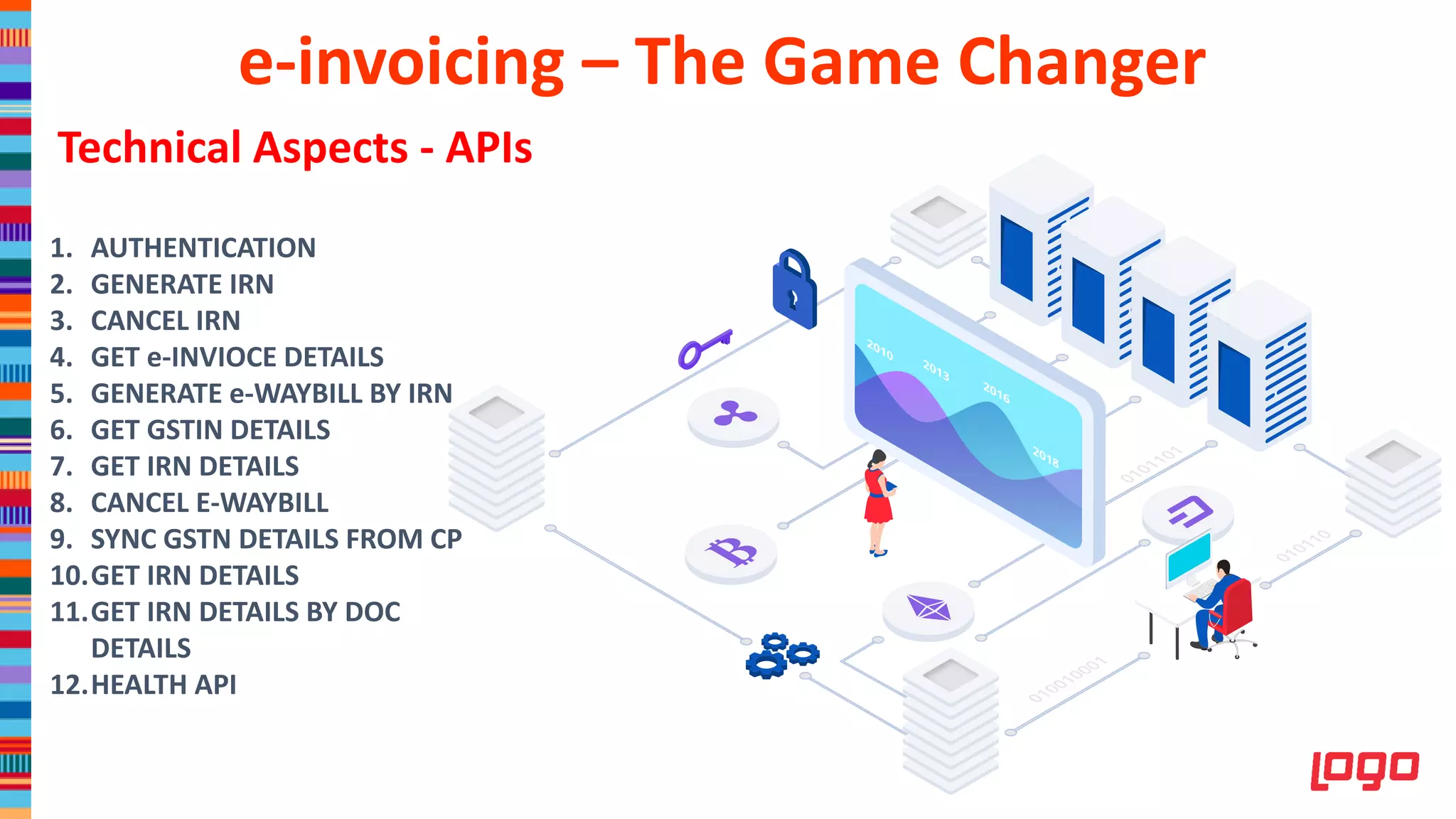

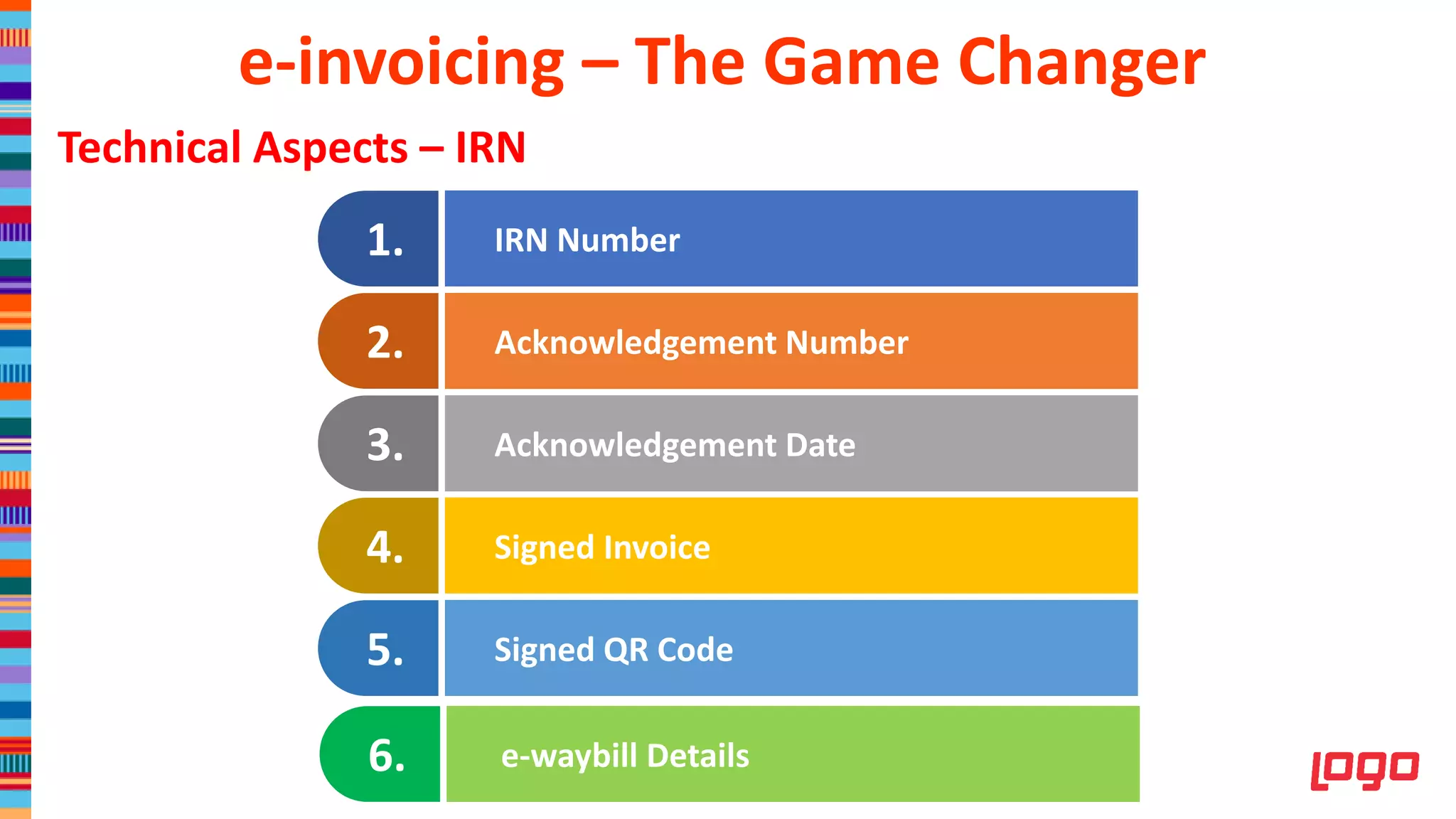

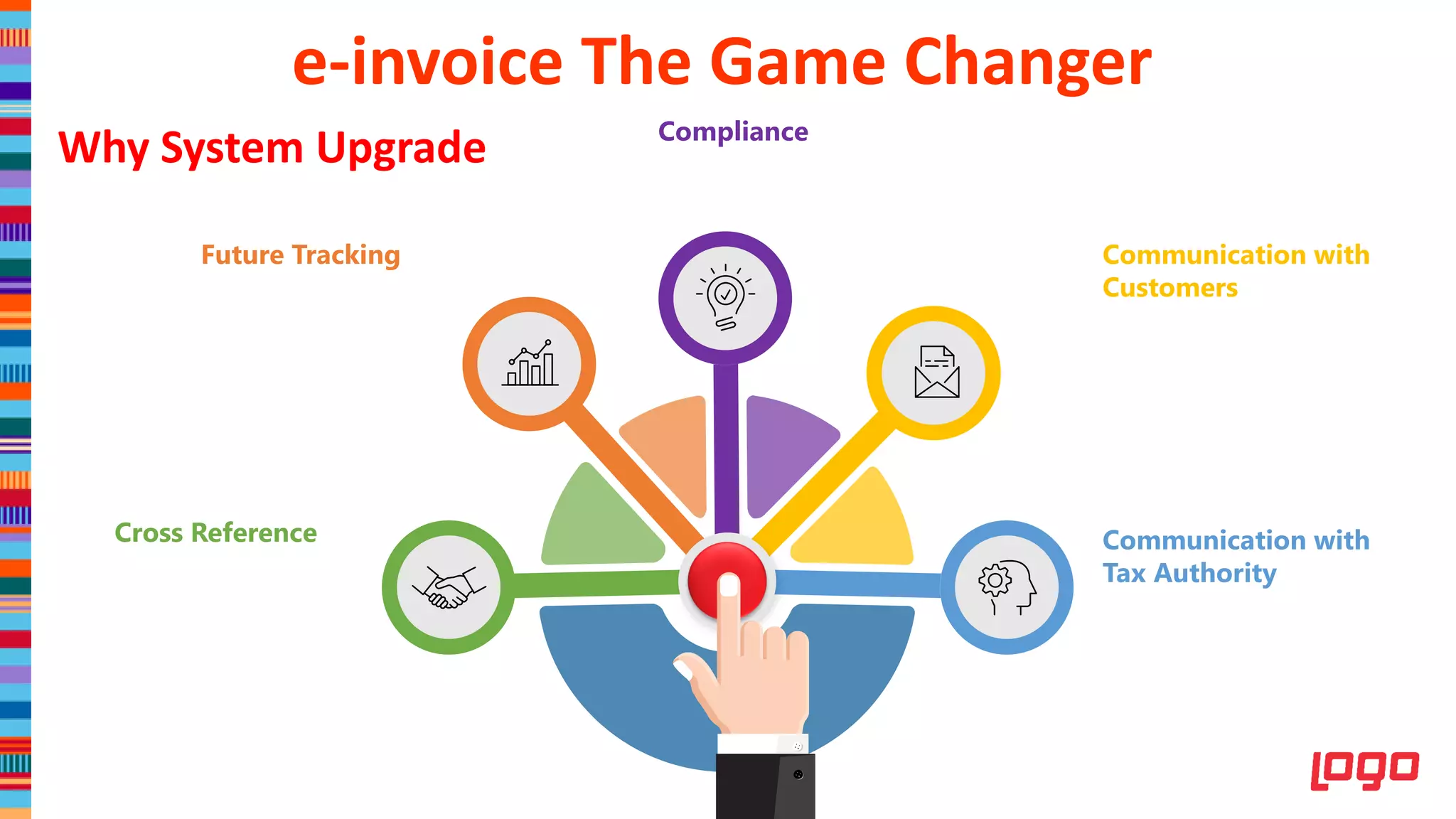

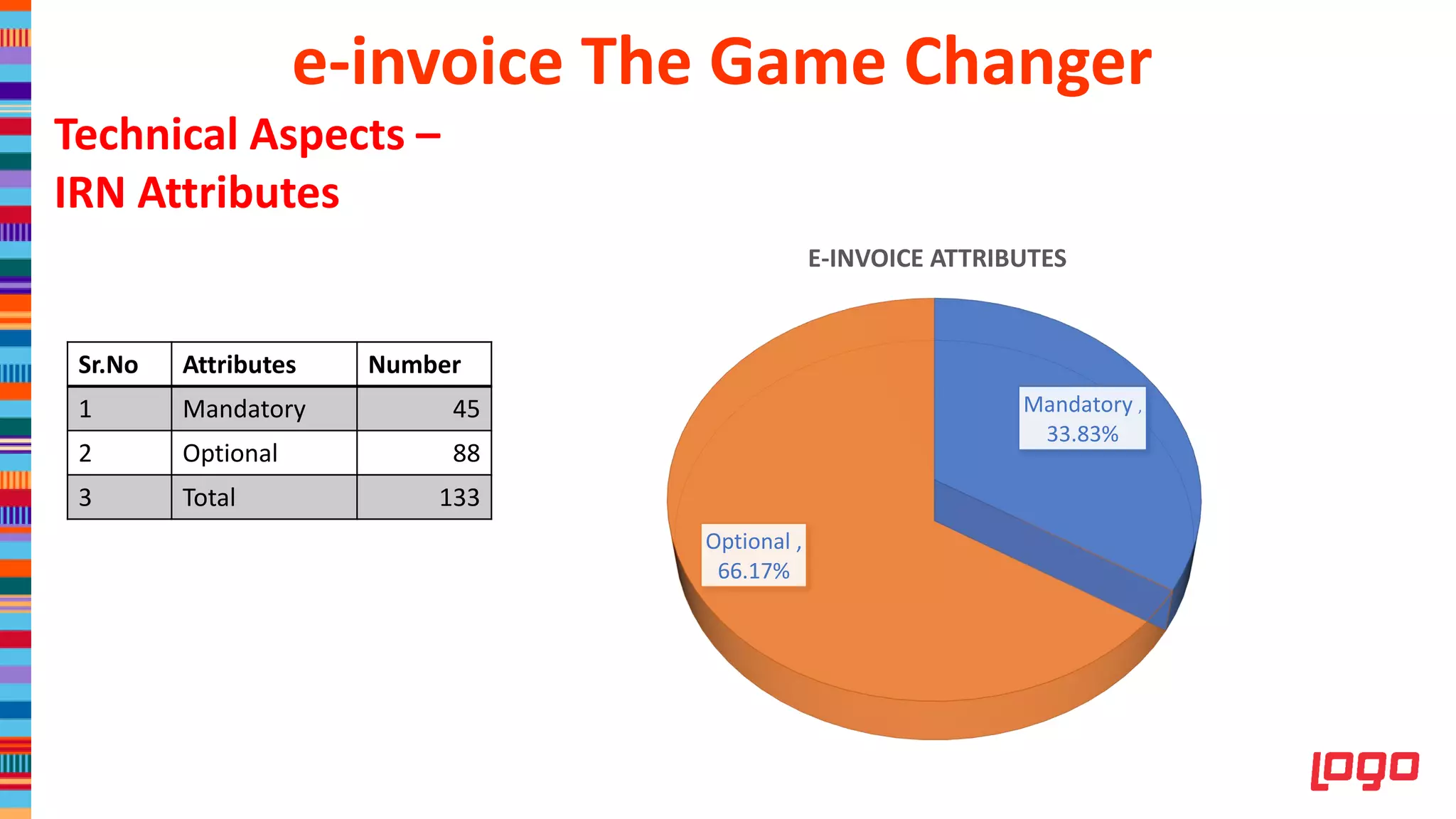

