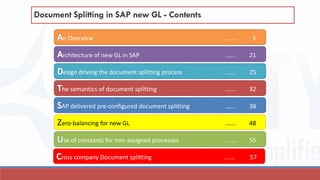

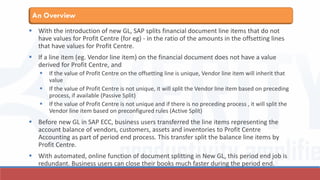

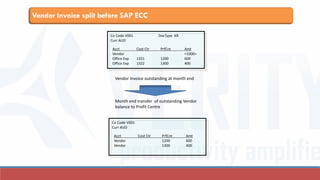

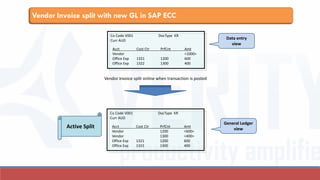

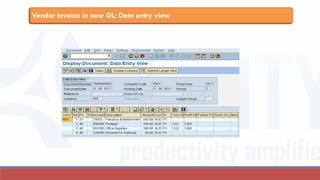

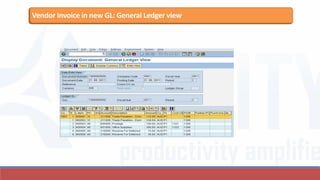

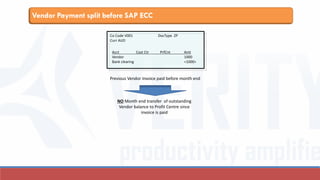

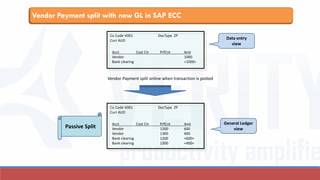

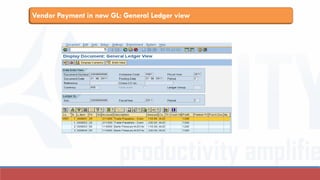

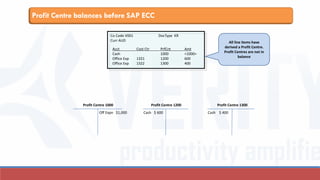

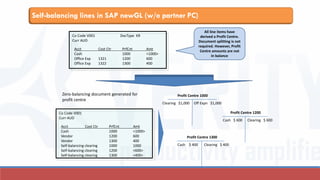

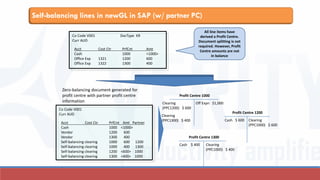

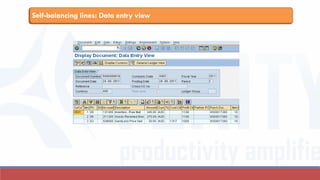

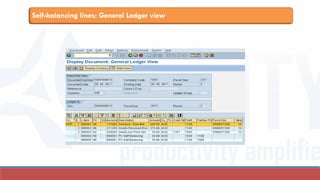

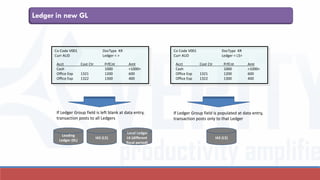

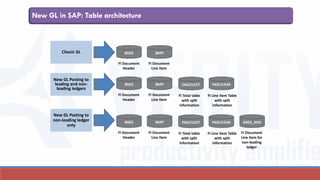

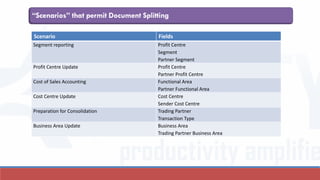

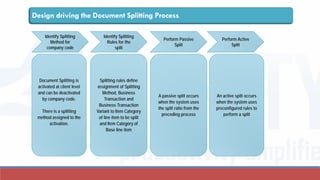

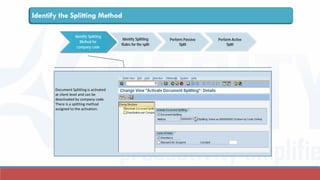

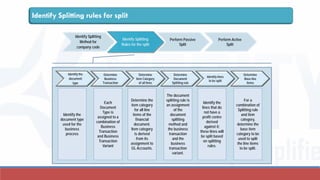

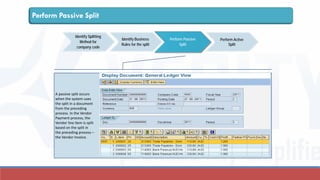

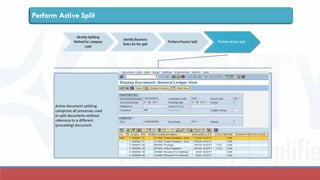

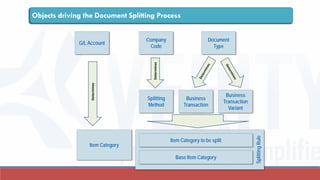

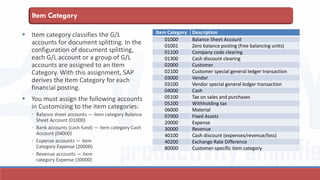

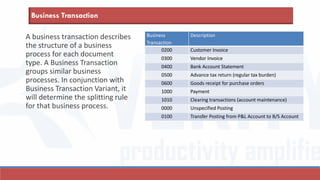

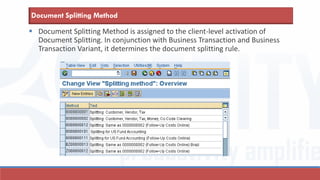

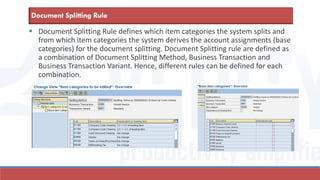

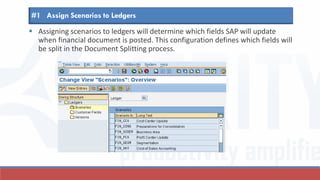

