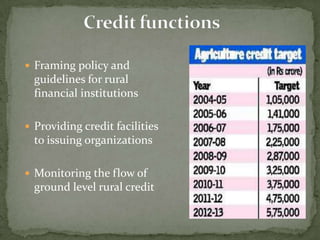

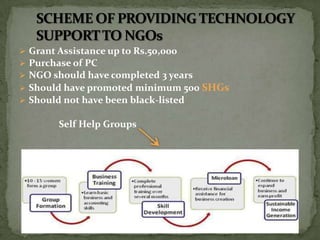

The document discusses NABARD (National Bank for Agriculture and Rural Development), an apex development bank established in 1982 to facilitate credit flow for rural development in India. It outlines NABARD's vision, mission, organizational structure, roles and functions, which include providing refinance support and loans to rural banks and institutions, developing model agriculture projects, and building capacity through training. The document also describes some of NABARD's promotional efforts like providing technology support to NGOs and innovative microfinance projects.