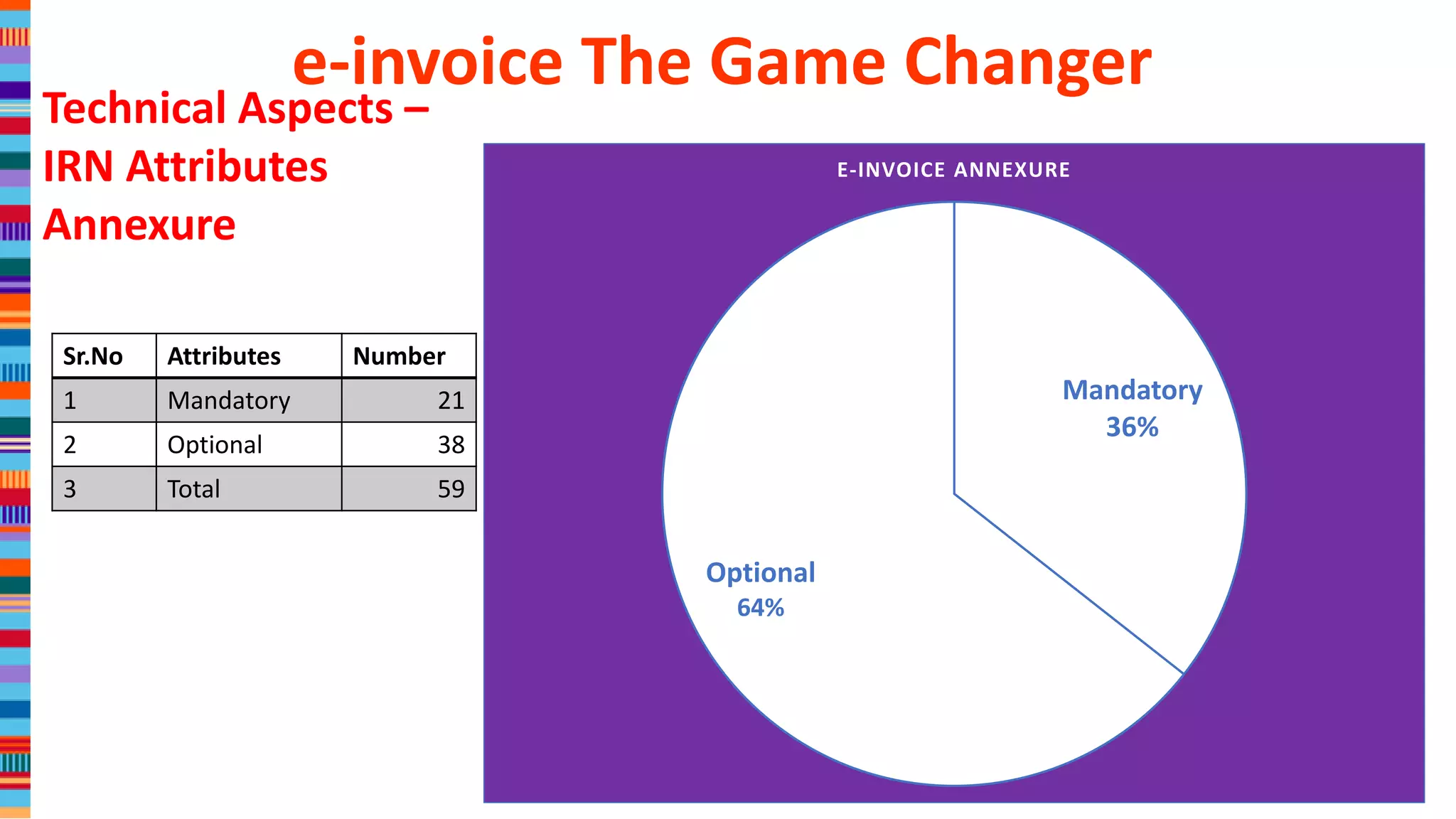

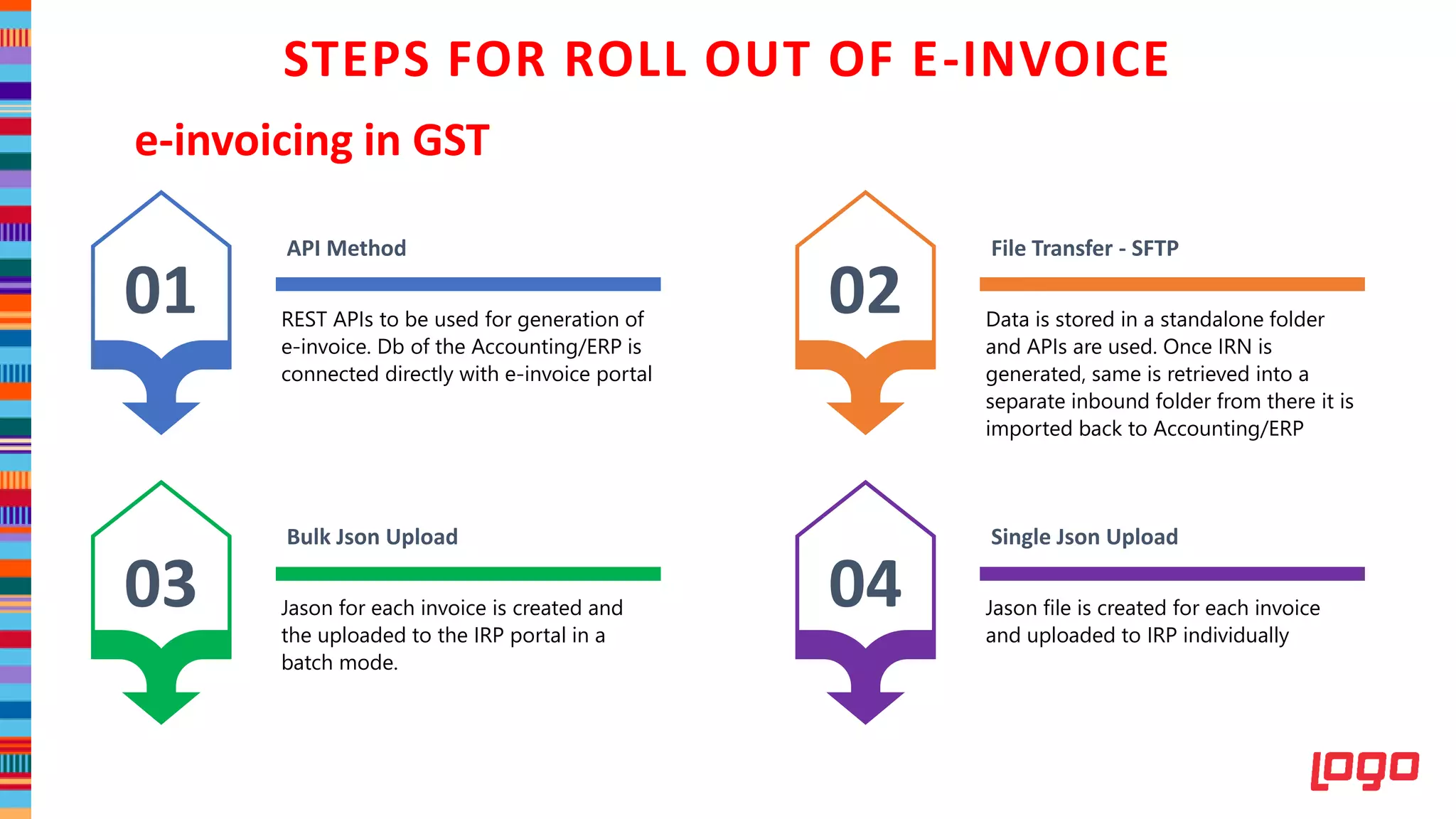

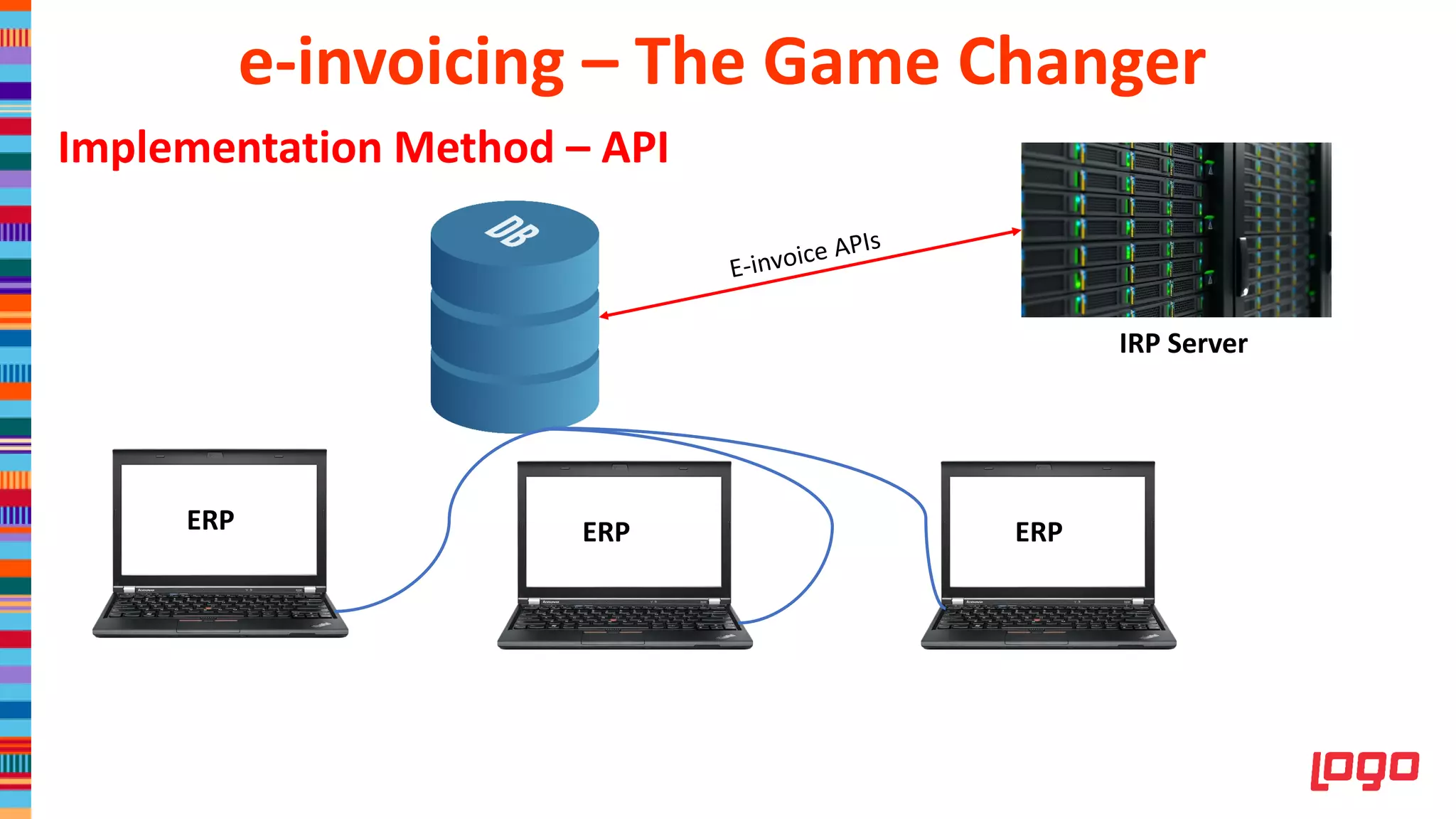

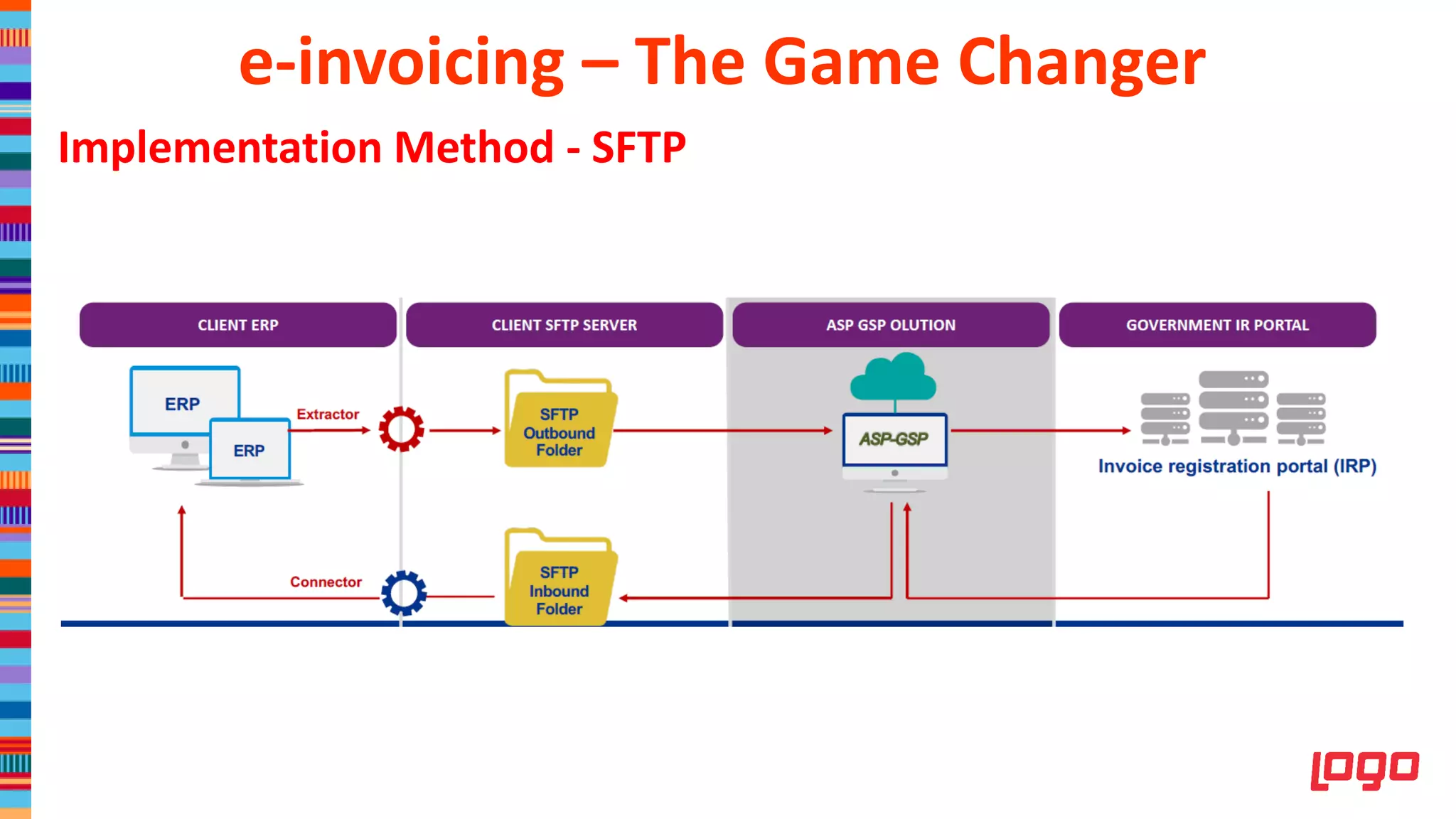

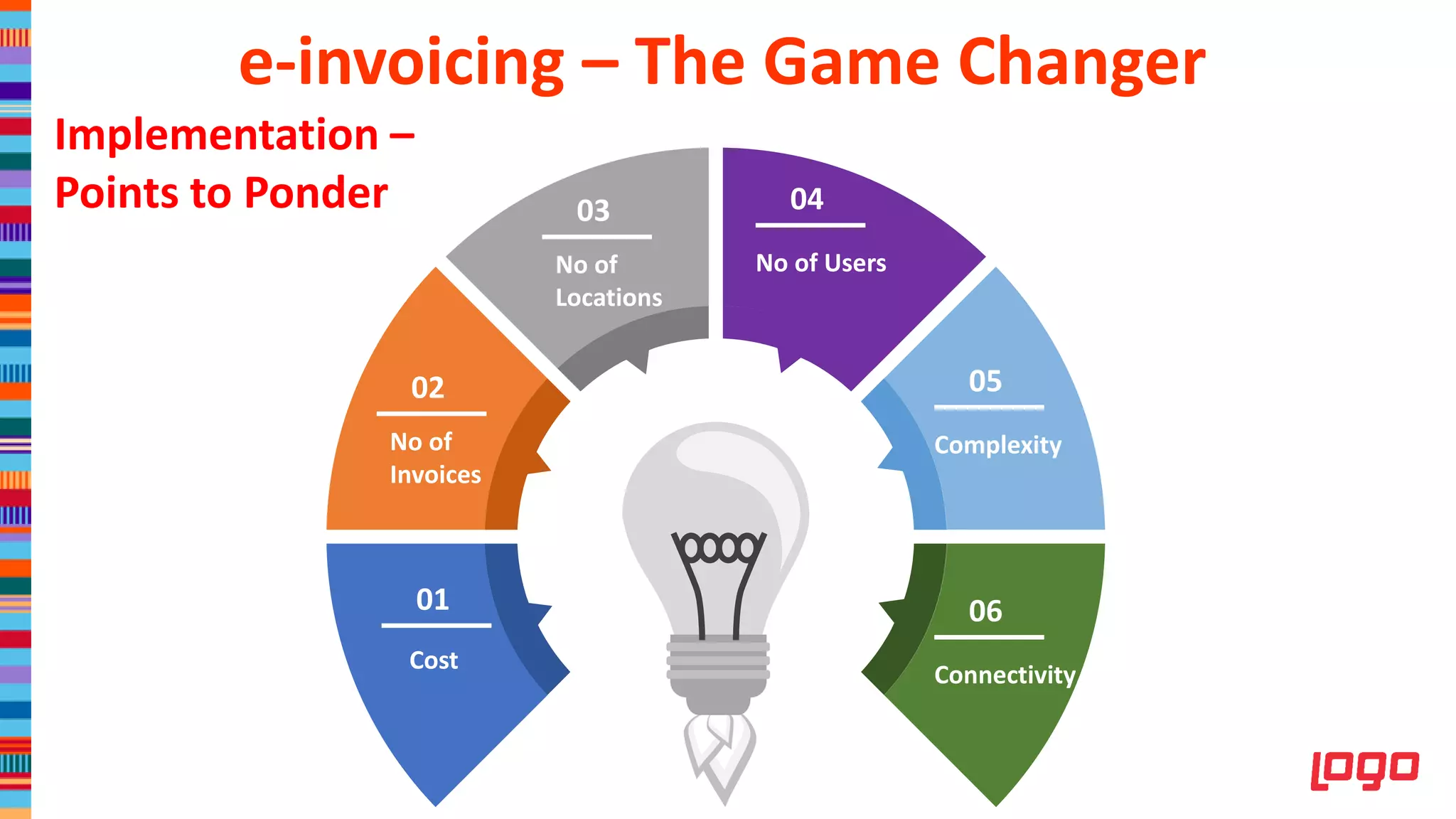

