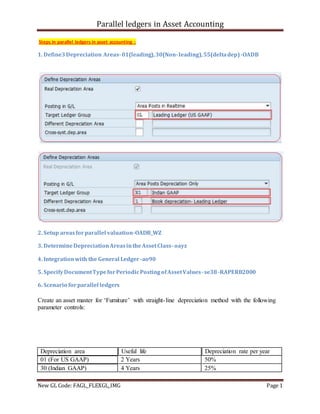

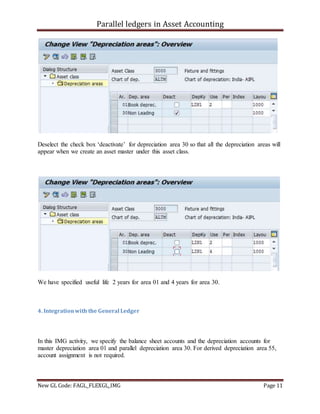

We can use parallel ledgers in asset accounting to value assets according to different accounting principles. The document outlines how to configure parallel ledgers for US GAAP and Indian GAAP valuations. Key steps include defining depreciation areas, assigning them to asset classes and general ledger accounts, and setting up periodic posting. Testing shows parallel acquisition and depreciation postings are made to the respective ledgers according to the depreciation areas assigned in the asset master. Retiring the asset then results in different gains/losses posted to each ledger.