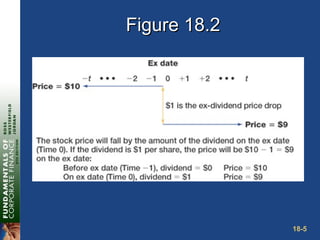

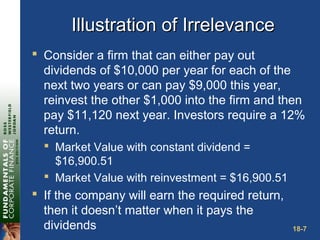

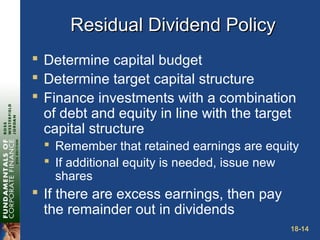

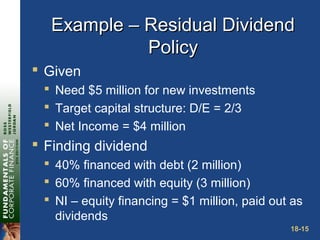

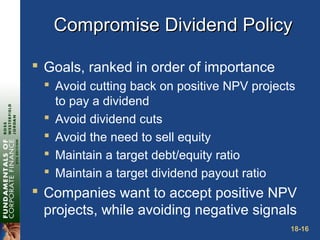

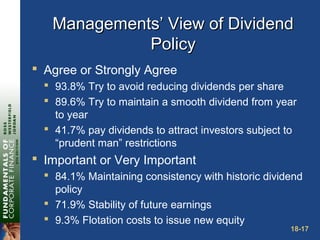

The document discusses various aspects of dividends and dividend policy. It begins by defining different types of cash dividends that companies can issue, such as regular cash dividends paid quarterly. It also explains the dividend payment process and timeline. The document then discusses whether dividend policy truly matters or if it is irrelevant under certain assumptions. It also outlines different dividend policies companies may follow, such as residual dividend policies, and considers why companies may prefer high or low dividend payouts. The document concludes by discussing stock repurchases and stock dividends as alternatives to cash dividends.