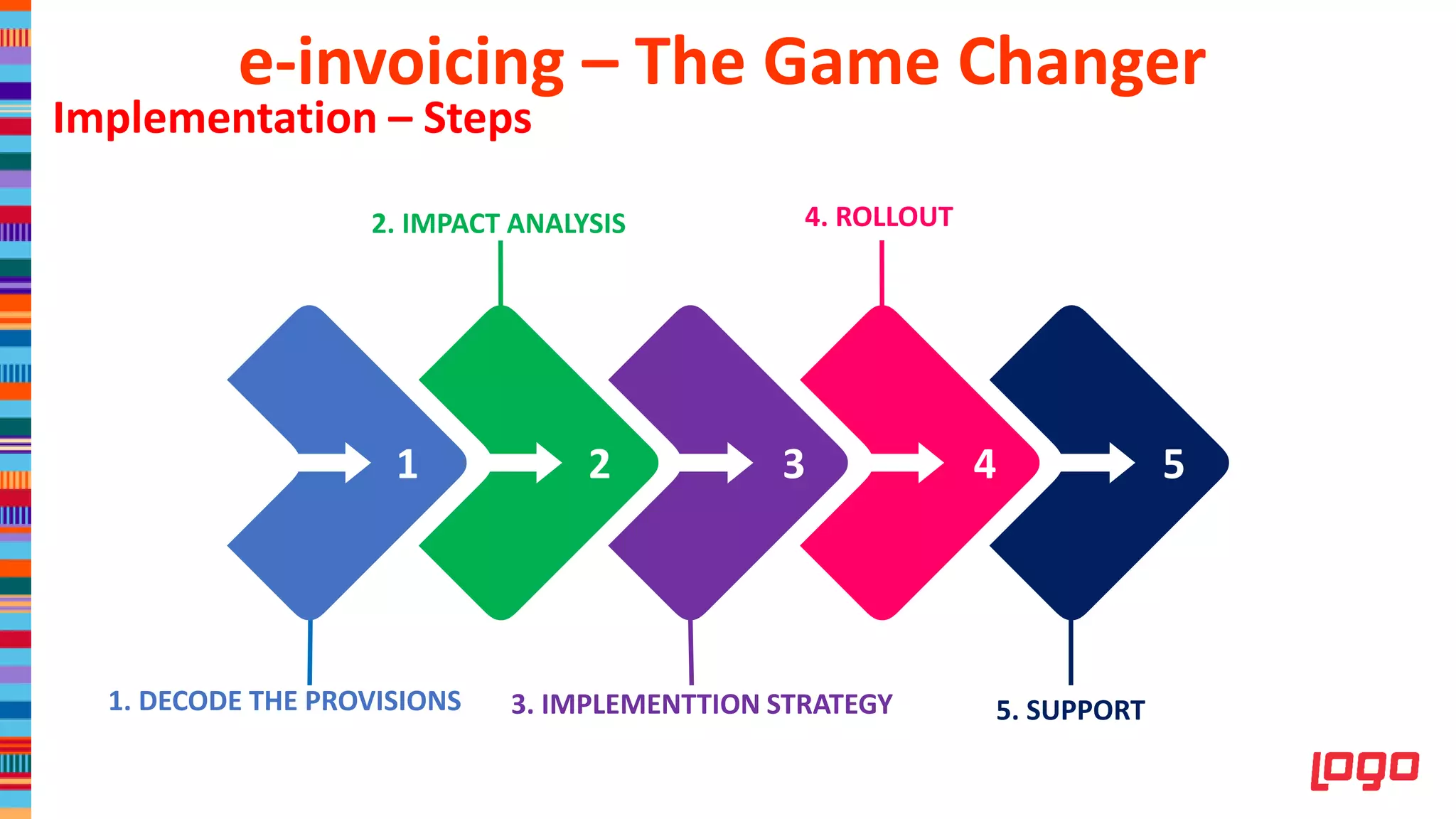

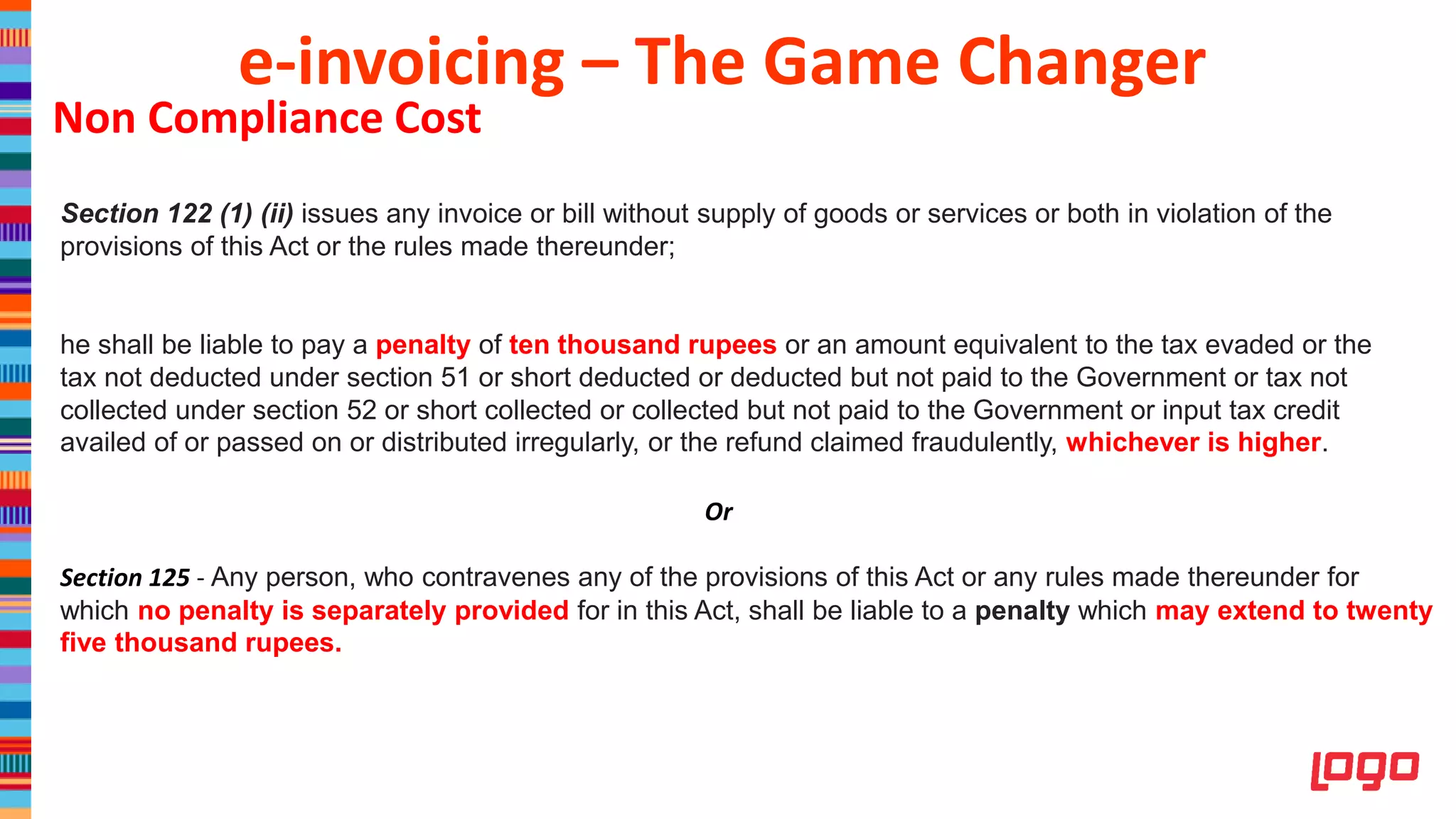

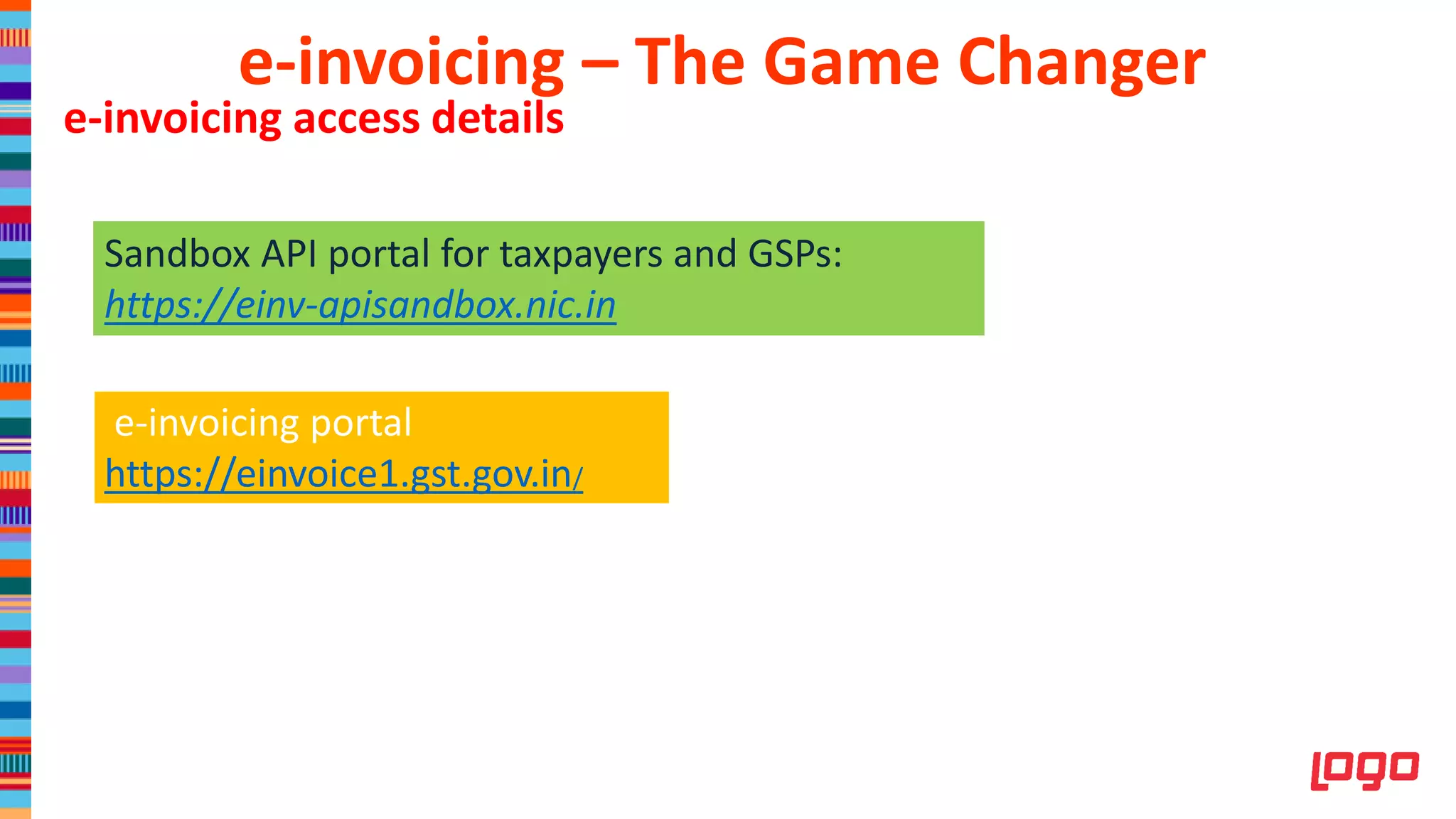

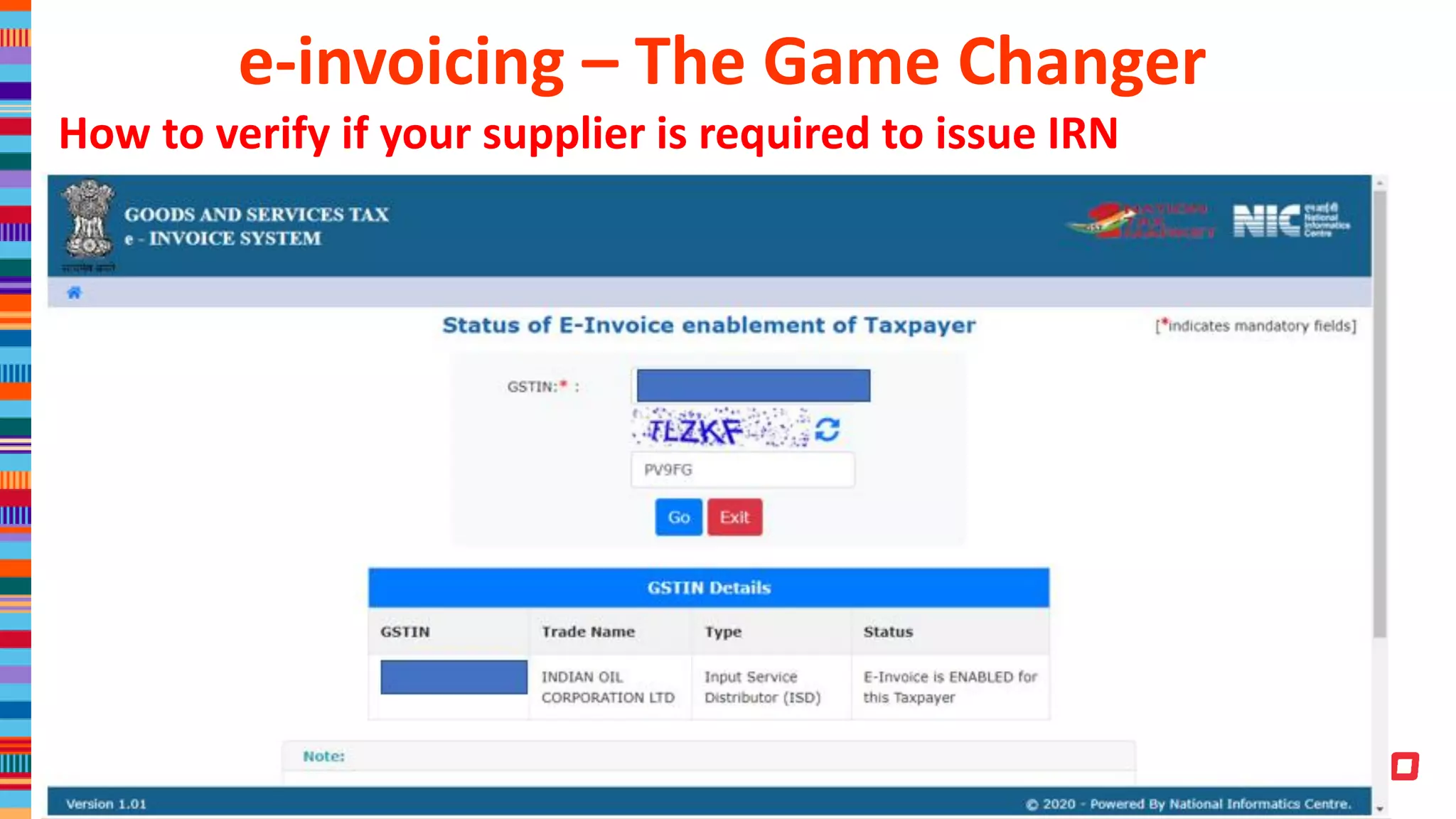