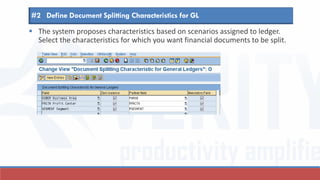

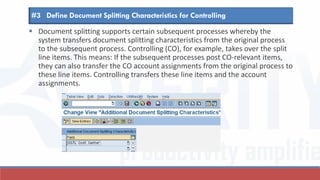

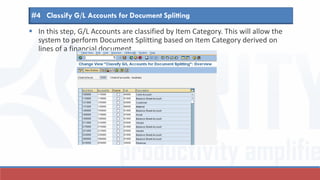

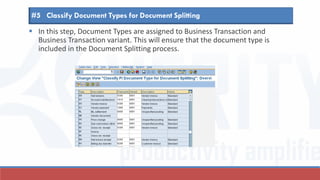

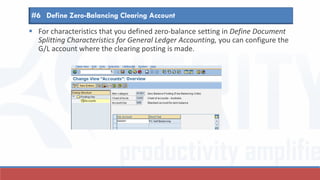

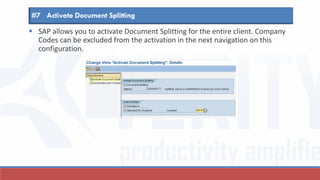

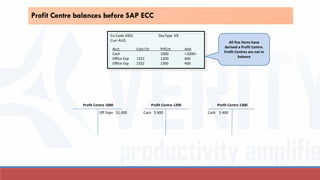

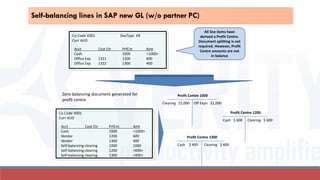

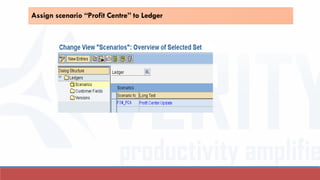

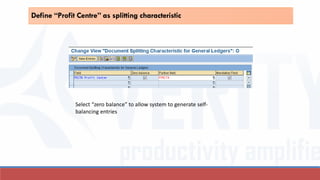

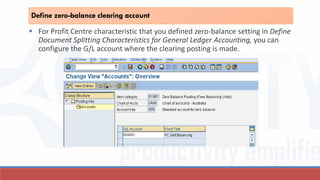

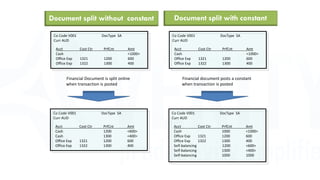

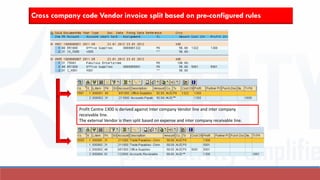

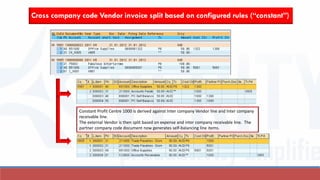

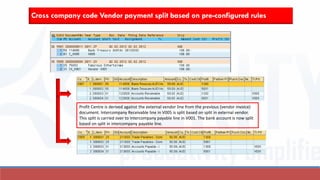

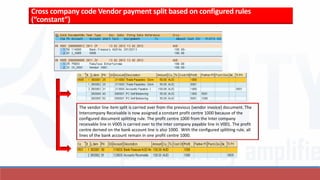

The document discusses document splitting in SAP's New General Ledger (New GL), which enhances reporting capabilities and streamlines the financial closing process. It outlines the mechanisms of active and passive document splitting, the relevant configurations, and the structural changes made in the system architecture to facilitate these processes. Additionally, it elaborates on zero-balancing functionality that creates automatic entries to ensure profit center balances, further optimizing the financial reporting accuracy and efficiency.