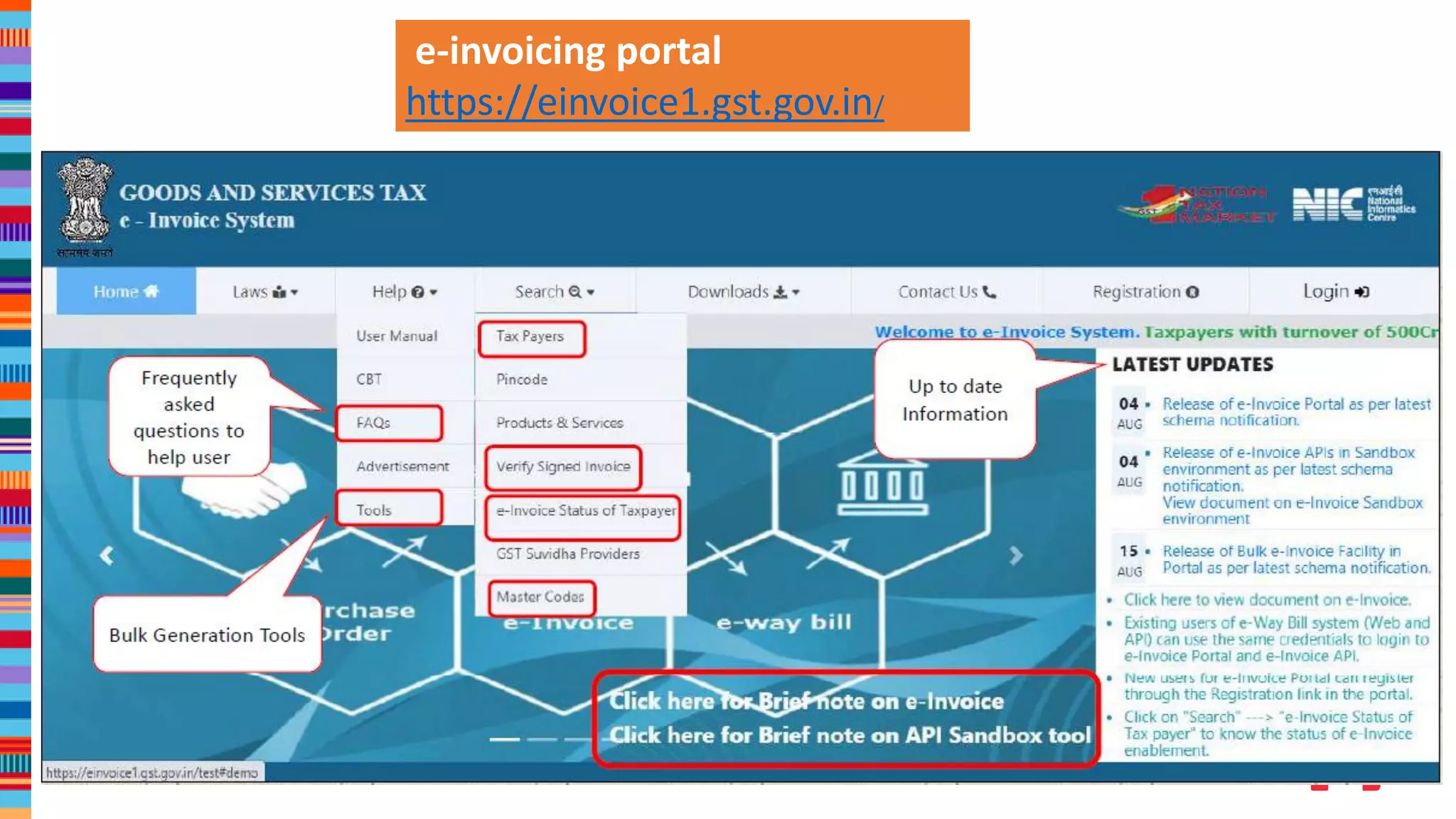

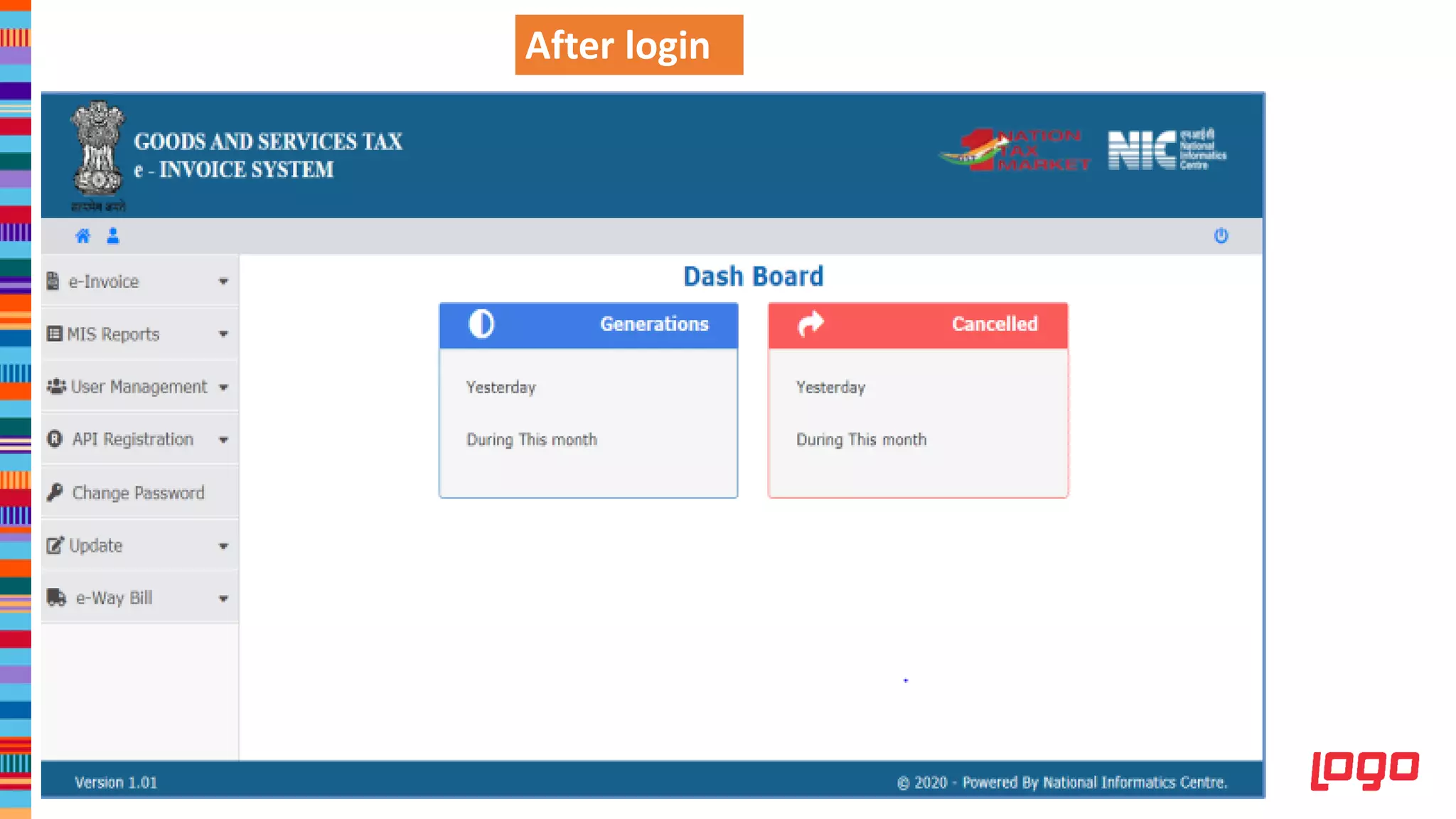

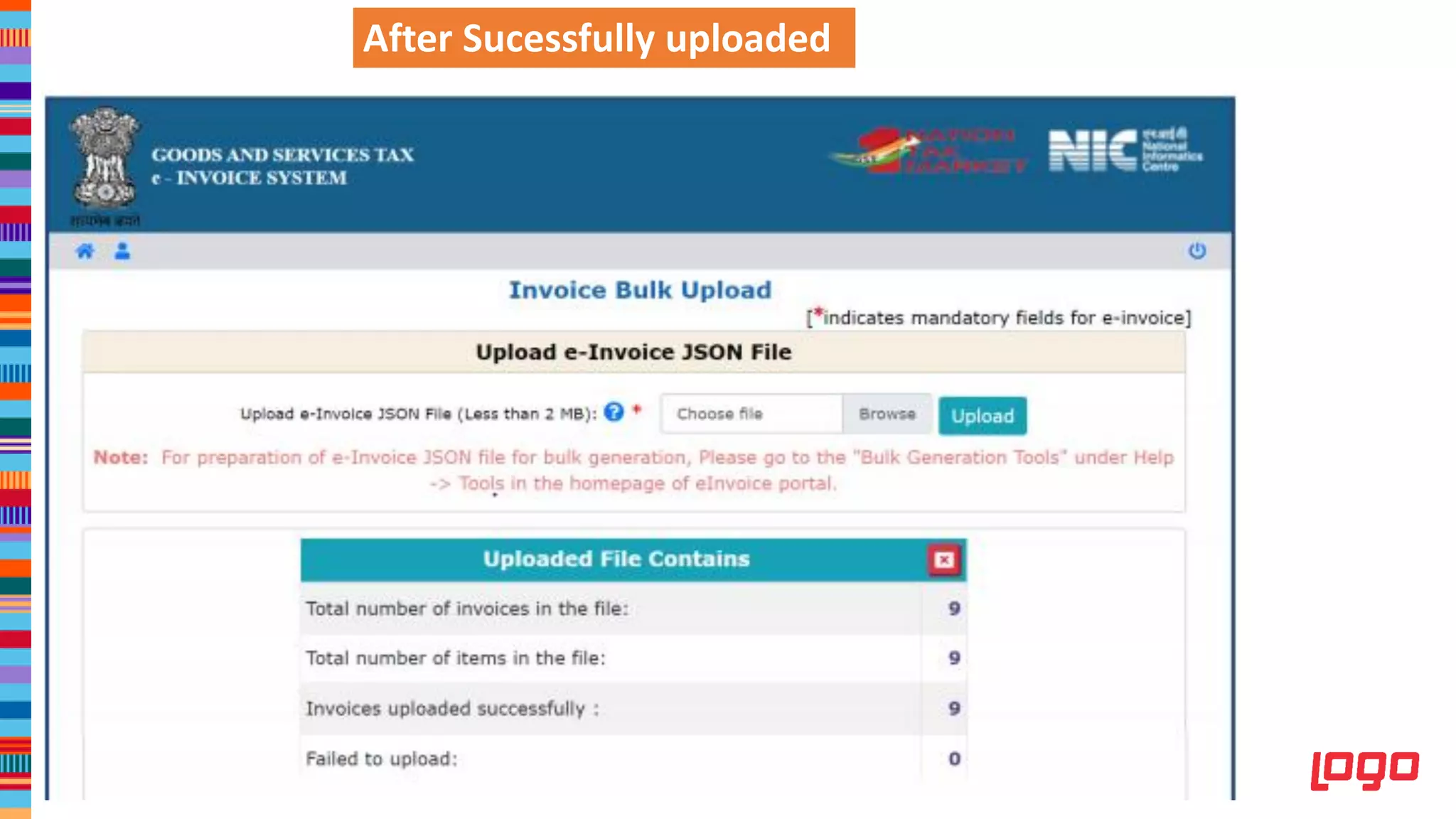

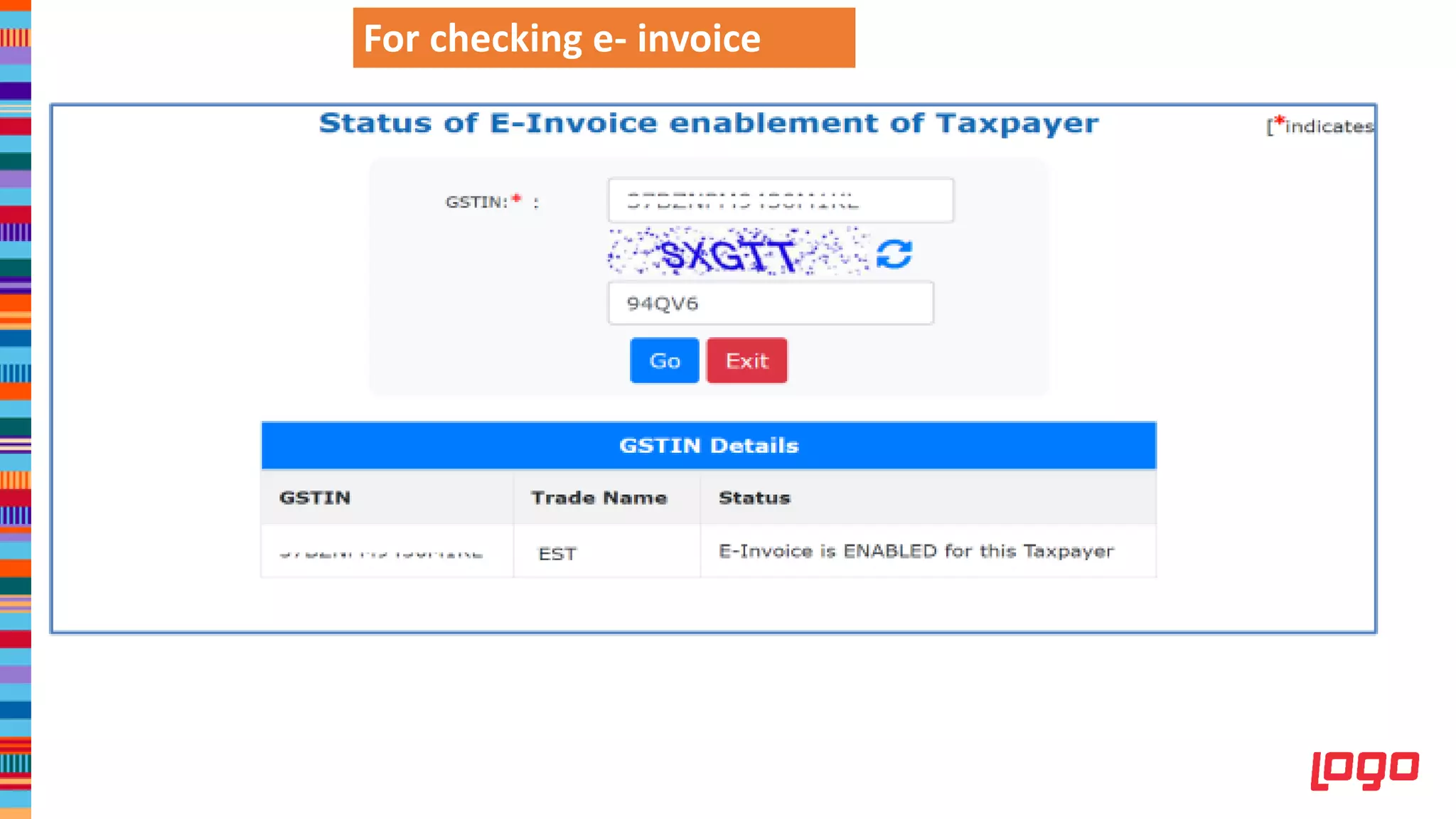

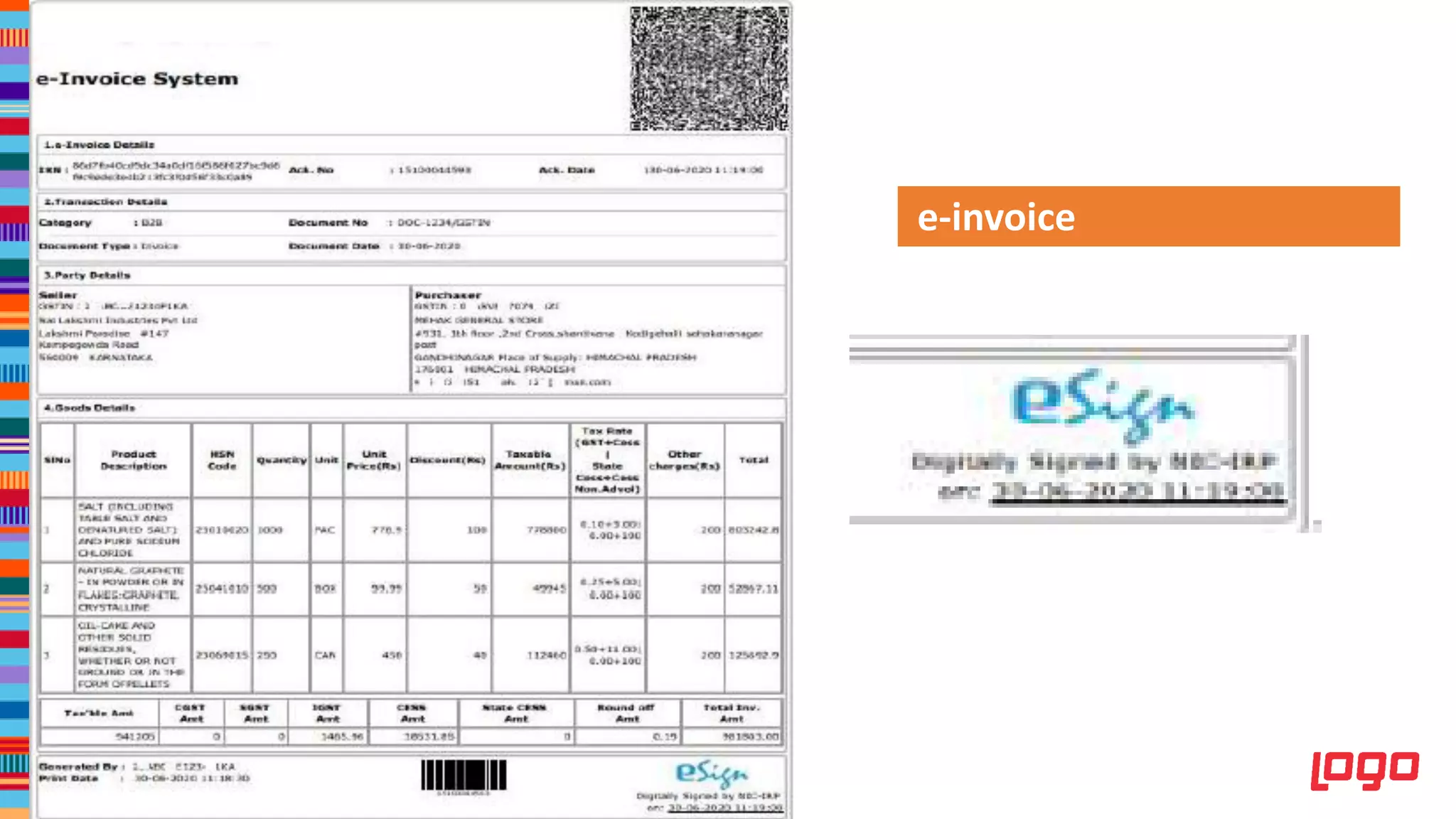

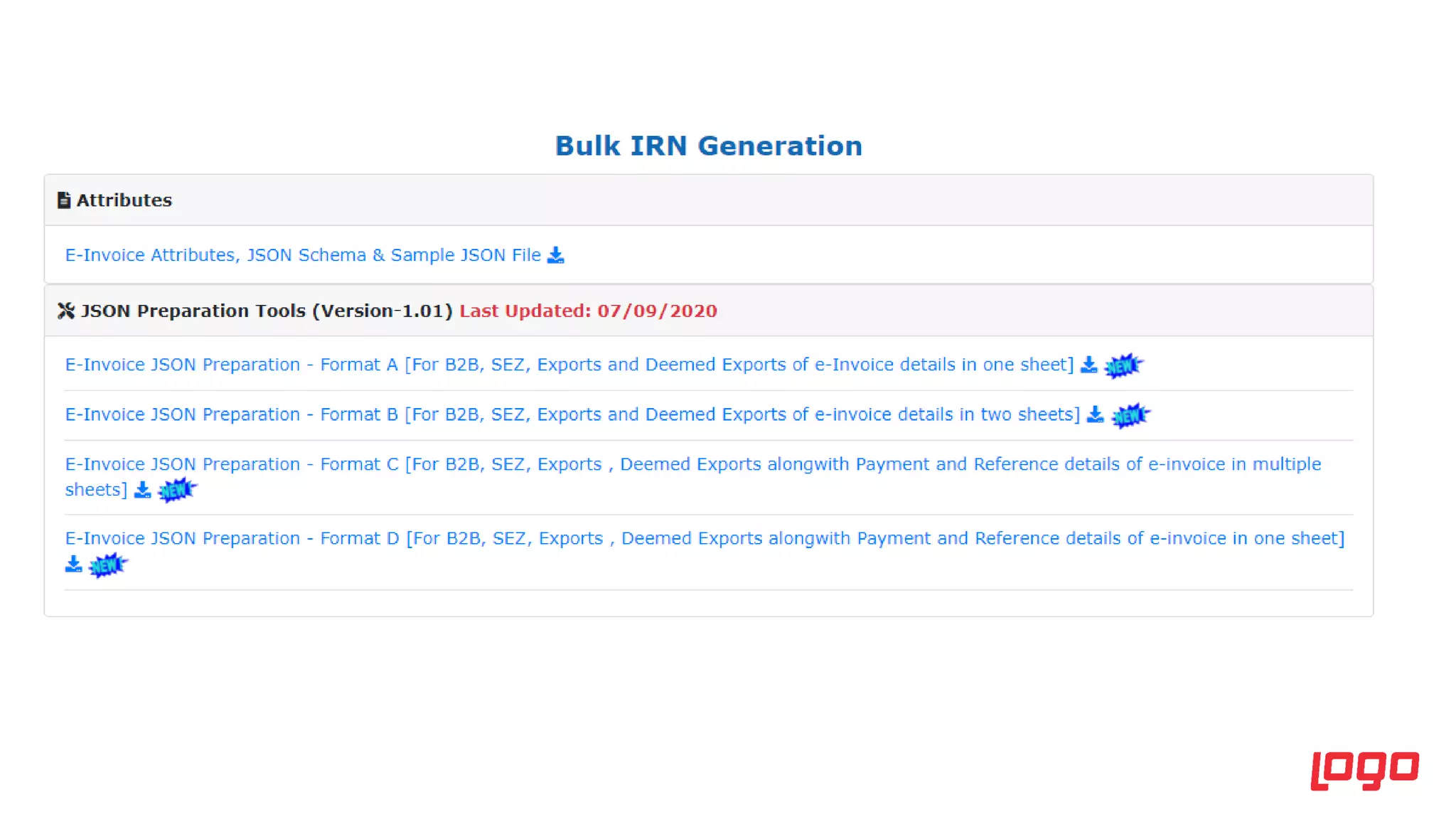

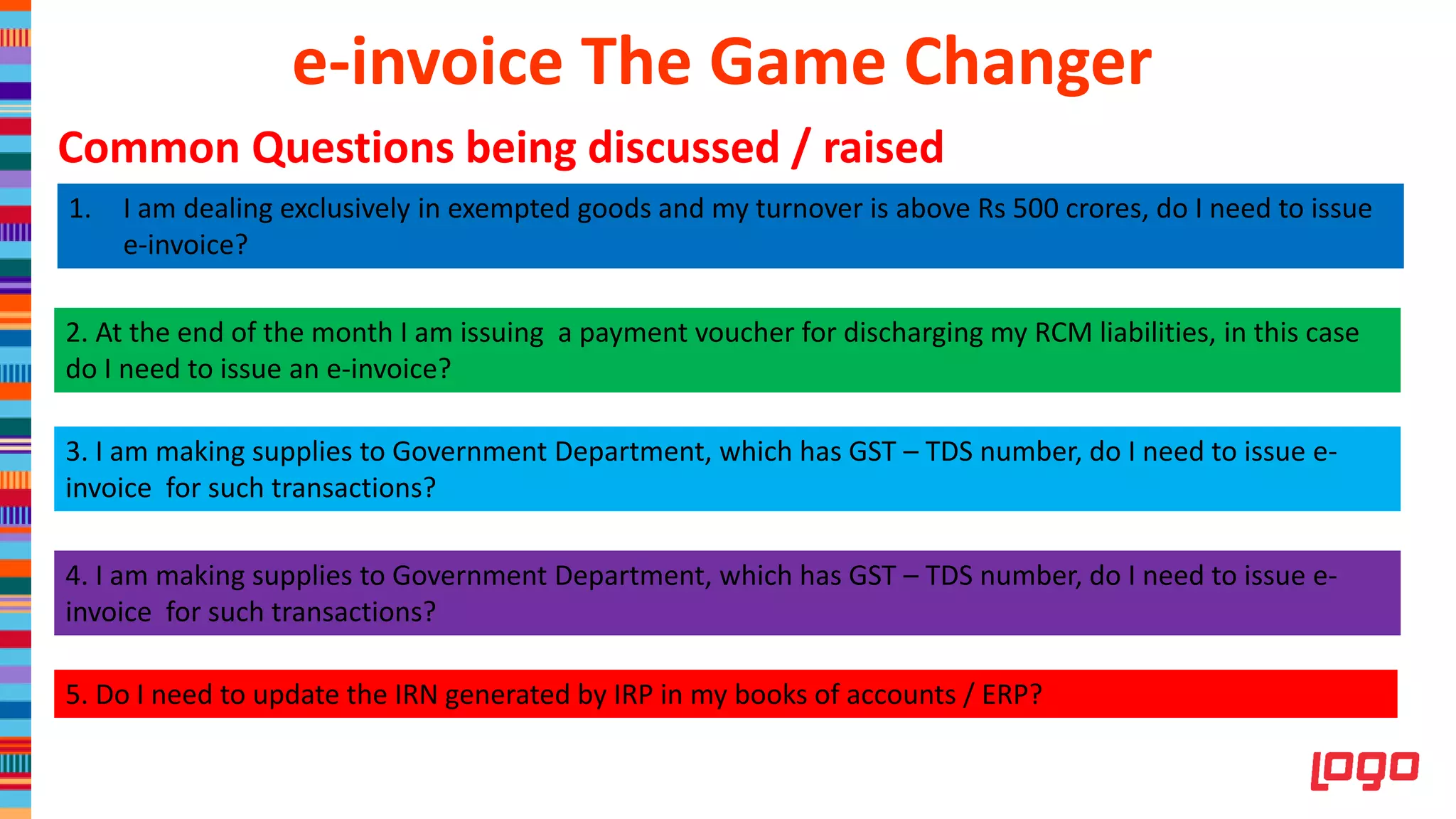

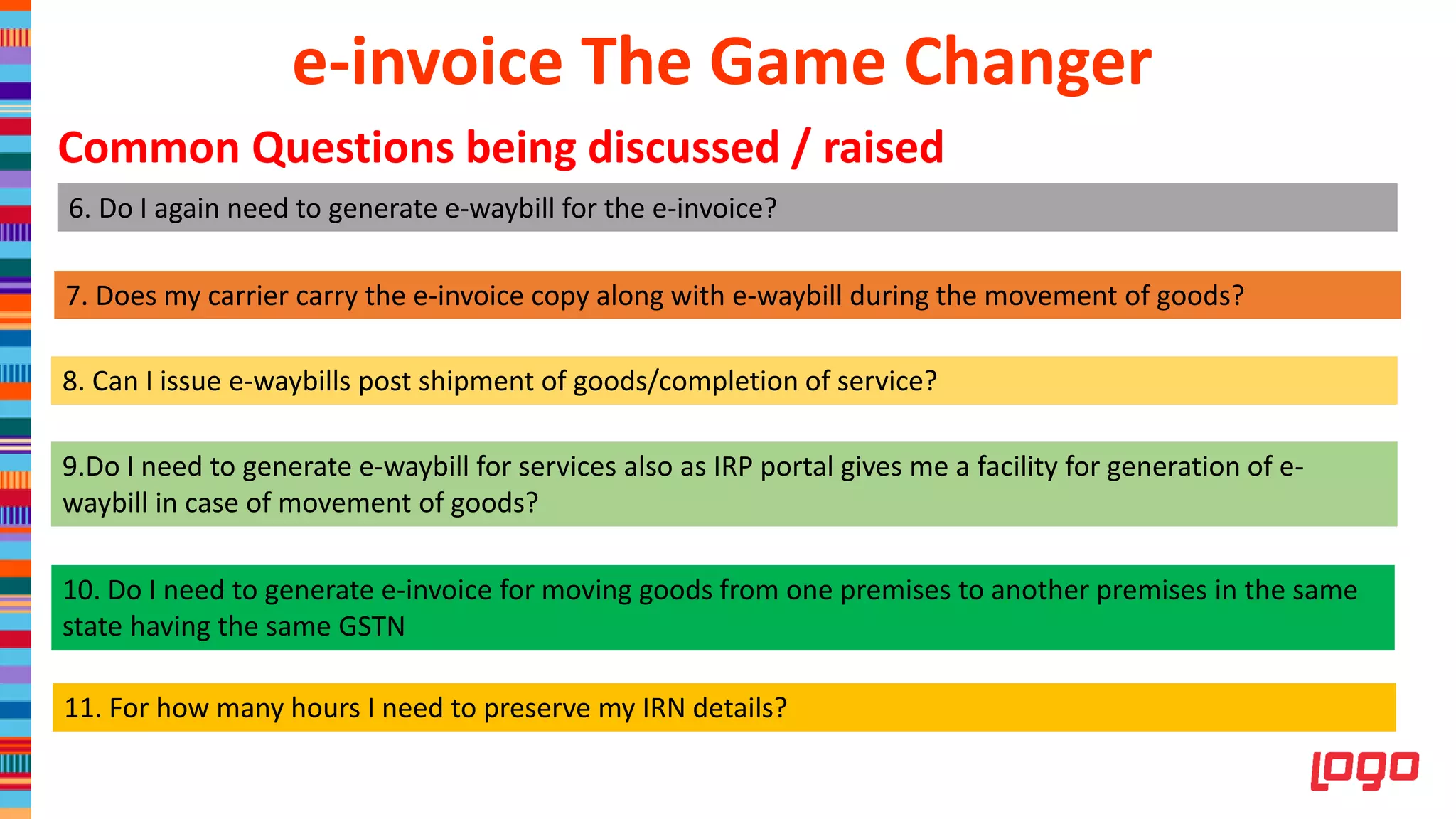

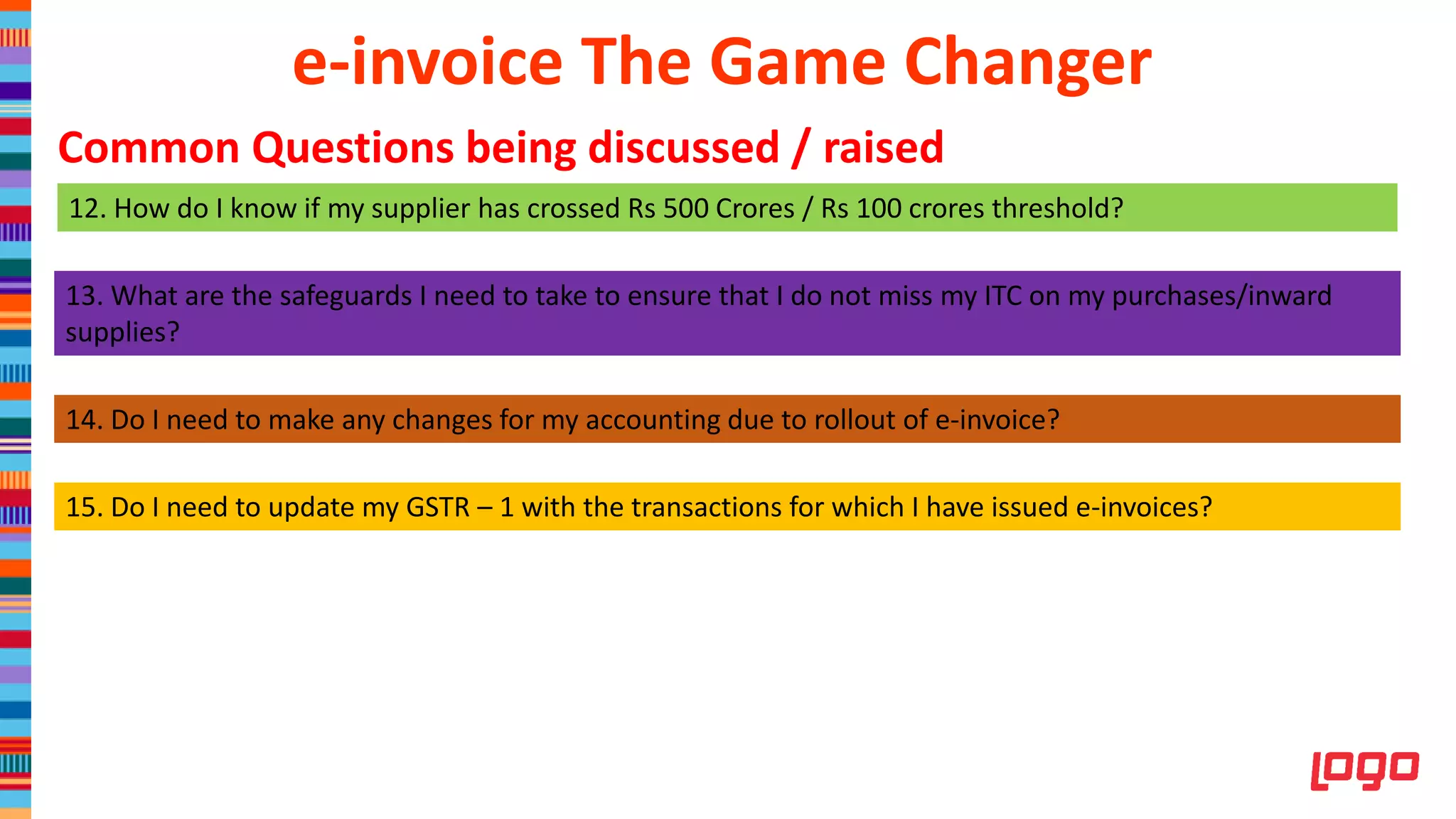

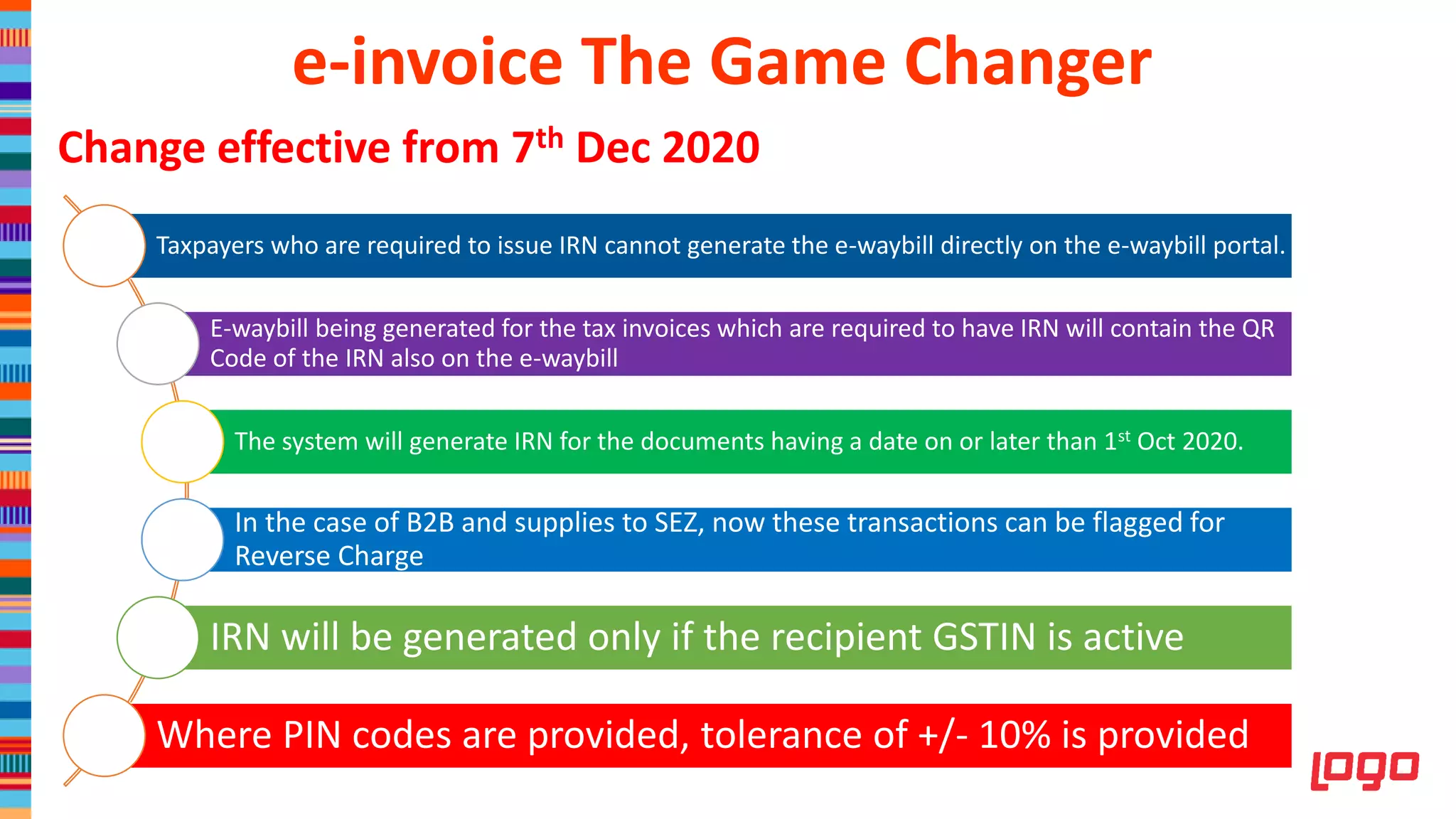

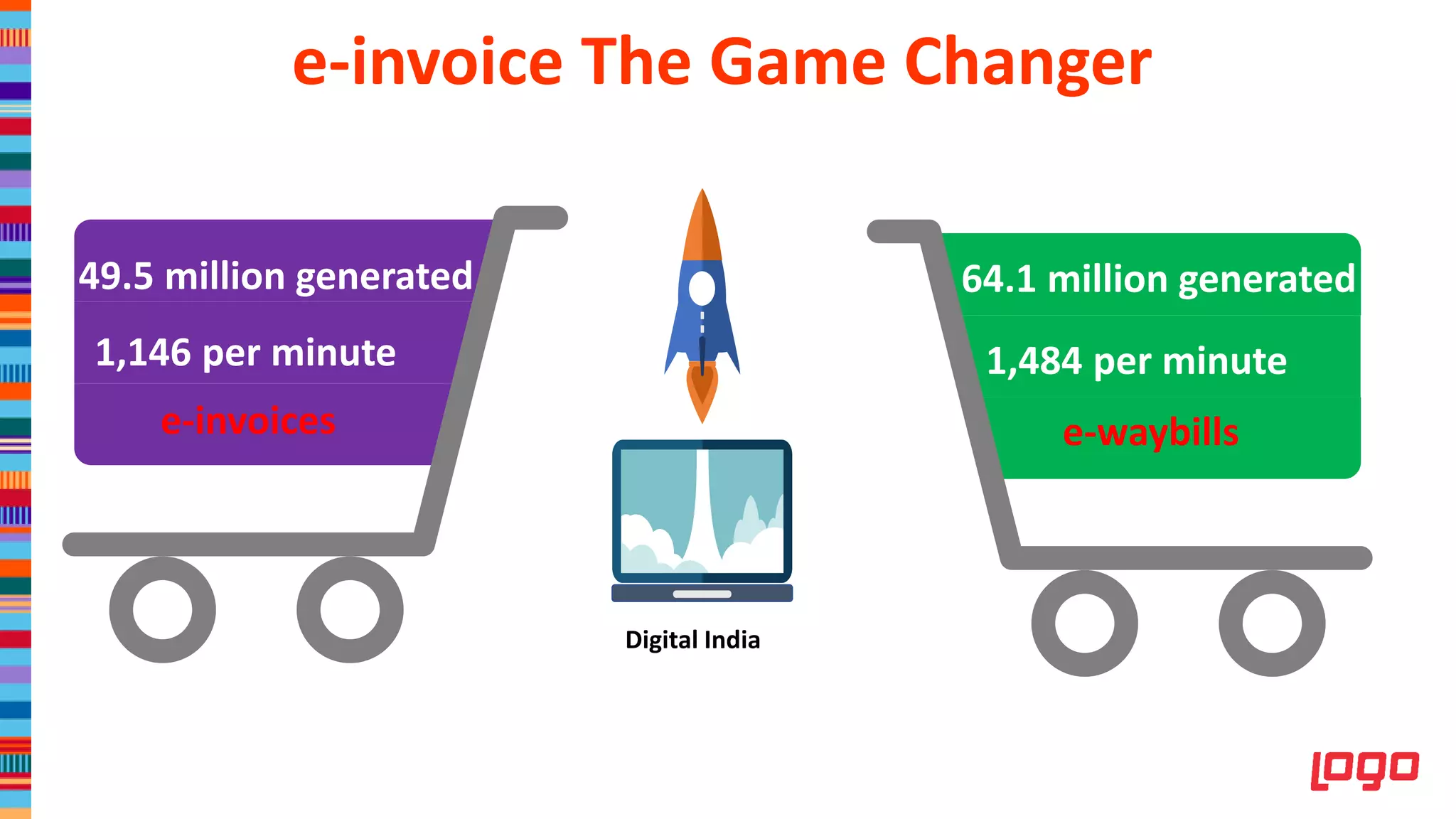

The document discusses the transformative impact of e-invoicing on taxation and compliance, highlighting its benefits such as cost and time savings, eco-friendliness, and real-time tax evasion prevention. It outlines the legal provisions for e-invoicing including various notifications, the technical aspects for implementation, and the necessary compliance measures for taxpayers. Additionally, it addresses common questions and concerns regarding e-invoice generation and related processes.